zukG4HQuCI

liked

Forest City is rumored to have built a casino, and the agency called the alarm to check the “source”

In response to the rumor that a casino will be built in the forest city of Johor, $BJCORP(3395.MY$The case has been reported to the police to thoroughly investigate the so-called “unnamed sources”.

According to the latest statement, Chenggong Agency indicated that the company's legal representative reported the case to the police on April 26 to allow the police to launch an investigation.

“In particular, in order to identify and identify the so-called 'unnamed source', the source disseminated completely untrue and false claims.

“We trust that the police will take the necessary action to investigate this matter, and we solemnly encourage any publication to carefully verify the content before reporting.”

On the 26th of this month, Bloomberg (Bloomberg) and The Edge Singapore quoted sources as reporting that successful institutions may open a second casino in Forest City (Forest City), Johor

Bloomberg's report revealed that Prime Minister Anwar and China's two business tycoons last week, namely Tan Sri Chen Zhiyuan, founder of successful institutions, and $GENTING(3182.MY$Chairman Tan Sri Lam Cathay had lunch, and the head of state, His Majesty Sultan Ibrahim, also sent a representative to attend.

On the same day, the successful agency issued a statement denying this, while urging Bloomberg and The Edge Singapore to remove related reports.

The next day, $GENM(4715.MY$They also denied participating in discussions on the construction of a casino in Forest City, and asked the media to remove the false reports.

Become...

In response to the rumor that a casino will be built in the forest city of Johor, $BJCORP(3395.MY$The case has been reported to the police to thoroughly investigate the so-called “unnamed sources”.

According to the latest statement, Chenggong Agency indicated that the company's legal representative reported the case to the police on April 26 to allow the police to launch an investigation.

“In particular, in order to identify and identify the so-called 'unnamed source', the source disseminated completely untrue and false claims.

“We trust that the police will take the necessary action to investigate this matter, and we solemnly encourage any publication to carefully verify the content before reporting.”

On the 26th of this month, Bloomberg (Bloomberg) and The Edge Singapore quoted sources as reporting that successful institutions may open a second casino in Forest City (Forest City), Johor

Bloomberg's report revealed that Prime Minister Anwar and China's two business tycoons last week, namely Tan Sri Chen Zhiyuan, founder of successful institutions, and $GENTING(3182.MY$Chairman Tan Sri Lam Cathay had lunch, and the head of state, His Majesty Sultan Ibrahim, also sent a representative to attend.

On the same day, the successful agency issued a statement denying this, while urging Bloomberg and The Edge Singapore to remove related reports.

The next day, $GENM(4715.MY$They also denied participating in discussions on the construction of a casino in Forest City, and asked the media to remove the false reports.

Become...

Translated

From YouTube

17

zukG4HQuCI

liked

$Royal Philips(PHG.US$1 hour : +20k ☝🏻Grateful![]()

22

7

zukG4HQuCI

liked

This week, the US stock market ended its recent continuous downward trend, boosted by major financial reports. Both the S&P 500 and Nasdaq closed higher, rising 0.87% and 1.11%, respectively, while the Dow Jones Industrial Average also recorded 0.67% growth. Goldman Sachs, in particular, performed well in the financial sector, with an increase of more than 3%. US stocks: The Dow rose 0.67%, the S&P 500 index rose 0.87%, and the NASDAQ rose 1.11%.

In the technology sector, although Tesla continued to fall due to price adjustments, with a cumulative decline of more than 14% over a week, the strong performance of Nvidia and Arm led to a rise in the entire chip sector. Nvidia rose more than 4%, and Arm surged nearly 7%. Furthermore, Apple's AI big model development plan and Musk's emphasis on autonomous taxis (RoboTaxi) have also become the focus of market attention.

In the US bond market, the two-year US Treasury yield once broke through 5.0% and reached a five-month high, then declined somewhat. The US dollar index declined slightly after experiencing fluctuations, while the exchange rate of the yen against the US dollar hit a new low since 1990. In the commodity market, risk perception in the Middle East has decreased. Gold and silver prices have dropped sharply, gold has fallen below the closing record high, and crude oil prices have also declined somewhat. Copper and aluminum prices have fluctuated, and aluminum prices have reached new highs in nearly two years.

