PanJen

voted

Rio Tinto is releasing its First Quarter Operations Review 2024 on April 17, before the Australian stock market opens. How will the market react to the company's quarter results on the day?

![]() Vote your answer to participate

Vote your answer to participate

![]() Rewards

Rewards

An equal share of 1,000 points: For mooers who correctly guess the price range of $Rio Tinto Ltd(RIO.AU$'s closing price at 4 PM AEDT April 17.

(e.g., If 50 mooers make a correct guess,...

An equal share of 1,000 points: For mooers who correctly guess the price range of $Rio Tinto Ltd(RIO.AU$'s closing price at 4 PM AEDT April 17.

(e.g., If 50 mooers make a correct guess,...

13

5

PanJen

reacted to

US and Aussie equities could move up here. Three things to consider

Firstly, It's a quiet and shorter week for the Aussie share market ( $S&P/ASX 200(.XJO.AU$), so leads will be taken from abroad, with the S&P500 ( $S&P 500 Index(.SPX.US$ ) trading at a record high and appearing to be supported at these levels for now.

With 'bad news' seemingly behind us and priced into markets, it ...

Firstly, It's a quiet and shorter week for the Aussie share market ( $S&P/ASX 200(.XJO.AU$), so leads will be taken from abroad, with the S&P500 ( $S&P 500 Index(.SPX.US$ ) trading at a record high and appearing to be supported at these levels for now.

With 'bad news' seemingly behind us and priced into markets, it ...

14

PanJen

voted

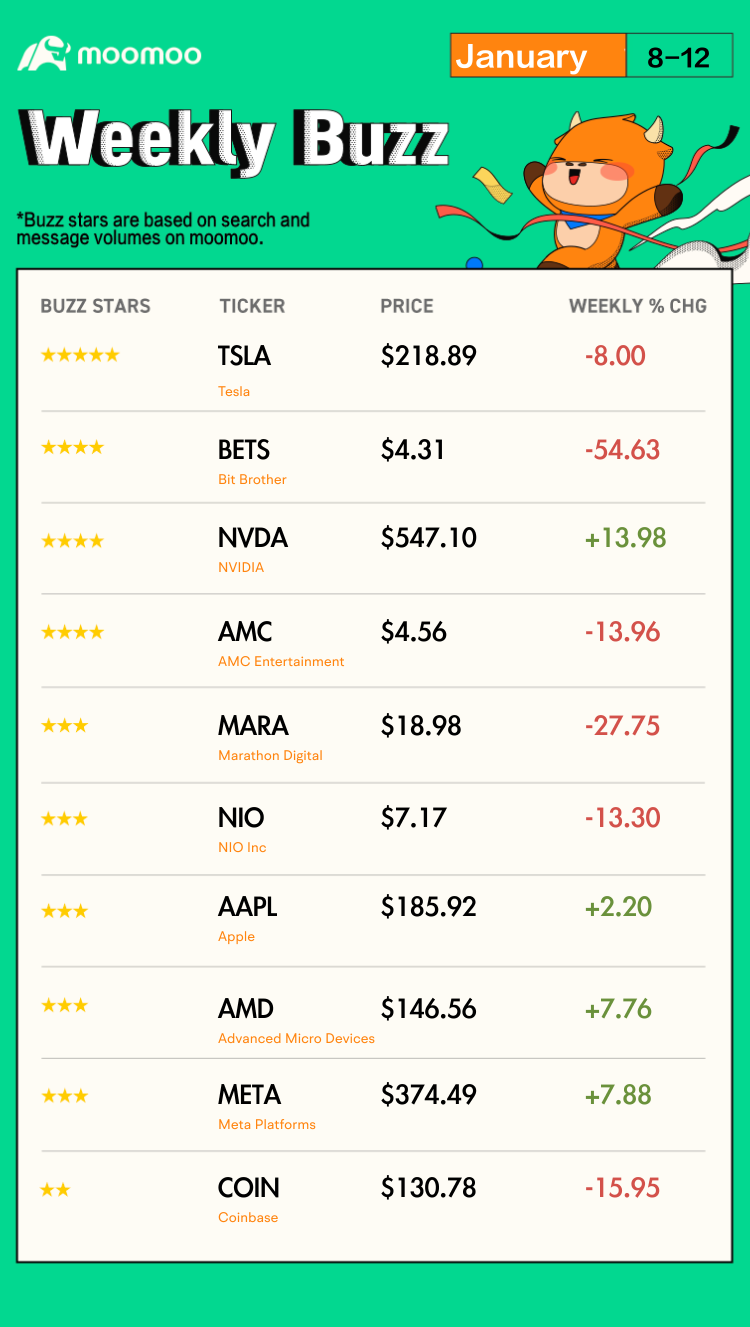

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

Make Your Choice

Weekly Buzz: Stocks pulled through a volatile week

US stocks once again closed little changed Friday as investors weighed positive inflation signs...

Make Your Choice

Weekly Buzz: Stocks pulled through a volatile week

US stocks once again closed little changed Friday as investors weighed positive inflation signs...

39

17

PanJen

voted

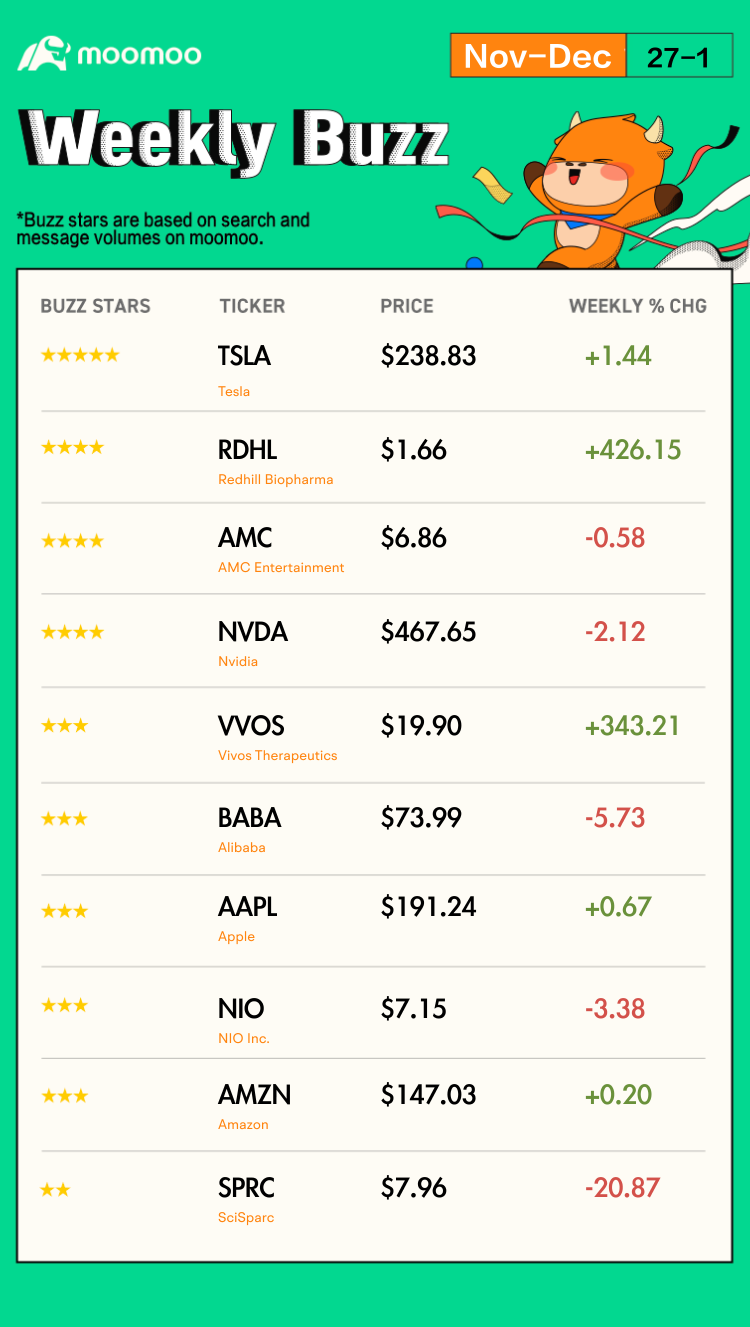

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

Make Your Choice

Weekly Buzz: November ends with sharp gains

U.S. stocks opened mostly lower on Friday after capping off a spectacular November for markets. Equities finis...

Make Your Choice

Weekly Buzz: November ends with sharp gains

U.S. stocks opened mostly lower on Friday after capping off a spectacular November for markets. Equities finis...

