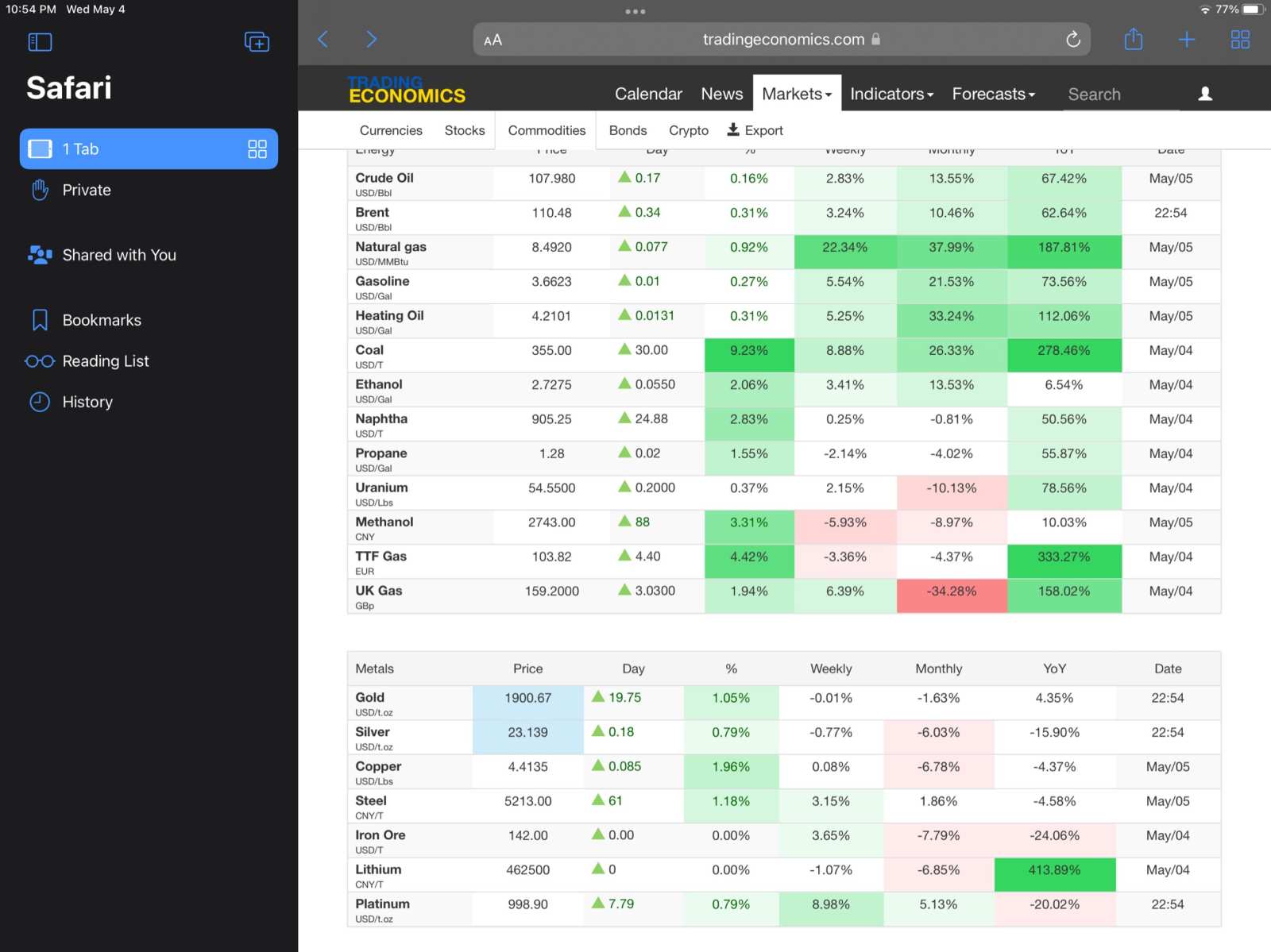

Is the Commodities Rally Still in Full Effect?

Commodities and Energy are jumping after the Fed rate hike. Jerome Powell mentioned high but manageable inflation. Is the “Volker Era” coming soon? I can barely afford a full gas tank as it is already. ![]() The ban on Russian oil by the EU is surely the cause for the pop. You can blame supply chain issues all you want. Rising oil prices is the number one cause of inflation in most cases.

