最新

熱門

電動車股票 $特斯拉(TSLA.US$, $Rivian Automotive(RIVN.US$, $Lucid(LCID.US$ 現在抽煙很熱。股票市場 $納斯達克綜合指數(.IXIC.US$, $S&P 500 index(.SPX.US$ 似乎給電動車股票帶來了令人難以置信的高估值,無論這些公司是否已經證明了自己有效的製造商。與 EV 股票一樣,會有贏家和輸家,而這些投資似乎屬於股票投資組合中較投機的部分。了解個人風險承受能力水平是確定哪種電動汽車股票適合投資者的重要一步。 $特斯拉(TSLA.US$ 是市場上最成熟和最成功的電動汽車公司。是否 $特斯拉(TSLA.US$ 被高估或不是辯論,該公司似乎變得越來越強,收入更高,利潤更高,利潤更高,以及更好的收益。還有一個很好的機會 $特斯拉(TSLA.US$ 在未來推動更高的利潤。雖然 $特斯拉(TSLA.US$ 根據傳統指標(例如市盈率),仍然會出現高估,持續產生正淨收入是朝著正確方向邁出的一步。相對未經證實,但有一個夢幻般的開始, $Rivian Automotive(RIVN.US$ 和 $Lucid(LCID.US$ 似乎是高風險,高潛力回報的增長股。無論投資者選擇哪種電動汽車股票,都無可否認,隨著新產品產品、充電網絡和售後服務的不斷發展,電動車股票普遍輕鬆地擊敗了市場,這種趨勢在未來可能會很好地延續下去。

$Arrival(ARVL.US$

$BYD Co.(BYDDF.US$

$Canoo(GOEV.US$

$Fisker(FSR.US$

$Ford Motor(F.US$

$General Motors(GM.US$

$Li Auto(LI.US$

$蔚來(NIO.US$

$Sono Group(SEV.US$

$Toyota Motor(TM.US$

$VOLKSWAGEN A G(VWAGY.US$

$XPeng(XPEV.US$

$Arrival(ARVL.US$

$BYD Co.(BYDDF.US$

$Canoo(GOEV.US$

$Fisker(FSR.US$

$Ford Motor(F.US$

$General Motors(GM.US$

$Li Auto(LI.US$

$蔚來(NIO.US$

$Sono Group(SEV.US$

$Toyota Motor(TM.US$

$VOLKSWAGEN A G(VWAGY.US$

$XPeng(XPEV.US$

已翻譯

117

70

在全球範圍內,EV(電動汽車)的受歡迎程度是壓倒性的,隨著生態時刻的增長勢頭。作為汽車愛好者,消費者將在幾家電動汽車製造商之間進行激烈的競爭歸因於實地日,例如 $特斯拉(TSLA.US$, $蔚來(NIO.US$, $Rivian Automotive(RIVN.US$, $Ford Motor(F.US$ $XPeng(XPEV.US$

最近,這些電動汽車公司的股票價格估值飆升。顯然,作為投資者,我們的最終目標是「買好」,而不是說「再見」。

為了實現我們的目標,我們可能不得不比較汽車製造商像巨人這樣的經驗歷史 $特斯拉(TSLA.US$ 和 $Lucid(LCID.US$

有兩件事 $特斯拉(TSLA.US$ 和 $Lucid(LCID.US$ 有共同點。一個是他們都在位泰坦和兩個,是彼得·羅林森,清醒汽車公司的首席執行官曾經是特斯拉的執行官,並幫助工程師特斯拉 Model S。因此,通過工程清醒空氣轎車,彼得·羅林森直接對特斯拉的優勢構成了挑戰。此外,清醒汽車已經實現了「製造最好的汽車在

世界」當空氣被賦予了令人垂涎的「年度汽車趨勢汽車」的獎項。Lucid 還計劃針對其出口到中國和中東,這聽起來很有希望。

清醒有一個範圍 520 英里這是超過特斯拉的 405 英里範圍.

