United Airlines Earnings Spurs Stock Surge: Who Could Benefit From Demand Resurgence?

$United Airlines(UAL.US$, headquartered in Chicago, released its first-quarter earnings report on Tuesday evening, leading to a surge in its stock price by more than 17% on Wednesday. The entire airline industry followed suit, with $American Airlines(AAL.US$ rising 2.3% and $Delta Air Lines(DAL.US$ climbing 3%.

What Are the Key Points in United's Report?

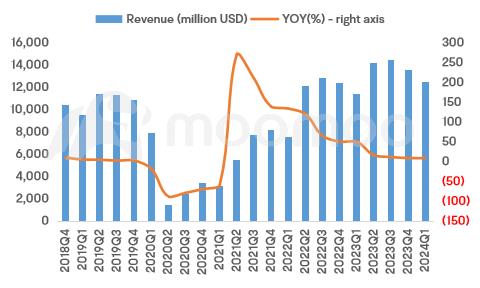

The company kicked off the fiscal year with a revenue of $12.54 billion, marking a 9.7% year-over-year increase and surpassing market expectations of $12.44 billion. Capacity saw anupswing of 9.1% compared to the first quarter of 2023. The adjusted per-share loss stood at $0.15, notably better than the average forecasted loss of $0.57 per share.

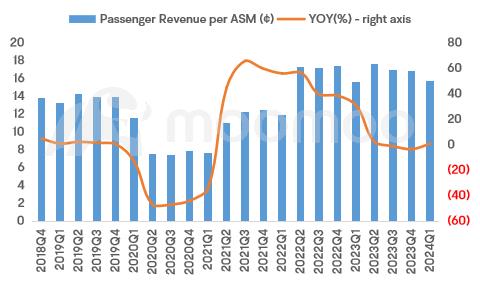

A strong flight demand fueled revenue growth, particularly in the company's Atlantic and Domestic markets, which both reported substantial hikes in passenger revenue per available seat mile (PRASM) – a critical gauge of airline earning efficiency – with year-over-year increases of 11% and 6%, respectively.

Additionally, strategic adjustments to domestic capacity paid off, resulting in meaningful gains in first-quarter profitability.

The company reported a first-quarter loss of $124 million, primarily due to the three-week grounding of its $Boeing(BA.US$ 737 Max 9 fleet following an incident in early January where a cabin door detached mid-flight on an Alaska Airlines 737 Max 9 aircraft. Nevertheless, United Airlines announced on Wednesday that it has reached a confidential agreement with Boeing regarding compensation for the grounding and delays of the Max jet.

These earnings reflect the approximately $200 million impact from the Boeing 737 MAX 9 grounding, without which the company would have reported a quarterly profit.

Furthermore, despite ongoing delivery delays from Boeing, the U.S. carrier has forecasted earnings between $3.75 to $4.25 a share in the second quarter, which is significantly higher than Wall Street estimates.

Global Economic Recovery Boosts Airline Business Travel

The demand for airline services is notably influenced by macroeconomic conditions, which means that the aviation sector's performance is often closely tied to economic cycles. This year, the global economy has demonstrated resilience, and the likelihood of a soft landing is increasingly apparent.

On April 16, the International Monetary Fund (IMF) released its latest World Economic Outlook report, which projects a 3.2% global economic growth for 2024. This forecast marks a 0.1 percentage point increase from January's prediction, representing the second upward revision by the IMF for the 2024 global growth rate this year. Additionally, the IMF has revised its growth projections for the U.S. economy upwards by 0.6 and 0.2 percentage points for 2024 and 2025, respectively, to 2.7% and 1.9%.

United's financial results serve as further proof of the accelerating rebound in corporate travel, with the airline reporting a double-digit percentage increase in business demand in the first quarter compared to pre-pandemic levels.

Delta also reported similar trends, stating that its managed corporate sales rose 14% YoY in Q1, with the tech, consumer services, and financial services sectors leading the way. Meanwhile, a recent survey conducted by Delta showed that 90% of companies expect their travel volumes to increase or remain stable in the June quarter and beyond.

Additionally, other airlines are slated to announce their financial results in the coming weeks, whichcould offer additional insights into the aviation industry's performance and broader economic trends. Keep an eye out for $American Airlines(AAL.US$ and $Southwest Airlines(LUV.US$, both set to release their earnings on April 25, $JetBlue Airways(JBLU.US$ on April 23, and $Spirit Airlines(SAVE.US$ on May 6.

