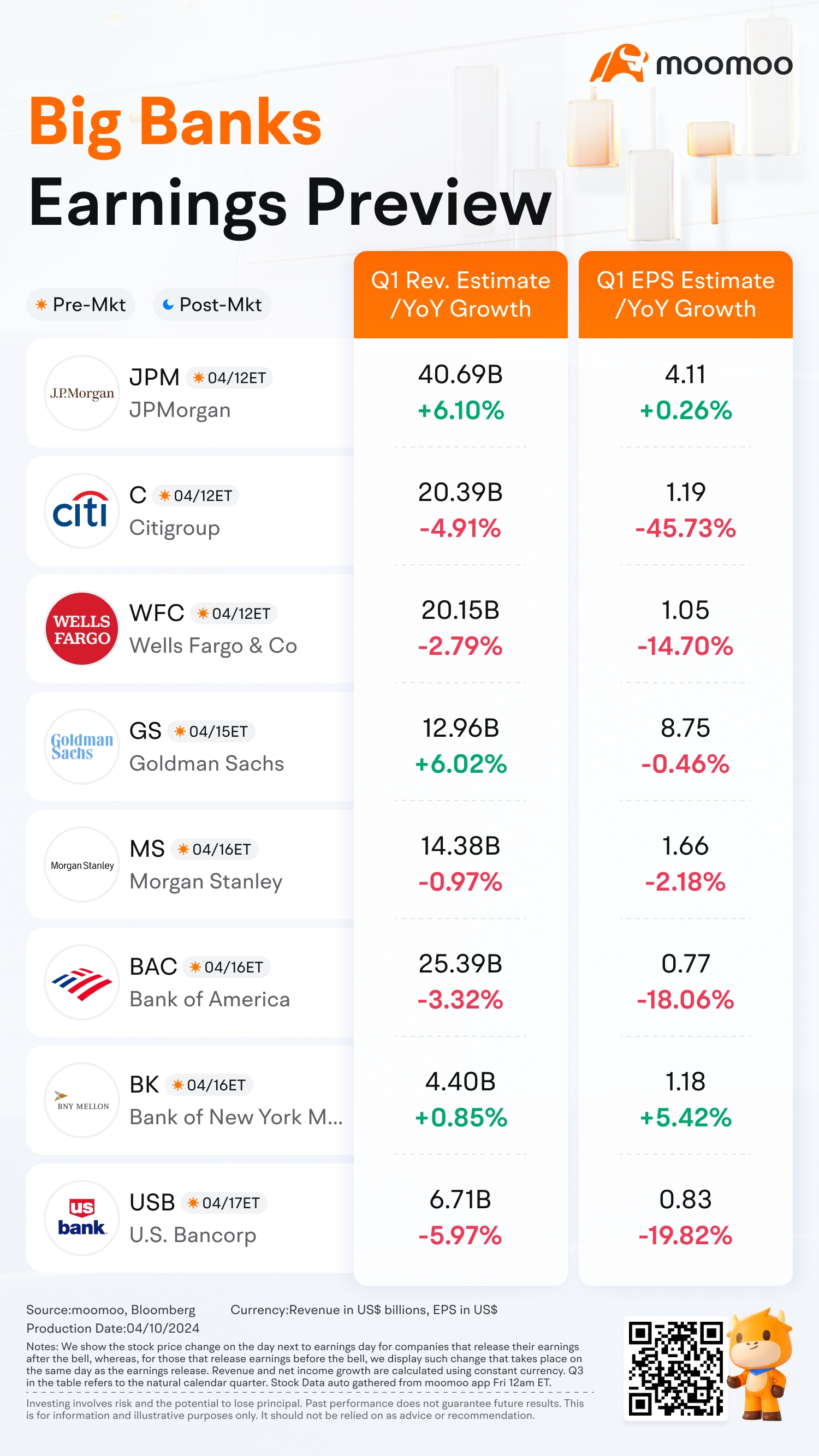

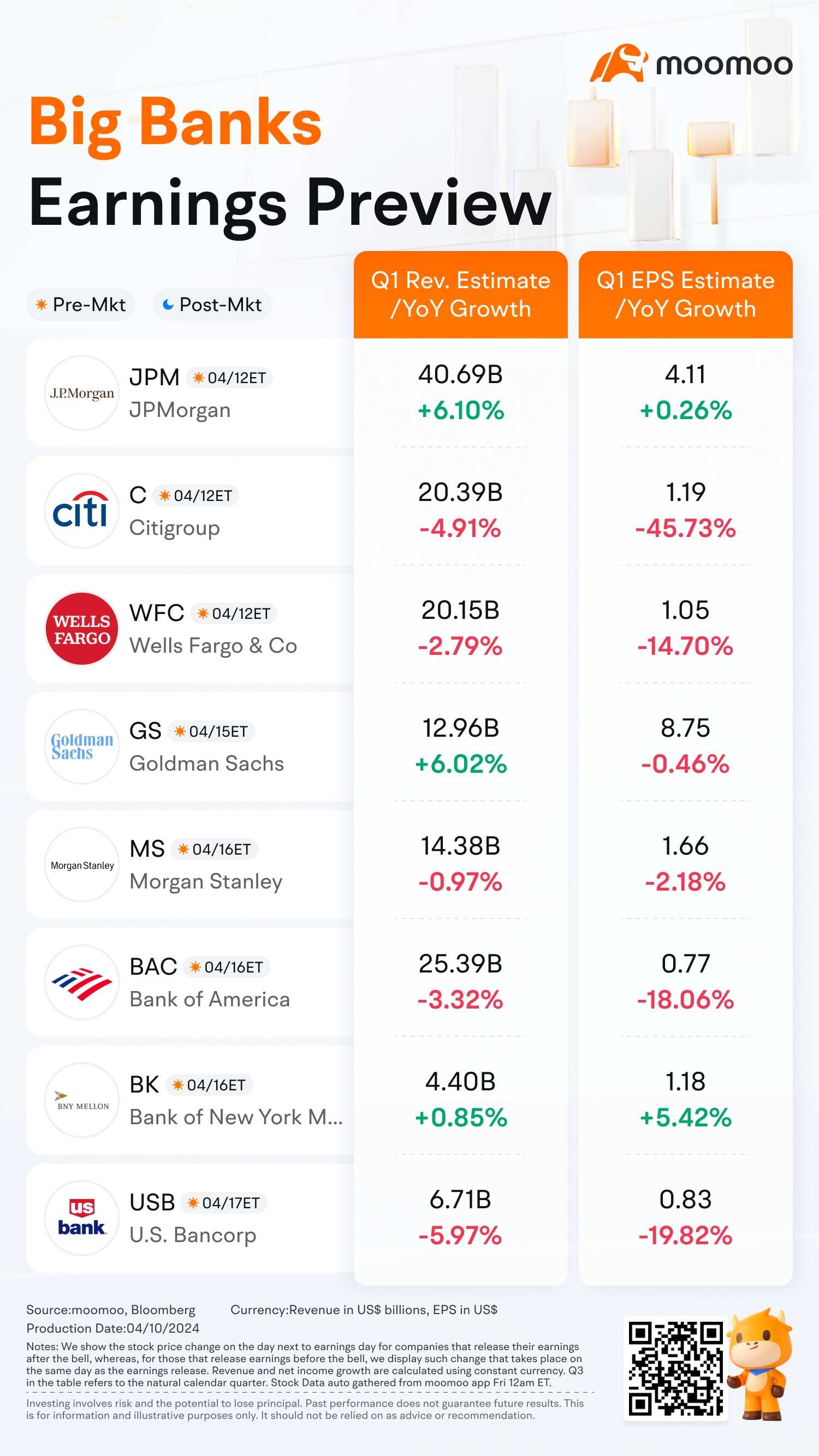

Bank Earnings Preview: What Does the Expansion of the Balance Sheet Mean for Large-Cap Banks?

Major banks, including JP Morgan, Citigroup, and Wells Fargo, will release their quarterly reports this week. The Federal Reserve's H.8 table shows that in the first quarter of 2024, the balance sheet of the U.S. banking industry accelerated its expansion, likely contribute to an increase in bank profits, especially in a high interest rate environment.

■ How is the growth of deposits?

The Fed's stats showed that seasonally adjusted deposits increased by 1.55% in the first quarter, reversing its downward trend seen in the past two years. Both large and small banks see deposit inflow, reflecting continued income growth amid low unemployment rates.

The decline in the proportion of large time deposits means that banks’ interest payment pressure may be alleviated.

■ Banks trim what they pay for deposits even before rate cuts

Banks are taking a less aggressive approach to gathering deposits and starting to cut the interest rates they pay, althoughthe moves aren't all that big. High-yield savings accounts at large online banks paid about 4.43% on average this month, a tiny decrease from 4.49% earlier this year, according to a DepositAccounts.com index.

Last year, in an effort to secure essential deposits, banks provided one-year certificates of deposit (CDs) with interest rates of 4.5% or higher. However, banks are now less interested in locking up money for that long at that price.

Instead, they're gearing their CDs toward terms of just a few months. JPMorgan Chase, for example, is now paying a higher promotional rate on two-month CDs than on CDs of other lengths. That strategy gives them more flexibility to reprice CDs downwards if the Fed lowers interest rates this year, a prospect that remains likely, even though investors are increasingly calling it into question.

