The First U.S. Earnings Season This Year Is Around the Corner! Which Sectors Are Expected to Shine?

The first earnings season for U.S. stocks this year is just around the corner, the major bank earnings reports set to be released this week will kick off the Q1 earnings season. Despite the S&P 500 Index climbing 10.16% in the first three months, the earnings guidance of S&P 500 companies in the first quarter is not optimistic.

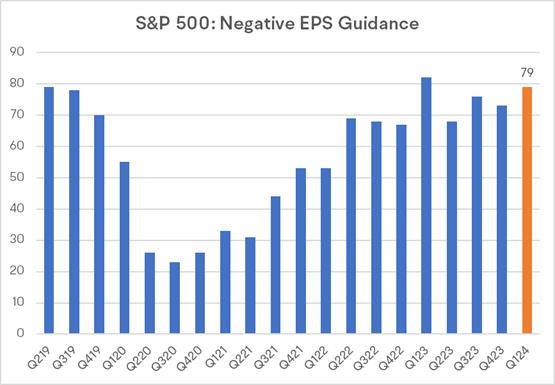

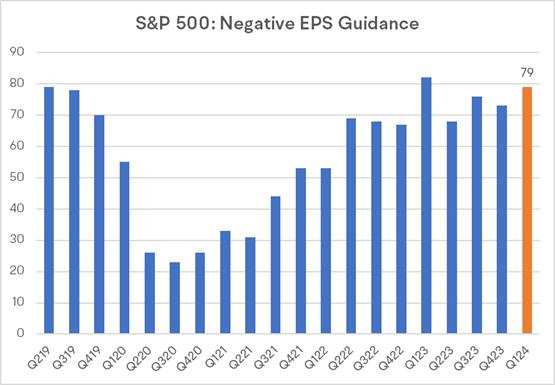

According to FactSet, 79 S&P 500 companies have issued negative earnings per share guidance for the first quarter, which is the second-highest number of S&P 500 companies since Q2 2019.

Source: FactSet

Despite companies having a more pessimistic outlook on their earnings for the first quarter, analysts have been less pessimistic in their earnings estimates for S&P 500 companies.

“With traders anticipating interest-rate cuts by the Federal Reserve later this year, that will likely feed into even stronger consumer spending, economic activity and, in turn, better earnings growth and higher stock prices,” Wendy Soong, senior analyst at BI, said over the phone.

At the sector level, analyst expect that four sectors in the S&P 500 are poised to see an increase in their bottom-up EPS estimate for Q1 2024, led by the Communication Services and Information Technology sector.

Source: FactSet

Communication Services: Interactive media is expected to lead industry earnings growth, with Meta has strong upside potential.

The Communication Services sector is expected to report earnings growth rate at 19.4%. Two industries are projected to report double-digit growth: Interactive Media & Services is projected to see a 42% increase, and Wireless Telecommunication Services is expected to grow by 16%.

At the company level, $Meta Platforms(META.US$ has strong upside potential. Jefferies recently raised its 12-month price target on the stock to $585 from $550. RBC Capital Markets also upped its price target for Meta to $600 from $565, reflecting a potential upside of 14%.

“Meta has too many advantages to count,” the Jefferies analysts wrote. Additionally, the analysts said Meta could capture as much as 50% of incremental industry ad this year. They also predicted Meta could outgrow Amazon's ad business for the first time since 2015.

Information Technology: NVIDIA, semiconductors remain the biggest highlights.

The Information Technology sector is expected to report earnings growth rate at 20.4%. Two industries are projected to report double-digit growth: The Semiconductors & Semiconductor Equipment is projected to see a growth rate of 75%, while the Software industry is anticipated to be around 15%.

At the company level, $NVIDIA(NVDA.US$ is expected to be the largest contributor to earnings growth for the sector. KeyBanc analysts raised their price target for NVIDIA and other chipmakers in a note Monday, saying that artificial intelligence remains robust as expected, despite plenty of cross currents.

The Nvidia price target was raised to $1,200, while the $Qualcomm(QCOM.US$ price target was lifted to $205. KeyBanc also increased its $Arm Holdings(ARM.US$ target to $135 and its $Micron Technology(MU.US$ target to $150.

Consumer Discretionary: Amazon is expected to be the largest contributor for the sector,with leisure products and broadline retail predicted to report double-digit growth.

The Consumer Discretionary sector is expected to report earnings growth rate at 15.0%. Three industries are projected to report double-digit growth: Leisure Products, Broadline Retail and Hotels, Restaurants, & Leisure.

At the company level, $Amazon(AMZN.US$ is expected to be the largest contributor to earnings growth for the sector. Morgan Stanley analyst Brian Nowak reiterated Amazon as the bank's Top Pick on April 8, citing its "multiyear, efficiency-based cash-flow story." The investment bank's analyst raised his price target by $15 to $215 a share.

Nowak sees Amazon's "cost to serve" model, tied to the regional alignment of its fulfillment and transportation supply chains, providing a roadmap to Amazon achieving $100 billion in earnings by 2026.

Source: FactSet, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FearGreed : Interesting