$Yibin Tianyuan Group(002386.SZ$ It's almost over, can I go back?

Translated

HebeSM

liked

$Cassava Sciences(SAVA.US$ shares are trading higher after a review by the Journal of Neuroscience showed there is no evidence of data manipulation in a 2012 company technical paper.Cassava Sciences, Inc., a clinical stage biotechnology company, develops drugs for neurodegenerative diseases. Its lead therapeutic product candidate is simufilam, a small molecule drug, which is completed Phase 2b clinical trial.

Cassava Sciences' stock was trading about 42.5% higher at $80.75 per share on Thursday at the time of publication. The stock has a 52-week high of $146.16 and a 52-week low of $6.70.. $Cassava Sciences(SAVA.US$ $Apple(AAPL.US$ $Futu Holdings Ltd(FUTU.US$

Cassava Sciences' stock was trading about 42.5% higher at $80.75 per share on Thursday at the time of publication. The stock has a 52-week high of $146.16 and a 52-week low of $6.70.. $Cassava Sciences(SAVA.US$ $Apple(AAPL.US$ $Futu Holdings Ltd(FUTU.US$

6

1

HebeSM

liked

The iPhone maker $Apple(AAPL.US$ generates large revenues and free cash flows and will most certainly continue to do so for the foreseeable future. This, however, could already be priced in the company's stock, which makes it susceptible to a price consolidation or slight correction in the short term. This is even more so due to the post-pandemic hefty 2021 revenue increases, which the company is unlikely to sustain in the next year or two.

I have compiled some data from the company's past annual reports. I will go quickly through the existing financial situation of the company and then move on to more fun stuff.

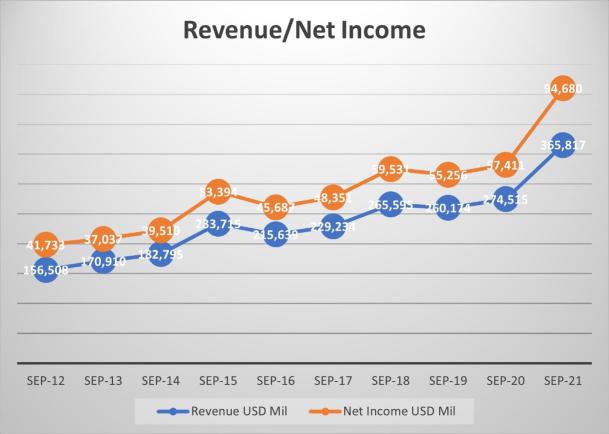

Revenue and Net Income

Apple generates revenues from multiple flagship products and services, including iPhone and iPad sales, App Store, Apple Care services, and cloud storage, to name a few. iPhone sales are the major contributor to revenues, but recently the Other Products category, which includes such items as Apple Watch, Home Air Pods, Home accessories and other wearables, has picked up quite nicely. Apple product users are pretty much locked into the iOS ecosystem and unwilling to part with such products anytime soon. Short of the company successively releasing a few subquality devices, it is not likely Apple's loyal customers will abandon the company anytime soon. This, in turn, will ensure Apple's consistent revenue generation for many more years to come.

The operating margin is good at over 25%, considering the fierce competition in the tech sector, where margins are always being tested in order to gain market share.

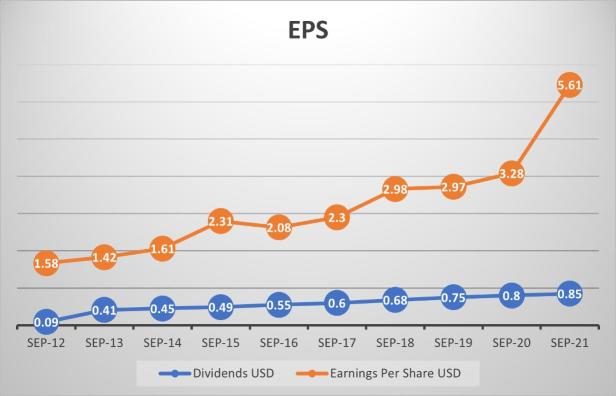

Earnings have seen a sharp increase in 2021 after modest gains over the previous years. The earnings will likely pull back a bit, in line with the trend leading up to the pandemic. The dividend yield is relatively low when compared to many other tech giants.

