Good news this time!

America's June, which was announced last weekPCE deflator(Personal Consumption Expenditure Price Index)

Although it has risen 3% from 1 year ago,Growth has shrunk for the second month in a row.

Simply put, “Prices are falling!” That's it.

*PCE deflator: An indicator showing high prices

Also, the core index, which excludes food and energy, rose 4.1% from a year ago.

This has also shrunk to the level since September 2021.

It has been shown that the high inflation rate is settling down.

In this way, it seems that inflation (= soaring prices) that has continued in the US will finally come to an end.

Then, if we look at analysts' predictions, by cutting interest rates in the future,

It is said that it is also possible to aim for the possibility that the economy will improve without falling into a recession (soft landing).

When this happens, what we can expect next is a “rise in stock prices.”

By lowering interest rates that had been forcibly raised in the future in order to suppress inflation

That's because monetary tightening has come to an end, and monetary easing will occur.

What is the timing of interest rate cuts as of 2023/07/31

It's become “2024/5”...

America's June, which was announced last weekPCE deflator(Personal Consumption Expenditure Price Index)

Although it has risen 3% from 1 year ago,Growth has shrunk for the second month in a row.

Simply put, “Prices are falling!” That's it.

*PCE deflator: An indicator showing high prices

Also, the core index, which excludes food and energy, rose 4.1% from a year ago.

This has also shrunk to the level since September 2021.

It has been shown that the high inflation rate is settling down.

In this way, it seems that inflation (= soaring prices) that has continued in the US will finally come to an end.

Then, if we look at analysts' predictions, by cutting interest rates in the future,

It is said that it is also possible to aim for the possibility that the economy will improve without falling into a recession (soft landing).

When this happens, what we can expect next is a “rise in stock prices.”

By lowering interest rates that had been forcibly raised in the future in order to suppress inflation

That's because monetary tightening has come to an end, and monetary easing will occur.

What is the timing of interest rate cuts as of 2023/07/31

It's become “2024/5”...

Translated

![[US Market] Stock price increases are expected after January 24! [Slowing inflation and interest rate cuts]](https://sgsnsimg.moomoo.com/181533246/editor_image/a4245d6470743a149ddd0b6106e5948e.png/thumb)

![[US Market] Stock price increases are expected after January 24! [Slowing inflation and interest rate cuts]](https://sgsnsimg.moomoo.com/181533246/editor_image/453da025529b374d801dec06c0788ef3.png/thumb)

![[US Market] Stock price increases are expected after January 24! [Slowing inflation and interest rate cuts]](https://sgsnsimg.moomoo.com/181533246/editor_image/2fc508de03e43382aba7385ef28a9cf6.png/thumb)

+1

9

Coca-Cola's financial results were higher than expected in terms of both sales and net profit!

Profit increased by +33% compared to the previous year, making a big leap forward.

That said, Coca-Cola sales volume has remained flat since last year.

“It sold more than usual!” I'm not saying that.

So what was good about it was that the selling price was raised.

It simply means that the price has been raised.

Demand remained strong even when prices were raised, and profit increased significantly.

Following favorable results, Coca-Cola revised its future sales forecast upward.

In 2023, sales are expected to increase by 8 to 9% compared to last year.

Coca-Cola's stock price has increased 33% over the past 5 years.

It's a high-dividend stock that Buffett also bought. I'm looking forward to the future as well.

Profit increased by +33% compared to the previous year, making a big leap forward.

That said, Coca-Cola sales volume has remained flat since last year.

“It sold more than usual!” I'm not saying that.

So what was good about it was that the selling price was raised.

It simply means that the price has been raised.

Demand remained strong even when prices were raised, and profit increased significantly.

Following favorable results, Coca-Cola revised its future sales forecast upward.

In 2023, sales are expected to increase by 8 to 9% compared to last year.

Coca-Cola's stock price has increased 33% over the past 5 years.

It's a high-dividend stock that Buffett also bought. I'm looking forward to the future as well.

Translated

![[Understand in 1 minute] Coca-Cola financial results summary [+33% increase in 5 years]](https://sgsnsimg.moomoo.com/181533246/editor_image/875d9c042c633523bb62a4efbabb448f.png/thumb)

![[Understand in 1 minute] Coca-Cola financial results summary [+33% increase in 5 years]](https://sgsnsimg.moomoo.com/181533246/editor_image/1bd2bda041eb3936b212ac2af2a17835.png/thumb)

![[Understand in 1 minute] Coca-Cola financial results summary [+33% increase in 5 years]](https://sgsnsimg.moomoo.com/181533246/editor_image/e7283f292ea83661a6ee4fc2b1a5442e.png/thumb)

+1

8

The July FOMC has come to an end. Here's a summary of the key points!

