walker915

liked

The unexpected cooling of the US CPI inflation data brought a significant boost to US stocks. In May, CPI growth slowed to 3.3%, with zero month-on-month growth. Core CPI increased 3.4% year-on-year and 0.2% month-on-month, all showing clear signs of slowing inflation. As a result, the market completely absorbed expectations of two interest rate cuts this year. Driven by this positive news, the S&P 500 and Nasdaq indices hit record highs for three consecutive days.

Meanwhile, the Federal Reserve stated at a recent meeting that although inflation has cooled down, the level is still above target, and more positive data is needed to support interest rate cut decisions. Powell stressed that although inflation has decelerated significantly, more “good data” still needs to be observed. The Federal Reserve now expects to cut interest rates only once this year, reducing the previous forecast of three times.

In terms of individual stocks, technology stocks, driven by the AI boom, have risen sharply. US stocks of Nvidia, Microsoft, Broadcom, and TSMC all hit new highs. Among them, Broadcom rose an additional 10% due to good after-hours earnings performance. After Apple introduced new features at the WWDC conference, its stock price rose by more than 7%, once surpassing Microsoft to become the company with the highest market capitalization, even though Microsoft regained the lead.

In the fixed income market, after the CPI data was released, the price of US bonds rose sharply, and the yield fell sharply. The 10-year US Treasury yield plummeted by more than 10 basis points, hitting a two-month low. The US dollar index fell sharply after the data was released, and although there was some recovery after the Federal Reserve meeting, the increase was limited.

Crude oil prices rose for three consecutive days during this period, reaching a new two-week high. The metal market...

Meanwhile, the Federal Reserve stated at a recent meeting that although inflation has cooled down, the level is still above target, and more positive data is needed to support interest rate cut decisions. Powell stressed that although inflation has decelerated significantly, more “good data” still needs to be observed. The Federal Reserve now expects to cut interest rates only once this year, reducing the previous forecast of three times.

In terms of individual stocks, technology stocks, driven by the AI boom, have risen sharply. US stocks of Nvidia, Microsoft, Broadcom, and TSMC all hit new highs. Among them, Broadcom rose an additional 10% due to good after-hours earnings performance. After Apple introduced new features at the WWDC conference, its stock price rose by more than 7%, once surpassing Microsoft to become the company with the highest market capitalization, even though Microsoft regained the lead.

In the fixed income market, after the CPI data was released, the price of US bonds rose sharply, and the yield fell sharply. The 10-year US Treasury yield plummeted by more than 10 basis points, hitting a two-month low. The US dollar index fell sharply after the data was released, and although there was some recovery after the Federal Reserve meeting, the increase was limited.

Crude oil prices rose for three consecutive days during this period, reaching a new two-week high. The metal market...

Translated

23

walker915

reacted to

1. What does TSMC AGM say 2. The topic of data centers in Malaysia is very hot

$Taiwan Semiconductor(TSM.US$ $MNHLDG(0245.MY$ $SCGBHD(0225.MY$ $SIMEPROP(5288.MY$ $MAHSING(8583.MY$ $SUNCON(5263.MY$ $PWRWELL(0217.MY$ $VSTECS(5162.MY$ $SNS(0259.MY$ $PWRWELL(0217.MY$ $HEGROUP(0296.MY$ $PIE(7095.MY$

$Taiwan Semiconductor(TSM.US$ $MNHLDG(0245.MY$ $SCGBHD(0225.MY$ $SIMEPROP(5288.MY$ $MAHSING(8583.MY$ $SUNCON(5263.MY$ $PWRWELL(0217.MY$ $VSTECS(5162.MY$ $SNS(0259.MY$ $PWRWELL(0217.MY$ $HEGROUP(0296.MY$ $PIE(7095.MY$

Translated

51

1

walker915

voted

😊Hi, Malaysian mooers!

Malaysia Airports is estimated to release its next earnings report on May 30. How will the market react to the company's quarterly results? Vote your answer to participate!

🎁 Rewards

●👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $AIRPORT(5014.MY$'s closing price on its earnings release date (e.g., If 50 mooers make a correct guess, each of them wil...

Malaysia Airports is estimated to release its next earnings report on May 30. How will the market react to the company's quarterly results? Vote your answer to participate!

🎁 Rewards

●👌 An equal share of 1,000 points: For mooers who correctly guess the price range of $AIRPORT(5014.MY$'s closing price on its earnings release date (e.g., If 50 mooers make a correct guess, each of them wil...

160

109

walker915

liked

#指数要上涨离不开银行股

In the past, when the index soared, Bank 🐯 and Public Bank 🏦 took the lead. Unfortunately, PBBANK's profit YOY has declined for two consecutive quarters. YOY fell 3.5% in the latest quarter, causing the stock price to drop 2.6% this year (10 percent dividend was paid in March).

Therefore, in this round of MAYBANK and CIMB, the two bank stocks with the largest assets stormed the index. With TENAGA and Yang Jia Shuangxiong, more than two-thirds of the increase in the index this year came from these five companies.

$TENAGA(5347.MY$ $YTL(4677.MY$ $YTLPOWR(6742.MY$

For the index to rise, the banking sector must perform well, because the banking sector accounts for 41% of the index. Yesterday, MAYBANK handed over its 2024Q1 results, growing 9.8% year on year. Turnover and profit are all record highs. Coincidentally, last quarter's PAT was RM2,388 mil, and this quarter RM2,488 mil. I also congratulate you 🎊 Malaysian Stock 888!

$MAYBANK(1155.MY$

The total share of MAYBANK and CIMB indices is 23%. As long as these two companies stabilize and slowly rise, they can at least maintain the lower limit of the index. The remaining few bank stocks are assumed to be able to hand over single-digit% growth without lagging behind, and the market will basically stabilize.

$CIMB(1023.MY$

Assuming the rest of industry, healthcare, consumption, and electricity...

In the past, when the index soared, Bank 🐯 and Public Bank 🏦 took the lead. Unfortunately, PBBANK's profit YOY has declined for two consecutive quarters. YOY fell 3.5% in the latest quarter, causing the stock price to drop 2.6% this year (10 percent dividend was paid in March).

Therefore, in this round of MAYBANK and CIMB, the two bank stocks with the largest assets stormed the index. With TENAGA and Yang Jia Shuangxiong, more than two-thirds of the increase in the index this year came from these five companies.

$TENAGA(5347.MY$ $YTL(4677.MY$ $YTLPOWR(6742.MY$

For the index to rise, the banking sector must perform well, because the banking sector accounts for 41% of the index. Yesterday, MAYBANK handed over its 2024Q1 results, growing 9.8% year on year. Turnover and profit are all record highs. Coincidentally, last quarter's PAT was RM2,388 mil, and this quarter RM2,488 mil. I also congratulate you 🎊 Malaysian Stock 888!

$MAYBANK(1155.MY$

The total share of MAYBANK and CIMB indices is 23%. As long as these two companies stabilize and slowly rise, they can at least maintain the lower limit of the index. The remaining few bank stocks are assumed to be able to hand over single-digit% growth without lagging behind, and the market will basically stabilize.

$CIMB(1023.MY$

Assuming the rest of industry, healthcare, consumption, and electricity...

Translated

61

1

walker915

reacted to

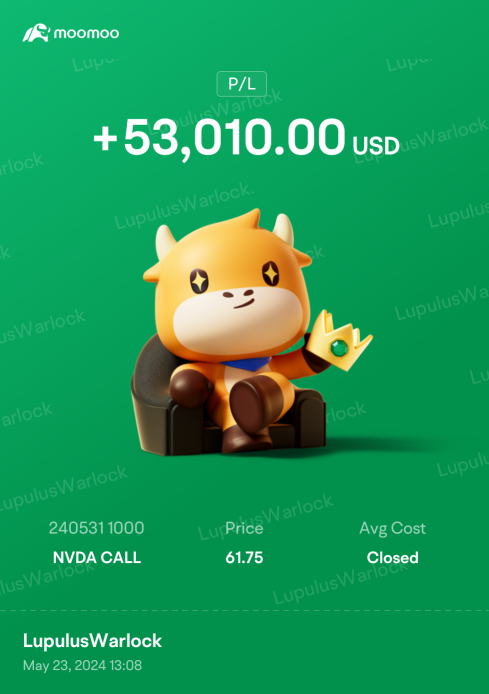

$NVIDIA(NVDA.US$

Closed out most of my positions, shifted some calls to June 14th to ride the inevitable post split jump

Closed out most of my positions, shifted some calls to June 14th to ride the inevitable post split jump

419

76

walker915

voted

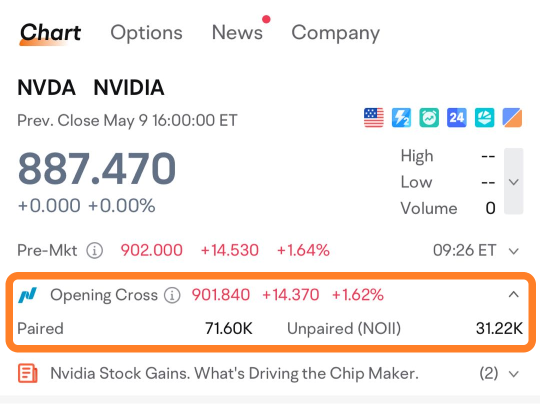

$NVIDIA(NVDA.US$ is releasing its Q1 earnings on May 22, after the U.S. stock market close. How will the whole market react to the AI giant's results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points:

For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET May 23 (e.g., If 50 mooers make a correct guess, they will get 200 points!)

(The vote will close ...

Rewards

● An equal share of 10,000 points:

For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET May 23 (e.g., If 50 mooers make a correct guess, they will get 200 points!)

(The vote will close ...

156

348

walker915

liked

Today, the glove stock once again became the most beautiful boy in the game.

The main reason was that the US escalated the trade war to a higher level.

Yesterday evening,

The US President's Office announced the latest round of import tariff lists for Chinese products, which has drastically raised import tariffs on specific products from China. The products involved are as follows:

1. Steel and aluminum (2024, increase from 0-7.5% to 25%)

2. Semiconductors (increase from 25% to 50% in 2025)

3. Electric vehicles (2024, increase from 25% to 100%)

4. Lithium-ion batteries (increase from 7.5% to 25% in 2024)

5. Electric vehicle battery components (increase from 7.5% to 25% in 2024)

6. Solar cells (2024, increase from 25% to 50%)

10. Medical syringes and needles (increase from 0% to 50% in 2024)

7. Personal protective equipment, including certain respirators and masks (in 2024, increase from 0-7.5% to 25%)

8. Rubber medical and surgical gloves (2026, increase from 7.5% to 25%)

This measure,

Nominally, in addition to encouraging the localization of American products,

It is also expected that it will allow American importers,

Shifting the source of product imports to Southeast Asia/South American countries.

Conceptually,

The beneficiaries of the Malaysian stock market are as follows:

1. Aluminum product manufacturer (extrusion/casting)

$LBALUM(9326.MY$ $PA(7225.MY$ $PMETAL(8869.MY$

...

The main reason was that the US escalated the trade war to a higher level.

Yesterday evening,

The US President's Office announced the latest round of import tariff lists for Chinese products, which has drastically raised import tariffs on specific products from China. The products involved are as follows:

1. Steel and aluminum (2024, increase from 0-7.5% to 25%)

2. Semiconductors (increase from 25% to 50% in 2025)

3. Electric vehicles (2024, increase from 25% to 100%)

4. Lithium-ion batteries (increase from 7.5% to 25% in 2024)

5. Electric vehicle battery components (increase from 7.5% to 25% in 2024)

6. Solar cells (2024, increase from 25% to 50%)

10. Medical syringes and needles (increase from 0% to 50% in 2024)

7. Personal protective equipment, including certain respirators and masks (in 2024, increase from 0-7.5% to 25%)

8. Rubber medical and surgical gloves (2026, increase from 7.5% to 25%)

This measure,

Nominally, in addition to encouraging the localization of American products,

It is also expected that it will allow American importers,

Shifting the source of product imports to Southeast Asia/South American countries.

Conceptually,

The beneficiaries of the Malaysian stock market are as follows:

1. Aluminum product manufacturer (extrusion/casting)

$LBALUM(9326.MY$ $PA(7225.MY$ $PMETAL(8869.MY$

...

Translated

107

3

walker915

voted

Are you ready to surf the tumultuous tides of the stock market when the Fed announces its monetary policy decisions? Our "Invest with Sarge" live stream on April 30th delved into the strategies and insights to help you navigate Fed days confidently. Here's a snapshot of the wisdom the veteran trader, Sarge, shared during this engaging session.

🔮 The Two-Day Meeting Mystique:

![]() The Silence Before the Storm: Picture the market as a va...

The Silence Before the Storm: Picture the market as a va...

🔮 The Two-Day Meeting Mystique:

64

19

walker915

liked and commented on

$CORAZA(0240.MY$ 💡💡💡

4

3

walker915

liked

MN Holdings Bhd via its wholly-owned subsidiary MN Power Transmission Sdn Bhd has secured a contract from Samaiden Sdn Bhd for the engineering, procurement, construction and commissioning (EPCC) work for a large solar scale photovoltaic (LSSPV) plant in Kulim for RM26mil.

In a statement, the underground utilities and substation engineering specialist said its unit had been appointed a sub-contractor for the 50 mega-watt alternating current (MWac) LS...

In a statement, the underground utilities and substation engineering specialist said its unit had been appointed a sub-contractor for the 50 mega-watt alternating current (MWac) LS...

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)