Return on Equity, Return on Invested Capital, and Return on Assets

The same can be observed with the return on equity, invested capital, and assets. All these three metrics have seen a jump in the last year, with the return in equity being the highest.

The free cash flow per share is illustrated in the chart below. The growth is steady as the company can generate a lot of cash due to the popularity of its products.

Financial Health

Apple's debt to equity ratio is 1.73, which is a bit high. The company will need to make principal payments at an average of $10 billion annually until 2026 and over $64 billion annually after that. The total term debt value is $118 billion.

The current and quick ratios have been declining in the last two years, correlated with the increase in liabilities. The quick ratio is slightly concerning due to having a value below 1, and the current ratio is not healthy either.

Free Cash Flow Yield

The chart below shows the relationship between the price and the FCF yield trend. This is another important metric in that it provides a measurement of the stock valuation. The stock price trending upwards while the yields are heading lower indicates an unsustainable trend and a likely correction in the short term.

Share buybacks

Conclusion

I think Apple is a great company that will handsomely reward its shareholders in the long run, but it would probably be wise to apply a wait-and-see approach in the short term. Any dip in the range of $125-130 would be a good entry position. If, after a correction, it breaks above $160, that would be my signal to increase my position to take advantage of the next bull run. Until then, I will be on the sidelines waiting patiently.

Thank you for reading.

I have compiled some data from the company's past annual reports. I will go quickly through the existing financial situation of the company and then move on to more fun stuff.

Revenue and Net Income

Apple generates revenues from multiple flagship products and services, including iPhone and iPad sales, App Store, Apple Care services, and cloud storage, to name a few. iPhone sales are the major contributor to revenues, but recently the Other Products category, which includes such items as Apple Watch, Home Air Pods, Home accessories and other wearables, has picked up quite nicely. Apple product users are pretty much locked into the iOS ecosystem and unwilling to part with such products anytime soon. Short of the company successively releasing a few subquality devices, it is not likely Apple's loyal customers will abandon the company anytime soon. This, in turn, will ensure Apple's consistent revenue generation for many more years to come.

The operating margin is good at over 25%, considering the fierce competition in the tech sector, where margins are always being tested in order to gain market share.

Earnings have seen a sharp increase in 2021 after modest gains over the previous years. The earnings will likely pull back a bit, in line with the trend leading up to the pandemic. The dividend yield is relatively low when compared to many other tech giants.

Return on Equity, Return on Invested Capital, and Return on Assets

The same can be observed with the return on equity, invested capital, and assets. All these three metrics have seen a jump in the last year, with the return in equity being the highest.

The free cash flow per share is illustrated in the chart below. The growth is steady as the company can generate a lot of cash due to the popularity of its products.

Financial Health

Apple's debt to equity ratio is 1.73, which is a bit high. The company will need to make principal payments at an average of $10 billion annually until 2026 and over $64 billion annually after that. The total term debt value is $118 billion.

The current and quick ratios have been declining in the last two years, correlated with the increase in liabilities. The quick ratio is slightly concerning due to having a value below 1, and the current ratio is not healthy either.

Free Cash Flow Yield

The chart below shows the relationship between the price and the FCF yield trend. This is another important metric in that it provides a measurement of the stock valuation. The stock price trending upwards while the yields are heading lower indicates an unsustainable trend and a likely correction in the short term.

Share buybacks

Conclusion

I think Apple is a great company that will handsomely reward its shareholders in the long run, but it would probably be wise to apply a wait-and-see approach in the short term. Any dip in the range of $125-130 would be a good entry position. If, after a correction, it breaks above $160, that would be my signal to increase my position to take advantage of the next bull run. Until then, I will be on the sidelines waiting patiently.

Thank you for reading.

+6

72

2

$SGX(S68.SG$ The epidemic is still having a big impact on the Singapore stock market!

Translated

23

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)