Wall Street's Mixed Earnings: Fall in Interest Income Offsets Recovery in Investment Banking Revenue

As Bank of America released its first quarter report, major banks have completed their first quarter earnings disclosure. Wall Street financial giants had mixed performances.

Bank of America's earnings took a hit in the first quarter as it faced a softer consumer banking sector and increased loan charge-offs, particularly in the credit card segment. The banking giant reported a profit of $6.7 billion or 76 cents per share during the quarter ending March 31, a decline from the previous year's $8.2 billion or 94 cents per share.

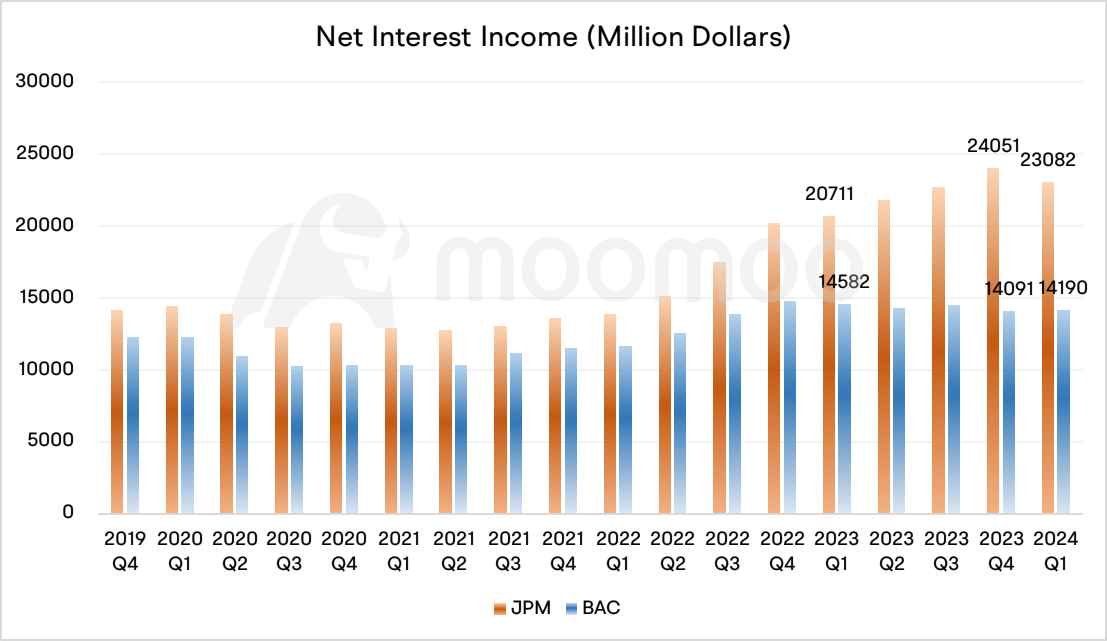

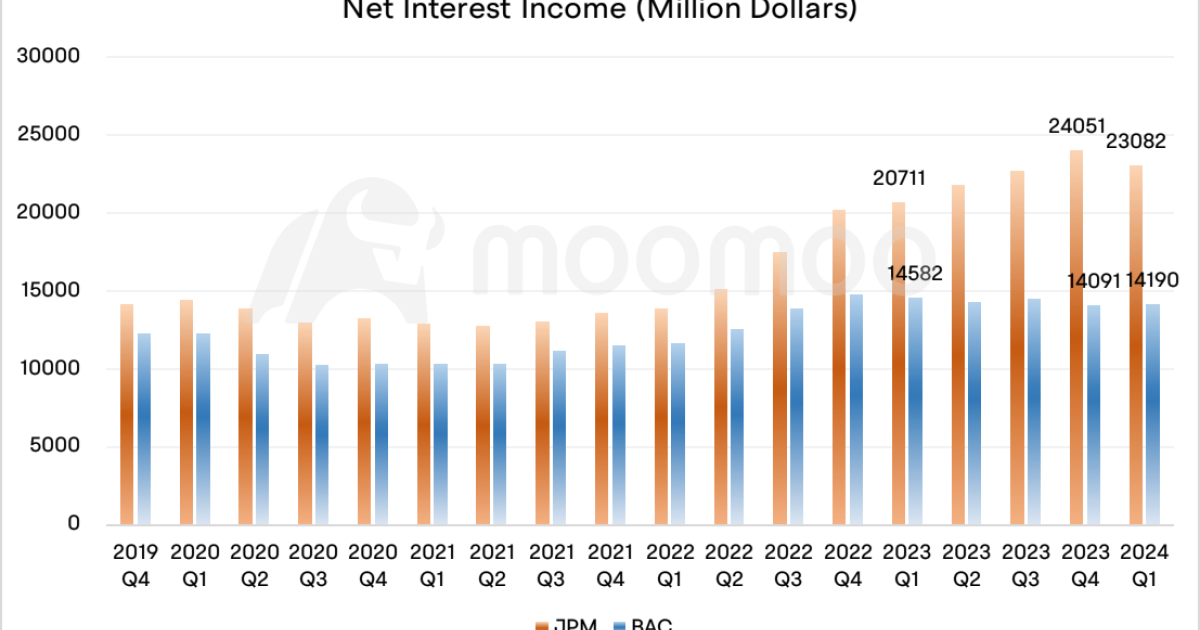

The bank's net interest income, which reflects the profit from loans minus the cost of deposits, fell by 3% to $14 billion due to rising deposit costs and only slight growth in loans.

