April Nonfarm Payrolls Preview: Latest Employment Data Unlikely to Change Fed's More Hawkish Stance

April's nonfarm payrolls report will be released at 8:30 ET this Friday. After a solid job report in March, the April figures are likely to suggest once more that the labor market is still tight.

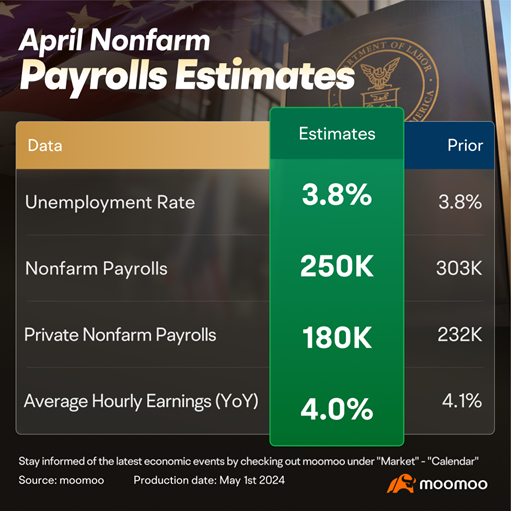

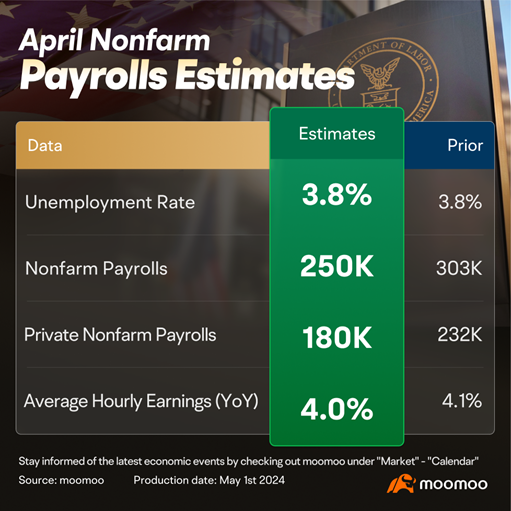

The consensus estimate polled by Bloomberg shows that nonfarm payroll is expected to increase by 250K, down from 303K in March. The unemployment rate is expected to remain at 3.8%.

Recruitment was probably focused on non-cyclical sectors like health services. Industries that are more sensitive to economic cycles are generally more hesitant to hire and may even be implementing job cuts. Within the cyclical categories, however, industries such as construction, leisure and hospitality might be exceptions, potentially taking on migrant workers and standing out as areas of employment growth.

ADP beats estimates, Jobless claims steady in April

Data published by private payroll firm ADP revealed that employers added 192,000 jobs in April, surpassing the expected 180,000. Additionally, the figure for March was revised up to 208,000 from the initial estimate of 184,000.

“Hiring was broad-based in April,” said Nela Richardson, chief economist at ADP.

Even if data from layoffs.fyi shows that Tesla’s layoffs caused a slight increase in the overall number of layoffs in April, it is difficult for the employment situation to show signs of significant deterioration.

Initial Jobless Claims in the US remained unchanged from the previous week's revised level of 208,000 in the week ending April 27, marking the lowest in two months. These figures further corroborate the existence of a tight labor market, potentially providing the Federal Reserve with additional justification to postpone interest rate cuts as it continues to address persistent inflation. Continuing Jobless Claims in the United States, which are seen as a proxy for the number of people receiving unemployment benefits, remained unchanged at 1.774 million in the week ending April 20, the lowest level since the first week of February.

Exhibit: Continuing Jobless Claims

Indeed's job postings data shows vacancies are declining, although they are still 15.7% higher than before the pandemic.

Wage growth may still lag a broader disinflation trend

The year-on-year growth rate of nonfarm payroll wages may remain high since nearly half of US states increased their minimum wages in the first quarter. According to the ADP report published on Wednesday, workers who stayed in their jobs saw a median pay bump of 5%, which is similar to the growth observed in March. Powell said last year that wage growth of 3.5% was appropriate to achieve the 2% inflation target.

The Atlanta Fed's wage tracker previously showed that the latest moving average of wage growth over the past three months dropped to 4.7%.

Although dissipating excess demand for workers and less churn in the labor market should help wage pressures to abate in the months ahead, monthly wage growth still likely rose 0.3% MoM following a 20% minimum-wage hike for California fast-food workers.

The Employment Cost Index, the Fed's preferred gauge, also showed the resilience of wage growth, released on Tuesday morning. Compensation costs for civilian workers in the United States rose by 1.2% in the first quarter of 2024, accelerating from a 0.9% increase in the previous three-month period and beating the market consensus of a 1% growth.

Exhibit: Employment Cost Index

What's the implication for the Fed?

The Federal Reserve officials unanimously decided to leave the target range for the benchmark federal funds rate at 5.25% to 5.5% on Wednesday. Chair Jerome Powell tried to keep the central bank's options open by sticking with his view that interest rates are restrictive and that inflation was likely to resume its decline.

Powell said that it's unlikely that the Fed's next move would be to raise interest rates, saying officials would need to see persuasive evidence that policy is tight enough to bring inflation back toward its 2% target. Still, Powell stopped short of signaling rate cuts were likely this year or that rates were at a peak, which he had said previously.

As a string of disappointing readings on price and wage, inflationary pressures have led investors to put less weight on the central bank's outlook and more attention on how the economic dataunfolds. Swaps traders are now pricing for the Fed to deliver at most two cuts by the end of the year. CME FedWatch shows the probability of the Fed cutting interest rates in July is less than 30%.

In addition, the ISM Services PMI released immediately after nonfarm payrolls could steal the show. Investors hang onto forward-looking surveys and adhere to their guidance. This data is approaching the 50-point mark that separates between contraction and expansion. More importantly,it holds significant guidance for both inflation and employment. If the service industry sentiment is still above 50, it means that the job market may remain tight for some time to come.

Source: Moomoo, CME, Bloomberg, Zerohedge

By moomoo news US Calvin and Adrienne

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment