US CPI Preview: March Inflation May Prompt Fed to Take More Hawkish Stance

The US March CPI data will be released by the Bureau of Labor Statistics at 8:30 ET on April 10th. As Fed Chair Jerome Powell highlighted in his April 3 speech, the disinflation process is bumpy. March CPI report is likely to illustrate that point.

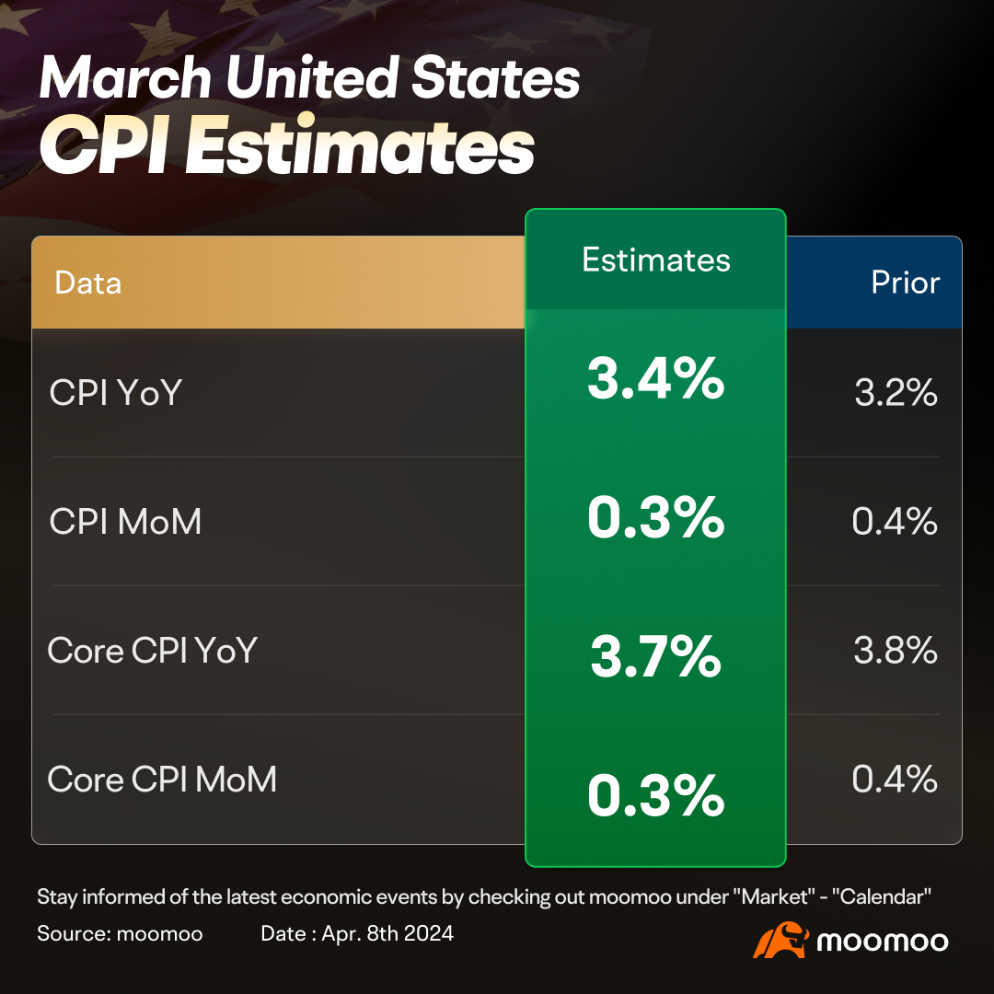

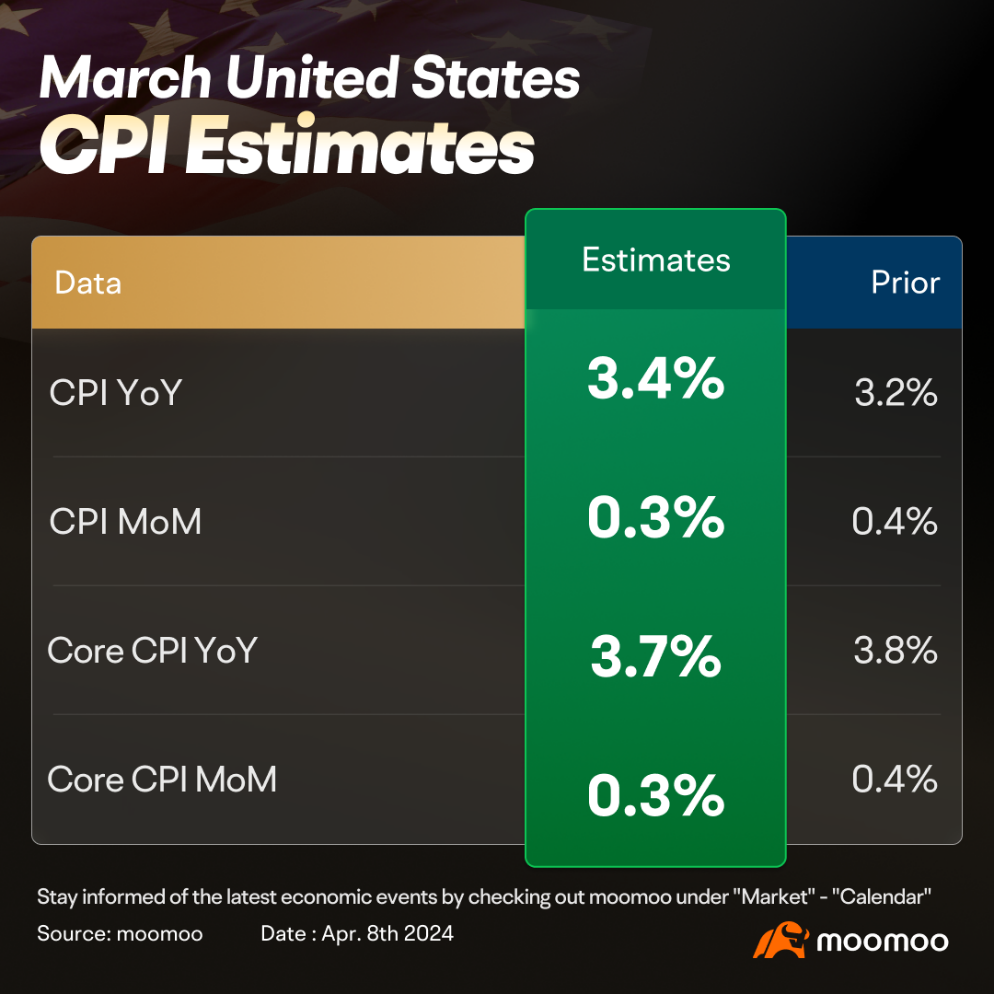

U.S. CPI is expected to rise from 3.2% to 3.4% in March, while core CPI falls to 3.7% from 3.8%. CPI energy continued to rise year-on-year, and Brent crude oil futures prices reached a high of $90 per barrel for the first time since October last year, rising 18% this year. In addition, prices of other raw materials such as copper, aluminum and cocoa are also rising sharply. Rising housing-related items, insurance and investment management fees will also lead to a rebound in super-core inflation data. It may be unlikely to see inflation fall to the Fed's target in the short term.

■ Energy prices rose in March, likely to fall in April

The average crude oil spot price stands at $83.55 in March, reflecting an increase of 3.72% from the previous month's $80.55, and a 9.25% rise compared to the price of $76.47 one year earlier.

However, geopolitical tensions in the Middle East show signs of easing. Israel withdrew more troops from Southern Gaza in a likely response to growing international pressure. Israel and Hamas also restarted peace talks in Egypt, easing tensions that ignited the recent rally in oil prices.

■ Food prices slowly normalize

The FAO Food Price Indexstood at 118.3 points in March 2024, up 1.3 points (1.1 percent) from its revised February level, as increases in the price indices for vegetable oils, dairy products and meat slightly more than offset decreases in those for sugar and cereals. The index, although it registered a first uptick in March following a seven-month long declining trend, was down 9.9 points (7.7%) from its corresponding value one year ago.

■ Falling used car prices likely drove core goods inflation down

Wholesale used-vehicle prices (on a seasonally adjusted basis) were down in March compared to February. The Manheim Used Vehicle Value Index (MUVVI) fell to 203.1, a decline of 14.7% from a year ago.The downward movement in the index is attributable to seasonal adjustments, which translated into a modest 0.4% decline from February to March.

Bloomberg economist Anna Wong noted the collapse of the Francis Scott Key Bridge in Baltimore and the disruptions to port activity may temporarily boost auto prices in the months ahead.

■ Rental prices saw a seasonal increase in March

In March, rental prices experienced an increase of 0.6 percent, marking the second month in a row of rising rents after a half-year period of consistent declines. This recent shift aligns with typical seasonal trends observed in the rental market, where there is usually an uptick in moving activities beginning to emerge after reaching a low point during the holiday season.

Comparing year-over-year figures, rent growth turned negative last summer and has stayed in that territory, with the current rate at a decrease of 0.8 percent.

From the market's supply perspective, the national vacancy rate has been on an upward trajectory and now sits at 6.7 percent. With the current year set to deliver the highest number of new apartment completions seen in many years, it is anticipated that the market will maintain a high level of unoccupied units in the coming year.

■ Expectations for a rate cut continue to be disappointed

Nonfarm payrolls in March have reduced expectations for an interest rate cut in June to below 50%. If the headline CPI rises as expected or exceeds expectations, it may further reduce the possibility of an interest rate cut in June.

On Thursday, after Minneapolis Federal Reserve President Neel Kashkari suggested that the Fed might not even cut rates this year, Federal Reserve Governor Michelle Bowman, who has a permanent voting right on the FOMC, said on Friday that it might be necessary to raise interest rates to control inflation. Bowman noted that there are some potential upward risks to U.S. inflation, and policymakers need to be cautious not to relax monetary policy too quickly, and may even need to raise interest rates to control inflation.

However, Nancy Tengler, CEO and Chief Investment Officer at Laffer Tengler Investments, believes that there is still room for the stock market to rise in 2024, and that future gains will not be entirely affected by the number of Fed rate cuts: "The current situation is similar to the Greenspan era of the 1990s, where the Fed might adopt a strategy like maintaining high-interest rates for a long time to drive productivity gains to curb inflation, especially in the context of continuous advancements in artificial intelligence technology."

Source: Apartment List, FAO, Cox Automotive

By Moomoo US Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Nidia_Girl : I called for rising interest rates months and months ago and now my projection might be correct !

Maniac Fool Nidia_Girl : Sad as many businesses are already closing shut for good due to the high interest-rates environment in addition to inflation…..

intuitive Jackal_354 : so your saying they're going to manipulate the numbers again

intuitive Jackal_354 Nidia_Girl : remember unemployment is going to shoot threw the roof in California with the new minimum wage of 20 per hour for fast food workers

Michael Fong : That's means to say rate cut is still uncertain until we can see a smooth sailing journey to deflation.

102983760 : good !

104453859 : $MAYBANK (1155.MY)$ $MAYBANK (1155.MY)$

HidenFromBiden Maniac Fool : not high interest rates... HIGH BIDENFLATION!!

not high interest rates... HIGH BIDENFLATION!!

1. many small business popped up during the pandemic with government COVID-19 grants. The smart ones saved and built solid businesses, the lackys spent all their profit looking at it like free money and now that their overhead comes out of their net they can't afford their business with this inflation, NOT HIGH RATES that came AFTER they got their loans. Also let's be honest... how many t-shirt, coffee and mug small businesses do we really need?

2. Giant corporations with monopolies that they weren't supposed to have, like Amazon, buy in massive bulk so they get products cheaper and will sell for a small loss that they can easily afford just for customer retention.

DudeThatsDerpy intuitive Jackal_354 : Uber laid off thousands in another state as well.

光辉岁月888 : Election year. This administration will do anything to make the stock market bullish. Eventually the bubble will pop and next crisis could be the mother of all.