JPMorgan Favors Low-Cost Options for Potential China Rebound

After three years of bumpyness, valuations in the Chinese market appear notably low compared to other emerging markets. Investors who would like to take exposure to China equity should consider using "cheap options" to benefit in the country's potential recovery, say strategists at JPMorgan Chase on Monday.

The report indicates a preference for buying options on broad market indices as a readiness strategy for a potential cyclical uptrend in Chinese stocks. The firm's analysts prefer narrow-range call options on $Hang Seng Index(800000.HK$ or the $FTSE China A50 Index Futures(MAY4)(CNmain.SG$, along with bullish options on Chinese stocks, provided that the USD to offshore RMB exchange rate does not decline.

As a result of China's official manufacturing data posting its highest level in a year, robust exports, and rising consumer prices, investors are becoming more upbeat about the second-largest economy in the world. Strong manufacturing, a resurgence of foreign investment, and the so-called National team's capital to save the market have all contributed to the recent resurgence of the Hang Seng Index from its January bottom.

Economic data, including China's official Manufacturing PMI and new orders index for March, have climbed to their highest levels since March 2023, along with the Caixin Manufacturing PMI for March also reaching its peak since February 2023, signaling a resumption of expansion in the manufacturing sector.

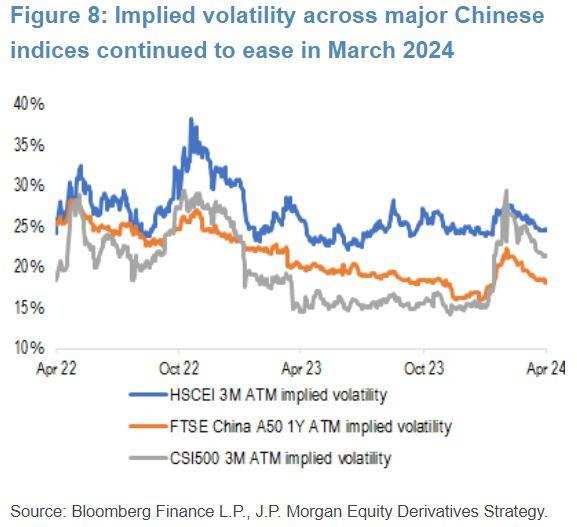

In terms of option-related metrics, the strategists noted that implied volatility for major Chinese indices in March (a measure of expected future volatility based on option prices) continued to decline. They wrote that the implied volatility levels for major stock indices, particularly the $Hang Seng China Enterprises Index(800100.HK$ and FTSE A50, are in the bottom quarter of their two-year range.

Another sign of improving investor outlook is that the volatility skew for the HSCEI has dropped to its lowest level since 2017, suggesting a reduced need for protection against significant downturns.

JPMorgan strategists believe it could be too early to move heavily into the market based on improved economic activity. They favor large-cap stocks supported by corporate buybacks and "national team" backing.

It's noteworthy that a growing number of foreign institutions have recently been vocal about their bullish stance on Chinese assets. On April 8, chief economist for Greater China at Citigroup, Yuxiang Xiong, released an analysis report stating that Citigroup has raised its forecast for China's GDP growth this year from 4.6% to 5%, expecting the country's annual growth targets to be achievable.

At the end of February, Morgan Stanley released research indicating that changes in regulatory policy stance, support for the private sector, a stabilizing real estate market, and a rebound in price indices are all contributing to a recovery in the A-share market and attracting capital inflows. In early March, the Goldman Sachs research team for Chinese equities maintained a high allocation rating for China's A-shares, forecasting a 10% expected return for the MSCI China Index and the in 2024, with corporate earnings growth expected to be between 8% and 10%.

Challenges are still ahead of the resurgence of the world's second-largest economy. On Tuesday, Fitch affirmed China's sovereign rating at 'A+', although the outlook was downgraded to negative as the firm forecasted economic growth this year would slow.

Source: Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73164454 : The Chinese themselves are not optimistic about the market, you are optimistic

随机 : Is there something wrong with this author? When did real estate stabilize in China? That's nonsense