Economists Warned of Looming Signs of Reflation, And Red Sea Attack Is Not the Only Reason

The continued impact of the recent Red Sea incident has aroused alarm about reflation. One reason for lower inflation in 2023 is the high base effect from the previous year, which may not be the case in 2024. The easing of the financial conditions index and record-high housing prices are the latest signs of inflation accelerating.

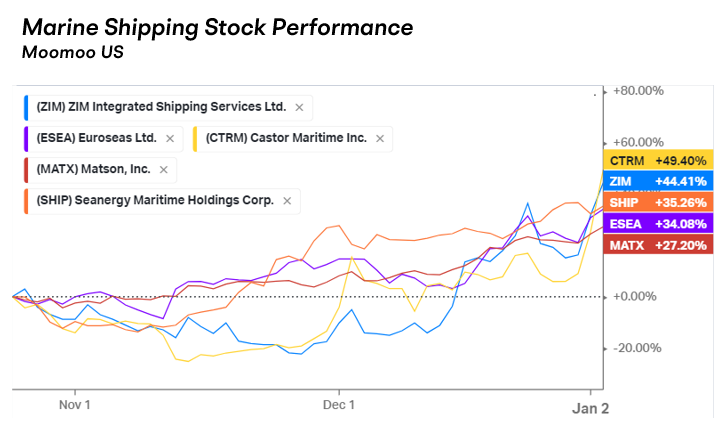

■ Sharp rise in shipping prices was a leading indicator of runaway inflation back in 2020.

The unwinding of supply bottlenecks has driven most of the disinflation in 2023, but it could reverse course in 2024 if higher geopolitical tensions and unusual weather patterns disrupt major global trade choke points. Bloomberg Chief US Economist Anna Wong warned that the simultaneous shutdown of the Panama Canal and Suez Canal due to drought caused by El Niño could cause havoc for global supply chains.

The recent surge in shipping stock prices has shown an opposite trend to technology stocks, recalling the cascade of inflationary effects caused by runaway shipping prices in 2020.

After suffering successive attacks by Houthi armed forces, Maersk said on Tuesday that it would once again suspend Red Sea transit indefinitely and divert it to the Cape of Good Hope; Hapag-Lloyd also announced on Friday that it would suspend Red Sea shipping. Shipping companies such as Switzerland's Mediterranean Shipping Company and France's CMA CGM have also suspended Red Sea sailings.

The current global supply chain is still subject to limited capacity constraints, and Goldman Sachs predicts that it will not exceed the levels during the pandemic. GS noted the main reason is that the shipping industry is still in a state of "oversupply." However, Anna Wong warned that a broadened war in the Middle East could further disrupt trading at the Strait of Hormuz. In that scenario, Anna predicted core PCE inflation would accelerate back to above 3% in late 2024, after dipping in 1H24.

■ Housing market and manufacturing sector began to rebound

Recent data shows that the decline in long-term interest rates over the past two months has improved interest rate-sensitive sectors: real estate, manufacturing.

Major U.S. house price indexes bottomed out and turned into positive growth year-on-year in October. It is worth noting that the 30-year mortgage interest rate reached the highest point since the interest rate hike in October, 7.8%, while housing prices are still rising, reflecting strong housing demand and relatively insufficient supply.

The recovery in housing prices will boost the consumption power of the household sector. In the second and third quarters of 2023, household net worth will increase by US$2.4 and 0.4 trillion respectively, with the year-on-year growth rate turning from negative to positive to 5.2%. From a historical perspective, the wealth effect brought by residential real estate often leads to a recovery in real consumption.

In the manufacturing sector, the December Dallas Fed Business Activity Survey manufacturing index recovered significantly from November. This index is highly correlated with the ISM manufacturing PMI, which may indicate a pickup in the manufacturing boom.

Recent data continue to prove that real estate and manufacturing will be the first to benefit from the decline in long-term interest rate.

Looking forward, with the further implementation of the industrial policy bill, the inventory replenishment and the easing of financing pressure, it is expected that the manufacturing cycle will likely restart in 2024, promoting the growth of non-residential investment.

■ Policy shifts, including the end of QT, may also increase the reflation risk

In terms of financial environment, since the FOMC meeting in November 2023, the Goldman Sachs Financial Conditions Index has dropped to 99.2, the loosest since August 2022.

The Federal Reserve's monetary policy tools are benefiting the financial system. Because of the spread between the federal funds rate and BTFP (Bank Term Funding Program), banks are arbitraging through BTFP. The usage has increased by US$26.7 billion since November last year.

The Federal Reserve's Senior Loan Officers Opinion Survey (SLOOS) in December showed that the net proportion of banks tightening credit card and industrial and commercial loans has declined significantly.

Meanwhile, cutting interest rates and ending QT too early is another risk that could exacerbate reflation and a hard landing.

The minutes from the latest Federal Reserve meeting, released on January 3, reveal that several participants commented on the Committee's balance sheet strategy. They noted that the plan is to decelerate and eventually halt the reduction of the balance sheet's size when reserve balances are slightly higher than the level deemed sufficient for maintaining ample reserves.

These participants suggested that it would be appropriate for the Committee to begin to discuss the technical factors that would guide a decision to slow the pace of runoff well before such a decision was reached in order to provide appropriate advance notice to the public.

Before the interest rate cut and end of QT has even begun, the economy has already released forward-looking signals that the economy is expected to recover. Once the Federal Reserve starts cutting interest rates, according to Bloomberg's previous forecast, demand-side driven core PCE inflation will stop falling and rebound after the interest rate cut.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

lightfoot : Why are we afraid of war. The longer we turn our cheek the faster our demise. We have children in the Whitehouse executive branch calling shots on this nation. A few shots over Iran and The USS Einsenhower off the coast of North Korea they will decrease their confrontation with us. Am I the only one willing to take a stand. This administration has raised our white flag. Don't hurt us, please

lightfoot : Why do we live with weak people. Compassion if overdone will kill us

clean up lightfoot: You obviously have no idea what war with Iran will bring, it will give Russia leverage with Ukraine oil prices will rocket up, Israel will tri reginal war with Iran, Iran proxy Hezbollah, Islamic jihad in the west bank, the Houthi in yahmen, and you mentioned North Korea, who has more fire power than our entire European alliance, and the capacity to invade south Korea, now this would give China the opportunity the craved, to invade Taiwan, so you want world war 3 it may happen, it's a good thing the military experts at the Pentagon and capital Hill is not as stupid as you are, peace is better than war, put an end to yourself imperialist attitude and preserve the lives of our American young men, and that doesn't mean we're weak, we're far from being weak, we need to be concerned about America and American's interest, not Ukraine and Israel, America 1st. so just calm down with your blood lust.

up, Israel will tri reginal war with Iran, Iran proxy Hezbollah, Islamic jihad in the west bank, the Houthi in yahmen, and you mentioned North Korea, who has more fire power than our entire European alliance, and the capacity to invade south Korea, now this would give China the opportunity the craved, to invade Taiwan, so you want world war 3 it may happen, it's a good thing the military experts at the Pentagon and capital Hill is not as stupid as you are, peace is better than war, put an end to yourself imperialist attitude and preserve the lives of our American young men, and that doesn't mean we're weak, we're far from being weak, we need to be concerned about America and American's interest, not Ukraine and Israel, America 1st. so just calm down with your blood lust.

THEWIZARD clean up:

THEWIZARD lightfoot: Oviously you exist far away from realities.

However, you certainly have all the rights to deceive yourself, for all you want.

Cheers!

clean up THEWIZARD: