Latest

Hot

$Pfizer(PFE.US$ has recently announced overwhemingly positive results from a clinical study of its Covid-19 pill Paxlovid. It appears highly probable that Paxlovid would win authorization and the pill may even start selling before the end of the year . The market reacted positively to the news with huge gains for the stock price of $Pfizer(PFE.US$. Investors hoping to jump aboard the $Pfizer(PFE.US$ train to profit from the antiviral pill could be a little late to join the party. Still, there are other reasons to like the stock. The valuation of $Pfizer(PFE.US$ remains attractive and the stock is still trading at a bargain, considering its growth prospects in the near term and long term. With the huge potential for Paxlovid, the cash stockpile for $Pfizer(PFE.US$ should continue to increase greatly. The success of its battle against Covid-19 should give the company even more flexibility to make acquisitions and other business development deals that could bring about further growth. $Pfizer(PFE.US$ appears to be a fast growing company on the basis of its coronavirus revenue as well as having a bigger, more effective pipeline of related projects.

$Nasdaq Composite Index(.IXIC.US$

$S&P 500 Index(.SPX.US$

$AstraZeneca(AZN.US$

$BioNTech(BNTX.US$

$Johnson & Johnson(JNJ.US$

$Merck & Co(MRK.US$

$Moderna(MRNA.US$

$Novavax(NVAX.US$

$Ocugen(OCGN.US$

$Nasdaq Composite Index(.IXIC.US$

$S&P 500 Index(.SPX.US$

$AstraZeneca(AZN.US$

$BioNTech(BNTX.US$

$Johnson & Johnson(JNJ.US$

$Merck & Co(MRK.US$

$Moderna(MRNA.US$

$Novavax(NVAX.US$

$Ocugen(OCGN.US$

53

40

This year, two giants pharmaceutical companies, $Merck & Co(MRK.US$ and $Pfizer(PFE.US$ have announced their clinical findings on the use of antiviral pills for the treatment of Covid 19 and the Delta Varient. These antiviral pills are Molnupiravir, from $Merck & Co(MRK.US$ and Paxlovid, from $Pfizer(PFE.US$. Based on the companies’ clinical trials, both these two drugs help to reduce the coronavirus ability to replicate and hence slow down the disease process. They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. $Pfizer(PFE.US$ statistics showcases that Paxlovid can effectively treat 89% of the acutely hospitalised patients, which is a significant indicator for a good percentage of the patients’ recovery. Moreover, oral medications have greater convenience over the administration of intravenous medications.

Therefore, will there be a breakthrough in the era of the antiviral pills and which pharmaceutical company will emerge as the winner? Irregardless, of which company to emerge as the game changer, the vital role is for the antiviral 💊 not only to work, but most importantly, to work Effectively, in order to save the lives of the countless Covid 19 victims worldwide.

At this moment, their efficacies and side effects are not clearly defined yet. However, it will certainly open up a new chapter in the history of Healthcare if one of these two medications works, or even better still if both can prove their worth.

Obviously, the price for a treatment course is just as important. Molnupiravir is priced at US $700 for a five days’ treatment cost. $Pfizer(PFE.US$ has not revealed the Paxlovid’s pricing yet, but it has promised the consumers of an affordable cost. Recently, $Pfizer(PFE.US$ shares prices have surged upwards, since CEO, Albert Bourla’s announcement of the favourable research findings. Moving forward, I can anticipate that $Pfizer(PFE.US$ shares will even be more bullish once US, FDA has approved of its use as an antiviral pill.

$Moderna(MRNA.US$

$Novavax(NVAX.US$

$BioNTech(BNTX.US$

$Johnson & Johnson(JNJ.US$

$Merck & Co(MRK.US$

Therefore, will there be a breakthrough in the era of the antiviral pills and which pharmaceutical company will emerge as the winner? Irregardless, of which company to emerge as the game changer, the vital role is for the antiviral 💊 not only to work, but most importantly, to work Effectively, in order to save the lives of the countless Covid 19 victims worldwide.

At this moment, their efficacies and side effects are not clearly defined yet. However, it will certainly open up a new chapter in the history of Healthcare if one of these two medications works, or even better still if both can prove their worth.

Obviously, the price for a treatment course is just as important. Molnupiravir is priced at US $700 for a five days’ treatment cost. $Pfizer(PFE.US$ has not revealed the Paxlovid’s pricing yet, but it has promised the consumers of an affordable cost. Recently, $Pfizer(PFE.US$ shares prices have surged upwards, since CEO, Albert Bourla’s announcement of the favourable research findings. Moving forward, I can anticipate that $Pfizer(PFE.US$ shares will even be more bullish once US, FDA has approved of its use as an antiviral pill.

$Moderna(MRNA.US$

$Novavax(NVAX.US$

$BioNTech(BNTX.US$

$Johnson & Johnson(JNJ.US$

$Merck & Co(MRK.US$

29

6

ColumnsDevelopments of note

$Pfizer(PFE.US$ In late September, the FDA authorized a Comirnaty booster shot for those 65 years of age and older, those over 18 at high risk of severe COVID-19, and individuals 18 through 64 years of age with frequent institutional or occupational exposure to the coronavirus that places them at high risk of serious complications.

Late last month, the FDA gave the go-ahead for the use of Pfizer’s vaccine in children ages 5 to 11. The vaccine will be administered in a two-dose regimen of 10 micrograms given 21 days apart.

In a move that sent competitors' stocks ticking lower, Pfizer released data on Paxlovid, the company’s pill for treatment of COVID-19. A phase 3 trial showed Paxlovid reduces the risk of hospitalization or death by 89% compared to a placebo.

$Merck & Co(MRK.US$ molnupiravir, an oral treatment for COVID, received approval from the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) early this month. Merck is also awaiting emergency use authorization from the FDA for molnupiravir.

Merck’s CEO projected sales for the COVID pill would reach $5 billion to $7 billion in 2022, including $1 billion in sales this year if the treatment is approved by the FDA in December. The US government has a $1.2 billion contract with Merck for 1.7 million courses of molnupiravir at $700 a course.

However, in a Phase 3 trial involving patients with mild-to-moderate COVID-19, molnupiravir only reduced the risk of hospitalization or death by about 50%. Since Pfizer’s Paxlovid demonstrated an 89% efficacy rate, one would think Pfizer would capture most of the market moving forward.

In late September, Pfizer released results from a Phase 3 study evaluating the safety and immunogenicity of PREVNAR 20 for adults aged 65 and older when administered at the same time as a flu vaccine. The data indicated that the safety and efficacy of a PREVNAR 20 and a flu vaccine taken together were the same as when each vaccine was administered separately, one month apart.

Roughly a month later, the CDC recommended Prevnar 20 in adults 65 and older and adults 19 and older with certain risk factors.

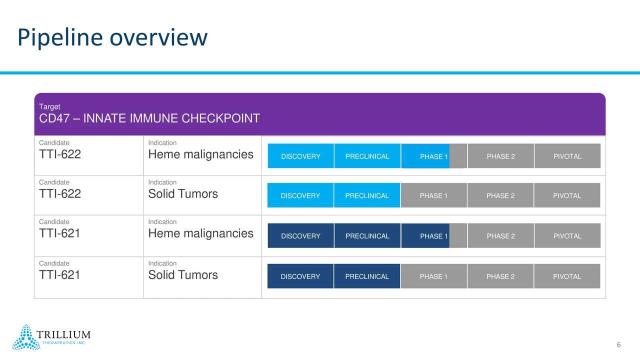

Back in August, Pfizer announced plans to acquire $Trillium Therapeutics(TRIL.US$ . Roughly two weeks ago, Trillium shareholders approved the acquisition. The deal will cost Pfizer $2.26 billion and serve to bolster Pfizer's oncology pipeline with blood cancer candidates TTI-622 and TTI-621.

The acquisition is expected to close no later than the first half of 2022, and management stated Trillium’s treatments might drive profits as early as 2026.

Early in September, Pfizer announced it initiated phase 3 trials for a respiratory syncytial virus (RSV) vaccine. RSV is a common, highly contagious virus that causes infections of the respiratory tract. The virus is the number one cause of respiratory hospitalization in infants, and it also results in more serious respiratory illnesses in the elderly, often leading to pneumonia in seniors and the immunocompromised.

The Pipeline and Patents

Pfizer has 94 drugs in its product pipeline, with 9 in the registration phase and 29 in phase 3.

U.S. patent expirations include Sutent in 2021 (2% of sales), Ibrance in 2023 (13% of sales), Vyndaqel/Vyndamax in 2024 (3% of sales), and Xeljanz (6% of sales), and Inlyta (2% of sales) in 2025.

Late last month, the FDA gave the go-ahead for the use of Pfizer’s vaccine in children ages 5 to 11. The vaccine will be administered in a two-dose regimen of 10 micrograms given 21 days apart.

In a move that sent competitors' stocks ticking lower, Pfizer released data on Paxlovid, the company’s pill for treatment of COVID-19. A phase 3 trial showed Paxlovid reduces the risk of hospitalization or death by 89% compared to a placebo.

$Merck & Co(MRK.US$ molnupiravir, an oral treatment for COVID, received approval from the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) early this month. Merck is also awaiting emergency use authorization from the FDA for molnupiravir.

Merck’s CEO projected sales for the COVID pill would reach $5 billion to $7 billion in 2022, including $1 billion in sales this year if the treatment is approved by the FDA in December. The US government has a $1.2 billion contract with Merck for 1.7 million courses of molnupiravir at $700 a course.

However, in a Phase 3 trial involving patients with mild-to-moderate COVID-19, molnupiravir only reduced the risk of hospitalization or death by about 50%. Since Pfizer’s Paxlovid demonstrated an 89% efficacy rate, one would think Pfizer would capture most of the market moving forward.

In late September, Pfizer released results from a Phase 3 study evaluating the safety and immunogenicity of PREVNAR 20 for adults aged 65 and older when administered at the same time as a flu vaccine. The data indicated that the safety and efficacy of a PREVNAR 20 and a flu vaccine taken together were the same as when each vaccine was administered separately, one month apart.

Roughly a month later, the CDC recommended Prevnar 20 in adults 65 and older and adults 19 and older with certain risk factors.

Back in August, Pfizer announced plans to acquire $Trillium Therapeutics(TRIL.US$ . Roughly two weeks ago, Trillium shareholders approved the acquisition. The deal will cost Pfizer $2.26 billion and serve to bolster Pfizer's oncology pipeline with blood cancer candidates TTI-622 and TTI-621.

The acquisition is expected to close no later than the first half of 2022, and management stated Trillium’s treatments might drive profits as early as 2026.

Early in September, Pfizer announced it initiated phase 3 trials for a respiratory syncytial virus (RSV) vaccine. RSV is a common, highly contagious virus that causes infections of the respiratory tract. The virus is the number one cause of respiratory hospitalization in infants, and it also results in more serious respiratory illnesses in the elderly, often leading to pneumonia in seniors and the immunocompromised.

The Pipeline and Patents

Pfizer has 94 drugs in its product pipeline, with 9 in the registration phase and 29 in phase 3.

U.S. patent expirations include Sutent in 2021 (2% of sales), Ibrance in 2023 (13% of sales), Vyndaqel/Vyndamax in 2024 (3% of sales), and Xeljanz (6% of sales), and Inlyta (2% of sales) in 2025.

22

5

Excitement is high about what these vaccines companies can produce in near future from $Moderna(MRNA.US$ $BioNTech(BNTX.US$ to big names $Pfizer(PFE.US$ and $Johnson & Johnson(JNJ.US$. These sector is surely a long term play and its exploded due to the race in developing vaccine for covid.

Emerging technologies such as the mRNA has fuel the rapid development for the vaccines. While all the countries are phasing out to the endemic level, there is no guarantee in future another type of virus or bacteria might appear. These stocks are purely a long term play. We have to be patient although these stocks now have retreated, but it might come back. 🍀

Emerging technologies such as the mRNA has fuel the rapid development for the vaccines. While all the countries are phasing out to the endemic level, there is no guarantee in future another type of virus or bacteria might appear. These stocks are purely a long term play. We have to be patient although these stocks now have retreated, but it might come back. 🍀

23

3

I think the $Pfizer(PFE.US$ pills are promising. I’m also optimistic about the pills by $Merck & Co(MRK.US$ 😊 Yes, the vaccines by $Moderna(MRNA.US$ and $BioNTech(BNTX.US$ are critical and have been instrumental in protecting lives and preventing serious infections from Covid so that we can build the herd immunity and live with COVID-19 as a new normal. However, without a cure to COVID-19, people cannot accept that the new normal would involve deaths - they can accept having covid-19 and rec...

17

4

$Moderna(MRNA.US$now has a huge bank account. What prevents them from M&A of smaller fish with promising great products who can't bring them to market due to insufficient capital? I think the impending deaths of Moderna and $BioNTech(BNTX.US$are greatly exaggerated.