All the shifts in banks' consumer deposit strategies are aimed at protecting their profit margins, which have been "getting squeezed" for the past year. Keeping deposit costs down is critical at this stage of the economic cycle since rates have flatlined and margins are under pressure.

■ How's loan growth and its structure?

Loans experience unexpected rebound amid high interest rates. Loans and leases increased by 1.43% QoQ in the first quarter, faster than the 0.26% growth in the last quarter of 2023.

The sustained inflationary pressures on low-income groups have led to a double-digit surge in credit card loan growth. Meanwhile, as of February, the growth rate of commercial and industrial loans returned to the level of 4%, which is consistent with the PMI for manufacturing and services that is within the expansionary range. Real estate loans remain at a pace faster than 4% since tangible assets are often seen as a means to hedge against inflation.

■ Will loan quality deteriorate?

For real estate loans, the company CoreLogic, Irvine, Calif., said on April 2ndthat the U.S. housing market posted an overall delinquency rate of 2.8% in January, approaching a record low. That’s flat from January 2023, and down by 0.3% from December. The serious delinquency rate was at 1%, and the foreclosure rate was at 0.3%, also near all-time lows.

However, for credit card loans, the delinquency rate has been rising. The annualized fourth-quarter net charge-off rate in the credit card segment rose 94 basis points from a year earlier to 4.15%, the highest level since this metric reached 4.38% in the second quarter of 2019, according to S&P Global. Total delinquent CRE loans stood at $25.26 billion at the close of 2023, up 79% from a year earlier.

Wedbush analyst David Chiaverini said high rates "may continue to pressure negative credit migration, especially for banks with outsized exposure to CRE and consumer loans."

■ Why would American balance sheets expand under high interest rates?

Typically, when interest rates rise, an expansion of the balance sheets of U.S. households is not the expected outcome. However, there are several reasons why balance sheets expand in a high-interest-rate environment:

Debt Repricing:Existing variable-rate loans (like adjustable-rate mortgages) would have their interest costs increase as rates rise, which could inflate the total amount of debt.

Increased Borrowing:In a high inflation environment, individuals and businesses might rely more on borrowing to cover daily expenses or operational costs, especially if they expect inflation to continue rising and that interest rates may fall at a future point.

Investment Behavior:If investors expect rates to fall in the future, they might increase borrowing to invest in advance, anticipating capital gains when rates decrease.

Asset Revaluation:Tangible assets, like real estate, may maintain value or appreciate because the cost of alternative investments increases, which could lead to an expansion of total asset values on the balance sheet.

■ What's the outlook for the banking sector?

The U.S. economy is in the exact opposite phase of what Taiwanese economist Richard C. Koo calls a "balance sheet recession." Ray Dalio also mentioned the phenomenon of economies leveraging up in his book"Principles for Navigating Big Debt Crises."

During the balance sheet expansion phase, borrowers are less likely to default as assets continue to appreciate in value. Affected by the inflow of deposits and active lending activities,banks are significant beneficiaries of this economic phenomenon.

In addition to interest income, IB fees rose 10% YoY per Dealogic, led by very strong growth in high yield issuance, leveraged loan syndications, and ECM volumes, to the highest levels since 4Q21. Meanwhile,Wealth and asset management fees should also benefit from strong equity markets.

Iron Bay Capital President Rober Bolton said, the industry overall remained profitable throughout 2023 and is expected to remain so this year. Profits also are poised to increase in the second half of 2024 and into next year should the Fed follow through on the rate cuts that policymakers said were likely in a report after their March meeting.

Among large banks, Deutsche Bank analyst Matt O-Connor classifies JPM and BAC as high bars, as the analyst expects a Net Interest Income guide up for JPM, and market share gains for Bank of America in investment banking and trading, and less credit risk than some peers.

JP Morgan analyst Vivek Juneja noted in the latest report that he prefers Bank of America, which should benefit from strong investment banking fees, better trading revenues, and solid wealth management fees, plus net interest income (NII) holding up better than feared. He said Citi is likely to lag peers in trading, and have a noisy quarter with large severance charges plus revenues muddied by Argentina devaluation, along with the continued rise in credit losses. Recent media story raises questions about its progress on regulatory issues, too. Wells Fargo continues to grow its investment banking business strongly, but trading revenue growth is likely to slow sharply from 2023, partly due to some one-time items.

Source: Federal Reserve, American Banker

By Moomoo US Team Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

DudeThatsDerpy : "Total delinquent CRE loans stood at $25.26 billion at the close of 2023, up 79% from a year earlier" says it all. Likely to cause the next string of bank failures.