The ban on Russian oil by the EU is surely the cause for the pop. You can blame supply chain issues all you want. Rising oil prices is the number one cause of inflation in most cases.

$ProShares Ultra Bloomberg Natural Gas(BOIL.US$ $United States Natural Gas(UNG.US$ $United States 12 Month Natural Gas Fund(UNL.US$ $United States Gasoline Fund Lp(UGA.US$ $United Sts Brent Oil Fd Lp Unit(BNO.US$ $United States Oil Fund LP(USO.US$ $Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares(GUSH.US$ $SPDR S&P Metals & Mining ETF(XME.US$ $iPath Bloomberg Commodity Index Total Return ETN(DJP.US$ $Ishares Global Energy Etf(IXC.US$ $Ishares U.S. Energy Etf(IYE.US$ $Bilibili(BILI.US$ $Kaixin Holdings(KXIN.US$ $DiDi Global (Delisted)(DIDI.US$ $Baidu(BIDU.US$ $RLX Technology(RLX.US$ $Chindata(CD.US$ $Li Auto(LI.US$ $Alibaba(BABA.US$ $Tencent Music(TME.US$ $JD.com(JD.US$ $NIO Inc(NIO.US$ $PDD Holdings(PDD.US$ $Futu Holdings Ltd(FUTU.US$ $SPDR S&P 500 ETF(SPY.US$ $SPDR Dow Jones Industrial Average Trust(DIA.US$ $Invesco QQQ Trust(QQQ.US$ $CBOE Volatility S&P 500 Index(.VIX.US$ $Crude Oil Futures(JUN4)(CLmain.US$ $Hang Seng TECH Index(800700.HK$ $Hang Seng Index(800000.HK$ $SSE Composite Index(000001.SH$ $SSE 50 Index(000016.SH$ $CSI 300 Index(000300.SH$ $Bitcoin(BTC.CC$ $Ethereum(ETH.CC$ $Dogecoin(DOGE.CC$ $AMC Entertainment(AMC.US$ $GameStop(GME.US$ $Twitter (Delisted)(TWTR.US$ $Netflix(NFLX.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

GNRForever : When they see red, they will change their tune

iamiam : I was bearish just for relief, because in real life it's all bullish - it's a fight for certain oil and we are buying diesel like crazy, along with everyone else sorry for the ramble finishing my post and barely keep my eyes open

sorry for the ramble finishing my post and barely keep my eyes open

its creating problems that will present themselves in the future.

Just today (because of the cost of diesel) we pushed up a bunch of projects and filed a bunch of breach of contracts because some people (and govt entities) are reluctant to pay the higher cost and think price will come down (a big part with govt is they are reluctant/stubborn to use different materials and want what they call for in their specifications but they all have the same specs so everyone is chasing the same manufacturers and materials *hello more govt caused inflation*)

Say you do order something and now they tell you we'll give you a price when we deliver it in 6-12 months and you can expect a higher price.

Anyways I'm tired and rambling,

but jpow-wow actually said today the FED can't control commodity, energy and food price inflation and that's why they dont track it. Let that sink in. This is going to end ugly but first it will be glorious. The FED cant land this, inflation wont be controlled until they crush demand but then they CRUSH DEMAND

SpyderCallOP iamiam: No that’s good stuff. I must have been distracted when he said he the fed doesnt track commodities for inflation. Thats pretty wild. Crushing demand seems to be the only thing they can at least try to do. Volker Era Incoming

SpyderCallOP iamiam: And its funny because the other day it looked like a lot of commodities and oil were going for a small leg down and then boom EU bans Russian Oil. Couldn’t have planned it better myself

solo invest : EU banning Russian oil. Yikes. I hope the EU can survive this. I’m sure they already have a plan in place.

SpyderCallOP : I wish i knew that plan. Do they have it in legislation somewhere? Can the public view this content?

SpyderCallOP iamiam: Commodities are going to take off next week you think? I think that Russian oil ban by the EU is beginning to sink in. What do you think I am?

iamiam SpyderCallOP: next week - that is tough to predict we could bottom then reverse or we could bottom and hang around. I know that next week is a buying week either way

SpyderCallOP iamiam: Heard