52

13

PanJen

voted

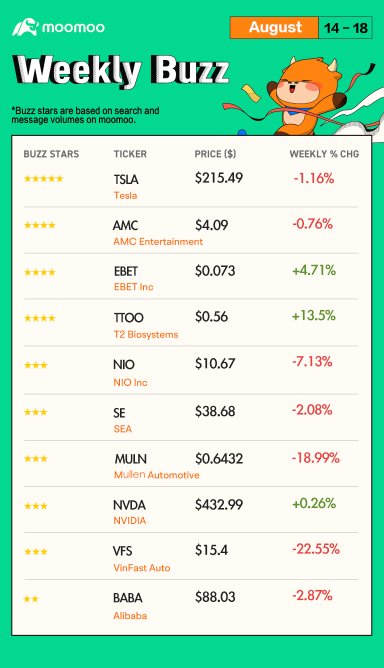

Spoiler: At the end of this post, there is a chance for you to win points! ![]() Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! (Nano caps are excluded.)

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! (Nano caps are excluded.)

📊 Make Your Choices

💡Buzzing Stocks List & Mooers Comments

US stocks recovered from steep early losses in Frid...

📊 Make Your Choices

💡Buzzing Stocks List & Mooers Comments

US stocks recovered from steep early losses in Frid...

46

21

PanJen

liked

I talked a lot yesterday, and some friends asked, so let's write a few more sentences.

1. $Alphabet-C(GOOG.US$ What do I think of it? As the largest holding position, I'm a bit nervous right now. No one can predict the rise or fall of the stock market, but everyone can control risk. My stop loss was set at the lowest point on May 24, and if it doesn't fall below, I won't get out of the car. After it fell below, I left some of my positions first. However, no matter how many subsequent falls, once the decline stops, I will make up for my position.

2. Let's talk about this year's prettiest boy, Lao Huang's Viagra. $NVIDIA(NVDA.US$ I think the current results are real; the chip sales are reasonable; as to whether expectations are as good as expected, we will have to wait for the next financial report. I haven't bought it before, which is a pity, but luckily it wasn't shorted. As Zhu Geliang's reflection after the incident, the biggest misjudgment: he didn't realize that the water released by the Federal Reserve back then was too little to be recovered. There is too much idle money in the market, and AI will inevitably be hyped up. For example, there used to be 100 bubbles, which were distributed roughly evenly across all walks of life, S&P 4800. It later exploded in half, S&P 3800, and the remaining 50 bubbles, all went to AI![]()

![]()

![]() As the old man in the store, just sell the chip. When will the bubble burst? Actually, it's still early. We will have to wait until the economy falls into stagflation and the Federal Reserve raises interest rates to 6% or more before the bubble is squeezed out. As for those AI startups, if they are light on assets and rent the Chat GPT service, it's fine. If they actually buy their own chips, there will be one when they go bankrupt and liquidate...

As the old man in the store, just sell the chip. When will the bubble burst? Actually, it's still early. We will have to wait until the economy falls into stagflation and the Federal Reserve raises interest rates to 6% or more before the bubble is squeezed out. As for those AI startups, if they are light on assets and rent the Chat GPT service, it's fine. If they actually buy their own chips, there will be one when they go bankrupt and liquidate...

1. $Alphabet-C(GOOG.US$ What do I think of it? As the largest holding position, I'm a bit nervous right now. No one can predict the rise or fall of the stock market, but everyone can control risk. My stop loss was set at the lowest point on May 24, and if it doesn't fall below, I won't get out of the car. After it fell below, I left some of my positions first. However, no matter how many subsequent falls, once the decline stops, I will make up for my position.

2. Let's talk about this year's prettiest boy, Lao Huang's Viagra. $NVIDIA(NVDA.US$ I think the current results are real; the chip sales are reasonable; as to whether expectations are as good as expected, we will have to wait for the next financial report. I haven't bought it before, which is a pity, but luckily it wasn't shorted. As Zhu Geliang's reflection after the incident, the biggest misjudgment: he didn't realize that the water released by the Federal Reserve back then was too little to be recovered. There is too much idle money in the market, and AI will inevitably be hyped up. For example, there used to be 100 bubbles, which were distributed roughly evenly across all walks of life, S&P 4800. It later exploded in half, S&P 3800, and the remaining 50 bubbles, all went to AI

