Apple Inc. is a market leader of technology products and services, and one of the largest companies in the world by market cap. Investors closely watch Apple's key decisions as they can impact the other major US listed companies connected to Apple in this list. These companies are involved in the development, production, and distribution of Apple products and services. Investing in these companies offers exposure to the potential growth opportunities of Apple's products and services. As Apple continues to innovate and release new products, investors see potential for more growth in revenue and earnings, and higher stock prices.

- 1770.462

- -18.861-1.05%

- 5D

- 1D

- 1W

- 1M

- 1Q

- 1Y

News

Stocks Most Shunned by Hedge Funds and Mutual Funds

Nvidia Looks a Good Bet to Replace Intel in the Dow

Wall Street Snaps Five-Week Winning Streak, Economic Growth Slows, Inflation Holds Steady in April: This Week in the Market

The U.S. stock market ended a five-week positive streak as investors feared that slowing economic momentum could impact the earnings outlook for American corporations.

Shares of Semiconductor Stocks Are Trading Lower in Possible Sympathy With Marvell, Which Reported Worse-than-expected Q1 Earnings.

Shares of Semiconductor Stocks Are Trading Lower in Possible Sympathy With Marvell, Which Reported Worse-than-expected Q1 Earnings.

10 Information Technology Stocks With Whale Alerts In Today's Session

Traders will search for circumstances when the market estimation of an option diverges heavily from its normal worth.

Investors Punished Salesforce After Earnings. See the Other Worst Recent Post-report Reactions

Comments

Apple Event Takeaway:

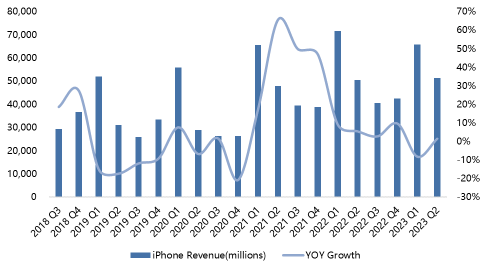

1. The iPhone 15 and iPhone 15 Plus received basic updates, featuring the "Dynamic Island" design, the A16 chip, and an improved main camera with 48 million pixels.

2. The Pro Max models received the most significant updates. In addition to the titanium alloy body, the major highlight is the redesigned A17 PRO chip, and the Pro Max camera system underwent further upgr...

So what's different about the iPhone 15 compared to before? I made a arrangement based on the information on the market:

In terms of exterior design, the iPhone 15 Pro and iPhone 15 Pro Max will choose "titanium" as the new frame material. Lighter, thinner titanium, previously used on the Apple Watch. The addition of the new materi...

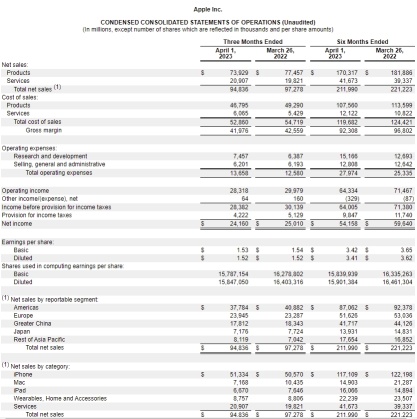

How is Apple's earnings this quarter? What exactly are we buying when we buy AAPL?

1. The company's performance exceeded expectations, and its core business showed a strong ability to resist risks

The core business has demonstrated a strong ability to resist risks. In 23Q1, the company's r...

Does a $5 stock price not deserve a name?

$Apple(AAPL.US$ $Apple Supplier(LIST2437.US$

Which performance do you expect more?

According to the financial report, NIO’s total revenue in the second quarter was 10.2924 billion RMB (about 1.5366 billion U.S. dollars), an increase of 21.8% compared with the second quarter of 2021 and a 3.9% increase compared to the first quarter of 2022. The net loss attributable to NIO ordinary shareholders was 2.745 billion...

Zul Zulkifli : $Tesla (TSLA.US)$