The imminent disappearance of COVID in its various manifestations is as unlikely as is the disappearance of flu or the common cold. Because COVID wasn't killed at birth but allowed to spread worldwide it will never die. The genie h...

The imminent disappearance of COVID in its various manifestations is as unlikely as is the disappearance of flu or the common cold. Because COVID wasn't killed at birth but allowed to spread worldwide it will never die. The genie h...

16

4

$Pfizer(PFE.US$

$Moderna(MRNA.US$

Another 100 SHARES???

The news sent shares of Pfizer PFE soaring 8.2% in trading on Friday, capping off a week in which the company reported better-than-expected sales of its COVID-19 vaccine and its oral COVID-19 pill produced compelling results in a clinical trial.

“As long as you have COVID around, you will have a need to vaccinate and protect, and then you will have a need to treat and save lives,” Pfizer CEO Albert Bourla told investors during Tuesday’s earnings call, according to a FactSet transcript.

https://www.marketwatch.com/amp/story/pfizer-to-seek-authorization-of-covid-19-pill-as-soon-as-possible-11636124909

$Moderna(MRNA.US$

Another 100 SHARES???

The news sent shares of Pfizer PFE soaring 8.2% in trading on Friday, capping off a week in which the company reported better-than-expected sales of its COVID-19 vaccine and its oral COVID-19 pill produced compelling results in a clinical trial.

“As long as you have COVID around, you will have a need to vaccinate and protect, and then you will have a need to treat and save lives,” Pfizer CEO Albert Bourla told investors during Tuesday’s earnings call, according to a FactSet transcript.

https://www.marketwatch.com/amp/story/pfizer-to-seek-authorization-of-covid-19-pill-as-soon-as-possible-11636124909

19

$Moderna(MRNA.US$ shareholders aren't the only ones to worry about $Pfizer(PFE.US$ cure. The essence of the real problem is that $Novavax(NVAX.US$ vaccine, which has solved the production problem, is about to be mass-produced at the world's top 3 SII in India, Takeda in Japan, and SKB foundries in Korea. The launch of Novavax is like a requiem of death for Pfizer and Moderna, who have formed a monopoly despite the controversy over quality degradation. Novavax is expected from side effects con...

17

2

Although both $Merck & Co(MRK.US$ and $Pfizer(PFE.US$ have come out with covid medicine such as the covid pills to treat covid, the covid virus may not disappear like in the case of the deadly smallpox virus.

This is because the current covid vaccines and covid medicine that we have, only at most reduce death rate and decrease hospitalization rate.

It is not the same as the smallpox vaccine, which is the first true vaccine to be developed, and offer immunity against the smallpox virus in a single jab.

Keeping this in mind, this would mean that other vaccine or medicine producer does have opportunities to win the race if they are able to come out the one covid vaccine jab or covid medicine that is able eradicate the covid virus.

Before we end this discussion, let's have a vote if you feel that there will be more market volatility ahead before 2021 end.

Thank you for your support.![]()

This is because the current covid vaccines and covid medicine that we have, only at most reduce death rate and decrease hospitalization rate.

It is not the same as the smallpox vaccine, which is the first true vaccine to be developed, and offer immunity against the smallpox virus in a single jab.

Keeping this in mind, this would mean that other vaccine or medicine producer does have opportunities to win the race if they are able to come out the one covid vaccine jab or covid medicine that is able eradicate the covid virus.

Before we end this discussion, let's have a vote if you feel that there will be more market volatility ahead before 2021 end.

Thank you for your support.

15

2

I added to $Moderna(MRNA.US$ and $BioNTech(BNTX.US$ today. BioNTech is the better stock because of much better distribution, thanks to their alliance with $Pfizer(PFE.US$ . This is despite the temperature storage advantage for the Moderna vaccine. Both have promising pipelines. Realize that BNTX will likely have a far better earnings announcement than MRNA did when BNTX announces earnings on Nov.9.

18

1

101767718 : Strongly agree, Pfizer is a good share for the long term.

jasonleett : Well written, Pfizer is indeed a prized stock in the current pandemic...

不理不理左不理 : Pfizer has an impressive slew of revenue from its widely successful portfolio which would make it highly attractive. Though it seemed like it is a tradable stocks, it’s too high for average investors.

HuatLady : $Pfizer (PFE.US)$ will have a promising future with Paxlovid because an effective antiviral pill will be the answer to our prayer of fighting the Covid 19 infection.

Spearhead : Good

View more comments...