毫無疑問,許多人認為特斯拉是 EV 演變的領導者,因為它是一個標誌性的家喻戶曉的名字。但是,最近有些因素與特斯拉的形象有影響。他們是:-

![]() 最近首席執行官,馬斯克·埃隆一直

最近首席執行官,馬斯克·埃隆一直

卸載特斯拉股票的大塊。

馬斯克·埃隆的決定並沒有引起

在魯莽出售特斯拉股票的主要野餐呢。儘管如此,它仍然構成了波動的市場。

![]() 11 月 18 日,特斯拉回憶起

11 月 18 日,特斯拉回憶起

7,6000 輛車在美國,因為駕駛員的安全氣囊靠墊引起的安全問題的某些風險。會這樣

問題會對其 EV 銷售產生負面影響?只有時間才能看出來

無論我們想到哪些 EV 股票,我們都可以設想在不久的將來華爾街電動車競賽的趨勢。

也許我們可以把重點放在電動車公司之一,作為一項有前途的長期投資。

向前邁進,作為投資者,我們將不得不非常密切地監控交易市場,並磨練我們的交易技巧,以便做出及時,精明的選擇。

$Sono Group(SEV.US$

$General Motors(GM.US$

$TOYOTA MOTOR CORP(TOYOF.US$

$VOLKSWAGEN AG(VLKAF.US$

$Arrival(ARVL.US$

$Li Auto(LI.US$

$Apple(AAPL.US$

$比亞迪股份(01211.HK$

$Volta(VLTA.US$

$ChargePoint(CHPT.US$

最近,這些電動汽車公司的股票價格估值飆升。顯然,作為投資者,我們的最終目標是「買好」,而不是說「再見」。

為了實現我們的目標,我們可能不得不比較汽車製造商像巨人這樣的經驗歷史 $特斯拉(TSLA.US$ 和 $Lucid(LCID.US$

有兩件事 $特斯拉(TSLA.US$ 和 $Lucid(LCID.US$ 有共同點。一個是他們都在位泰坦和兩個,是彼得·羅林森,清醒汽車公司的首席執行官曾經是特斯拉的執行官,並幫助工程師特斯拉 Model S。因此,通過工程清醒空氣轎車,彼得·羅林森直接對特斯拉的優勢構成了挑戰。此外,清醒汽車已經實現了「製造最好的汽車在

世界」當空氣被賦予了令人垂涎的「年度汽車趨勢汽車」的獎項。Lucid 還計劃針對其出口到中國和中東,這聽起來很有希望。

清醒有一個範圍 520 英里這是超過特斯拉的 405 英里範圍.

毫無疑問,許多人認為特斯拉是 EV 演變的領導者,因為它是一個標誌性的家喻戶曉的名字。但是,最近有些因素與特斯拉的形象有影響。他們是:-

卸載特斯拉股票的大塊。

馬斯克·埃隆的決定並沒有引起

在魯莽出售特斯拉股票的主要野餐呢。儘管如此,它仍然構成了波動的市場。

7,6000 輛車在美國,因為駕駛員的安全氣囊靠墊引起的安全問題的某些風險。會這樣

問題會對其 EV 銷售產生負面影響?只有時間才能看出來

無論我們想到哪些 EV 股票,我們都可以設想在不久的將來華爾街電動車競賽的趨勢。

也許我們可以把重點放在電動車公司之一,作為一項有前途的長期投資。

向前邁進,作為投資者,我們將不得不非常密切地監控交易市場,並磨練我們的交易技巧,以便做出及時,精明的選擇。

$Sono Group(SEV.US$

$General Motors(GM.US$

$TOYOTA MOTOR CORP(TOYOF.US$

$VOLKSWAGEN AG(VLKAF.US$

$Arrival(ARVL.US$

$Li Auto(LI.US$

$Apple(AAPL.US$

$比亞迪股份(01211.HK$

$Volta(VLTA.US$

$ChargePoint(CHPT.US$

已翻譯

125

3

If I had said a few years ago that $特斯拉(TSLA.US$ would one day be worth $266 billion, there would have been many skeptics. I bring that number up because in just eight trading days, the electric vehicle maker lost that much in market cap from its recent all-time high to its low point on Monday. Shares have been struggling recently thanks to CEO Elon Musk's selling of Tesla shares, an overhang that's taking the narrative away from what the bulls would really like to be discussing currently.

Elon Musk has a set of stock options that must be exercised next summer or he will lose them, resulting in a potential tax bill that's estimated to be $15 billion. The outspoken company leader also started a poll on Twitter during the first weekend of this month asking if he should sell 10% of his position. As of Monday, Elon had sold about $8 billion worth of shares, with investors bracing for more sales in the coming days. Before his share sales, other directors and former directors sold hundreds of millions worth of Tesla shares, including Elon's brother Kimbal whose roughly $100 million sale was curiously not part of a pre-arranged sales program.

