Bitcoin 'Halving' Will Deal a $10 Billion Blow to Crypto Miners

Bitcoin Halving is around the corner. On April 20th, the halving will cut the amount of Bitcoin that “miners” can earn each day for validating transactions to 450 from 900 now. Based on Bitcoin’s current price, it could spell revenue losses of around $10 billion a year for the industry as a whole.

Marathon Digital, CleanSpark, and other miners, which compete for a fixed Bitcoin reward by solving mathematical puzzles using superfast computers, have invested in new equipment and sought to buy smaller rivals in an attempt to mitigate the decline in revenue.

“This is the final push for miners to squeeze out as much revenue as they can before their production takes a big hit,” said Matthew Kimmell, a digital asset analyst at CoinShares. “With revenues across the board decreasing overnight, the strategic response of each miner, and how they adapt, could well determine who comes out ahead and who gets left behind.”

Source: Moomoo

A double-whammy

Apart from the Bitcoin halving, miners also have to deal with growing competition from artificial intelligence companies.

Miners need to continually spend more money in a never-ending, technological arms race for smaller rewards. And while the energy-intensive validation process has always made mining expensive, companies now face even more competition for power from the burgeoning and deep-pocketed artificial intelligence industry.

“Power in the US is extraordinarily constrained,” said Adam Sullivan, chief executive officer at Core Scientific. “Right now, miners are competing against some of the largest tech companies in the world, who are trying to find space for data centers, which are high energy consumers too.”

The nascent AI industry is drawing in massive amounts of capital, which is making it harder for miners to secure favorable electricity rates with utility companies. Amazon is set to spend almost $150 billion on data centers, while Blackstone is building a $25 billion empire of centers. Google and Microsoft are also making hefty investments.

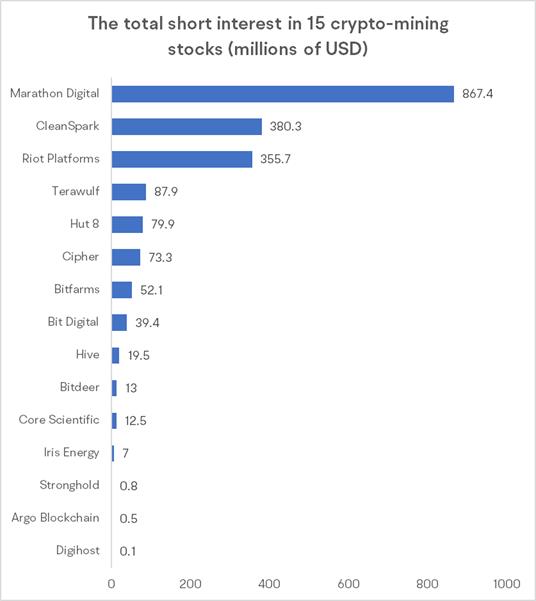

Besides, short interest in crypto-mining stocks are quite crowded

According to an estimate from S3 Partners LLC, the total short interest (which is the dollar value of the shares borrowed and sold by bearish traders) stood at about $2 billion as of April 11. That short interest accounted for almost 15% of the group’s outstanding shares - three times more than the US average of 4.75%, said Ihor Dusaniwsky, managing director of predictive analytics at S3.

Source: S3 Partners LLC

Note: As of the close April 8, 2024

Spot Bitcoin ETFs may be a better choice in the long run

Bitcoin experienced a significant slump of 8% after Iran launched an attack on Israel on Saturday, marking the most significant decline since March 2023, and the safe-haven properties of “digital gold” have been questioned.

However, in the medium to long term, the price of Bitcoin remains imaginable as supply-side mining costs continue to rise and demand-side resistance to the over-issuance of fiat currencies globally continues.

For the reasons analyzed above, it is clear that bitcoin spot ETFs capture the bitcoin market more accurately compared to bitcoin miners.

Since February, the Bitcoin Miners ETF has underperformed Bitcoin by 47.02%.

Source: Bloomberg, CoinDesk, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment