Apple Inc. is a market leader of technology products and services, and one of the largest companies in the world by market cap. Investors closely watch Apple's key decisions as they can impact the other major US listed companies connected to Apple in this list. These companies are involved in the development, production, and distribution of Apple products and services. Investing in these companies offers exposure to the potential growth opportunities of Apple's products and services. As Apple continues to innovate and release new products, investors see potential for more growth in revenue and earnings, and higher stock prices.

- 1790.864

- -13.105-0.73%

- 5D

- 1D

- 1W

- 1M

- 1Q

- 1Y

News

Looking Into Qualcomm's Recent Short Interest

Qualcomm's (NYSE:QCOM) short percent of float has risen 8.24% since its last report. The company recently reported that it has 20.47 million shares sold short, which is 1.84% of all regular shares tha

Looking At Texas Instruments's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Texas Instruments. Our analysis of options history for Texas Instruments (NASDAQ:TXN) revealed 18 unusual trades.Delving into the details, we f

What's Going On With Broadcom Shares Friday?

Broadcom Inc. (NASDAQ:AVGO) shares are trading lower on Friday.The company unveiled its Accelerate Program, distributed through exclusive agreements. Expanding the Broadcom Global Cybersecurity Aggreg

Looking At Broadcom's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bullish stance on Broadcom (NASDAQ:AVGO).And retail traders should know.We noticed this today when the trades showed up on publicly available option

What's Going On With AMD Stock Friday?

Advanced Micro Devices, Inc (NASDAQ:AMD) stock is trading higher Friday amid reports that Microsoft Corp (NASDAQ:MSFT) is eying the former's artificial intelligence chips for its cloud computing custo

Applied Materials Gets Renewed Vote of Confidence From Wall Street After Q2 Results

Comments

Apple Event Takeaway:

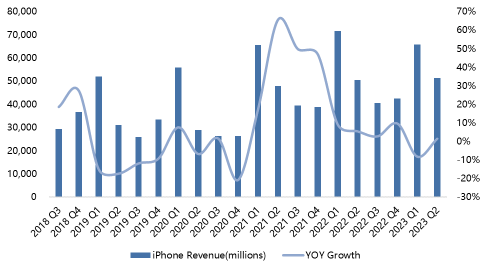

1. The iPhone 15 and iPhone 15 Plus received basic updates, featuring the "Dynamic Island" design, the A16 chip, and an improved main camera with 48 million pixels.

2. The Pro Max models received the most significant updates. In addition to the titanium alloy body, the major highlight is the redesigned A17 PRO chip, and the Pro Max camera system underwent further upgr...

So what's different about the iPhone 15 compared to before? I made a arrangement based on the information on the market:

In terms of exterior design, the iPhone 15 Pro and iPhone 15 Pro Max will choose "titanium" as the new frame material. Lighter, thinner titanium, previously used on the Apple Watch. The addition of the new materi...

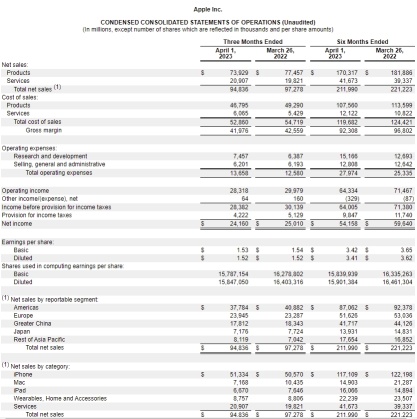

How is Apple's earnings this quarter? What exactly are we buying when we buy AAPL?

1. The company's performance exceeded expectations, and its core business showed a strong ability to resist risks

The core business has demonstrated a strong ability to resist risks. In 23Q1, the company's r...

Does a $5 stock price not deserve a name?

$Apple(AAPL.US$ $Apple Supplier(LIST2437.US$

Which performance do you expect more?

According to the financial report, NIO’s total revenue in the second quarter was 10.2924 billion RMB (about 1.5366 billion U.S. dollars), an increase of 21.8% compared with the second quarter of 2021 and a 3.9% increase compared to the first quarter of 2022. The net loss attributable to NIO ordinary shareholders was 2.745 billion...

Zul Zulkifli : $Tesla (TSLA.US)$