Terry Aakre

liked

Can TOPGLOV be followed? I need to see if there are any secure blocks in the way? [CC ENGLISH SUBTITLES ENG SUB]

$TOPGLOV(7113.MY$

Can TOPGLOV be followed? I need to see if there are any secure blocks in the way? [CC ENGLISH SUBTITLES ENG SUB]

$TOPGLOV(7113.MY$

Can TOPGLOV be followed? I need to see if there are any secure blocks in the way? [CC ENGLISH SUBTITLES ENG SUB]

Translated

From YouTube

22

1

Terry Aakre

liked

Terry Aakre

liked

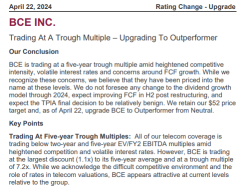

CIBC upgrades $BCE Inc(BCE.CA$ , worries about dividend growth and competition are already fully baked into the stock. 8.8% yield...

4

Terry Aakre

liked

The rising tension in the Middle East had a significant impact on US stocks. The Nasdaq Composite Index fell 1.8%, the biggest one-day decline in two months. The S&P 500 index fell more than 1% for two consecutive days, the biggest two-day decline since the Bank of Silicon Valley went out of business. The Dow fell for the sixth day in a row, and Salesforce's stock price plummeted by more than 7%.

Tesla's stock price fell 5.6% to an 11-month low, leading the decline of the “Seven Sisters” in the tech industry. Although Nvidia rose nearly 3% in early trading, it eventually closed down 2.5%. Furthermore, benefiting from a strong rebound in the investment banking business, Goldman Sachs net profit surged 28% year over year in the first quarter, and the stock price eventually closed up nearly 3%.

The US government said it did not support Israel's retaliatory attacks against Iran. Meanwhile, after the US retail sales data was released, the yield on 10-year US Treasury bonds rose by more than 10 basis points in the intraday period, breaking 4.60%, reaching a five-month high. The US dollar index also jumped to a new five-month high, while the yen continued to fall, hitting a new low since 1990.

Increased instability in the Middle East prompted investors to seek safe haven assets. Gold prices surged nearly 3% intraday, hitting a record high for the third day in a row. After experiencing fluctuations in crude oil prices, the decline narrowed somewhat. Affected by global political uncertainty, the price of Bitcoin also experienced a sharp drop, falling below $63,000 at one point.

At the same time, due to the release of the new “National Nine Rules” policy, China's A-share market generally rose, but small stocks and ST shares experienced sharp declines. China Securities also performed well in the US stock market...

Tesla's stock price fell 5.6% to an 11-month low, leading the decline of the “Seven Sisters” in the tech industry. Although Nvidia rose nearly 3% in early trading, it eventually closed down 2.5%. Furthermore, benefiting from a strong rebound in the investment banking business, Goldman Sachs net profit surged 28% year over year in the first quarter, and the stock price eventually closed up nearly 3%.

The US government said it did not support Israel's retaliatory attacks against Iran. Meanwhile, after the US retail sales data was released, the yield on 10-year US Treasury bonds rose by more than 10 basis points in the intraday period, breaking 4.60%, reaching a five-month high. The US dollar index also jumped to a new five-month high, while the yen continued to fall, hitting a new low since 1990.

Increased instability in the Middle East prompted investors to seek safe haven assets. Gold prices surged nearly 3% intraday, hitting a record high for the third day in a row. After experiencing fluctuations in crude oil prices, the decline narrowed somewhat. Affected by global political uncertainty, the price of Bitcoin also experienced a sharp drop, falling below $63,000 at one point.

At the same time, due to the release of the new “National Nine Rules” policy, China's A-share market generally rose, but small stocks and ST shares experienced sharp declines. China Securities also performed well in the US stock market...

