Options Market Statistics: Micron Options Pop as Analysts Raise Price Targets, Turn Bullish

News Highlights

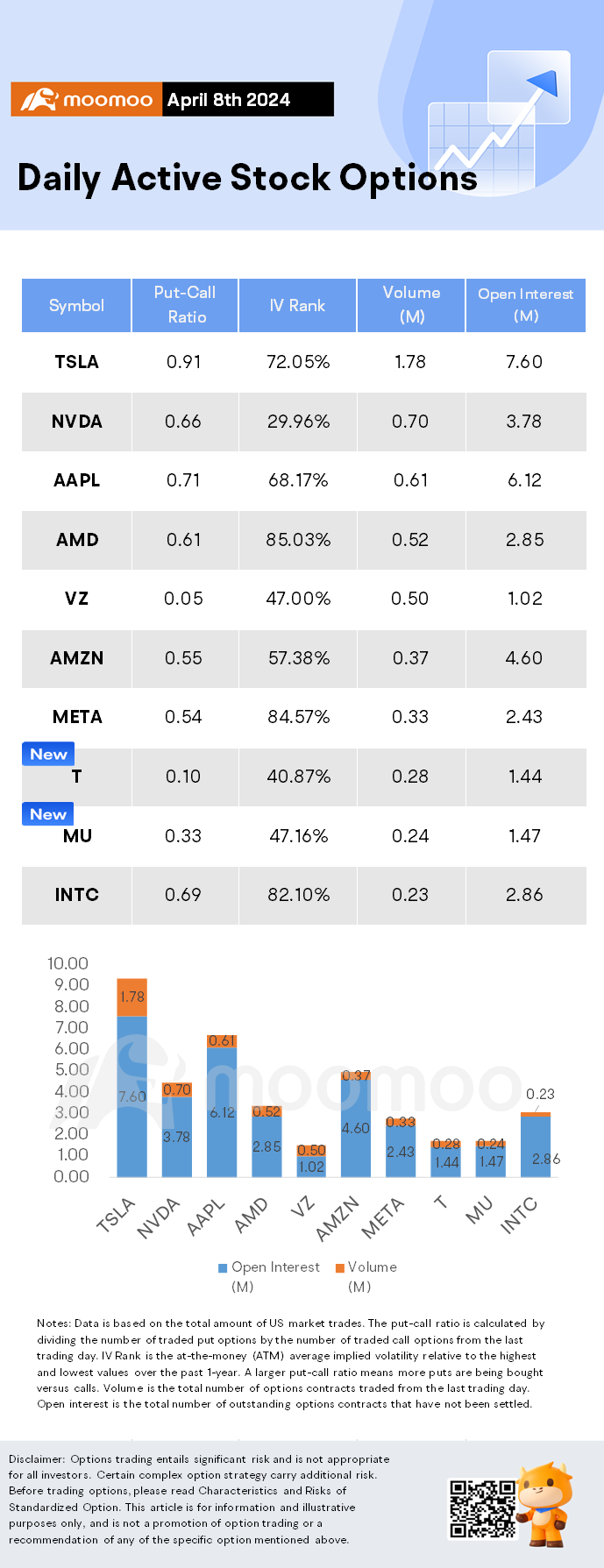

$Tesla(TSLA.US$ shares rose by 4.90%, closing at $172.98. Its options trading volume was 1.78 million. Call contracts account for 52.3% of the total trading volume. The most traded calls are contracts of $175 strike price that expire on Apr. 19th. The total volume reaches 39,095 with an open interest of 32,607. The most traded puts are contracts of a $170 strike price that expires on Apr. 12th; the volume is 44,159 contracts with an open interest of 5,909.

A source told Reuters that Chief Executive Elon Musk is going "all in" on robotaxi. Tesla stock sank on the report, hitting its 2024 low of 160.51 intraday Friday. However, TSLA began to pare losses after Musk took to X, formerly Twitter, alleging that Reuters "is lying (again)."

Morgan Stanley analyst Adam Jonas, historically a Tesla bull, wrote late Friday that the Model 2 is "critical to the medium-term top-line growth narrative" for Tesla. Jonas has modeled that the next-generation vehicle accounts for more than 40% of incremental unit volume from 2024 to 2030.

Model 2 may be a small part of the profit pool for Tesla, a pulling back from low-cost/high volume products would be negative to near-term sentiment and is potentially thesis-changing for many bulls," Jonas said.

The analyst added that some investors have interpreted the timing of the Reuters story with excitement around the latest version Tesla's full self-driving (FSD) program and scaling up of a Tesla robotaxi business ahead of schedule.

While we do believe Tesla has advantages around developing the computer vision/robotics technologies necessary to be dominant in autonomous driving, we believe a host of legal/regulatory issues will make this journey measured in decades rather than years," Jonas wrote.

