Tam Leo

liked

I would like to emulate the legend Warren Buffet.![]()

![]() Two of the first things I bought positions when I started Moomoo are $Coca-Cola(KO.US$ & $Berkshire Hathaway-B(BRK.B.US$.The market has been on a rollercoaster ride for almost a year now and sometimes my heart can’t take it anymore.

Two of the first things I bought positions when I started Moomoo are $Coca-Cola(KO.US$ & $Berkshire Hathaway-B(BRK.B.US$.The market has been on a rollercoaster ride for almost a year now and sometimes my heart can’t take it anymore. ![]()

![]() With everything that’s happening in the world now, I have more appreciation towards value investing—it is slowly but surely, boring but steady, and something that I can hold forever. To ...

With everything that’s happening in the world now, I have more appreciation towards value investing—it is slowly but surely, boring but steady, and something that I can hold forever. To ...

14

7

Tam Leo

voted

JPMorgan economists have updated their projections on Federal Reserve interest hikes, and now expect nine consecutive rate increases, to 2.25%, by March 2023.

What Happened:The bank’s economists said that the U.S. inflation reading of 7.5% in January, which outpaced December’s 7% rate, came as a surprise. “We now no longer see deceleration from last quarter’s near-record pace,” the economists wrote.

“We now look for the Fed to hike 25bp at...

What Happened:The bank’s economists said that the U.S. inflation reading of 7.5% in January, which outpaced December’s 7% rate, came as a surprise. “We now no longer see deceleration from last quarter’s near-record pace,” the economists wrote.

“We now look for the Fed to hike 25bp at...

18

2

Tam Leo

voted

We all know what $Netflix(NFLX.US$ does. They just have, I don't want to say a monopoly, but they have a really strong position, a really strong brand in streaming, in how we consume movies and TV shows now, and a really big advantage over the traditional cable providers, or even the network providers where you had a set time. If you want to see Cheers, you had to show up Thursday at nine. Netflix gives you the power to watch any show you want, whenever you want, any movie you want, whenever you...

3

1

Tam Leo

liked

$Disney(DIS.US$ Chapek characterized the demand at the parks as "extraordinary," which indicates they could grow revenue further in the near term. Disney is continuing to open new rides and attractions to drive traffic, which in turn, could drive more high-margin revenue from Genie+.

The biggest new attraction is the Star Wars: Galactic Starcruiser that opens at Walt Disney World on March 1. It's an immersive two-night experience that makes the guests f...

The biggest new attraction is the Star Wars: Galactic Starcruiser that opens at Walt Disney World on March 1. It's an immersive two-night experience that makes the guests f...

7

1

Tam Leo

liked

Hey mooers, check out today's hot sectors and hot stocks here!

+1

4

Tam Leo

liked

2022 seems like a challenging year for investment. With the unsettled COVID pandemic lurking around, Fed interest rates rising, Western and Eastern Europe tensions over war, these constitute concerns over the performance of the stock market. With these in mind, I would need to be prepared for unexpected market volatility. However, this would also bring along new investment opportunities.

My investment portfolio, as shared previously, had always been Bank Stocks: Reits: Others in the ratio of 50% : 40% : 10%. I have spent much of 2021 building the foundation of my passive income (for dividend returns) through the accumulation of Reits,

$CapLand Ascendas REIT(A17U.SG$

$CapLand IntCom T(C38U.SG$

$Mapletree Ind Tr(ME8U.SG$

And also Bank Stocks

$OCBC Bank(O39.SG$

$DBS Group Holdings(D05.SG$

$UOB(U11.SG$

As concurrently that I am still expanding on the above counters, I am shifting my focus slightly to the US and HK market to grow my 10% segment. I have identified:

a. US Market:

1. $Alphabet-A(GOOGL.US$

To capitalise on the upcoming stock split with speculation that it will rise after, just like $Apple(AAPL.US)$ previously

2. $Microsoft(MSFT.US)$ ,

Waiting for stock price to dip for entry, and

3. $Meta Platforms(FB.US)$

Though FB is presently plagued with many issues, fundamentally, it is still a strong company. No doubt gradually, its stock price will recover. I bought in some shares at 30% dip previously, monitoring to buy more.

b. HK Market:

1. $ICBC(01398.HK)$

Being keen in Bank stocks, I did some due diligence. Some Sharing on Technical Analysis on this Bank, and why I am recommending it. In comparison with our 3 BIG local SG Banks, you can see that ICBC has a market capacity of 1.69T vis-a-vis billions for DBS, OCBC, and UOB. Furthermore, it has a dividend yield of 6.74%! Looking at its P/E and P/B ratios, ICBC values are so much lower. Definitely, ICBC has huge growth potential, and with an undervalued stock price, it is an attractive counter.

I hope that my sharing will benefit everyone! Happy Investing in 2022!