Translated

22

Terry Aakre

liked

1. The war situation in the Middle East has always been carried out in a “proxy war situation”. Pro-Iranian forces, such as Hezbollah in Lebanon, the Syrian government, Hamas, and Iraqi militias, have clashed with Israel's border

2. Iran has the largest armed army in the Middle East and is also seen as the supporter behind these “agents”

3. On April 1, 2024, Israel dropped several bombs on the Iranian consulate in the Syrian capital Damascus, killing some senior commanders and generals suspected of being in touch with “agents”

4. Iran says it will retaliate after the attack

5. According to reports, Iran's foreign minister notified the US a week ago that it would “proportionate and restraint” launch a “non-escalating” counterattack against Israel, and notified allies and Western countries

6. On Friday, the US said Israel would be attacked by Iran's drones within 24-48 hours. Iran issued an order asking the UN to condemn Israel to launch an attack otherwise

7. Iran attacked Israel as expected. Iran claimed that it had achieved the expected results and indicated that the punishment against Israel was over; at the same time, Israel also claimed that it had almost completely intercepted drones from Iran

8. Israel and neighboring countries, such as Jordan, Iraq, and Lebanon, announced the reopening of airspace

9. US says it condemns Iran but does not seek to get involved in war with Iran

Observation:

Judging from Iran's entire military operation, the early warning given in advance, plus the issuance...

2. Iran has the largest armed army in the Middle East and is also seen as the supporter behind these “agents”

3. On April 1, 2024, Israel dropped several bombs on the Iranian consulate in the Syrian capital Damascus, killing some senior commanders and generals suspected of being in touch with “agents”

4. Iran says it will retaliate after the attack

5. According to reports, Iran's foreign minister notified the US a week ago that it would “proportionate and restraint” launch a “non-escalating” counterattack against Israel, and notified allies and Western countries

6. On Friday, the US said Israel would be attacked by Iran's drones within 24-48 hours. Iran issued an order asking the UN to condemn Israel to launch an attack otherwise

7. Iran attacked Israel as expected. Iran claimed that it had achieved the expected results and indicated that the punishment against Israel was over; at the same time, Israel also claimed that it had almost completely intercepted drones from Iran

8. Israel and neighboring countries, such as Jordan, Iraq, and Lebanon, announced the reopening of airspace

9. US says it condemns Iran but does not seek to get involved in war with Iran

Observation:

Judging from Iran's entire military operation, the early warning given in advance, plus the issuance...

Translated

84

5

Terry Aakre

liked

ASX copper stocks are drawing the same buzz as lithium miners did in 2022.

With booming demand outstripping new supplies, copper prices are surging. 📈

The metal has already gained over 10% in 2024, and analysts predict further gains. 🚀

Shareholders in $Aeris Resources Ltd(AIS.AU$ and $Sandfire Resources Ltd(SFR.AU$ are likely to welcome this news. 🔎

But what's really driving copper prices towards new highs? 🤔

The ASX copper stocks...

With booming demand outstripping new supplies, copper prices are surging. 📈

The metal has already gained over 10% in 2024, and analysts predict further gains. 🚀

Shareholders in $Aeris Resources Ltd(AIS.AU$ and $Sandfire Resources Ltd(SFR.AU$ are likely to welcome this news. 🔎

But what's really driving copper prices towards new highs? 🤔

The ASX copper stocks...

15

Terry Aakre

liked

$Grab Holdings(GRAB.US$ I expected Grab's mobility segment to recover to figures between Q1 and Q2, given that COVID19 cases are stabilizing in SEA. However, this minor recovery isn't enough to justify its current $52bn valuation, where its valuation implies an expectation of 35% CAGR on top of a fully recovered pre-pandemic mobility segment over the five years. On top of that, the removal of the $10 NAV floor post-merger and the high inflationary and high risk of tapering/rate hikes economic environment adds to investors' downside risk. Therefore, we chose the conservative alternative to take profits at this price level and only leave profits on the table to capture potential spike on announcements related to its merger.

15

1

Terry Aakre

reacted to

$Grab Holdings(GRAB.US$ $Altimeter Growth Corp(AGC.US$ Grab's Q3 adjusted net sales stand at $429mn, 22% decline QoQ. Grab's Q3 revenue also declined 13% QoQ. This implies incentives to consumers declined 27% QoQ. It is a comfort to see that revenue is less sensitive to consumer incentives. A more worrying sign would be increasing adjusted net sales (or incentives) and declining revenue. Since incentives to consumers declined more than revenue, there isn't evidence suggesting an anomaly or discrepancy. Rather, the decline is more likely to stern from the business environment, which is what Grab has reminded investors about in Q2.