<Roughly speaking>

✅ Interest rate hike of 0.25% as expected

✅ Since it is as predicted by the market, there are no major movements in stock prices

→It was as predicted in advance, so there was no major movement. It's reassuring to be able to pass through without any problems.

Also, the view on the current state of the economy was generally positive.

<Statement by Chairman Powell>

✅ Prices and labor market trends are trending as expected

✅ Inflation is slowing down (but I want to keep an eye on it)

✅ There is a possibility that a soft landing can be made without becoming a recession

✅ Interest rate cuts will be carried out at the timing determined to be appropriate. I'm not thinking about the end of the year.

✅ It is estimated that it will take until around 2025 for the inflation rate to return to 2% (an appropriate value)

→Basically, just follow the details of the previous meeting

It was like this, and there was a sense of security because “the results are as expected” and “inflation is improving.”

The stock price felt like ↓, and it was about moving in small increments.

The point I'm worried about in the future is whether there will be an interest rate hike next time or not.

It says “it depends on the data” about this....

<Roughly speaking>

✅ Interest rate hike of 0.25% as expected

✅ Since it is as predicted by the market, there are no major movements in stock prices

→It was as predicted in advance, so there was no major movement. It's reassuring to be able to pass through without any problems.

Also, the view on the current state of the economy was generally positive.

<Statement by Chairman Powell>

✅ Prices and labor market trends are trending as expected

✅ Inflation is slowing down (but I want to keep an eye on it)

✅ There is a possibility that a soft landing can be made without becoming a recession

✅ Interest rate cuts will be carried out at the timing determined to be appropriate. I'm not thinking about the end of the year.

✅ It is estimated that it will take until around 2025 for the inflation rate to return to 2% (an appropriate value)

→Basically, just follow the details of the previous meeting

It was like this, and there was a sense of security because “the results are as expected” and “inflation is improving.”

The stock price felt like ↓, and it was about moving in small increments.

The point I'm worried about in the future is whether there will be an interest rate hike next time or not.

It says “it depends on the data” about this....

Translated

![[The timing of interest rate cuts is ●●!] July FOMC summary](https://sgsnsimg.moomoo.com/181533246/editor_image/cf77860ab46431ee8d895c2ddf5666c1.png/thumb)

![[The timing of interest rate cuts is ●●!] July FOMC summary](https://sgsnsimg.moomoo.com/181533246/editor_image/56b66e3ba1a4392fa84b012e0be5b107.png/thumb)

![[The timing of interest rate cuts is ●●!] July FOMC summary](https://sgsnsimg.moomoo.com/181533246/editor_image/0a46b587048b3423845b6b758cc6cc83.png/thumb)

+2

5

TOM【投資】

voted

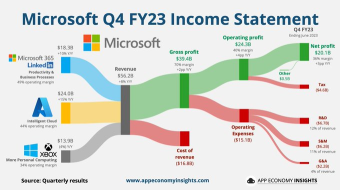

$Microsoft(MSFT.US$ Q4 FY23 (ending in June):

• Revenue +8% Y/Y to $56.2B ($0.7B beat).

• Gross margin 70% (+2pp Y/Y)

• Operating margin 43% (+4pp Y/Y).

• EPS $2.69 ($0.14 beat).

Azure +26% Y/Y (+27% fx neutral).

Q4 Overall Performance Beats Expectations, Cloud Growth Slows

In Q4, Microsoft's productivity and business division saw a 10% YoY growth, exceeding estimates at $18.3 billion. Office 365 and cloud services contr...

• Revenue +8% Y/Y to $56.2B ($0.7B beat).

• Gross margin 70% (+2pp Y/Y)

• Operating margin 43% (+4pp Y/Y).

• EPS $2.69 ($0.14 beat).

Azure +26% Y/Y (+27% fx neutral).

Q4 Overall Performance Beats Expectations, Cloud Growth Slows

In Q4, Microsoft's productivity and business division saw a 10% YoY growth, exceeding estimates at $18.3 billion. Office 365 and cloud services contr...