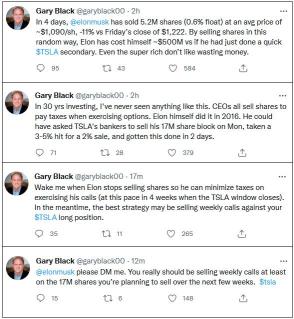

In the grand scheme of things, some will argue that Elon's Tesla sale this time around (he will have additional sales down the road as more options expire) shouldn't be that significant. Tesla was worth about $1.25 trillion at its peak, so one would normally assume that a sale of this size wouldn't do that much, as Tesla has been trading $25 billion or so worth of shares daily in recent days. Well, the stock's reaction has been rather sharp as I pointed out above, falling from a high over $1,243 to Monday's low below $979. As detailed in a series of tweets compiled below, some major supporters like Gary Black, who has personally owned Tesla shares over the years and has the stock as the largest holding in his $THE FUTURE FUND ACTIVE ETF(FFND.US$, are a little upset at how Elon is handling his business.

Some will argue that Gary's secondary plan would have had a larger impact than 3-5%, but that's something we'll truly never know. What we do know is that Elon's selling in drips and drabs have helped to send the stock sharply lower, with some very crazy intra-day moves recently. Until Elon completes his selling, nobody is sure whether things will finish up in a day, week, month, etc., which is putting a dark cloud above Tesla right now. Unless Elon Musk was going to forfeit these options and give up several billion dollars, it was really only a matter of time until this process had to occur.

Tesla bulls would rather be talking about a variety of other items, however. Analyst estimates have been on the rise lately, especially on the bottom line, after the company smashed Q3 estimates as I predicted it would. We are now halfway through the final quarter of the year, a period where Tesla is expected to produce its first Model Y vehicles from two new factories, one in the Berlin, Germany area, and another in Austin, Texas. While these new facilities will add several hundred thousand units of new production in the coming quarters, deliveries won't be seen in the current quarter according to management.

Elon Musk has a set of stock options that must be exercised next summer or he will lose them, resulting in a potential tax bill that's estimated to be $15 billion. The outspoken company leader also started a poll on Twitter during the first weekend of this month asking if he should sell 10% of his position. As of Monday, Elon had sold about $8 billion worth of shares, with investors bracing for more sales in the coming days. Before his share sales, other directors and former directors sold hundreds of millions worth of Tesla shares, including Elon's brother Kimbal whose roughly $100 million sale was curiously not part of a pre-arranged sales program.

In the grand scheme of things, some will argue that Elon's Tesla sale this time around (he will have additional sales down the road as more options expire) shouldn't be that significant. Tesla was worth about $1.25 trillion at its peak, so one would normally assume that a sale of this size wouldn't do that much, as Tesla has been trading $25 billion or so worth of shares daily in recent days. Well, the stock's reaction has been rather sharp as I pointed out above, falling from a high over $1,243 to Monday's low below $979. As detailed in a series of tweets compiled below, some major supporters like Gary Black, who has personally owned Tesla shares over the years and has the stock as the largest holding in his $THE FUTURE FUND ACTIVE ETF(FFND.US$, are a little upset at how Elon is handling his business.

Some will argue that Gary's secondary plan would have had a larger impact than 3-5%, but that's something we'll truly never know. What we do know is that Elon's selling in drips and drabs have helped to send the stock sharply lower, with some very crazy intra-day moves recently. Until Elon completes his selling, nobody is sure whether things will finish up in a day, week, month, etc., which is putting a dark cloud above Tesla right now. Unless Elon Musk was going to forfeit these options and give up several billion dollars, it was really only a matter of time until this process had to occur.

Tesla bulls would rather be talking about a variety of other items, however. Analyst estimates have been on the rise lately, especially on the bottom line, after the company smashed Q3 estimates as I predicted it would. We are now halfway through the final quarter of the year, a period where Tesla is expected to produce its first Model Y vehicles from two new factories, one in the Berlin, Germany area, and another in Austin, Texas. While these new facilities will add several hundred thousand units of new production in the coming quarters, deliveries won't be seen in the current quarter according to management.

45

14

$特斯拉(TSLA.US$ As Tesla continues to expand its production capabilities, every quarter now is expected to set a new delivery record. Avid Tesla follower Troy Teslike recently called for 270,000 deliveries in Q4 2021, which would be 9,000 more than street estimates. His number could be revised even higher in the coming weeks if we continue to see strong production numbers coming out of China. We don't currently know the true potential of that factory as management has been very tight-lipped about its capacity numbers, only saying that it is "greater than 450,000 vehicles annually" at its two most recent earnings reports. October's delivery and export numbers extrapolate to a more than 652,000 vehicle per year rate, which could push Tesla over 900,000 deliveries for this year if recent trends hold in the final two months of the year.

Tesla shares recently took off after rental car company $Hertz Global(HTZ.US$ announced it was buying at least 100,000 Tesla Model 3 vehicles. However, Elon Musk later said that no deal was in place, despite reports of Hertz having already accepted some initial deliveries of Model 3's. The sharp rally put the stock more than $400 above its average street price target at one point, a gap that has narrowed by more than half since. At one point on Monday, Tesla shares were less than $100 from their 50-day moving average seen in the chart below, with the 200-day being a bit further below its shorter term counterpart. By most technical metrics, Tesla shares were extremely overheated as they raced past $1,200, so the recent pullback has improved that picture quite a bit.

There's a dark cloud hanging over Tesla shares currently, and investors are hoping that its end comes rather soon. Elon Musk is in the midst of selling shares to pay an upcoming large tax bill, which caused the stock's losses to total more than $265 billion at times on Monday. Tesla bulls would really like this process to end quickly, so they can change the current narrative back to the company's production growth story. If we continue to see the CEO's stock sales come in small portions over a series of trading days, recent price action suggests shares could continue to head towards the 50-day moving average, at which point a major technical test would come.

Tesla shares recently took off after rental car company $Hertz Global(HTZ.US$ announced it was buying at least 100,000 Tesla Model 3 vehicles. However, Elon Musk later said that no deal was in place, despite reports of Hertz having already accepted some initial deliveries of Model 3's. The sharp rally put the stock more than $400 above its average street price target at one point, a gap that has narrowed by more than half since. At one point on Monday, Tesla shares were less than $100 from their 50-day moving average seen in the chart below, with the 200-day being a bit further below its shorter term counterpart. By most technical metrics, Tesla shares were extremely overheated as they raced past $1,200, so the recent pullback has improved that picture quite a bit.

There's a dark cloud hanging over Tesla shares currently, and investors are hoping that its end comes rather soon. Elon Musk is in the midst of selling shares to pay an upcoming large tax bill, which caused the stock's losses to total more than $265 billion at times on Monday. Tesla bulls would really like this process to end quickly, so they can change the current narrative back to the company's production growth story. If we continue to see the CEO's stock sales come in small portions over a series of trading days, recent price action suggests shares could continue to head towards the 50-day moving average, at which point a major technical test would come.

46

10

$Rivian Automotive(RIVN.US$ 上漲 9.88% 至 164.12 美元,交易前交易高達 169.70 美元。RIVN 的交易量超過 53 萬股,還剩幾個小時交易。

Rivian 今天的估值上漲至 143 億美元,這令分析師在 12 月 20 日到期後將走到哪裡的問題。Rivian IPO 的主要承包商是高盛、摩根和摩根士丹利。BofA、巴克萊、德意志銀行、威爾斯法戈和許多其他人參與承保。儘管在安靜期限到期的第一天,分析師的等價等級幾乎是前所未見的,但其他 EV 股票由於泡沫估值而出現了大量中性等值評級。在某些情況下,電動汽車高端機股票在評級增加時冷卻。

其他潛在催化劑在 2022 年初出現,當 Rivian 開始在會議上公開出現並發布公司的第一份收入/生產報告。由於供應鏈問題,芯片短缺或其他問題而導致生產時間進行改變,電動汽車行業發生了許多股價跌勢。

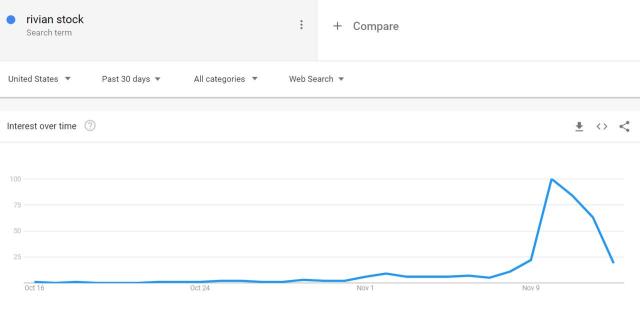

關於社交媒體的興趣,谷歌對 Rivian,RIVN 和 Rivian 股票的搜索在 IPO 期間高峰之後處於下降趨勢。

在提及方面,RIVN 仍然是 Reddit 的牆街投注和股票 Twitter 上的頂級股票。在 moomoo 上,關注一周歲的里維安人比 47 歲的人更多 $Foot Locker(FL.US$.

Rivian 今天的估值上漲至 143 億美元,這令分析師在 12 月 20 日到期後將走到哪裡的問題。Rivian IPO 的主要承包商是高盛、摩根和摩根士丹利。BofA、巴克萊、德意志銀行、威爾斯法戈和許多其他人參與承保。儘管在安靜期限到期的第一天,分析師的等價等級幾乎是前所未見的,但其他 EV 股票由於泡沫估值而出現了大量中性等值評級。在某些情況下,電動汽車高端機股票在評級增加時冷卻。

其他潛在催化劑在 2022 年初出現,當 Rivian 開始在會議上公開出現並發布公司的第一份收入/生產報告。由於供應鏈問題,芯片短缺或其他問題而導致生產時間進行改變,電動汽車行業發生了許多股價跌勢。

關於社交媒體的興趣,谷歌對 Rivian,RIVN 和 Rivian 股票的搜索在 IPO 期間高峰之後處於下降趨勢。

在提及方面,RIVN 仍然是 Reddit 的牆街投注和股票 Twitter 上的頂級股票。在 moomoo 上,關注一周歲的里維安人比 47 歲的人更多 $Foot Locker(FL.US$.

已翻譯

34

14

投資者最喜歡的電動汽車股票上積累了賣壓力 $Rivian Automotive(RIVN.US$ 在一條路上看到它的第一天下降,而 $Lucid(LCID.US$, $Fisker(FSR.US$, $Arrival(ARVL.US$, $Lordstown Motors(RIDE.US$ 和 $Faraday Future Intelligent Electric Inc.(FFIE.US$ 都顯著是反向的。

首次公開招股新手 $Sono Group(SEV.US$ 正在保持其大早期收益,高於 15 美元的首次公開招股定價水平約 93%。這家太陽能汽車製造商迄今為止的股價高點為 32.34 美元。

該公司在首次公開招股中出售 150 萬股後,今天籌集了 150 億美元。迄今為止,Sono 是一家專注於歐洲的電動汽車公司,預訂來自德國,奧地利,瑞士,法國,荷蘭,意大利,西班牙和葡萄牙。Sono 與 MAN 卡車和巴士合作夥伴關係。該公司屬於 $VOLKSWAGEN AG(VLKAF.US$ 企業傘。

Sono 本週在催化劑觀看中,預計會有一些煙花,因為它正在電動車興趣高興時將上市。

汽車行業的其他地方, $Hyzon Motors(HYZN.US$ 正在從昨天的下跌中恢復, $Ferrari(RACE.US$ 在摩根士丹利稱其為其最喜歡的電動汽車股票之後,正在走高。

與此同時, $特斯拉(TSLA.US$ 考慮到埃隆·馬斯克現在在最新批銷售後已經卸下了價值約 8.8 億美元的股票,正處於一個穩健的一天。

首次公開招股新手 $Sono Group(SEV.US$ 正在保持其大早期收益,高於 15 美元的首次公開招股定價水平約 93%。這家太陽能汽車製造商迄今為止的股價高點為 32.34 美元。

該公司在首次公開招股中出售 150 萬股後,今天籌集了 150 億美元。迄今為止,Sono 是一家專注於歐洲的電動汽車公司,預訂來自德國,奧地利,瑞士,法國,荷蘭,意大利,西班牙和葡萄牙。Sono 與 MAN 卡車和巴士合作夥伴關係。該公司屬於 $VOLKSWAGEN AG(VLKAF.US$ 企業傘。

Sono 本週在催化劑觀看中,預計會有一些煙花,因為它正在電動車興趣高興時將上市。

汽車行業的其他地方, $Hyzon Motors(HYZN.US$ 正在從昨天的下跌中恢復, $Ferrari(RACE.US$ 在摩根士丹利稱其為其最喜歡的電動汽車股票之後,正在走高。

與此同時, $特斯拉(TSLA.US$ 考慮到埃隆·馬斯克現在在最新批銷售後已經卸下了價值約 8.8 億美元的股票,正處於一個穩健的一天。

已翻譯

35

11

$Ford Motor(F.US$ is selling it's stake in Rivian to fund it's own EV production. They own 12% of $Rivian Automotive(RIVN.US$, worth about $10 billion. Seems like the legacy manufacturers could make a buttload of money for shareholders by simply floating new EV IPO's that are nothing but a plan to eventually have an electric car company. Silly that Rivian, with no actual cars to sell, has a bigger market cap than Ford or $General Motors(GM.US$. If it's that easy to start an electric car company, then it begs the question, what's preventing anyone else from entering and taking Rivian's market share? Here come's $Apple(AAPL.US$, $Alphabet-C(GOOG.US$, $Meta Platforms(FB.US$, along with every other vehicle manufacturer.... Heck, I could see Deere and CAT having their own EV companies. Basically any company that's remotely attached to making things with wheels could start up an EV company and get a $100 billion valuation. Personally, I'm waiting for Mattel to come out with the new Big Wheel brand EV. It will be made of plastic and have a cool hand brake that can make you spin 180 degrees...you can even put a playing card in the wheels to make a clickity sound, since EV's are boringly silent. There's a whole market of ancillary products they can add that should make it a $trillion company, like those little streamers that hang off of handlebars...you could hang them off the sideview mirrors. Or maybe even a full size EV Tonka Truck? There's a trillion dollar market cap right there...

The reality is that any idea that keeps us sitting by ourselves in traffic is not a solution to global climate change. Europe and Asia are busy making efficient trains and bike highways that get people out of their cars. I spent some time in the Netherlands and never even got in a car....just a 5 minute bike ride to the train and I can get anywhere in Europe with my bike included. You know all those obese people waddling around the Walmart in the US? They don't have them in Europe. People are generally thin and fit. Think of how much better Tinder & Bumble will be if we all start riding bikes! No more gambling on someone who only posts photos from the chest up!

The reality is that any idea that keeps us sitting by ourselves in traffic is not a solution to global climate change. Europe and Asia are busy making efficient trains and bike highways that get people out of their cars. I spent some time in the Netherlands and never even got in a car....just a 5 minute bike ride to the train and I can get anywhere in Europe with my bike included. You know all those obese people waddling around the Walmart in the US? They don't have them in Europe. People are generally thin and fit. Think of how much better Tinder & Bumble will be if we all start riding bikes! No more gambling on someone who only posts photos from the chest up!

34

10

$特斯拉(TSLA.US$ 向認為用於評估股票的傳統指標是虛假的垃圾,這些人們認為是古老的工業時代技術的例子,這些人們宣道是毫無用的。今天,這一切都是關於預測,一切都是關於電動車和 FSD 等可靠的顛覆性技術。

當我們看到令人驚訝的估值時,有些老人微笑 $Rivian Automotive(RIVN.US$ , $Lucid(LCID.US$ , $特斯拉(TSLA.US$ 和其他電動汽車公司。有人記得數字設備或一般數據嗎?他們是「破壞性」的公司,股市的愛好者,成長超快。直到市場部分飽和,一切都崩潰。有人記得 PC 市場的開始嗎?我買了一台頂級的施樂電腦,我認為以 3,000 美元左右,今天的錢約為 8,000 美元。施樂很熱門。然後施樂消失之後,破壞性的 PC 市場繼續飆升,而 Gateway 電腦是市場最受歡迎的其中一個。您可以在各處看到他們獨特的紙箱,他們正在邁向市場統治。嗯,這些時候有人買閘道電腦嗎?Wang Labs 是 PC 的先驅者,是另一個市場喜愛的,這是一種名為文字處理器的確定新技術。然後,該公司就變成了。

Rivian 和 Lucid 的大多數熱股人群都不意識到,是超增長市場可以放緩多快。整體車輛市場 l 成熟,增長緩慢,飽和,週期性,具有高競爭力。不是一個擁有大量估值的市場,事實上幾十年來,大多數汽車製造商的收入不到一倍。

「破壞性」的 EV 區段需要多長時間才能碰到這塊磚牆?即使是電動車部門甚麼時候也會變得擁擠和飽和?根據特斯拉、Rivian 和 Lucid 的市值高,電動汽車行業將增長 50% 或更高,再十年不受干擾。儘管在未來幾年內,他們的 20X 和 30X 收入估值將不會壓縮到可預見的將來的 1X 平均值。