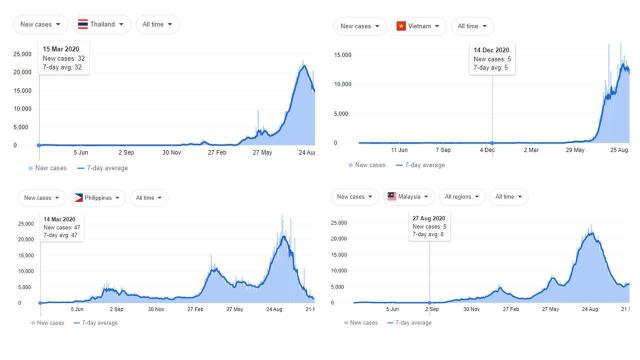

In Q2, Grab warned investors about potential severe COVID19-related mobility restrictions in Southeast Asia. During the period, Grab's full-year 2021 projection has considered the potential of partial and total lockdowns in various countries where the company operates as a consequence of COVID19's continued expansion. Grab's fear came true as COVID cases in SEA countries reached a new all-time high in Q3 due to the Delta variant. The Philippines reimposed lockdowns on Sept. 9, a day after announcing the lifting of stay-at-home orders for more than 13mn people. In August, Vietnam has also imposed a strict stay-at-home order in Ho Chi Minh City's southern suburbs and dispatched the army to assist quarantined citizens.

Therefore, it is no surprise that Grab attributed the decline in overall revenue to the lockdown, especially in Vietnam. This claim is accurate. By referring to Table 1, we can see that the decrease in revenue is mainly derived from its mobility segment. If we expand our analysis time period, we can observe that Grab's underperformance (drop in revenue) in 2021 is caused mainly by its mobility segment. Grab's Q2 mobility segment revenue, and total revenue dropped $27mn and $35mn QoQ, respectively. Grab's Q3 mobility segment revenue and total dropped $30mn and $23mn QoQ, respectively. The decline in the mobility segment coincides with increases in COVID19 cases across SEA (Figure 4). Therefore, Grab's claim that its decline in revenue is contributed by the lockdowns and travel restrictions across SEA.

Despite the drop in revenue, activities (GMV) on the company's platform actually increased 5% during the period. This may not seem like a big deal, but this statistic actually invalidated one of our previous hypotheses (maturing market). In Q2, Grab's GMV only increased 6.5% in spite of a 27% increase in incentives. This suggested that Grab's market is reaching maturity. However, Grab's GMV increased 4.1% (QoQ) in spite of a 27% (QoQ) decline in Q3. This means that Grab's GMV growth isn't fueled by incentives as much as initially thought.

Following Grab's narrative, monthly transacting users (MTU) also declined due to lockdowns. This is also expected. However, what was unexpected is GMV per MTU actually increased. This further proves that Grab indeed has a network effect where activities (GMV) of existing users increase. This is crucial to Grab's overall growth for several reasons:

It is unlikely for Grab to expand beyond SEA. This is because Grab, Uber, and DiDi (NYSE:DIDI) share equity with one another. Therefore, it is unlikely for them to compete with one another.

Due to the limited geographical expansion, it is clear that Grab has to upsell and cross-sell new products to the existing userbase to increase the revenue stream.

For these very reasons, Grab's increase in GMV and GMV per MTU is a positive takeaway. With UBER as comps, Grab has to grow at 35% CAGR on top of a fully recovered pre-pandemic mobility segment over the next five years. This feat is very challenging. Firstly, the majority of Grab's revenue is derived from its mobility segment. Based on the relationship between COVID19 cases and Grab's mobility segment (Figure 4 and Table 1), we expect Grab's Q4 mobility segment to be in between Q1's and Q2's, somewhere around $135mn. This figure only represents around 6.75% of the pre-pandemic level (approximately $2bn). Hence, there is still a very long way to go. Secondly, we don't expect food delivery to grow materially from here as we expect the need for food delivery to decrease when the economy reopens. Hence, food delivery is not expected to contribute to Grab's overall growth. Thirdly, financial service and enterprise & new initiatives' overall contribution to revenue is only marginal. Hence, it is difficult to justify Grab at its current $52bn valuation.