7

This time, while I've been investing for about 5 and a half years,

Here are 5 of the biggest mistakes I've made.

It's a bad behavior that you just end up doing, so

Please check to see if that's true.

■NG behavior 1. Buy in bulk

Buying all at once at the same timing is a no-go.

There is also a possibility that it will crash after buying it.

It is important to distribute investments over time in small amounts.

■NG behavior 2. Concentrate on investing in one stock

Businesses are affected by scandals, management difficulties, intensifying competition, etc.

There is also a risk of decline.

That's why it's important to make diversified investments in multiple companies.

■NG behavior 3. Sell as soon as there's a little profit

Common human mentality ↓

“I don't want to confirm my losses”

“I want to determine my profit right away”

As a result, loss of salting may occur,

It will be a situation where only a small amount of profit can be obtained.

■NG behavior 4. I can't trade aiming for a bottom price

No one can predict where the lowest price (bottom price) will be.

“Where's the cheapest?” If you're searching for things like that, it's hard to put them into action.

■NG behavior 5. Invest with money that would be a problem if it decreased

Investments should be made with surplus funds!

I wonder if they have secured living expenses for about six months to a year...

Here are 5 of the biggest mistakes I've made.

It's a bad behavior that you just end up doing, so

Please check to see if that's true.

■NG behavior 1. Buy in bulk

Buying all at once at the same timing is a no-go.

There is also a possibility that it will crash after buying it.

It is important to distribute investments over time in small amounts.

■NG behavior 2. Concentrate on investing in one stock

Businesses are affected by scandals, management difficulties, intensifying competition, etc.

There is also a risk of decline.

That's why it's important to make diversified investments in multiple companies.

■NG behavior 3. Sell as soon as there's a little profit

Common human mentality ↓

“I don't want to confirm my losses”

“I want to determine my profit right away”

As a result, loss of salting may occur,

It will be a situation where only a small amount of profit can be obtained.

■NG behavior 4. I can't trade aiming for a bottom price

No one can predict where the lowest price (bottom price) will be.

“Where's the cheapest?” If you're searching for things like that, it's hard to put them into action.

■NG behavior 5. Invest with money that would be a problem if it decreased

Investments should be made with surplus funds!

I wonder if they have secured living expenses for about six months to a year...

Translated

![[I lost a lot when I did this] 5 bad investment actions](https://sgsnsimg.moomoo.com/181533246/editor_image/69acff6e28153ee68a781df5746f489a.png/thumb)

![[I lost a lot when I did this] 5 bad investment actions](https://sgsnsimg.moomoo.com/181533246/editor_image/7ead0108febb3d7799aabf937d7d91a2.png/thumb)

![[I lost a lot when I did this] 5 bad investment actions](https://sgsnsimg.moomoo.com/181533246/editor_image/28e0d705f8ea37f6adb64af7221ddf56.png/thumb)

+2

44

3

The US market continues to be strong 😊

🌟 In the US market, the NASDAQ 100 has finally risen 39% year-to-date

The rise continues in anticipation of a decline in interest rates.

The AI boom is also underpinning it 😌

I'm happy that all of the indices have risen over any period of time.

I bought more NVIDIA and QQQ this month too!

🌟 Top 5 popular ETFs

Here are 5 ETFs you should definitely know if you're investing.

Thank you for your hard work this week too 😊

🌟 In the US market, the NASDAQ 100 has finally risen 39% year-to-date

The rise continues in anticipation of a decline in interest rates.

The AI boom is also underpinning it 😌

I'm happy that all of the indices have risen over any period of time.

I bought more NVIDIA and QQQ this month too!

🌟 Top 5 popular ETFs

Here are 5 ETFs you should definitely know if you're investing.

Thank you for your hard work this week too 😊

Translated

![[Top 5 Popular ETFs] The US Market Is Finally +39% Year-to-Date!](https://sgsnsimg.moomoo.com/181533246/editor_image/a0cbfe47b33f37deac4c8829045a0677.png/thumb)

![[Top 5 Popular ETFs] The US Market Is Finally +39% Year-to-Date!](https://sgsnsimg.moomoo.com/181533246/editor_image/71bf4789d94b3becad9d0ce35845b612.png/thumb)

13

It's finally the end of the month, isn't it?

The personal consumption expenditure price index will be announced on 30th (Friday).

It is a super important indicator that the Fed uses as a standard for judgment when considering future interest rates.

We need to pay attention to whether prices are falling.

Until then, there have been no major indicators, and the US market is expected to remain strong.

I want to do my best in my work and investment during the last week.

The personal consumption expenditure price index will be announced on 30th (Friday).

It is a super important indicator that the Fed uses as a standard for judgment when considering future interest rates.

We need to pay attention to whether prices are falling.

Until then, there have been no major indicators, and the US market is expected to remain strong.

I want to do my best in my work and investment during the last week.

Translated

![[This week's schedule] Pay attention to the personal consumption expenditure price index](https://sgsnsimg.moomoo.com/181533246/editor_image/b78156ccc3dd364292ffd13dfc5a42f0.png/thumb)

3

There are so many mutual funds that I don't know which ones are good...

Are there any popular recommendations?

I will answer these questions.

So, this time

✅ 5 popular mutual funds

I'll explain it on the subject!

I think it's better not to buy mutual funds at the counter of a bank or securities company, but to buy them yourself online.

If you go to the counter, there is a high possibility that you will be introduced to bottakuri products with high fees.

The five introduced this time are trust remuneration (fees) at the lowest level

It's something you can easily buy with the app.

I hope you can use it as a reference!

*Please use your own judgment when making actual investments.

■No5. eMAXIS Slim Developed Markets Equity Index

■No4. SBI V US Equity Index Fund

■No3. eMAXIS Slim Worldwide Stock (All Country)

■No2. eMAXIS Slim US Stock (S&P500)

■No1. SBI V S&P 500 Index Fund

The rankings were like this! Summarizing it again, it is as follows.

Even if you don't go to the counter of a bank or securities company, excellent mutual funds can be found online...

Are there any popular recommendations?

I will answer these questions.

So, this time

✅ 5 popular mutual funds

I'll explain it on the subject!

I think it's better not to buy mutual funds at the counter of a bank or securities company, but to buy them yourself online.

If you go to the counter, there is a high possibility that you will be introduced to bottakuri products with high fees.

The five introduced this time are trust remuneration (fees) at the lowest level

It's something you can easily buy with the app.

I hope you can use it as a reference!

*Please use your own judgment when making actual investments.

■No5. eMAXIS Slim Developed Markets Equity Index

■No4. SBI V US Equity Index Fund

■No3. eMAXIS Slim Worldwide Stock (All Country)

■No2. eMAXIS Slim US Stock (S&P500)

■No1. SBI V S&P 500 Index Fund

The rankings were like this! Summarizing it again, it is as follows.

Even if you don't go to the counter of a bank or securities company, excellent mutual funds can be found online...

Translated

![[If you're a beginner, start with this] 5 Excellent Investment Trusts](https://sgsnsimg.moomoo.com/181533246/editor_image/d2b005a0278c3f1c94dad97792165f6a.png/thumb)

![[If you're a beginner, start with this] 5 Excellent Investment Trusts](https://sgsnsimg.moomoo.com/181533246/editor_image/e1339c0d7f9d32f28cef675a2e5a8ea5.png/thumb)

![[If you're a beginner, start with this] 5 Excellent Investment Trusts](https://sgsnsimg.moomoo.com/181533246/editor_image/e865a630b06b353bbf6c2d6b93693c12.png/thumb)

+4

15

Last night, the most notable event in the stock market, the FOMC, came to an end.

As a result, as shown in the image, interest rates remained unchanged 😌

Since rising interest rates = rising bank interest, it becomes difficult for companies to receive loans.

Then, the risk that stock prices will fall due to management difficulties will increase.

This time, the increase in interest rates was postponed, so there was a sense of security for now 😁

*The relationship between interest rates and stock prices is a seesaw relationship as follows.

However, there were also worrisome announcements. It is said that “interest rate hikes are longer than expected due to prolonged inflation.”

As shown in the image below, the policy interest rate outlook is higher than before.

There is a possibility that there will be two additional interest rate increases this year, so if that happens,

There is a possibility that companies will be pressured and the market will decline again.

I think this area depends entirely on the results of economic indicators

I would like to keep checking my monthly metrics!