$NVIDIA(NVDA.US$ shares fell by 0.99%, closing at $871.33. Its options trading volume was 0.70 million. Call contracts account for 60.2% of the total trading volume.

Nvidia shares have rocketed 76% year to date, but the demand for the company's data center chips could still support new highs, according to analysts at KeyBanc.

After digging into Nvidia's supply chain, the firm sees evidence of strong demand for Nvidia's GB200 super chip designed for artificial intelligence (AI). KeyBanc maintained an overweight (buy) rating on the shares but raised the price target from $1,100 to $1,200, representing an upside of nearly 38% over the next 12 months or so from the current share price of around $871.

$Micron Technology(MU.US$ shares fell by 0.51%, closing at $122.95. Its options trading volume was 0.24 million. Call contracts account for 75.1% of the total trading volume. The most traded calls are contracts of $130 strike price that expire on Apr. 19th. The total volume reaches 16,260 with an open interest of 28,071.

KeyBanc analyst John Vinh maintained his overweight (buy) rating on the stock while increasing his price target to $150 from its previous level of $135. That suggests potential upside of roughly 21% compared to Friday's closing price, on top of the stock's 115% gains over the past year.

After a quarterly supply chain review, the analyst came away more bullish on Micron's prospects. Users report that Micron's recently released HBM3E (High Bandwidth Memory 3E) chip offers "meaningfully superior" thermal and power performance vs. the competition. Vinh believes this puts Micron in the "pole position" and on track to exceed $1 billion in HBM revenue in calendar 2024.

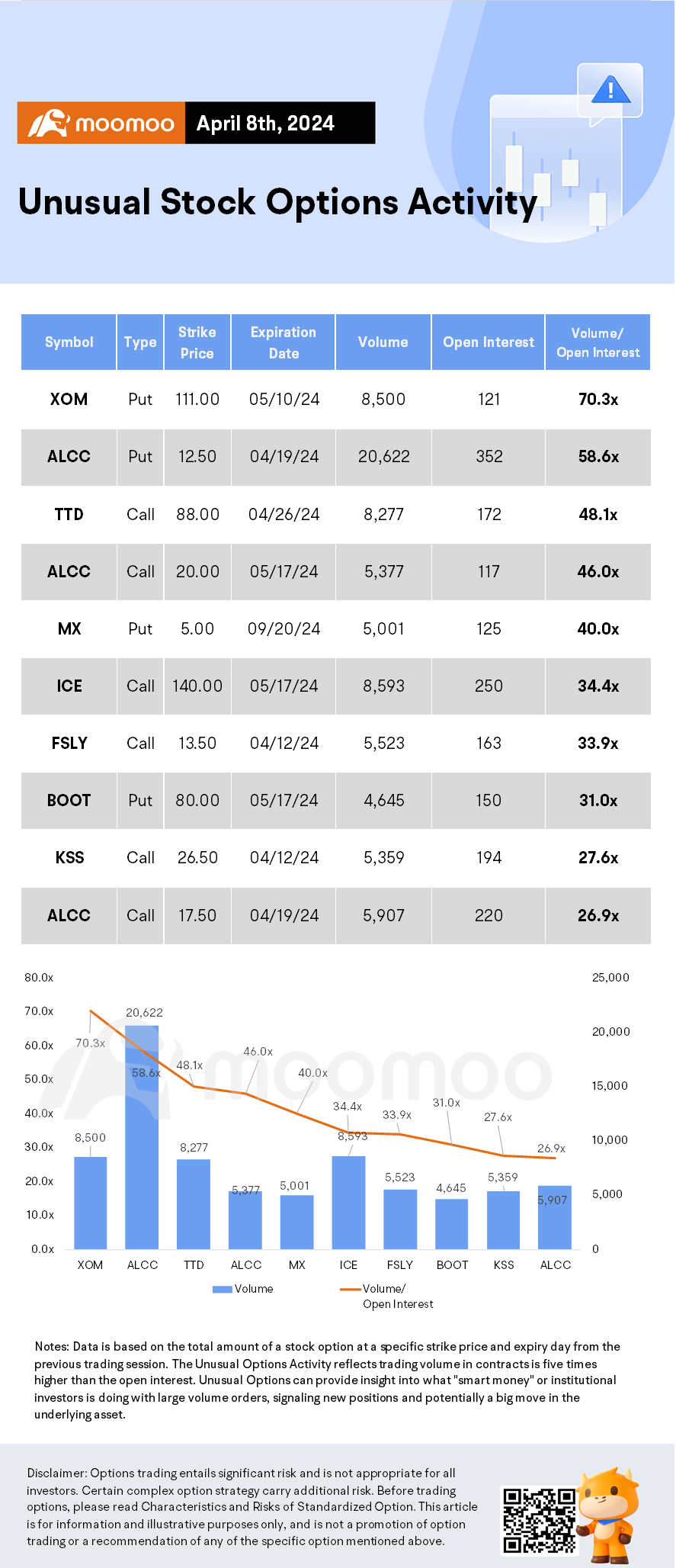

Unusual Stock Options Activity

Some notable put activity is being seen in $Exxon Mobil(XOM.US$, which is primarily being driven by activity on the May 10 put. Volume on this contract is 8,500 versus open interest of 121.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