Moreover, investors will lose the $10 NAV safety net once the Grab-AGC merger is completed. This adds to investors' downside risks. In addition, the overall macroeconomy conditions add to the difficulty in investing in high-growth companies. High inflation erodes the value of future earnings, while any form of tapering or rate hikes will devalue Grab's intrinsic value.

In Q2, Grab warned investors about potential severe COVID19-related mobility restrictions in Southeast Asia. During the period, Grab's full-year 2021 projection has considered the potential of partial and total lockdowns in various countries where the company operates as a consequence of COVID19's continued expansion. Grab's fear came true as COVID cases in SEA countries reached a new all-time high in Q3 due to the Delta variant. The Philippines reimposed lockdowns on Sept. 9, a day after announcing the lifting of stay-at-home orders for more than 13mn people. In August, Vietnam has also imposed a strict stay-at-home order in Ho Chi Minh City's southern suburbs and dispatched the army to assist quarantined citizens.

Therefore, it is no surprise that Grab attributed the decline in overall revenue to the lockdown, especially in Vietnam. This claim is accurate. By referring to Table 1, we can see that the decrease in revenue is mainly derived from its mobility segment. If we expand our analysis time period, we can observe that Grab's underperformance (drop in revenue) in 2021 is caused mainly by its mobility segment. Grab's Q2 mobility segment revenue, and total revenue dropped $27mn and $35mn QoQ, respectively. Grab's Q3 mobility segment revenue and total dropped $30mn and $23mn QoQ, respectively. The decline in the mobility segment coincides with increases in COVID19 cases across SEA (Figure 4). Therefore, Grab's claim that its decline in revenue is contributed by the lockdowns and travel restrictions across SEA.

Despite the drop in revenue, activities (GMV) on the company's platform actually increased 5% during the period. This may not seem like a big deal, but this statistic actually invalidated one of our previous hypotheses (maturing market). In Q2, Grab's GMV only increased 6.5% in spite of a 27% increase in incentives. This suggested that Grab's market is reaching maturity. However, Grab's GMV increased 4.1% (QoQ) in spite of a 27% (QoQ) decline in Q3. This means that Grab's GMV growth isn't fueled by incentives as much as initially thought.

Following Grab's narrative, monthly transacting users (MTU) also declined due to lockdowns. This is also expected. However, what was unexpected is GMV per MTU actually increased. This further proves that Grab indeed has a network effect where activities (GMV) of existing users increase. This is crucial to Grab's overall growth for several reasons:

It is unlikely for Grab to expand beyond SEA. This is because Grab, Uber, and DiDi (NYSE:DIDI) share equity with one another. Therefore, it is unlikely for them to compete with one another.

Due to the limited geographical expansion, it is clear that Grab has to upsell and cross-sell new products to the existing userbase to increase the revenue stream.

For these very reasons, Grab's increase in GMV and GMV per MTU is a positive takeaway. With UBER as comps, Grab has to grow at 35% CAGR on top of a fully recovered pre-pandemic mobility segment over the next five years. This feat is very challenging. Firstly, the majority of Grab's revenue is derived from its mobility segment. Based on the relationship between COVID19 cases and Grab's mobility segment (Figure 4 and Table 1), we expect Grab's Q4 mobility segment to be in between Q1's and Q2's, somewhere around $135mn. This figure only represents around 6.75% of the pre-pandemic level (approximately $2bn). Hence, there is still a very long way to go. Secondly, we don't expect food delivery to grow materially from here as we expect the need for food delivery to decrease when the economy reopens. Hence, food delivery is not expected to contribute to Grab's overall growth. Thirdly, financial service and enterprise & new initiatives' overall contribution to revenue is only marginal. Hence, it is difficult to justify Grab at its current $52bn valuation.

Moreover, investors will lose the $10 NAV safety net once the Grab-AGC merger is completed. This adds to investors' downside risks. In addition, the overall macroeconomy conditions add to the difficulty in investing in high-growth companies. High inflation erodes the value of future earnings, while any form of tapering or rate hikes will devalue Grab's intrinsic value.

21

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)