祝你好運我預測到可怕的飽和現實與大約 2025 年(最遲到 2027 年)的超增長電動汽車故事碰撞。當這種情況發生時,許多電動汽車股票-汽車製造商和支持公司-將向南走。

我知道,我太老了,無法理解新的現實。但我已經看到許多顛覆性技術 —— 傳真機、行動電話、電腦、迷你電腦、智慧型手機、有線電視等技術 —— 比華爾街預測的早得多了飽和且增長緩慢。

當我們看到令人驚訝的估值時,有些老人微笑 $Rivian Automotive(RIVN.US$ , $Lucid(LCID.US$ , $特斯拉(TSLA.US$ 和其他電動汽車公司。有人記得數字設備或一般數據嗎?他們是「破壞性」的公司,股市的愛好者,成長超快。直到市場部分飽和,一切都崩潰。有人記得 PC 市場的開始嗎?我買了一台頂級的施樂電腦,我認為以 3,000 美元左右,今天的錢約為 8,000 美元。施樂很熱門。然後施樂消失之後,破壞性的 PC 市場繼續飆升,而 Gateway 電腦是市場最受歡迎的其中一個。您可以在各處看到他們獨特的紙箱,他們正在邁向市場統治。嗯,這些時候有人買閘道電腦嗎?Wang Labs 是 PC 的先驅者,是另一個市場喜愛的,這是一種名為文字處理器的確定新技術。然後,該公司就變成了。

Rivian 和 Lucid 的大多數熱股人群都不意識到,是超增長市場可以放緩多快。整體車輛市場 l 成熟,增長緩慢,飽和,週期性,具有高競爭力。不是一個擁有大量估值的市場,事實上幾十年來,大多數汽車製造商的收入不到一倍。

「破壞性」的 EV 區段需要多長時間才能碰到這塊磚牆?即使是電動車部門甚麼時候也會變得擁擠和飽和?根據特斯拉、Rivian 和 Lucid 的市值高,電動汽車行業將增長 50% 或更高,再十年不受干擾。儘管在未來幾年內,他們的 20X 和 30X 收入估值將不會壓縮到可預見的將來的 1X 平均值。

祝你好運我預測到可怕的飽和現實與大約 2025 年(最遲到 2027 年)的超增長電動汽車故事碰撞。當這種情況發生時,許多電動汽車股票-汽車製造商和支持公司-將向南走。

我知道,我太老了,無法理解新的現實。但我已經看到許多顛覆性技術 —— 傳真機、行動電話、電腦、迷你電腦、智慧型手機、有線電視等技術 —— 比華爾街預測的早得多了飽和且增長緩慢。

已翻譯

30

8

$BYD Co.(BYDDF.US$ 在 2020 年,在市場強勁增長和政治和監管的後風背後,電動汽車行業開始吸引大量關注,這導致許多受關注最多的玩家的股價爆炸。 $特斯拉(TSLA.US$ 成為一個很好的例子。該公司今天的價值超過 1 萬億美元,儘管只銷售全球所有汽車的 1% 左右。其他電動車純遊戲也受益於大規模的廣播,例如 $Rivian Automotive(RIVN.US$ 和 $Lucid(LCID.US$ 它們的價值分別約為 100 億美元和 80 億美元,儘管在整個公司歷史中只生產了幾十輛汽車--這是參考,這是一個市值在一個大球場上的市值 $Ford Motor(F.US$ 或者 $DAIMLER AG ADR(DMLRY.US$ ,每年銷售數百萬輛汽車。

由於其增長前景更好,EV Pureplays 自然相對於今天的舊汽車製造商的價值得獲得優惠。但是,以當前價格來看,這似乎是過度過度的,並且似乎很懷疑,像 Rivian 這樣的公司是否應該以與已證明自己能夠擴展營運並產生數十億美元的淨利潤的老牌同行相似的市值進行交易。

然而,並非所有這個領域的公司都以 RIVN,LCID,TSLA 的極高估值進行交易,因為市場不同程度對所有電動汽車公司都沒有同樣的推廣。比亞迪公司是其中一家幾乎沒有廣播的公司,而且可能是這個領域的最佳選擇之一。

由於其增長前景更好,EV Pureplays 自然相對於今天的舊汽車製造商的價值得獲得優惠。但是,以當前價格來看,這似乎是過度過度的,並且似乎很懷疑,像 Rivian 這樣的公司是否應該以與已證明自己能夠擴展營運並產生數十億美元的淨利潤的老牌同行相似的市值進行交易。

然而,並非所有這個領域的公司都以 RIVN,LCID,TSLA 的極高估值進行交易,因為市場不同程度對所有電動汽車公司都沒有同樣的推廣。比亞迪公司是其中一家幾乎沒有廣播的公司,而且可能是這個領域的最佳選擇之一。

已翻譯

24

8

$Lucid(LCID.US$ 汽車行業的總 MC 正在爆炸,而該行業的 TAM 數字將在未來幾年保持大致相同。不管是行業參與者將獲得永久更高的估值,或者將需要清除行業參與者的數目。一些投資者必須相信這些新的電動車玩家將取代傳統的人。

這些天真的投資者將電動汽車視為一種新型汽車。不是,這是一種新型的傳動系統。不變的是其他一切,例如輪子,輪胎,車身板,保險桿,制動器,窗戶,內飾等。誰在汽車製造方面擁有 100 年的製造經驗?誰已經有生產數百萬輛汽車的能力?由於訂購量大量,由於訂購量大,以優惠的成本,誰簽訂了零件製造分包商合同?傳統汽車製造商就是誰。特斯拉在擴大其營運方面越來越辛苦,這根據埃隆的說法,幾乎導致破產。他們很幸運在當時成為唯一的電動汽車製造商,並且能夠通過出售綠色信用來保持能力而無任何競爭的情況下保持能力。任何認為這些電動汽車製造商將取代傳統的人的人都在開玩笑。什麼可能會發生,Legacy 的傢伙學會製造電動力傳動系統,還是這些新的電動車玩家能夠完美、經濟和快速地生產數百萬輛汽車?

除外 $特斯拉(TSLA.US$由於它具有巨大的領先地位,並且可以成為電動汽車緊湊型轎車的領導者,其餘的電動車新手最好將是利基型玩家,以每年最低的六位數單位銷售價格。在幾年內,他們將以當前愚蠢的股價的一小部分進行交易。

最後,電動汽車採用將比樂觀者所認為的慢,而 Legacy 銷售 ICE 和 EV 將成為一個優勢。

這些天真的投資者將電動汽車視為一種新型汽車。不是,這是一種新型的傳動系統。不變的是其他一切,例如輪子,輪胎,車身板,保險桿,制動器,窗戶,內飾等。誰在汽車製造方面擁有 100 年的製造經驗?誰已經有生產數百萬輛汽車的能力?由於訂購量大量,由於訂購量大,以優惠的成本,誰簽訂了零件製造分包商合同?傳統汽車製造商就是誰。特斯拉在擴大其營運方面越來越辛苦,這根據埃隆的說法,幾乎導致破產。他們很幸運在當時成為唯一的電動汽車製造商,並且能夠通過出售綠色信用來保持能力而無任何競爭的情況下保持能力。任何認為這些電動汽車製造商將取代傳統的人的人都在開玩笑。什麼可能會發生,Legacy 的傢伙學會製造電動力傳動系統,還是這些新的電動車玩家能夠完美、經濟和快速地生產數百萬輛汽車?

除外 $特斯拉(TSLA.US$由於它具有巨大的領先地位,並且可以成為電動汽車緊湊型轎車的領導者,其餘的電動車新手最好將是利基型玩家,以每年最低的六位數單位銷售價格。在幾年內,他們將以當前愚蠢的股價的一小部分進行交易。

最後,電動汽車採用將比樂觀者所認為的慢,而 Legacy 銷售 ICE 和 EV 將成為一個優勢。

已翻譯

24

8

YL tan : 我最喜歡的還是特斯拉。這是任何投資者都可以擁有的最好的 EV 股票

garay : 特斯拉已經是一個成熟的股票,並已被證明具有強勁的回報。但是,每當馬斯克推特有趣的事情時,它有時會非常

不理不理左不理 : 特斯拉是未來。我認為這對於 EV 來說是一個合理和最好的投資,儘管涉及名義上的風險。

Spearhead : 很好

101767718 : 我認為電動汽車股票將在未來幾年表現得非常好,但需求更強

查看更多評論...