Despite a downturn in interest income, Bank of America saw a rise in revenue from its investment banking and wealth management services, helping to counterbalance the earnings dip. The firm's investment banking fees soared by 35% to reach $1.6 billion. Furthermore, trading revenue, not including Debt Valuation Adjustment, came in at $5.18 billion, surpassing the anticipated $5.02 billion. The wealth and investment management division also performed well, reporting revenue of $5.59 billion, which exceeded analysts' expectations of $5.34 billion.

The bank maintained a solid standardized Common Equity Tier 1 (CET1) ratio at 11.8%, aligning with projections.

■ Reports from other commercial banks this week also showed pressure on interest income

PNC Financial Services reported a 21% fall in first-quarter profit on Tuesday, also hurt by lower interest income as the lender paid more to hold customer deposits in a high interest rate environment. The bank forecasts net interest income (NII) will decline by about 1% in the current quarter, compared with the first quarter. Net income fell to $1.34 billion, or $3.10 per diluted share, for the three months ended March 31, compared with $1.69 billion, or $3.98 per share, in the year-ago period.

Bank of New York Mellon shares also fell despite reporting a 5% profit rise, driven by higher investment services fees from rising asset value. Still, interest income still weighed on overall profits.

Last Friday, JP Morgan Chase and Wells Fargo's net interest income guidance fell short of expectations, indicating that the benefits of high interest rates to banks may be diminishing.

■ Most banks have seen an increase in nonperforming loans

Bank of America's nonperforming loans increased from 3.9 billion in the first quarter last year to 5.9 billion this year, while JP Morgan's nonperforming loans increased 11.3% year-on-year to 7.7 billion.

"Bank of America is considered a leading indicator for consumer trends," noted David Wagner, portfolio manager at Aptus Capital Advisors. "The increase in credit card delinquencies took them by surprise."

In the first quarter, BofA reported that its net charge-offs — debts deemed unrecoverable — climbed to $1.5 billion from $807 million the previous year, with the majority stemming from credit card defaults. These charge-offs result from delinquencies in the last quarter, but they are starting to level off, according to Alastair Borthwick, the chief financial officer.

The U.S. banking industry appears more cautious in dealing with potential debt losses. Bank of America raised the Loan Loss Provision from 1.10 billion in the fourth quarter to 1.32 billion in the first quarter.

■ Investment banking business is generally better than the commercial banking sector

It's not just Bank of America's Investment Banking business that's growing; revenue from the sector also rose at its rivals, JPMorgan Chase and Citigroup, in the first quarter, fueled by gains in debt and equity capital markets.

Goldman Sachs reported on Monday that its profits surpassed expectations, driven by a strong performance in underwriting, deal-making, and bond trading, which elevated its earnings per share to levels not seen since the end of 2021. Scaling back its loss-making consumer lending unit has also helped the bank. Morgan Stanley's performance was also better than expected, with its investment banking fees rising 19% from a year ago, driven mostly by equity and fixed-income underwriting as work on IPOs and bond issuances picked up.

■ What's the outlook for the banking sector?

An uncertain economic outlook and shifting expectations for U.S. interest rate cuts have made it more difficult to predict future profits, banking executives said last week.

If the Federal Reserve keeps rates higher for longer in the coming months, lenders that made bumper profits from rising interest rates in the last two years could build on their gains. But their earnings could diminish if a potential economic slowdown deters borrowers from taking out loans.

"Still, We continue to expect that Q2 will be the low point for NII and we expect the back half of 2024 to grow," Bank of America’s Borthwick told analysts on a conference call on Tuesday.

JPMorgan, the largest U.S. lender, slightly increased its estimate for NII, disappointing investors who hoped that the bank would reap even greater benefits from a prolonged period of higher interest rates.

Commercial real estate is another concern. It took more write-downs on office loans for banks, which partly increased loan losses for commercial division. Still, Bank of America's CFO said the lender had limited commercial real estate exposure and was reviewing ratings, property appraisals, and sales.

A good thing is a resilient U.S. economy, buoyant equities, and a flurry of large deals have reignited hopes of a nascent recovery in dealmaking.

In general, the environment faced by banks may still be complex. Therefore, how to allocate credit resources and how to deal with economic uncertainty is a continuous test for large banks.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment