YN-7up

liked and commented on

$Tesla(TSLA.US$

$Occidental Petroleum(OXY.US$

$Lockheed Martin(LMT.US$

$Netflix(NFLX.US$

The major market indices rebounded as scheduled yesterday. Is it time to follow up and go long? The answer is probably not yet. From the perspective of Japanese K-line technical analysis, all major indices are in a downward trend, and the upward pressure to rebound is also strong, so it is not suitable to aggressively go long. The market has been unstable recently, and I haven't taken any action. However, I was able to actually operate blindly, thanks to the experience of following my mentor's reading notes to learn the legendary experience of Wall Street stock master Jesse Livermore. For newcomers to the stock market, instead of randomly buying stocks, it's better to start learning by reading books about stocks. If you are interested in reading books, you can search the internet for Jesse Livermore's financial reading notes, and I believe you will also gain quite a bit.

$Occidental Petroleum(OXY.US$

$Lockheed Martin(LMT.US$

$Netflix(NFLX.US$

The major market indices rebounded as scheduled yesterday. Is it time to follow up and go long? The answer is probably not yet. From the perspective of Japanese K-line technical analysis, all major indices are in a downward trend, and the upward pressure to rebound is also strong, so it is not suitable to aggressively go long. The market has been unstable recently, and I haven't taken any action. However, I was able to actually operate blindly, thanks to the experience of following my mentor's reading notes to learn the legendary experience of Wall Street stock master Jesse Livermore. For newcomers to the stock market, instead of randomly buying stocks, it's better to start learning by reading books about stocks. If you are interested in reading books, you can search the internet for Jesse Livermore's financial reading notes, and I believe you will also gain quite a bit.

Translated

12

9

YN-7up

liked and commented on

$ProShares Ultra VIX Short-Term Futures ETF(UVXY.US$

$Tesla(TSLA.US$

$Occidental Petroleum(OXY.US$

$Netflix(NFLX.US$

With the intensification of tensions between Russia and Ukraine, US stocks are also affected by it. The major indexes did not extend the upward trend of the day before yesterday, and all fell back high today. The sign of the bull market is about to disappear, but is there really a bear market coming?

UVXY is showing signs today that it is likely to break the key point of $22 in the previous period. Once UVXY breaks through this key point, it means that the upward space is open, and the market may really be about to go. Therefore, the rational operation strategy, personally think that now is not suitable to copy the bottom of the market. It is true that in the previous period of stock market decline, many stocks have fallen sharply and seem to be very cheap, but is this really the cheapest bargaining chip? Or will there be cheaper stock prices? Judging from the trend of UVXY today, it is the best strategy not to be greedy for bargains at this time, but to wait and see. It is not too late to enter the arena when the situation becomes a little clearer. Taking this opportunity, you might as well calm down and learn more about how the stock market operates. Follow my mentor's reading notes and continue to learn the classic trading case of Wall Street stock guru Jesse Livermore, one of the important things to learn is to wait.

$Tesla(TSLA.US$

$Occidental Petroleum(OXY.US$

$Netflix(NFLX.US$

With the intensification of tensions between Russia and Ukraine, US stocks are also affected by it. The major indexes did not extend the upward trend of the day before yesterday, and all fell back high today. The sign of the bull market is about to disappear, but is there really a bear market coming?

UVXY is showing signs today that it is likely to break the key point of $22 in the previous period. Once UVXY breaks through this key point, it means that the upward space is open, and the market may really be about to go. Therefore, the rational operation strategy, personally think that now is not suitable to copy the bottom of the market. It is true that in the previous period of stock market decline, many stocks have fallen sharply and seem to be very cheap, but is this really the cheapest bargaining chip? Or will there be cheaper stock prices? Judging from the trend of UVXY today, it is the best strategy not to be greedy for bargains at this time, but to wait and see. It is not too late to enter the arena when the situation becomes a little clearer. Taking this opportunity, you might as well calm down and learn more about how the stock market operates. Follow my mentor's reading notes and continue to learn the classic trading case of Wall Street stock guru Jesse Livermore, one of the important things to learn is to wait.

Translated

16

13

YN-7up

commented on

$iShares Russell 2000 ETF(IWM.US$

$Senseonics(SENS.US$

$Tesla(TSLA.US$

$Apple(AAPL.US$

$FULU HOLDINGS(02101.HK$

SENS is a medical technology company focused on developing and manufacturing long-term, implantable continuous blood sugar monitoring systems for diabetics. I have owned SENS since June 2021 until now, and I am optimistic about SENS products. Whether it rises or falls, it wants to make a profit when its next-generation products are approved.

On February 11, 2022, SENS received approval from the US Food and Drug Administration for the next generation Eversense E3CGM system. However, the stock price plummeted on the same day. Stocks that had been in business for a long time turned into losses, which really made people cry and laugh. Reflecting on the idea of operation, I realized that I still didn't establish a good operating system for stock profits, nor did I have a pre-formulated profit operation plan; of course, I didn't establish a take-profit or stop-loss plan; as a result, stocks that could have been profitable turned into losses. SENS also made me realize that being optimistic about a company doesn't mean holding at any cost; a good company is not necessarily a good investment target. Of course, you should even less follow the news to trade stocks; fantasize that the stock price will be...

$Senseonics(SENS.US$

$Tesla(TSLA.US$

$Apple(AAPL.US$

$FULU HOLDINGS(02101.HK$

SENS is a medical technology company focused on developing and manufacturing long-term, implantable continuous blood sugar monitoring systems for diabetics. I have owned SENS since June 2021 until now, and I am optimistic about SENS products. Whether it rises or falls, it wants to make a profit when its next-generation products are approved.

On February 11, 2022, SENS received approval from the US Food and Drug Administration for the next generation Eversense E3CGM system. However, the stock price plummeted on the same day. Stocks that had been in business for a long time turned into losses, which really made people cry and laugh. Reflecting on the idea of operation, I realized that I still didn't establish a good operating system for stock profits, nor did I have a pre-formulated profit operation plan; of course, I didn't establish a take-profit or stop-loss plan; as a result, stocks that could have been profitable turned into losses. SENS also made me realize that being optimistic about a company doesn't mean holding at any cost; a good company is not necessarily a good investment target. Of course, you should even less follow the news to trade stocks; fantasize that the stock price will be...

Translated

10

7

YN-7up

liked and commented on

$Netflix(NFLX.US$

$Tesla(TSLA.US$ $PROSHARES NASDAQ-100 DORSEY WRIGHT MOMENTUM ETF(QQQA.US$

$S&P 500 Index(.SPX.US$

The recent rise and fall of the stock market has been very unstable. Sometimes I watch stocks rise, and it's really hard to resist the urge to catch up. Stop it. It's the first magic trick I learned from my mentor. As a newcomer to the stock market, on weekdays, I like to flip through stocks, look at trend graphs, and try to find dark horses in the stock market. Although I don't know much about technology, I also generally understand the logic of not chasing pressure levels and entering the market with support levels. However, even when they reach the support level, they clearly know that they can buy it from technical analysis, but they often don't dare to buy it; and when stocks rise, they are moved, and they often can't help but want to chase after it. As a result, I got a handful of loss-making stocks. I had the pleasure of meeting my mentor, and the first thing I learned was to control my hands and manage my mentality well. Don't chase stocks when you see them rise; buy stocks as soon as they fall. At any time, you must clearly see the trend in the market and follow the trend. Don't watch the trend go bad, and be delusional that it will rise again soon. What I learned from my mentor also realized the importance of a trading plan. The so-called trading plan should include...

$Tesla(TSLA.US$ $PROSHARES NASDAQ-100 DORSEY WRIGHT MOMENTUM ETF(QQQA.US$

$S&P 500 Index(.SPX.US$

The recent rise and fall of the stock market has been very unstable. Sometimes I watch stocks rise, and it's really hard to resist the urge to catch up. Stop it. It's the first magic trick I learned from my mentor. As a newcomer to the stock market, on weekdays, I like to flip through stocks, look at trend graphs, and try to find dark horses in the stock market. Although I don't know much about technology, I also generally understand the logic of not chasing pressure levels and entering the market with support levels. However, even when they reach the support level, they clearly know that they can buy it from technical analysis, but they often don't dare to buy it; and when stocks rise, they are moved, and they often can't help but want to chase after it. As a result, I got a handful of loss-making stocks. I had the pleasure of meeting my mentor, and the first thing I learned was to control my hands and manage my mentality well. Don't chase stocks when you see them rise; buy stocks as soon as they fall. At any time, you must clearly see the trend in the market and follow the trend. Don't watch the trend go bad, and be delusional that it will rise again soon. What I learned from my mentor also realized the importance of a trading plan. The so-called trading plan should include...