— — — —

Also check: What are stocks that are resistant to falling markets? ↓The pension-type dividend king you want to buy at NISA

article:

[Limited release] 3 pension-type US stocks I want to buy at NISA [I want to hold them even after 10 years]

As a result, as shown in the image, interest rates remained unchanged 😌

Since rising interest rates = rising bank interest, it becomes difficult for companies to receive loans.

Then, the risk that stock prices will fall due to management difficulties will increase.

This time, the increase in interest rates was postponed, so there was a sense of security for now 😁

*The relationship between interest rates and stock prices is a seesaw relationship as follows.

However, there were also worrisome announcements. It is said that “interest rate hikes are longer than expected due to prolonged inflation.”

As shown in the image below, the policy interest rate outlook is higher than before.

There is a possibility that there will be two additional interest rate increases this year, so if that happens,

There is a possibility that companies will be pressured and the market will decline again.

I think this area depends entirely on the results of economic indicators

I would like to keep checking my monthly metrics!

— — — —

Also check: What are stocks that are resistant to falling markets? ↓The pension-type dividend king you want to buy at NISA

article:

[Limited release] 3 pension-type US stocks I want to buy at NISA [I want to hold them even after 10 years]

Translated

![[Latest Trends] Interest rate hikes have been postponed! However, developments I honestly cannot be pleased with [recession risk]](https://sgsnsimg.moomoo.com/181533246/editor_image/a0b94ca4f1f236d7979e354ffec9f41f.png/thumb)

![[Latest Trends] Interest rate hikes have been postponed! However, developments I honestly cannot be pleased with [recession risk]](https://sgsnsimg.moomoo.com/181533246/editor_image/cb149ca482663691a3797b6252300864.jpg/thumb)

![[Latest Trends] Interest rate hikes have been postponed! However, developments I honestly cannot be pleased with [recession risk]](https://sgsnsimg.moomoo.com/181533246/editor_image/5475b3ef84df3a419e81ae0d3198a93a.png/thumb)

+2

4

I have a lot of important plans for this week.

Both stocks and exchange rates are likely to move, so I'd like to refrain from unnecessary trading!

・ 🇺🇸 FOMC

・ 🇺🇸 Consumer Price Index (CPI)

・ 🇺🇸 Producer Price Index (PPI)

This is particularly noteworthy.

Interest rates are expected to remain unchanged (no interest rate hikes) in the current FOMC.

That's because inflation has calmed down quite a bit compared to before. Good news for the stock market 😌

But you can't let your guard down.

As you can see in the image below, although the “overall” of the CPI (Consumer Price Index) has declined, the “core” is still flat.

In other words, “prices have declined overall, but some are still high.”

When it comes to “partial”, it's mainly the service price.

Take a look at the pie chart for the overall CPI and the structure of the CPI core. (Composition ratio as of 23/2)

Food and energy prices seem to be falling,

Housing, medical care, transportation, labor costs, etc. have remained high.

In other words, in order to forcibly lower this price

There is a possibility that the Fed will raise interest rates again after July...

Both stocks and exchange rates are likely to move, so I'd like to refrain from unnecessary trading!

・ 🇺🇸 FOMC

・ 🇺🇸 Consumer Price Index (CPI)

・ 🇺🇸 Producer Price Index (PPI)

This is particularly noteworthy.

Interest rates are expected to remain unchanged (no interest rate hikes) in the current FOMC.

That's because inflation has calmed down quite a bit compared to before. Good news for the stock market 😌

But you can't let your guard down.

As you can see in the image below, although the “overall” of the CPI (Consumer Price Index) has declined, the “core” is still flat.

In other words, “prices have declined overall, but some are still high.”

When it comes to “partial”, it's mainly the service price.

Take a look at the pie chart for the overall CPI and the structure of the CPI core. (Composition ratio as of 23/2)

Food and energy prices seem to be falling,

Housing, medical care, transportation, labor costs, etc. have remained high.

In other words, in order to forcibly lower this price

There is a possibility that the Fed will raise interest rates again after July...

Translated

![[This week's schedule] A week where the risk of sudden changes in stock prices and exchange rates is extremely high!](https://sgsnsimg.moomoo.com/181533246/editor_image/1787c6d2e0a4372aad99f4757c1d6016.png/thumb)

![[This week's schedule] A week where the risk of sudden changes in stock prices and exchange rates is extremely high!](https://sgsnsimg.moomoo.com/181533246/editor_image/f8277d35dd09322cbfcb1fc039da2da1.png/thumb)

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)