The Chinese market also showed fluctuations. A-shares fluctuated and adjusted throughout the day, and oil and gas and cyclical stocks did not perform well. However, Hong Kong stocks closed higher, with Tencent rising by more than 5%. The overall performance of Chinese securities listed in the US is strong...

In the technology sector, although Tesla continued to fall due to price adjustments, with a cumulative decline of more than 14% over a week, the strong performance of Nvidia and Arm led to a rise in the entire chip sector. Nvidia rose more than 4%, and Arm surged nearly 7%. Furthermore, Apple's AI big model development plan and Musk's emphasis on autonomous taxis (RoboTaxi) have also become the focus of market attention.

In the US bond market, the two-year US Treasury yield once broke through 5.0% and reached a five-month high, then declined somewhat. The US dollar index declined slightly after experiencing fluctuations, while the exchange rate of the yen against the US dollar hit a new low since 1990. In the commodity market, risk perception in the Middle East has decreased. Gold and silver prices have dropped sharply, gold has fallen below the closing record high, and crude oil prices have also declined somewhat. Copper and aluminum prices have fluctuated, and aluminum prices have reached new highs in nearly two years.

The Chinese market also showed fluctuations. A-shares fluctuated and adjusted throughout the day, and oil and gas and cyclical stocks did not perform well. However, Hong Kong stocks closed higher, with Tencent rising by more than 5%. The overall performance of Chinese securities listed in the US is strong...

Translated

21

zukG4HQuCI

liked

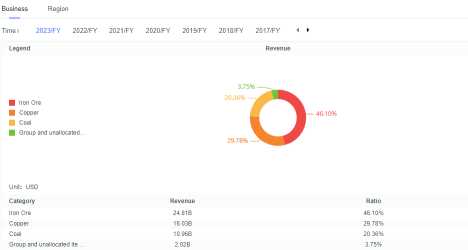

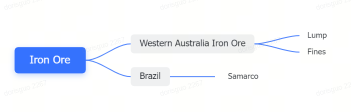

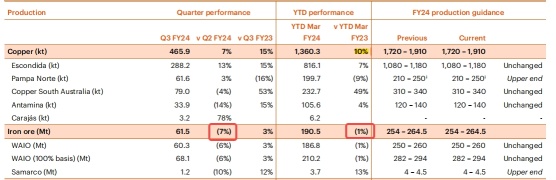

$BHP Group Ltd(BHP.US$ $BHP Group Ltd(BHP.AU$ $Rio Tinto(RIO.US$ $Rio Tinto Ltd(RIO.AU$

BHP, the Australian mining giant, recently released its latest operating results for the nine months ending on March 31st, 2024. Investors are excited about BHP due to the hot commodity market, and its third quarter performance was closely watched. The new quarterly report was pretty much what the market expected and BHP's stock price on the US...

BHP, the Australian mining giant, recently released its latest operating results for the nine months ending on March 31st, 2024. Investors are excited about BHP due to the hot commodity market, and its third quarter performance was closely watched. The new quarterly report was pretty much what the market expected and BHP's stock price on the US...

+4

12

zukG4HQuCI

liked

$Enbridge Inc(ENB.CA$ Down because interest rate cuts are not eminent. And have quite a bit of debt. But assets are solid. I bought last time it was in the $45s. Waiting for 42-43 range. $Enbridge Inc(ENB.CA$