Translated

16

12

PanJen

voted

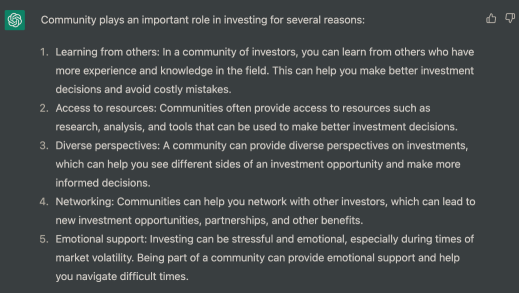

We asked ChatGPT, "why is community important in investing?" It said:

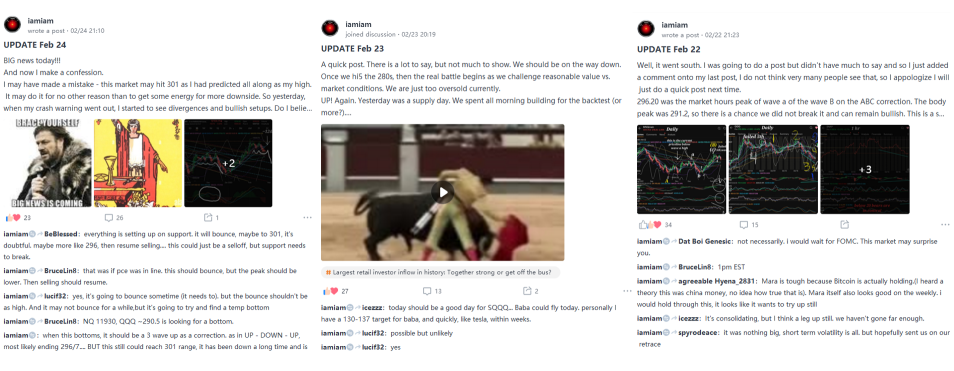

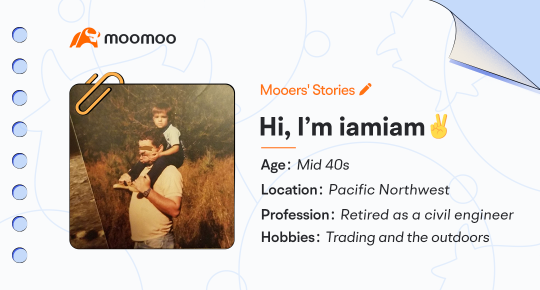

Yes, learning from each other is the essence of a community. That's why mooers are the core of our community. Mooers' Stories aims to let you meet mooers that might inspire you in our community. In this episode, we invited @iamiam, who has been investing for more than 20 years and posting daily, to offer his insights on how to take the...

Yes, learning from each other is the essence of a community. That's why mooers are the core of our community. Mooers' Stories aims to let you meet mooers that might inspire you in our community. In this episode, we invited @iamiam, who has been investing for more than 20 years and posting daily, to offer his insights on how to take the...

+4

63

48

PanJen

commented on

$Ubs Ag London Etracs Mntly Pay 2X Lvgd Sml Cp Div Sr B(SMHB.US$ Anyone received coupon payment this month?

2

PanJen

liked

$Tesla(TSLA.US$ 1. Buy 10 or more stocks. Too many stocks were bought, and there were no heavy stocks. The result is that energy is scattered, and doubling a single stock has no effect on your total earnings. It may indeed have avoided certain risks, but it also lost the meaning of investing; it is better to buy funds. 2. Hasty decisions to buy or sell stocks. A friend or online person immediately decided to buy it without looking at the fundamentals of the stock or anything. Seeing that the stock was falling, they were in a hurry to sell it again. 3. I'm too concerned about short-term results. If I buy stocks, I hope to make money right away. It's best to go up and stop tomorrow. Once it falls, I can't stand it. I feel like I've bought the wrong stock. In fact, these short-term fluctuations don't determine anything in investment. 4. The mentality has always been influenced by the sentiment of the stock market. Once you enter a bear market, you are afraid that everything is a risk. You feel that stocks are no longer saved, and you have to sell them even if you have blue chips. Once you enter a bull market, you feel that there are opportunities everywhere; you can earn money as long as you buy. 5. I always hope to make money and double my assets in the first year. Stock trading is really a long-term practice process. People who have insight and are willing to really understand the stock market will eventually have good results. $Apple(AAPL.US$ $Alibaba(BABA.US$

Translated

8

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)