Translated

11

6

YN-7up

liked and commented on

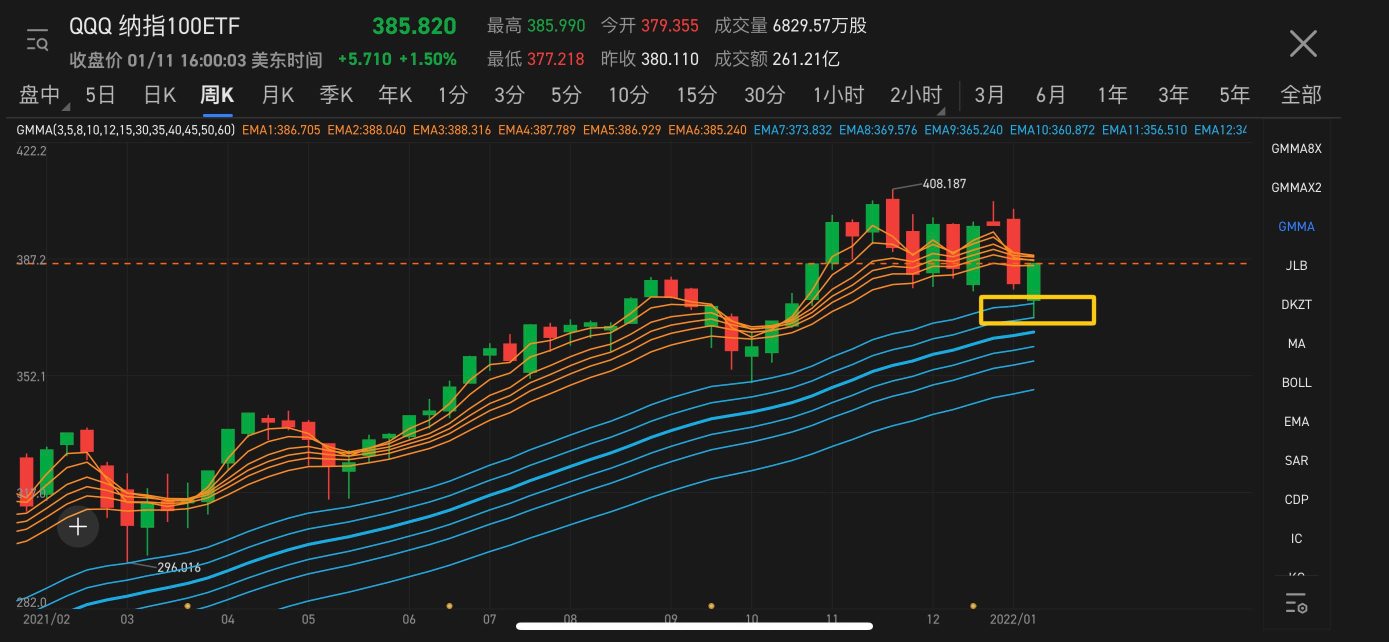

Recently, the price of a social media giant has plummeted. I saw N people hurriedly “scavenging the bottom” on various platforms. I thought I had found a big bargain, and as the stock price continued to fall, I started to panic again. Actually, in my opinion, I need to figure out my role in the stock market first, and then do something loyal to that role. If you think about it, what kind of image would it be to wear a Taoist uniform and read the sutras in a temple every day? If you consider yourself a long-term investor, always optimistic about this company, and encounter a sharp drop, you think this is a rare discount opportunity. Then you can continue to invest in the long term, just hold on to it. Don't worry too much about the time costs

If you're just betting on it, it will bounce back. So you need to have a basis for gambling, right? On what basis? technology? news? Feeling? No matter what you base it on, please continue to rely on it.

I'm currently based on technology, so I haven't joined; I'm still waiting. I've heard the phrase “fall sharply, don't break the bottom” from my teacher a long time ago. The logic behind this sentence is the same as what we often hear, “If you stand on the cusp, even a pig can fly.” The reflection is to follow the trend and do more with less. I will continue to explore technical indicators such as GMMA, parallel channels, and minimum resistance levels. Contrast my conclusions with the views on this subject mentioned in the teacher's daily two-day video, and wait patiently for the opportunity. It's like a hungry wolf waiting for its prey. The social media giant is a real piece of meat. I want to make sure I'm eating meat and not a moustache.

If you're just betting on it, it will bounce back. So you need to have a basis for gambling, right? On what basis? technology? news? Feeling? No matter what you base it on, please continue to rely on it.

I'm currently based on technology, so I haven't joined; I'm still waiting. I've heard the phrase “fall sharply, don't break the bottom” from my teacher a long time ago. The logic behind this sentence is the same as what we often hear, “If you stand on the cusp, even a pig can fly.” The reflection is to follow the trend and do more with less. I will continue to explore technical indicators such as GMMA, parallel channels, and minimum resistance levels. Contrast my conclusions with the views on this subject mentioned in the teacher's daily two-day video, and wait patiently for the opportunity. It's like a hungry wolf waiting for its prey. The social media giant is a real piece of meat. I want to make sure I'm eating meat and not a moustache.

Translated

16

13

YN-7up

liked

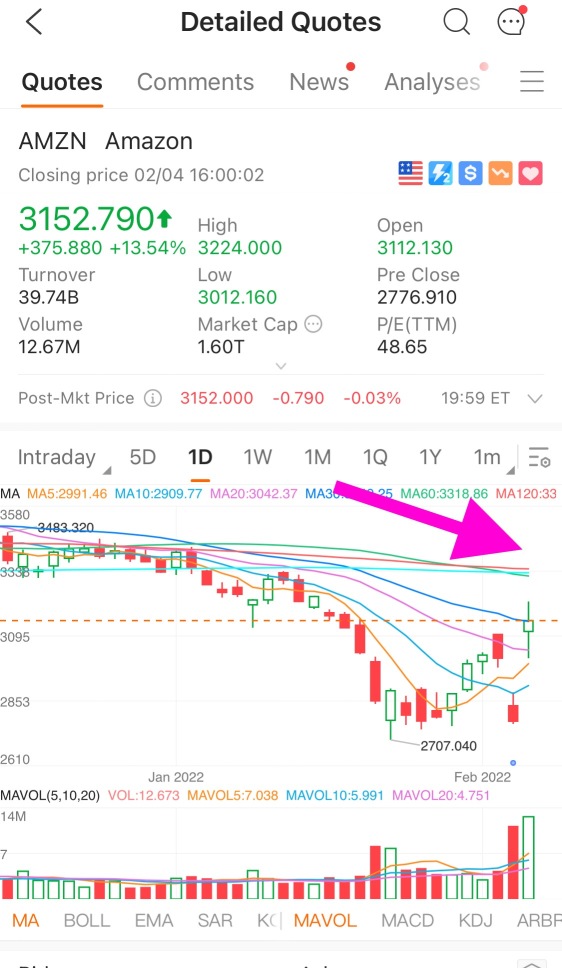

$Amazon(AMZN.US$

Amazon's strong upward attack on Friday brought a glimmer of life to a market that is neither above nor below. Will the bull market return like this? No one knows this. Personally, I think it's better for Amazon to follow the mobile take-profit strategy when the next strong pressure level is 3,300.

In times of market instability, mindful study is also a strategy. Keep studying with my “mentor” as she interprets the Wall Street Master's JESSE LIVERMORE LEGENDARY TRADING BOOK. The reason I put quotes on my mentor is because he doesn't know me at all and doesn't know I have a student like me, but that doesn't affect me in any way by watching his videos to learn from Master JESSE LIVERMORE's experience and improve my knowledge of the market!

Amazon's strong upward attack on Friday brought a glimmer of life to a market that is neither above nor below. Will the bull market return like this? No one knows this. Personally, I think it's better for Amazon to follow the mobile take-profit strategy when the next strong pressure level is 3,300.