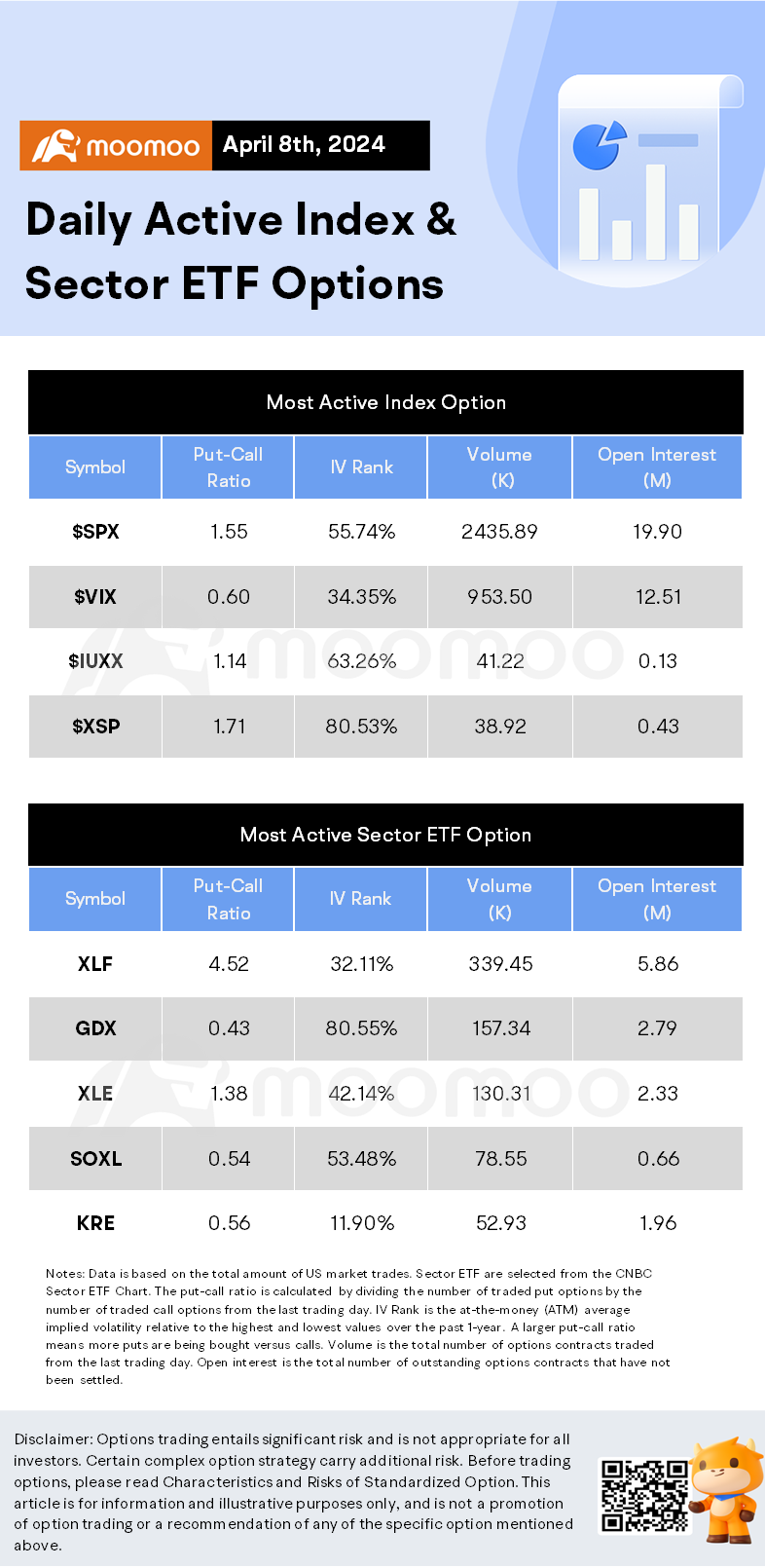

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Benzinga

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102177533 : Where is my Apple share still No Appear in my a/c ?

102177533 : Normally it take how many days ?

102976117 : Assalamualaikum wharahmatullahi taala wabarakatu I love you all over the world, I hope you can tell me what I should do because you know I don't know enough about this business because I want to have a gaide thank you

Joanne2802 : 180 days

CasualInvestor : Riding the Rollercoaster

Remember the Masterplan $Tesla (TSLA.US)$