14

zukG4HQuCI

liked

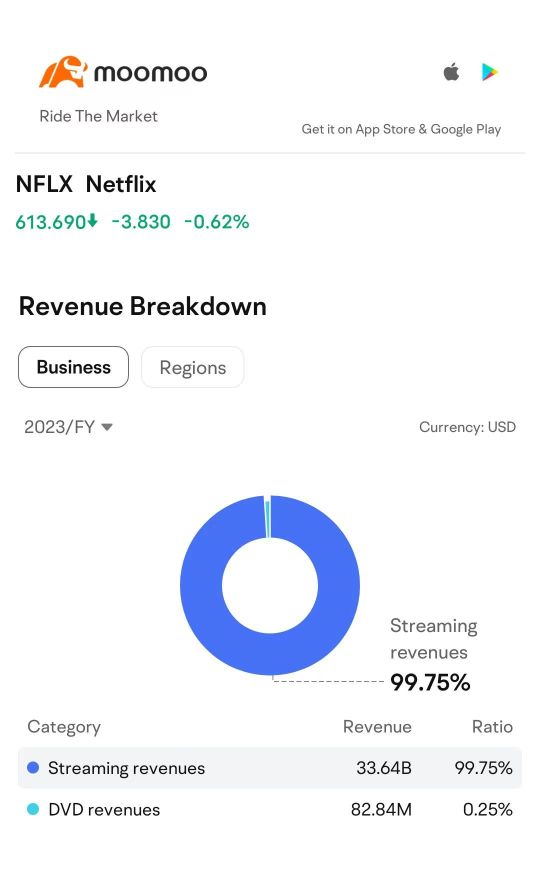

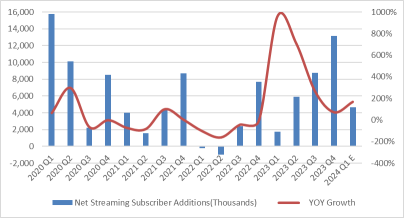

$Netflix(NFLX.US$ is set to release its earnings report after the market closes on April 18, Eastern Time. In the previous two quarters, Netflix's stock price surged impressively by 16.1% and 10.7%, respectively, following their earnings announcements. Since the beginning of the year, Netflix's share price has risen by 26.83%, outperforming the S&P 500 index and reaching a new high for the first time in nearly two...

+1

38

3

zukG4HQuCI

liked

Last weekend, the international situation was extremely turbulent. For the first time in history, Iran carried out a large-scale attack on mainland Israel, using missiles and drones. Although US President Joe Biden indicated to Israeli Prime Minister Binyamin Netanyahu on the phone that the US does not support Israel's countermeasures, the Iranian military has stated that its military operation has ended. Although this conflict has attracted international attention, it appears that it will not escalate further, as Iran's move may be aimed at showing internal determination; as long as Israel does not react violently, the situation may gradually calm down.

In the economic sector, the latest consumer price index (CPI) data exceeded market expectations, heightened concerns about continued inflation, and cooled investors' expectations that the Federal Reserve might cut interest rates soon. Tonight, the US will release important retail sales data, which will provide the Federal Reserve with more clues about the state of the domestic economy. Furthermore, on April 18, the Federal Reserve will release its Beige Book on the state of the economy, reporting in detail on inflation, employment, and economic prospects, which will have an important impact on future monetary policy decisions of Fed officials.

Last week, due to the dual effects of inflation concerns and geopolitical instability, the three major indices of the US stock market fell. This week's market focus will shift to earnings reports from companies including Goldman Sachs, Morgan Stanley, Bank of America, Asmack, TSMC, and Netflix. These reports will once again test the profitability of major companies. In the current complex macro environment, investors need to pay close attention to these financial indicators and corporate performance in order to better overcome weaknesses and stay strong.

$阿斯麦(ASML.US$ $奈飞(NFLX.US$ $高盛(GS.US$ $摩根大通(JPM.US$ $Bank of America(BAC.US$ $台积电(TSM.US$

...

In the economic sector, the latest consumer price index (CPI) data exceeded market expectations, heightened concerns about continued inflation, and cooled investors' expectations that the Federal Reserve might cut interest rates soon. Tonight, the US will release important retail sales data, which will provide the Federal Reserve with more clues about the state of the domestic economy. Furthermore, on April 18, the Federal Reserve will release its Beige Book on the state of the economy, reporting in detail on inflation, employment, and economic prospects, which will have an important impact on future monetary policy decisions of Fed officials.

Last week, due to the dual effects of inflation concerns and geopolitical instability, the three major indices of the US stock market fell. This week's market focus will shift to earnings reports from companies including Goldman Sachs, Morgan Stanley, Bank of America, Asmack, TSMC, and Netflix. These reports will once again test the profitability of major companies. In the current complex macro environment, investors need to pay close attention to these financial indicators and corporate performance in order to better overcome weaknesses and stay strong.

$阿斯麦(ASML.US$ $奈飞(NFLX.US$ $高盛(GS.US$ $摩根大通(JPM.US$ $Bank of America(BAC.US$ $台积电(TSM.US$

...

Translated

15

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)