Tourism Industry Shows Recovery Signs

Despite the impact of the Covid-19 pandemic on almost every industry over the past few years, the tourism sector has been among the hardest hit. However, after almost four years since the WHO declared Covid-19 a pandemic, the industry is finally beginning to see signs of optimism.

According to UNWTO Tourism, global tourism continued its recovery in 2023, reaching 88% of pre-pandemic levels and recording an estimated 1.3 billion international tourist arrivals. The industry is expected to fully recover pre-pandemic levels by 2024, with initial estimates indicating 2% growth above 2019 levels.

The latest UNWTO Tourism Confidence Index survey reflects this positive outlook, with 67% of tourism professionals indicating better or much better prospects for 2024 compared to 2023. Key factors contributing to this optimism include:

1) Asia's recovery set to benefit from reopening source markets and destinations.

2) China's inbound and outbound tourism to accelerate in 2024 with visa facilitation and improved air capacity.

3) Visa and travel facilitation measures to boost travel in the Middle East and Africa, including a unified tourist visa for GCC countries.

4) Europe expected to lead the way in 2024, with Romania and Bulgaria joining the Schengen area and Paris hosting the Summer Olympics.

Which Sectors and Companies Could Benefit from the Recovery?

Transportation Industry

$Delta Air Lines(DAL.US$ is one of the major airlines of the United States and a legacy carrier headquartered in Atlanta, Georgia. The United States' oldest operating airline and the seventh-oldest operating worldwide, Delta along with its subsidiaries and regional affiliates, including Delta Connection, operates over 5,400 flights daily and serves 325 destinations in 52 countries on six continents.

$United Airlines(UAL.US$ is a major American airline headquartered at the Willis Tower in Chicago, Illinois. United operates an extensive domestic and international route network across the United States and all six inhabited continents primarily out of its eight hubs, with Chicago–O'Hare having the largest number of daily flights and Denver carrying the most passengers in 2023. Regional service is operated by independent carriers under the brand name United Express.

$Uber Technologies(UBER.US$ is an American multinational transportation company that provides ride-hailing services, courier services, food delivery, and freight transport. It is headquartered in San Francisco, California, and operates in approximately 70 countries and 10,500 cities worldwide. It is the largest ridesharing company worldwide with over 150 million monthly active users and 6 million active drivers and couriers. It facilitates an average of 28 million trips per day and has facilitated 47 billion trips since its inception in 2010.

Hotel Industry

$Marriott International(MAR.US$ is an American multinational company that operates, franchises, and licenses lodging brands that include hotel, residential, and timeshare properties. Marriott International owns over 30 hotel and timeshare brands with 8,785 locations and 1,597,380 rooms across its network. Marriott International is headquartered in Bethesda, Maryland.

$Hilton Worldwide(HLT.US$ is an American multinational hospitality company that manages and franchises a broad portfolio of hotels, resorts, and timeshare properties. Hilton is headquartered in Tysons, Virginia, United States. As of December 31, 2023, the company's portfolio includes 7,530 properties (including timeshare properties) with 1,182,937 rooms in 118 countries and territories. Hilton has 22 brands across different market segments.

Leisure and Tourism Industry

$Royal Caribbean(RCL.US$, formerly known as Royal Caribbean Cruises Ltd., is a global cruise holding company incorporated in Liberia and based in Miami, Florida. It is the world's second-largest cruise line operator, after Carnival Corporation & plc. As of March 2024, Royal Caribbean Group fully owns three cruise lines: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises with 65 ships in the current fleet and 5 ships on order until 2028. They also hold a 50% stake in TUI Cruises and Hapag-Lloyd Cruises.

$Carnival(CCL.US$ is a British-American cruise operator with a combined fleet of over ninety vessels across nine cruise line brands and one joint venture with China State Shipbuilding Corporation (CSSC). It's the world's largest leisure travel company with 87 ships sailing under 9 brands including Princess. Carnival Cruise Line is the company's biggest brand with 22 ships, operating 1,500 voyages annually, calling on ports from Cozumel to Ketchikan.

Source: Statista, UNWTO Tourism, CNBC

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment