WANDD88

liked

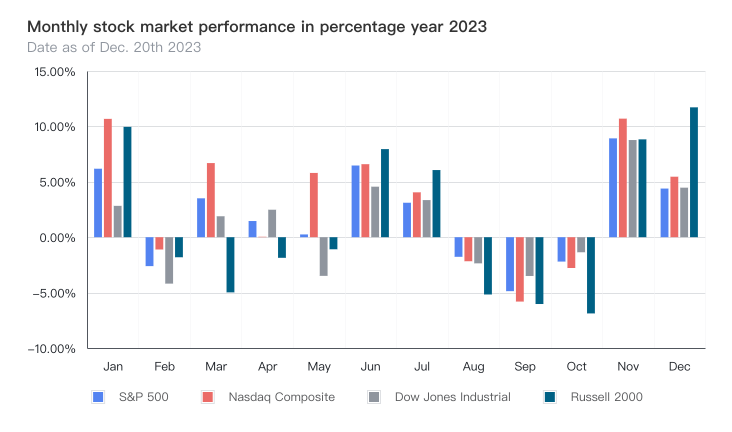

Time flies, and in just one week, 2023 will come to an end. Wishing everyone a Merry Christmas and a Happy New Year! 🥳🎄🎉

Here, Cici takes everyone through a review of this year's major events and provides insights into the investment knowledge behind them. I hope to help everyone reflect on this year's investment highlights and enter 2024 with confidence. Also, those who haven't joined the official investment learning group yet, are welcome to join. Click here to join.���������...

Here, Cici takes everyone through a review of this year's major events and provides insights into the investment knowledge behind them. I hope to help everyone reflect on this year's investment highlights and enter 2024 with confidence. Also, those who haven't joined the official investment learning group yet, are welcome to join. Click here to join.���������...

+10

245

65

WANDD88

commented on

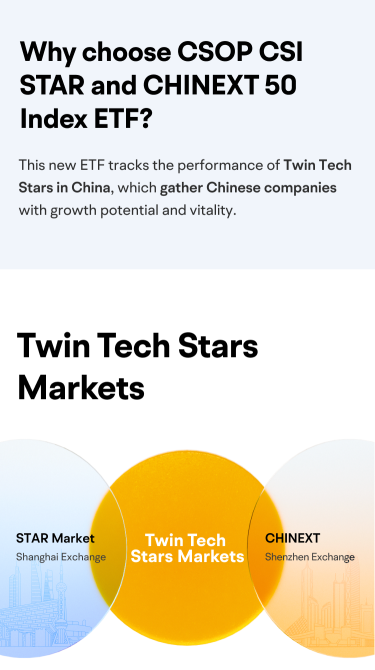

No more cloud spin-off due to US chip export restrictions.

• Revenue +9% Y/Y to $30.8B ($0.2B miss).

• Non-GAAP EPADS $2.14 ($0.05 beat).

• Operating margin 15% (+3pp Y/Y).

• Free cash flow margin 20% (+3pp Y/Y).

$ALIBABA GROUP HOLDING LTD(BABAF.US$ $Alibaba(BABA.US$ $BABA-SW(09988.HK$ $Hang Seng TECH Index(800700.HK$ $China Concept Stocks(BK2517.US$

• Revenue +9% Y/Y to $30.8B ($0.2B miss).

• Non-GAAP EPADS $2.14 ($0.05 beat).

• Operating margin 15% (+3pp Y/Y).

• Free cash flow margin 20% (+3pp Y/Y).

$ALIBABA GROUP HOLDING LTD(BABAF.US$ $Alibaba(BABA.US$ $BABA-SW(09988.HK$ $Hang Seng TECH Index(800700.HK$ $China Concept Stocks(BK2517.US$

3

WANDD88

commented on

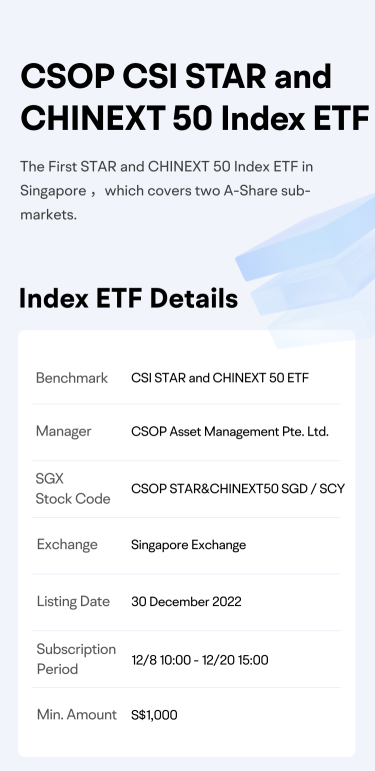

$Hang Seng Index(800000.HK$ recorded a 27% increase in November, the largest monthly increase since 1998. The trend continued into early December and was further reinforced by rounds of policy easing of restrictions last week.

As China's epidemic policy is further relaxed, Wall Street's calls to buy Chinese concept stocks are getting louder.

Do you also want to share the benefits brought by emerging Chinese companies?

For ...

As China's epidemic policy is further relaxed, Wall Street's calls to buy Chinese concept stocks are getting louder.

Do you also want to share the benefits brought by emerging Chinese companies?

For ...

+2

125

872

Trade only at technical support level and when fear is greater vix>35.

Patience is the key and use limit order to only enter trade according to plan.

Follow stop lost strictly and buy only in stages.

Spx 4000 is a very good support level to enter trades.

Patience is the key and use limit order to only enter trade according to plan.

Follow stop lost strictly and buy only in stages.

Spx 4000 is a very good support level to enter trades.

3

WANDD88

liked

Today's stock market adjustments aren't any news; the tax supplement via is the big news. The national dilemma reflected behind Via's tax payment is what matters most.

Actually, it's just four words. Finance is tight

The tax avoidance method used by Via is the current mainstream tax avoidance law, including Fan Bingbing, who was also taxed in the same way back then. If you are familiar with tax planning, you should know that they all use tax approval methods to form shell companies to launder high income into approval and taxation. After such an operation, it is possible that the final profit of 100 million dollars only needs to be paid 5 points in tax. However, if you file your taxes normally and truthfully, when corporate income tax and personal income tax are removed, you won't be able to get away with 45 points.

Who can't get along with money? A normal person would pay 45 points in taxes. Except for the wages stated by business executives. The reason it was fine before is an accident now. It is because the country has to implement the national policy of common prosperity and return the tax avoidance money from high-income people.

Are you saying that Via broke the law? It's definitely against the law, but in the past it was just a bug; people didn't raise an official and didn't investigate; local governments opened one eye and closed one eye. But now it's not what it used to be. The rich people who want to move are at the head of these traffic fields. She used to be a movie star, but now she's a live streaming celebrity. Furthermore, human society is aimed at high-income groups regardless of whether it is within or outside of Japan. Crackdown on the rich. Although the poor didn't get a dime, they were very happy to eat melons.

So what does common wealth have to do with stock market investment? The relationship is huge. If you want to see the country's determination to achieve common prosperity, what do you emphasize?

Fair! Fair! Still damn fair!

Therefore, the future of many industries will be cut off by the national policy of fairness, and some expectations have been cut off. In particular, platform-based companies that use traffic to make money, such as Alibaba, Douyin Headline, or Meituan, and other Internet-related industries.

Who is the smartest of these platforms? It's a TikTok headline.

I've said it and you'll understand. If you haven't used Douyin, you've probably heard of it, Classmate Zhang. In just a few months, there were 20 million fans filming Life in the Countryside. The People's Daily has made a special review. Some analyses are that professional shooting techniques are popular, while others are that people are tired of watching the high life in the city and yearn for the countryside.

It's all wrong.

This is the most obvious case under the common wealth policy. It is to create opportunities for grassroots. Only when grassroots have an opportunity can it mean that most ordinary people also have a chance to become the next student Zhang. Douyin knows national policies too well, alleviates poverty, helps farmers, and starts grassroots short video businesses. In the future, we will also support a large number of students Zhang to show off the various opportunities and livelihoods in rural areas with huge traffic. If you happen to be a short video entrepreneur or live e-commerce operator, you should see this trend. This is the policy direction conveyed by D's will. Going to the countryside to start a business in the future is the best outlet. Whether it's e-commerce in rural areas or ecotourism, it's a good direction for the future.

However, D's will must also allow banks to reduce the benefits of fixed income products and fully popularize equity assets. It's also a way to get rich together. Only when ordinary people also have opportunities to grow their wealth can this society be healthy. Instead of rich people getting richer through stock market investments, ordinary people don't see opportunities.

The national policy for common prosperity requires a thorough understanding in order to seize the opportunities that belong to you in the next 20 years. At the same time, we also need to think about how many billion dollars is Via's income, and her share of tax burden is still less than that of people with a few thousand wages?

Is that reasonable?

OK, let's talk about this briefly. If you're interested, we can talk about how much the world, Jingyu, and national policies can change our lives later $TENCENT(00700.HK$ $BABA-SW(09988.HK$ $MEITUAN-W(03690.HK$

Actually, it's just four words. Finance is tight

The tax avoidance method used by Via is the current mainstream tax avoidance law, including Fan Bingbing, who was also taxed in the same way back then. If you are familiar with tax planning, you should know that they all use tax approval methods to form shell companies to launder high income into approval and taxation. After such an operation, it is possible that the final profit of 100 million dollars only needs to be paid 5 points in tax. However, if you file your taxes normally and truthfully, when corporate income tax and personal income tax are removed, you won't be able to get away with 45 points.

Who can't get along with money? A normal person would pay 45 points in taxes. Except for the wages stated by business executives. The reason it was fine before is an accident now. It is because the country has to implement the national policy of common prosperity and return the tax avoidance money from high-income people.

Are you saying that Via broke the law? It's definitely against the law, but in the past it was just a bug; people didn't raise an official and didn't investigate; local governments opened one eye and closed one eye. But now it's not what it used to be. The rich people who want to move are at the head of these traffic fields. She used to be a movie star, but now she's a live streaming celebrity. Furthermore, human society is aimed at high-income groups regardless of whether it is within or outside of Japan. Crackdown on the rich. Although the poor didn't get a dime, they were very happy to eat melons.

So what does common wealth have to do with stock market investment? The relationship is huge. If you want to see the country's determination to achieve common prosperity, what do you emphasize?

Fair! Fair! Still damn fair!

Therefore, the future of many industries will be cut off by the national policy of fairness, and some expectations have been cut off. In particular, platform-based companies that use traffic to make money, such as Alibaba, Douyin Headline, or Meituan, and other Internet-related industries.

Who is the smartest of these platforms? It's a TikTok headline.

I've said it and you'll understand. If you haven't used Douyin, you've probably heard of it, Classmate Zhang. In just a few months, there were 20 million fans filming Life in the Countryside. The People's Daily has made a special review. Some analyses are that professional shooting techniques are popular, while others are that people are tired of watching the high life in the city and yearn for the countryside.

It's all wrong.

This is the most obvious case under the common wealth policy. It is to create opportunities for grassroots. Only when grassroots have an opportunity can it mean that most ordinary people also have a chance to become the next student Zhang. Douyin knows national policies too well, alleviates poverty, helps farmers, and starts grassroots short video businesses. In the future, we will also support a large number of students Zhang to show off the various opportunities and livelihoods in rural areas with huge traffic. If you happen to be a short video entrepreneur or live e-commerce operator, you should see this trend. This is the policy direction conveyed by D's will. Going to the countryside to start a business in the future is the best outlet. Whether it's e-commerce in rural areas or ecotourism, it's a good direction for the future.

However, D's will must also allow banks to reduce the benefits of fixed income products and fully popularize equity assets. It's also a way to get rich together. Only when ordinary people also have opportunities to grow their wealth can this society be healthy. Instead of rich people getting richer through stock market investments, ordinary people don't see opportunities.

The national policy for common prosperity requires a thorough understanding in order to seize the opportunities that belong to you in the next 20 years. At the same time, we also need to think about how many billion dollars is Via's income, and her share of tax burden is still less than that of people with a few thousand wages?

Is that reasonable?

OK, let's talk about this briefly. If you're interested, we can talk about how much the world, Jingyu, and national policies can change our lives later $TENCENT(00700.HK$ $BABA-SW(09988.HK$ $MEITUAN-W(03690.HK$

Translated

60

6

WANDD88

liked

As mentioned awhile back, I finally have the time to do a short youtube video on a list of Chinese metaverse concept stocks.

Youtube link is as follows:-

https://youtu.be/sNEAaDe6vfg

As always, this should not be construed as any investment or trading advice.

$Baidu(BIDU.US$ $BIDU-SW(09888.HK$ $TENCENT(00700.HK$ $Alibaba(BABA.US$ $HUYA Inc(HUYA.US$ $BILIBILI-W(09626.HK$ $Bilibili(BILI.US$ $KUAISHOU-W(01024.HK$ $DouYu(DOYU.US$ $NetEase(NTES.US$ $NTES-S(09999.HK$ $XIAOMI-W(01810.HK$ $Xiaomi Corp. Unsponsored ADR Class B(XIACY.US$ $Weibo(WB.US$

Youtube link is as follows:-

https://youtu.be/sNEAaDe6vfg

As always, this should not be construed as any investment or trading advice.

$Baidu(BIDU.US$ $BIDU-SW(09888.HK$ $TENCENT(00700.HK$ $Alibaba(BABA.US$ $HUYA Inc(HUYA.US$ $BILIBILI-W(09626.HK$ $Bilibili(BILI.US$ $KUAISHOU-W(01024.HK$ $DouYu(DOYU.US$ $NetEase(NTES.US$ $NTES-S(09999.HK$ $XIAOMI-W(01810.HK$ $Xiaomi Corp. Unsponsored ADR Class B(XIACY.US$ $Weibo(WB.US$

18

1

WANDD88

liked

Two things keeping me on my toes about $S&P 500 Index(.SPX.US$ .

Firstly, number of stocks above MA200 (a sign of bullish trend) is less than 50%. In other words, less than 50% of stocks in US market is now above MA200. Check out MMTH index in barchart or trading view.

Secondly, US Fed will start tapering QE. Thus, reducing liquidity in the market.

![]()

Firstly, number of stocks above MA200 (a sign of bullish trend) is less than 50%. In other words, less than 50% of stocks in US market is now above MA200. Check out MMTH index in barchart or trading view.

Secondly, US Fed will start tapering QE. Thus, reducing liquidity in the market.

7

WANDD88

liked and commented on

1. Buy shares right before market close. With less than 30 seconds left. This will cause an After Hours spike which could get the stock more exposure to buyers.

2. Enter limit sell orders at a 20% profit. This keeps them from being borrowed.

3. Buying Options is not as helpful as a market order.

4. Spread good news.

5. While holding a stock accumulate more shares anytime the price drops below your average, if possible.

6. Focus on a stocks long term outlook. Focusing on short term causes panic selling and more losses than gains.

7. Buy on market pullbacks, sell after projections met.

8. The stock market is complex. Projections are just that projections. Insiders can sell, slow days happen, news happens constantly, and hedge funds make money by tricking you.

9.Let the facts tell you what to believe, and let your feelings tell you what to expect. And don't be scared of the unknown, or the known, or pretend that you're on to something while deep in your heart you know that you're not. Be honest.

This week I like:

$Duck Creek Technologies Inc(DCT.US$

$LIVE OAK ACQUISITION CORP II(LOKB.US$

$ChemoCentryx Inc(CCXI.US$

$U.S. Well Services Inc(USWS.US$

$Valneva(VALN.US$

Watch

$Limelight Networks Inc(LLNW.US$

$Vuzix(VUZI.US$

Long term

$Very Good Food(VGFC.US$ will announce acquisition soon.

2. Enter limit sell orders at a 20% profit. This keeps them from being borrowed.

3. Buying Options is not as helpful as a market order.

4. Spread good news.

5. While holding a stock accumulate more shares anytime the price drops below your average, if possible.

6. Focus on a stocks long term outlook. Focusing on short term causes panic selling and more losses than gains.

7. Buy on market pullbacks, sell after projections met.

8. The stock market is complex. Projections are just that projections. Insiders can sell, slow days happen, news happens constantly, and hedge funds make money by tricking you.

9.Let the facts tell you what to believe, and let your feelings tell you what to expect. And don't be scared of the unknown, or the known, or pretend that you're on to something while deep in your heart you know that you're not. Be honest.

This week I like:

$Duck Creek Technologies Inc(DCT.US$

$LIVE OAK ACQUISITION CORP II(LOKB.US$

$ChemoCentryx Inc(CCXI.US$

$U.S. Well Services Inc(USWS.US$

$Valneva(VALN.US$

Watch

$Limelight Networks Inc(LLNW.US$

$Vuzix(VUZI.US$

Long term

$Very Good Food(VGFC.US$ will announce acquisition soon.

211

88

WANDD88

commented on

To me, this is really a blend of theories, knowledge of the market as well as mostly luck.

Importantly, we need to know what is stop loss and take profit.

Stop loss is set on trading stocks to remind you to pull the plug when you were wrong about the anticipated direction of the market. Stop loss enables you to exit the market when a stock has fallen below your acceptable threshold and prevent you from losing more.

Take profit is for you to decide to exit the market after realizing considerable amount of profits for the investment made and more excitingly, it is to use the profit to pay for any major purchases, living expenses, or use the profits to build and fulfill your portfolio allocation strategy by putting them into another investment to earn even more.

There is some underlying principles in stop loss and take profit for example, 1) after you had purchased a stock at a price, it will not always shoot up right away. Therefore, giving it a bit of room to move before it starts to go up is essential instead of trying to achieve zero loss. Selling immediately upon a drop will also make you lose on commission and against your initial decision of the stock’s potential growth. Have some faith, as every investor wants to buy low and sell high, hence you need to give it chance to grow. The idea of a stop loss is meant to be a safe guard only whenever you made a very wrong expectation about the stock’s direction, but not for you to make knee jerk reaction, 2) likewise, do not sell a stock for profit just because the price had risen as you will be falling into the trap of taking a small win after a stock gained in value and neglecting future greater earnings and; 3) all “buy and hold” investors have the intent to buy stocks at the absolute bottom price but may not be always accurate. If you are caught in a downtrend, the stop-loss must be executed if the price continues to decline even after the purchase.

Next, I would also categorize stop loss and take profit into two areas namely micro and macro considerations with some fundamental rules.

For micro, there is a need to determine your present financial risk appetite figuratively. For example if you buy a stock at $1.00 and set stop loss at $0.94, then you have $0.06 of risk per share. If you have a position size of 1,000 shares, the total risk on your trade is $0.06 x 1,000 shares, which is $60 plus buy-sell commission. This can correspondingly increase depending on your appetite to lose. Generally, the amount put at risk should represent only a small portion of your total trading account like 2%, meaning if $60 risk is 2%, the your trading account should be about $3000. Some trading platforms have the trailing stop-loss order function, which let the stop loss number follows with the same margin as the stock increases in price.

Next, it would be the rule of 72. Take profit on an investment takes time and it is often hard to calculate how long it will take before the returns are substantial. To avoid the complex calculations, to find the amount of time the investment takes to double, you should use the rule of 72 to gauge the rate of return and in how many years it will take to double. An example would be to take the number 72 and divide it by the rate (e.g. 6%) at which an investment is projected to grow every year, and then divide 72 by 6 will get 12 years. Therefore, it will take 12 years to double the investment that is growing at a rate of 6%. With that in mind, the investor ought not to be affected by the stop loss or takes profit since it is going to take 12 years anyway, for amount to double for reputable companies’ stocks.

On the macro level, situations may have changed and there is a need to react to stop loss or take profit. These situations are 1) the investment thesis has changed especially when you encountered drop in dividend amount which signaled that the company is struggling financially, the entire particular industry is struggling onwards, or that a company has a negative change in its business or executive board etc., are indicators to stop loss, 2) the company that is being acquired can lead to sell to take profit or stop loss. After an acquisition is announced, the stock price of the company being acquired typically rises to a level close to the agreed-upon purchase price. Since further upside potential can be quite limited, it may be wise to take profit after the acquisition announcement, 3) rebalance of portfolio by selling due to a) owning a high-performing stock which has significantly increased in price and represented a large portion of the value of your overall portfolio and is safer to take profit to minimize risk in one company while b) seeking to reduce your stock exposure in anticipation of need for money for e.g. retirement, getting married etc., c) one popular rule of thumb for stocks investment is to subtract your age from 110 to determine the percentage of your portfolio that should be invested in stocks. If your portfolio seems too stock-heavy, then selling some stocks to take profit is advised.

Nevertheless, determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult. Say for example, if a stock had grown to a considerable amount and presented with the opportunity to take large profit, should you take profit now and what if the stock may fall suddenly due to attack by government or other changes in policies and profits may diminish significantly or the stock may continue grow even more. No one can really predict accurately. However, for sure, if you failed to follow the trend of the stock and recognize its dip or rise in price, you may end up missing out on huge gains and preventable losses. All investors ought to stay informed and be diligent to observe for trends, set a price target, have a benchmark for selling the stock aimed at cutting lose or realizing profits every time.

Importantly, we need to know what is stop loss and take profit.

Stop loss is set on trading stocks to remind you to pull the plug when you were wrong about the anticipated direction of the market. Stop loss enables you to exit the market when a stock has fallen below your acceptable threshold and prevent you from losing more.

Take profit is for you to decide to exit the market after realizing considerable amount of profits for the investment made and more excitingly, it is to use the profit to pay for any major purchases, living expenses, or use the profits to build and fulfill your portfolio allocation strategy by putting them into another investment to earn even more.

There is some underlying principles in stop loss and take profit for example, 1) after you had purchased a stock at a price, it will not always shoot up right away. Therefore, giving it a bit of room to move before it starts to go up is essential instead of trying to achieve zero loss. Selling immediately upon a drop will also make you lose on commission and against your initial decision of the stock’s potential growth. Have some faith, as every investor wants to buy low and sell high, hence you need to give it chance to grow. The idea of a stop loss is meant to be a safe guard only whenever you made a very wrong expectation about the stock’s direction, but not for you to make knee jerk reaction, 2) likewise, do not sell a stock for profit just because the price had risen as you will be falling into the trap of taking a small win after a stock gained in value and neglecting future greater earnings and; 3) all “buy and hold” investors have the intent to buy stocks at the absolute bottom price but may not be always accurate. If you are caught in a downtrend, the stop-loss must be executed if the price continues to decline even after the purchase.

Next, I would also categorize stop loss and take profit into two areas namely micro and macro considerations with some fundamental rules.

For micro, there is a need to determine your present financial risk appetite figuratively. For example if you buy a stock at $1.00 and set stop loss at $0.94, then you have $0.06 of risk per share. If you have a position size of 1,000 shares, the total risk on your trade is $0.06 x 1,000 shares, which is $60 plus buy-sell commission. This can correspondingly increase depending on your appetite to lose. Generally, the amount put at risk should represent only a small portion of your total trading account like 2%, meaning if $60 risk is 2%, the your trading account should be about $3000. Some trading platforms have the trailing stop-loss order function, which let the stop loss number follows with the same margin as the stock increases in price.

Next, it would be the rule of 72. Take profit on an investment takes time and it is often hard to calculate how long it will take before the returns are substantial. To avoid the complex calculations, to find the amount of time the investment takes to double, you should use the rule of 72 to gauge the rate of return and in how many years it will take to double. An example would be to take the number 72 and divide it by the rate (e.g. 6%) at which an investment is projected to grow every year, and then divide 72 by 6 will get 12 years. Therefore, it will take 12 years to double the investment that is growing at a rate of 6%. With that in mind, the investor ought not to be affected by the stop loss or takes profit since it is going to take 12 years anyway, for amount to double for reputable companies’ stocks.

On the macro level, situations may have changed and there is a need to react to stop loss or take profit. These situations are 1) the investment thesis has changed especially when you encountered drop in dividend amount which signaled that the company is struggling financially, the entire particular industry is struggling onwards, or that a company has a negative change in its business or executive board etc., are indicators to stop loss, 2) the company that is being acquired can lead to sell to take profit or stop loss. After an acquisition is announced, the stock price of the company being acquired typically rises to a level close to the agreed-upon purchase price. Since further upside potential can be quite limited, it may be wise to take profit after the acquisition announcement, 3) rebalance of portfolio by selling due to a) owning a high-performing stock which has significantly increased in price and represented a large portion of the value of your overall portfolio and is safer to take profit to minimize risk in one company while b) seeking to reduce your stock exposure in anticipation of need for money for e.g. retirement, getting married etc., c) one popular rule of thumb for stocks investment is to subtract your age from 110 to determine the percentage of your portfolio that should be invested in stocks. If your portfolio seems too stock-heavy, then selling some stocks to take profit is advised.

Nevertheless, determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult. Say for example, if a stock had grown to a considerable amount and presented with the opportunity to take large profit, should you take profit now and what if the stock may fall suddenly due to attack by government or other changes in policies and profits may diminish significantly or the stock may continue grow even more. No one can really predict accurately. However, for sure, if you failed to follow the trend of the stock and recognize its dip or rise in price, you may end up missing out on huge gains and preventable losses. All investors ought to stay informed and be diligent to observe for trends, set a price target, have a benchmark for selling the stock aimed at cutting lose or realizing profits every time.

11

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)