In times of market instability, mindful study is also a strategy. Keep studying with my “mentor” as she interprets the Wall Street Master's JESSE LIVERMORE LEGENDARY TRADING BOOK. The reason I put quotes on my mentor is because he doesn't know me at all and doesn't know I have a student like me, but that doesn't affect me in any way by watching his videos to learn from Master JESSE LIVERMORE's experience and improve my knowledge of the market!

Translated

8

6

YN-7up

liked and commented on

lookedThe secret to making a profit in US stocks: stock god Jesse Livermore's trading collectionAfterwards, I had a deep experience.

The critical points and minimum resistance levels complement each other. The key point is that before the stock price forms a clear trend, it will fluctuate on one platform for a while. Once the upper pressure level is broken, there will be an upward trend. The stock price will continue to move in the direction of this minimum resistance level.

Thanks to the teacher for the guidance.

Translated

4

5

YN-7up

liked and commented on

$Invesco QQQ Trust(QQQ.US$

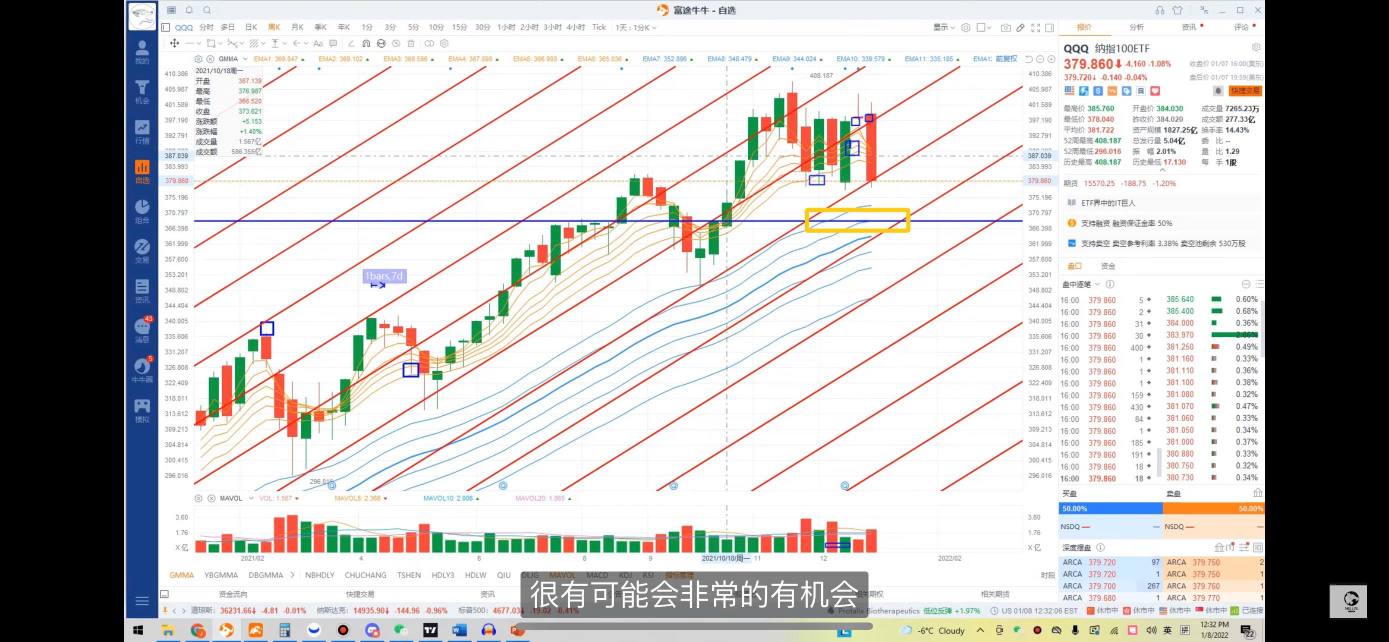

Last week, the Wolf King gave the QQQ the weekly line level and made a success of the bottom.

Have you got such a good chance of profit-loss ratio?

Last week, the Wolf King gave the QQQ the weekly line level and made a success of the bottom.

Have you got such a good chance of profit-loss ratio?

Translated

6

9

signal for market choice, such as trading, etc.

signal for market choice, such as trading, etc.![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

YN-7up : The novice in the market is still waiting for a clear direction.