My investment portfolio, as shared previously, had always been Bank Stocks: Reits: Others in the ratio of 50% : 40% : 10%. I have spent much of 2021 building the foundation of my passive income (for dividend returns) through the accumulation of Reits,

$CapLand Ascendas REIT(A17U.SG$

$CapLand IntCom T(C38U.SG$

$Mapletree Ind Tr(ME8U.SG$

And also Bank Stocks

$OCBC Bank(O39.SG$

$DBS Group Holdings(D05.SG$

$UOB(U11.SG$

As concurrently that I am still expanding on the above counters, I am shifting my focus slightly to the US and HK market to grow my 10% segment. I have identified:

a. US Market:

1. $Alphabet-A(GOOGL.US$

To capitalise on the upcoming stock split with speculation that it will rise after, just like $Apple(AAPL.US)$ previously

2. $Microsoft(MSFT.US)$ ,

Waiting for stock price to dip for entry, and

3. $Meta Platforms(FB.US)$

Though FB is presently plagued with many issues, fundamentally, it is still a strong company. No doubt gradually, its stock price will recover. I bought in some shares at 30% dip previously, monitoring to buy more.

b. HK Market:

1. $ICBC(01398.HK)$

Being keen in Bank stocks, I did some due diligence. Some Sharing on Technical Analysis on this Bank, and why I am recommending it. In comparison with our 3 BIG local SG Banks, you can see that ICBC has a market capacity of 1.69T vis-a-vis billions for DBS, OCBC, and UOB. Furthermore, it has a dividend yield of 6.74%! Looking at its P/E and P/B ratios, ICBC values are so much lower. Definitely, ICBC has huge growth potential, and with an undervalued stock price, it is an attractive counter.

I hope that my sharing will benefit everyone! Happy Investing in 2022!

+4

18

4

Tam Leo

reacted to

1. (50% of my cash reserve) Accumulate some cheap dividend stocks at bargain like $AbbVie(ABBV.US$ $Camping World(CWH.US$ $JPMorgan(JPM.US$. They provide a nice hedge against inflation and is a good way to get paid during rocky market like this.

2. For my existing long positions like $Lucid Group(LCID.US$ $Apple(AAPL.US$ $Plug Power(PLUG.US$, I will continue to sell covered calls against them to collect sweet premiums.

3. Hold enough cash so that I can buy stocks I want when they reach my price target. I'm definitely adding $Alphabet-C(GOOG.US$ to my portfolio before the split. Meanwhile, I will take a very small portion of my cash reserve to do some short-term swing trading.

2. For my existing long positions like $Lucid Group(LCID.US$ $Apple(AAPL.US$ $Plug Power(PLUG.US$, I will continue to sell covered calls against them to collect sweet premiums.

3. Hold enough cash so that I can buy stocks I want when they reach my price target. I'm definitely adding $Alphabet-C(GOOG.US$ to my portfolio before the split. Meanwhile, I will take a very small portion of my cash reserve to do some short-term swing trading.

17

4

Tam Leo

reacted to

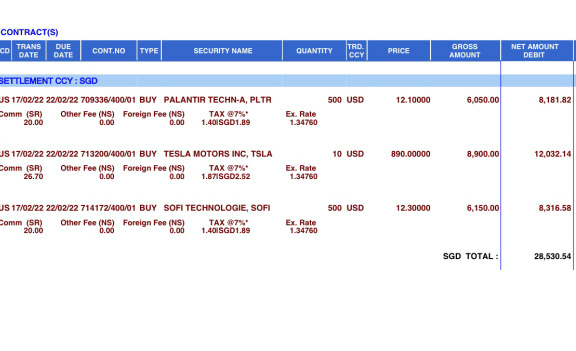

Continue holding $UOB(U11.SG$ and $DBS Group Holdings(D05.SG$ which are expected to improveme on their net interest incoming and strong growth in increasing interest rate environment . $UMS(558.SG$ is also expected to continue doing well with semiconductor crunch and positive cash flow. Dividends received from these stocks and high savings from income will be pumped into US high growth stocks $Tesla(TSLA.US$ $Palantir(PLTR.US$ and $SoFi Technologies(SOFI.US$ and perhaps ex...

12

5

Tam Leo

liked

$Grab Holdings(GRAB.US$ The end goal of any company is to eventually earn more money than you put in. Grab's strategy to do so since 2012 has failed so far, and they do not seem to have any coherent plan to achieve it. The intent was to haemorrhage money investing aggressively in customer growth, until it becomes so dominant that it could force out its competitors. Unfortunately that didn't seem to have worked out. The competition in all operating sectors is stronger than ever before, and most ...

6

5

Tam Leo

reacted to

$Advanced Micro Devices(AMD.US$ $NVIDIA(NVDA.US$ $Intel(INTC.US$ After a year and a half of graphics card shortages and price increases, DIY players may usher in a wave of good news in 2022. Recently, the price of graphics cards has dropped a lot, and the premium has narrowed a lot compared to before. The latest news says that 3 There was also a wave of price cuts for graphics cards in the month, and they plummeted. Well-informed whistleblower Greymon55 r...

11

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)