Getting Ready for a Recession? These Indicators Reveal That Equity Investors Have Become More Cautious

The fragile economic outlook, increasing geopolitical risks, feeble consumption,the highest interest rate levels in nearly 16 years, and monetary policy uncertainty have collectively exerted pressure on U.S.equity market.

Recently, a number of indicators have suggested that equity investors appear to be growing more cautious and that they may be bracing for a potential recession ahead.

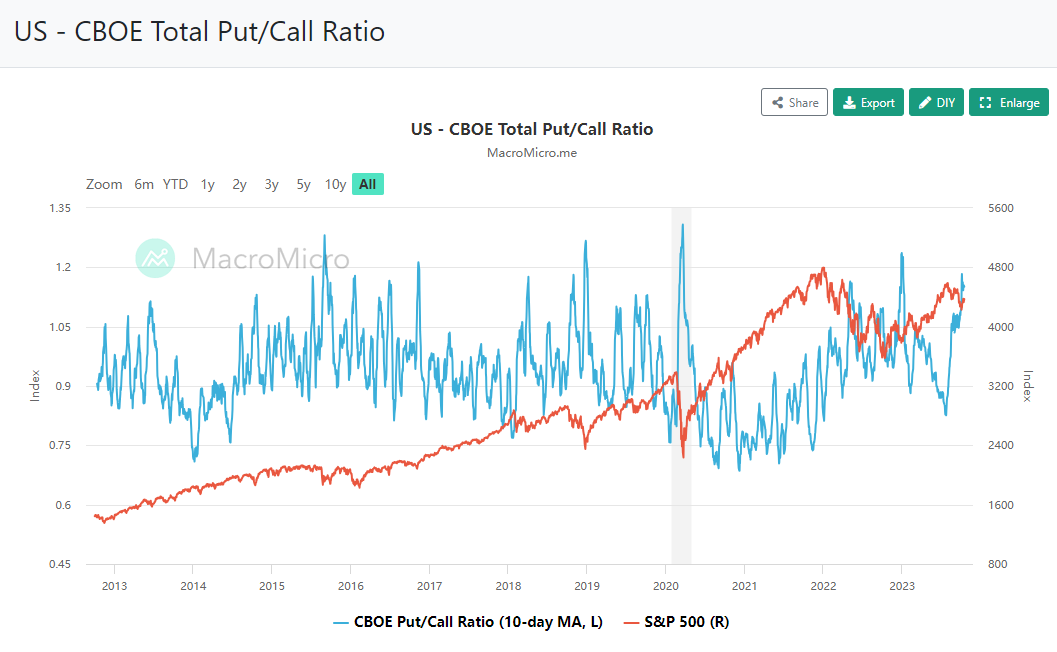

CBOE's Total Put/Call Ratio is a widely recognized market sentiment gauge that measures both index and equity options. The indicator has rapidly increased since the end of July and as of October 16, it reached 1.15, revealing an escalation in bearish sentiment as traders are acquiring more puts than calls.

Deutsche Bank's latest research shows that both systematic strategies and discretionary investors have considerably cut their positions, leading to a significant drop in overall equity positions, which have now fallen into the underweight territory, with a negative z score of -0.21 and percentile of 32%.

Specifically, most sectors have continued to see a decrease in their positions, and currently, there are no sectors with significant above-average exposure. The positioning in the Technology and Consumer Staples sectors is now only slightly above neutral, while the Real Estate sector's positioning is at an extremely low level.

Yardeni employs the difference between the inverse of the PE of the S&P 500 and the real yield of the 10-year Treasury bond to estimate the "equity risk premium". The data indicates that the current cost-effectiveness of equity investment has significantly decreased, implying that equity assets have become less appealing than bonds.

Likewise, Michael Hartnett, the Chief Investment Strategist at Bank of America, predicted early this month that“mutates into economic data, bonds rally big and bonds should be the best-performing asset class in the first half of 2024”. He pointed out that due to the convexity property of bonds, which tends to rise more but fall less, this investment is probable to generate a comparatively better return on investment in the future, while the downside risk is limited.

Specifically, if bond yields decrease by 100 basis points over the next 12 months, the benchmark portfolio is expected to generate a return of 13%. In contrast, if bond yields rise by the same amount, the benchmark portfolio's projected return is only -0.2%.

Bank of America reports that cash and treasury bills currently comprise 15.4% of its Private Client AUM (assets under management), which is above the historical average of 13%. Moreover, money market funds under management have expanded significantly to $5.7 trillion in just ten months.

The State Street Institutional Investor Risk Appetite Indicator has been on the decline since August, indicating that investors are becoming more risk-averse towards different asset classes. On September 29, the indicator dropped below 0 and declined to -18.2%.

Source: MacroMicro, Deutsche Bank, Yardeni, Bank of America, The State Street

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Ilya Jucius : Duely noted

NoahZeeshan : As long as there are retail inveators, dont worry you can ride any situation, covid, int rate increase or recession.

if you dont agree, think abt this situations without retail, should have gone down 2020. just kidding

razo2 : you forgot to mention the yields in 10 and 30y?