Fun Wong

liked

I started using Moomoo just to check out the world of stocks, not wanting to spend any own money as I was too scared ![]() and I not little ideas of how to pick good stocks. The free APPL $Apple(AAPL.US$ stock given by Moomoo was a great encourager to try buying at least cheap stocks to see how it all works since even if I lose I can just sell off my precious 1 share of $Apple(AAPL.US$ at $145 which was the price when I received the stock. I started to then build up my portfolio and adding more stocks like $NIO Inc(NIO.US$ $Kaixin Holdings(KXIN.US$ and other biotech Pharma stocks some actually did really well as I bought them at the bottom and did cost averaging as it went down like $Axsome Therapeutics(AXSM.US$ which I achieved at least 39% profit😁😁. other stocks I picked up didn’t do quite so well today but had potential to fly the moon before the recent slump. I learning that this roller coaster 🎢 ride will have its ups and downs so I will hang on to see that high in due time! anyways it been a great learning experience with Moomoo without which I will still be standing outside in the world of investing. thank you Moomoo

and I not little ideas of how to pick good stocks. The free APPL $Apple(AAPL.US$ stock given by Moomoo was a great encourager to try buying at least cheap stocks to see how it all works since even if I lose I can just sell off my precious 1 share of $Apple(AAPL.US$ at $145 which was the price when I received the stock. I started to then build up my portfolio and adding more stocks like $NIO Inc(NIO.US$ $Kaixin Holdings(KXIN.US$ and other biotech Pharma stocks some actually did really well as I bought them at the bottom and did cost averaging as it went down like $Axsome Therapeutics(AXSM.US$ which I achieved at least 39% profit😁😁. other stocks I picked up didn’t do quite so well today but had potential to fly the moon before the recent slump. I learning that this roller coaster 🎢 ride will have its ups and downs so I will hang on to see that high in due time! anyways it been a great learning experience with Moomoo without which I will still be standing outside in the world of investing. thank you Moomoo![]()

![]()

![]()

Positions Details

Positions Details

loading...

41

1

Fun Wong

liked

2021 is a year of volatility. ![]()

![]() It has witnessed the rise of meme stocks, starting with $GameStop(GME.US$ and WallStreeBets early in January and up to the moon $AMC Entertainment(AMC.US$ in June. After the 2020 pandemic, S&P 500 rallied 100% within 354 trading days*.

It has witnessed the rise of meme stocks, starting with $GameStop(GME.US$ and WallStreeBets early in January and up to the moon $AMC Entertainment(AMC.US$ in June. After the 2020 pandemic, S&P 500 rallied 100% within 354 trading days*. ![]()

![]() In times of chip shortage, investors are also watching the tech stocks closely. Not to mention dramas like what caused by Elon Musk and Donald Trump on $Tesla(TSLA.US$ and $Digital World Acquisition Corp(DWAC.US$ . What a year!

In times of chip shortage, investors are also watching the tech stocks closely. Not to mention dramas like what caused by Elon Musk and Donald Trump on $Tesla(TSLA.US$ and $Digital World Acquisition Corp(DWAC.US$ . What a year!

*Source: CNBC Maekets News

![]()

![]()

![]() Review Your 2021 to Win Free Stocks

Review Your 2021 to Win Free Stocks![]()

![]()

![]()

As 2021 comes to an end, moomoo invites you to write your own review of 2021 trading journey, reflecting on the year that was and looking ahead to 2022.![]() Join the topic discussion "2021 in Review: My Investing Journey Forges Ahead" and get rewards now!

Join the topic discussion "2021 in Review: My Investing Journey Forges Ahead" and get rewards now!

Event Duration: Now to December 31st, 11:59pm ET

Rewards*:

1. Top 40 posts will get FREE stock with a price range from $5 to $30.![]()

2. 9 Growing Stars of the Year* will get FREE stock with a price range from $20 to $50.![]()

3. All relevant posts with no less than 20 words will be rewarded with 88 points.

*Participants before December 22nd stand a chance to become Growing Stars of the Year, which is a title given by moomoo community to reward your effort made in 2021. A badge will be given to Growing Stars on the profile page to acknowledge your progress and achievement. The Growing Star will be rewarded with one random moomoo merchandise and one free stock with a price range from $20 to $50.

*Note: One can only get one out of the three rewards mentioned above.

The above rewards will be issued in 15 working days after the event ends.

Selection criteria:

(applied to both Top 40 posts and Growing Stars)

1. Content quality: a comprehensive review of 2021.

2. Good typesetting with order histories, stock's trend or other helpful charts.

3. User interaction with the post.

4. Relevant tickers added.

![]()

![]() How to join?

How to join?

Click here and join the discussion under the topic, and you stand a chance to win the free stocks! Easy peasy!

![]()

![]() Don't know what to write? Ask yourself the following three questions!

Don't know what to write? Ask yourself the following three questions!

ONE: How did your trades perform?![]()

![]() As we approach the end of 2021, it's time to look back on whether you make money over 2021! Where did you put your money in? Did your stocks bring you good returns? What are your highlights this year in trading?

As we approach the end of 2021, it's time to look back on whether you make money over 2021! Where did you put your money in? Did your stocks bring you good returns? What are your highlights this year in trading?

![]() Reviewing your trading performance is a way to acknowledge successes and drawbacks to improve your trading skills. Let's check out what moomoo features you could adopt to assist the writing of your reviews here.

Reviewing your trading performance is a way to acknowledge successes and drawbacks to improve your trading skills. Let's check out what moomoo features you could adopt to assist the writing of your reviews here.

TWO: What have you learned from trading?![]()

![]() Perhaps you made a profit, learned a new trading skill, developed good trading psychology, broke bad habits, and gained more confidence.

Perhaps you made a profit, learned a new trading skill, developed good trading psychology, broke bad habits, and gained more confidence.

![]() Even if 2021 might not be the best year in trading, time must have rewarded you with something greater than money, and that is AWESOME! What lesson did you learn, and what progress did you make? Write down the trading knowledge you've learned over the year now!

Even if 2021 might not be the best year in trading, time must have rewarded you with something greater than money, and that is AWESOME! What lesson did you learn, and what progress did you make? Write down the trading knowledge you've learned over the year now!

THREE: What cool thins have you done?![]()

![]() 2020 might be the worst year for many people as COVID-19 took away so many innocent lives. Is 2021 getting better with you? What are your stories this year? Did you meet any good fellows during your trading journey?

2020 might be the worst year for many people as COVID-19 took away so many innocent lives. Is 2021 getting better with you? What are your stories this year? Did you meet any good fellows during your trading journey?

![]() We are all ears for your remarkable stories! Please remember, mooers will always be by your side no matter what happens.

We are all ears for your remarkable stories! Please remember, mooers will always be by your side no matter what happens.

Final Words: 2022 Will Be Everything You Want It To Be

Moving forward, it isn't just about learning from what didn't' work in 2021, but also about learning, acknowledging, and genuinely appreciating what did work in the past. You should allow yourself to be happy and truly soak it all in if you want to thrive.![]()

![]()

Happy (almost) 2022, and remember, this year—it's going to be what you want it to be.

Join discussion and get rewards now! Click here: "2021 in Review: My Investing Journey Forges Ahead"

*Write Your Original Ideas: Plagiarism or cheating is not acceptable in any activities on moomoo. Please "Report" the suspicious posts if you find any. Once confirmed, the user committed shall be disqualified from the activities.

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

*Source: CNBC Maekets News

As 2021 comes to an end, moomoo invites you to write your own review of 2021 trading journey, reflecting on the year that was and looking ahead to 2022.

Event Duration: Now to December 31st, 11:59pm ET

Rewards*:

1. Top 40 posts will get FREE stock with a price range from $5 to $30.

2. 9 Growing Stars of the Year* will get FREE stock with a price range from $20 to $50.

3. All relevant posts with no less than 20 words will be rewarded with 88 points.

*Participants before December 22nd stand a chance to become Growing Stars of the Year, which is a title given by moomoo community to reward your effort made in 2021. A badge will be given to Growing Stars on the profile page to acknowledge your progress and achievement. The Growing Star will be rewarded with one random moomoo merchandise and one free stock with a price range from $20 to $50.

*Note: One can only get one out of the three rewards mentioned above.

The above rewards will be issued in 15 working days after the event ends.

Selection criteria:

(applied to both Top 40 posts and Growing Stars)

1. Content quality: a comprehensive review of 2021.

2. Good typesetting with order histories, stock's trend or other helpful charts.

3. User interaction with the post.

4. Relevant tickers added.

Click here and join the discussion under the topic, and you stand a chance to win the free stocks! Easy peasy!

ONE: How did your trades perform?

TWO: What have you learned from trading?

THREE: What cool thins have you done?

Final Words: 2022 Will Be Everything You Want It To Be

Moving forward, it isn't just about learning from what didn't' work in 2021, but also about learning, acknowledging, and genuinely appreciating what did work in the past. You should allow yourself to be happy and truly soak it all in if you want to thrive.

Happy (almost) 2022, and remember, this year—it's going to be what you want it to be.

Join discussion and get rewards now! Click here: "2021 in Review: My Investing Journey Forges Ahead"

*Write Your Original Ideas: Plagiarism or cheating is not acceptable in any activities on moomoo. Please "Report" the suspicious posts if you find any. Once confirmed, the user committed shall be disqualified from the activities.

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

392

39

Fun Wong

liked

$Grab Holdings(GRAB.US$

I was as excited as most Singaporeans on this app when our home-grown brand got listed. But when I deep-dive into the company, I will likely not invest in it, at least for the short term.

Grab’s market in the South East Asia definitely has growth potential i.e. people are getting affluent, there’s an increase in digital growth etc. However, do note that Grab faces intense competition and challenges in all its businesses/services (ride-hailing, food delivery and financial services). At the moment, I don’t see very strong Moat displayed by them yet - similar to $Uber Technologies(UBER.US$

1. Ride hailing - doesn’t seem like they are going to expand to countries outside South East Asia region. And this spells limited growth, at least for the short term. Furthermore, this area of business is badly impacted by the pandemic. Taxi drivers are suffering (it’s a real problem on the ground)

2. Food delivery - sales in this area did “rocket” as everyone started working from home since 2020. But Singapore, and a few other SEA countries, are too small. There is a limit to how much they can earn in this segment. Throw in Foodpanda, Deliveroo etc, their market shares will be further capped. Personally, I don’t think there is brand loyalty when it comes to food deliveries. I used Grab most of the time, but I also used the other two when there are discounts/ vouchers etc.

3. Financial services - there are so many financial institutions around. It’s going to be tough competing against the banks, and even giants like Apple $Apple(AAPL.US$ and Google $Alphabet-A(GOOGL.US$ for their payments services. Once again, throw in Favpay, Singtel’s Dash $Singtel(Z74.SG$ Alipay $Alibaba(BABA.US$ etc etc. How much pie / market shares can they capture?

Overall, the company’s financial situation isn’t fantastic. Their revenue did grow YOY, but they are not profitable yet. Things may change in 3 to 5 years’ time (expansion by the company, covid has gone etc). But for the short term, I don’t think I would invest my money in them. The dollars can be better invested into other stocks with higher growth. Would suggest to enter only when the coast is clear. Meantime, I will just remain as their consumer using their services.

Not financial advice. DYDD and invest safely.

$Grab Holdings(GRAB.US$

I was as excited as most Singaporeans on this app when our home-grown brand got listed. But when I deep-dive into the company, I will likely not invest in it, at least for the short term.

Grab’s market in the South East Asia definitely has growth potential i.e. people are getting affluent, there’s an increase in digital growth etc. However, do note that Grab faces intense competition and challenges in all its businesses/services (ride-hailing, food delivery and financial services). At the moment, I don’t see very strong Moat displayed by them yet - similar to $Uber Technologies(UBER.US$

1. Ride hailing - doesn’t seem like they are going to expand to countries outside South East Asia region. And this spells limited growth, at least for the short term. Furthermore, this area of business is badly impacted by the pandemic. Taxi drivers are suffering (it’s a real problem on the ground)

2. Food delivery - sales in this area did “rocket” as everyone started working from home since 2020. But Singapore, and a few other SEA countries, are too small. There is a limit to how much they can earn in this segment. Throw in Foodpanda, Deliveroo etc, their market shares will be further capped. Personally, I don’t think there is brand loyalty when it comes to food deliveries. I used Grab most of the time, but I also used the other two when there are discounts/ vouchers etc.

3. Financial services - there are so many financial institutions around. It’s going to be tough competing against the banks, and even giants like Apple $Apple(AAPL.US$ and Google $Alphabet-A(GOOGL.US$ for their payments services. Once again, throw in Favpay, Singtel’s Dash $Singtel(Z74.SG$ Alipay $Alibaba(BABA.US$ etc etc. How much pie / market shares can they capture?

Overall, the company’s financial situation isn’t fantastic. Their revenue did grow YOY, but they are not profitable yet. Things may change in 3 to 5 years’ time (expansion by the company, covid has gone etc). But for the short term, I don’t think I would invest my money in them. The dollars can be better invested into other stocks with higher growth. Would suggest to enter only when the coast is clear. Meantime, I will just remain as their consumer using their services.

Not financial advice. DYDD and invest safely.

$Grab Holdings(GRAB.US$

96

1

Fun Wong

liked

$SIA(C6L.SG$ : Just my opinion and sharing only, not suitable for trading. Please correct me, if I am wrong.

SIA face total passenger shut down in March 2020 for about 18 months or so, due to Covid-19, as such, it's share value had devalued from around $9.00 in Jan 2020 to as low as $3.20 in Aug 2020.

Therefore, my estimated 50% retracement is around $6.00. If I take Jan 2015 high of $12.91 for estimation, the 50% retracement would be around $8.00 in the coming months ahead. Not forgetting to factor in the 2 rights issues, which had diluted SIA shares. So we need to discount a bit. Unless, SIA intend to buy back shares in future.

Hopefully, no more new threatening virus resurface. If Covid-22 appear, then $3.20 may not even be sustainable. Because another world airline shut down, everyone on earth will suffer. I don't think all the world leaders would want to ground all the planes a second time round, unless there is a real necessity. Which we hope, it won't happen.

So far so good, no fatalities news from the new Omicron virus, besides it's fast infectious rate. Only then that, SIA, would have peace to progress from here.

As for now, if nothing threatening is found from the new Omicron virus, then the market fair value should be above $5.20. Good news is that it had found strong support around $4.76 to $4.80 area.

Finally, here is a word of caution, please trade within your means, and not overly exposed yourself. Else no one can help you. Be responsible for yourself. Do not blame others, or use strong words to hurt others, use polite and supportive words, instead. We are all human beings, we all have feelings, we all taking risk to earn a living.

Good luck and all the best to you guys.

Thank you.

SIA face total passenger shut down in March 2020 for about 18 months or so, due to Covid-19, as such, it's share value had devalued from around $9.00 in Jan 2020 to as low as $3.20 in Aug 2020.

Therefore, my estimated 50% retracement is around $6.00. If I take Jan 2015 high of $12.91 for estimation, the 50% retracement would be around $8.00 in the coming months ahead. Not forgetting to factor in the 2 rights issues, which had diluted SIA shares. So we need to discount a bit. Unless, SIA intend to buy back shares in future.

Hopefully, no more new threatening virus resurface. If Covid-22 appear, then $3.20 may not even be sustainable. Because another world airline shut down, everyone on earth will suffer. I don't think all the world leaders would want to ground all the planes a second time round, unless there is a real necessity. Which we hope, it won't happen.

So far so good, no fatalities news from the new Omicron virus, besides it's fast infectious rate. Only then that, SIA, would have peace to progress from here.

As for now, if nothing threatening is found from the new Omicron virus, then the market fair value should be above $5.20. Good news is that it had found strong support around $4.76 to $4.80 area.

Finally, here is a word of caution, please trade within your means, and not overly exposed yourself. Else no one can help you. Be responsible for yourself. Do not blame others, or use strong words to hurt others, use polite and supportive words, instead. We are all human beings, we all have feelings, we all taking risk to earn a living.

Good luck and all the best to you guys.

Thank you.

11

2

Fun Wong

reacted to

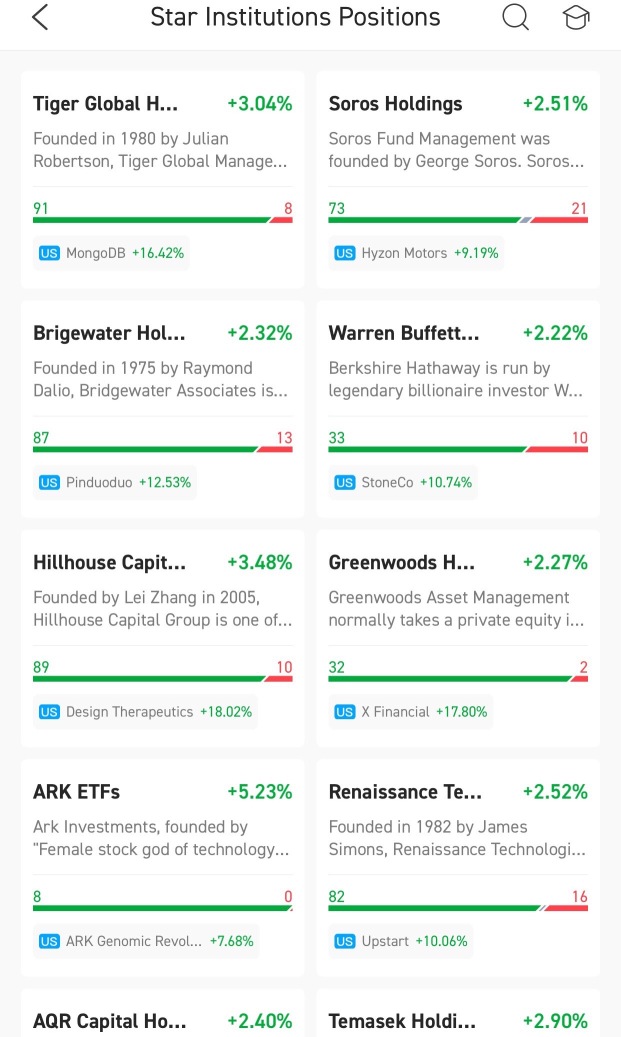

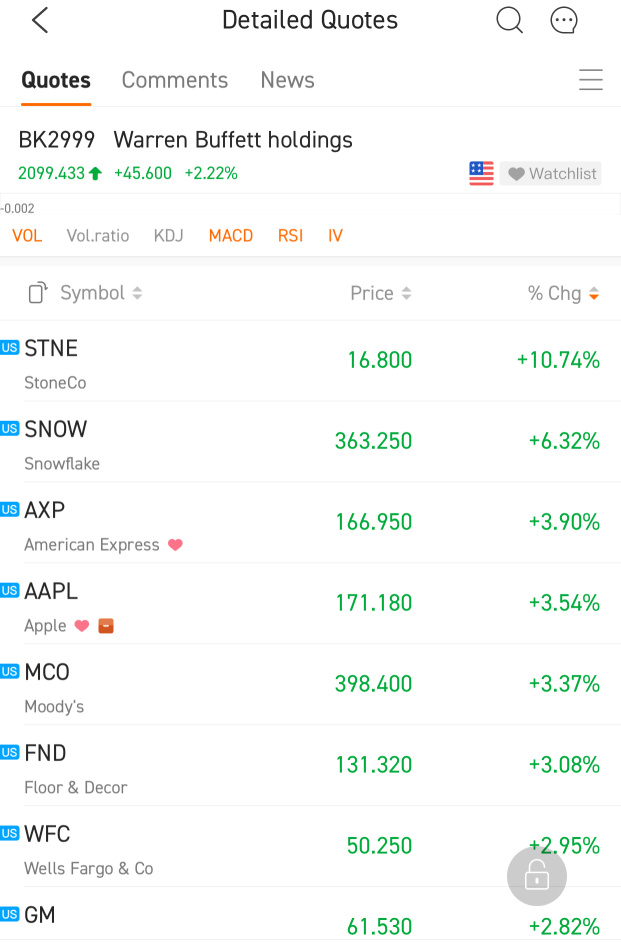

Can we ride on the coattails of star institutions to the moon? Moomoo app allows us to see the positions of top funds based on 13F filings (Quotes > Explore > Star Institutions). Compared to retail investors, institutional investors (sovereign funds, hedge funds, mutual funds, insurance companies, pension funds, etc) have the advantage of immense capital, teams of dedicated analysts and connections retail investors can only dream of. They may be aware of information that retail investor are not aware of or get the information earlier and they can influence the price of a stock due to the size of their trades. Thus, the positions they take can serve as a useful clue of which stocks are undervalued or overvalued.

$ARK Fintech Innovation ETF(ARKF.US$ $ARK Innovation ETF(ARKK.US$ $ARK Autonomous Technology & Robotics ETF(ARKQ.US$ $ARK Next Generation Internet ETF(ARKW.US$ $Vanguard S&P 500 ETF(VOO.US$ $SPDR S&P 500 ETF(SPY.US$ $Apple(AAPL.US$ $Alphabet-C(GOOG.US$ $Alphabet-A(GOOGL.US$ $Tesla(TSLA.US$ $Meta Platforms(FB.US$ $Netflix(NFLX.US$ $NVIDIA(NVDA.US$ $Amazon(AMZN.US$ $Advanced Micro Devices(AMD.US$ $Lucid Group(LCID.US$ $Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$ $Tiger Global Holdings(LIST2121.US$ $BYD Co.(BYDDF.US$ $Alibaba(BABA.US$ $DiDi Global (Delisted)(DIDI.US$ $PDD Holdings(PDD.US$ $Temasek Holdings(LIST2536.US$ $Snowflake(SNOW.US$ $Microsoft(MSFT.US$ $TAL Education(TAL.US$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental(EDU.US$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Long Term Investment - A Strategy For Growing Returns Without Sleepless Nights https://www.moomoo.com/community/feed/107495017873414?lang_code=2

$ARK Fintech Innovation ETF(ARKF.US$ $ARK Innovation ETF(ARKK.US$ $ARK Autonomous Technology & Robotics ETF(ARKQ.US$ $ARK Next Generation Internet ETF(ARKW.US$ $Vanguard S&P 500 ETF(VOO.US$ $SPDR S&P 500 ETF(SPY.US$ $Apple(AAPL.US$ $Alphabet-C(GOOG.US$ $Alphabet-A(GOOGL.US$ $Tesla(TSLA.US$ $Meta Platforms(FB.US$ $Netflix(NFLX.US$ $NVIDIA(NVDA.US$ $Amazon(AMZN.US$ $Advanced Micro Devices(AMD.US$ $Lucid Group(LCID.US$ $Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$ $Tiger Global Holdings(LIST2121.US$ $BYD Co.(BYDDF.US$ $Alibaba(BABA.US$ $DiDi Global (Delisted)(DIDI.US$ $PDD Holdings(PDD.US$ $Temasek Holdings(LIST2536.US$ $Snowflake(SNOW.US$ $Microsoft(MSFT.US$ $TAL Education(TAL.US$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental(EDU.US$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Long Term Investment - A Strategy For Growing Returns Without Sleepless Nights https://www.moomoo.com/community/feed/107495017873414?lang_code=2

151

16

Fun Wong

liked

$SGX(S68.SG$ Been looking at this stock for a while and once had a small postion in it. Cut loss at 9.65, the dividends couldn’t cover the losses. It wasn’t a big loss though. But it does appear that this stock really doesn’t respond to positive news well (recent IPOs), yet responses to negative news really really well (Covid, New variant, etc).

Im not hating on this stock, but for me, I’m steering clear. Trust your gut instinct, if it’s telling you to buy, go ahead and buy, but if its telling you to cut loss, then maybe think about cutting losses.

Im not hating on this stock, but for me, I’m steering clear. Trust your gut instinct, if it’s telling you to buy, go ahead and buy, but if its telling you to cut loss, then maybe think about cutting losses.

11

2

Fun Wong

liked

$SIA(C6L.SG$

It Gona grow, but I feel it will take a longer time then expected.

Most travellers are still on the observation mode and uncertainties due to new covid variant still loom....

But conclusion, good stock to invest in the long terms. ✌️

It Gona grow, but I feel it will take a longer time then expected.

Most travellers are still on the observation mode and uncertainties due to new covid variant still loom....

But conclusion, good stock to invest in the long terms. ✌️

19

Fun Wong

liked

Asia stocks set for steady start; Oil, yields jump

Asian stocks looked set for a steady start Wednesday after a mixed Wall Street session and a further climb in Treasury yields as traders weighed the prospect of tighter monetary policy to curb inflation.

Australia edged up at the open. Futures for Japan and Hong Kong were little changed. U.S. futures dipped modestly. Energy and financials helped the $S&P 500 Index(.SPX.US$ eke out a gain, while the $NASDAQ 100 Index(.NDX.US$ extended a drop. A gauge of Chinese shares traded in the U.S. fell for a second day.

Mall brands plunge as Gap, Nordstrom add to supply worries

Mall staples $Gap Inc(GPS.US$ and $Nordstrom(JWN.US$ tumbled after reporting disappointing results, adding to a series of worrisome retail earnings and renewing concerns over the global supply-chain crisis.

Gap shares fell 17% as of 5:55 p.m. Tuesday after regular trading in New York, while Nordstrom plunged 23%. Mall-based peer $Abercrombie & Fitch(ANF.US$, which reported results prior to the market open, fell 13% Tuesday. $Urban Outfitters(URBN.US$ slipped 9% after its earnings report.

Meme stocks suffer worst day since June as risk-off rages

Meme stocks including $GameStop(GME.US$ and $Bed Bath & Beyond Inc(BBBY.US$ are tumbling Tuesday as investors bail out of riskier assets in favor of value-oriented companies.

A group of 37 retail-trader favorites tracked by Bloomberg fell 5.5% Tuesday, the worst drop for the group since mid-June.

Profitable companies are leaving money-losing stocks in the dust

Making a profit is really paying off again. Investors are rewarding companies that make money at the highest rate in almost two decades when compared to their money-losing peers.

The average return for profitable members of the $Russell 3000 Index Ishares(IWV.US$ is 36% this year, about triple the gains for unprofitable companies, data compiled by Bloomberg show.

Retail traders jump back into tiny biotechs ahead of holiday

Two tiny biotechs, $iSpecimen(ISPC.US$ and $Longeveron(LGVN.US$, are the latest to see their stocks caught up in a social media-fueled frenzy ahead of a U.S. trading holiday.

ISpecimen closed 49% higher Tuesday after more than doubling at the open and triggering a volatility halt. The stock is majority held by individuals and about 44% is held by insiders.

Rocket Lab CEO says companies not reusing rockets are making 'a dead-end product'

$Rocket Lab(RKLB.US$ CEO Peter Beck has dramatically changed his tune on reusing rockets, a practice made increasingly popular by Elon Musk's SpaceX.

"I think anybody who's not developing a reusable launch vehicle at this point in time is developing a dead-end product because it's just so obvious that this is a fundamental approach that has to be baked in from day one," Beck said on Tuesday.

SpaceX is launching a NASA spacecraft that will crash into an asteroid

Elon Musk's SpaceX is set to launch a first-of-its-kind planetary defense mission for NASA in the early hours of Wednesday morning. "We're smashing into an asteroid," NASA's Launch Services Program senior launch director Omar Baez said.

The mission is known as the Double Asteroid Redirection Test (or DART). NASA is trying to learn how to deflect a threat if it were headed toward Earth.

Apple sues company known for hacking iPhones on behalf of governments

$Apple(AAPL.US$ is suing NSO Group, an Israeli firm that sells software to government agencies and law enforcement that enables them to hack iPhones. Amnesty International said earlier this year it discovered recent-model iPhones belonging to journalists and human rights lawyers that had been infected with NSO Group malware.

Apple said on Tuesday it patched the flaws that enabled the NSO Group malware and would warn iPhone owners who may have been targeted.

Source: Bloomberg, CNBC

Asian stocks looked set for a steady start Wednesday after a mixed Wall Street session and a further climb in Treasury yields as traders weighed the prospect of tighter monetary policy to curb inflation.

Australia edged up at the open. Futures for Japan and Hong Kong were little changed. U.S. futures dipped modestly. Energy and financials helped the $S&P 500 Index(.SPX.US$ eke out a gain, while the $NASDAQ 100 Index(.NDX.US$ extended a drop. A gauge of Chinese shares traded in the U.S. fell for a second day.

Mall brands plunge as Gap, Nordstrom add to supply worries

Mall staples $Gap Inc(GPS.US$ and $Nordstrom(JWN.US$ tumbled after reporting disappointing results, adding to a series of worrisome retail earnings and renewing concerns over the global supply-chain crisis.

Gap shares fell 17% as of 5:55 p.m. Tuesday after regular trading in New York, while Nordstrom plunged 23%. Mall-based peer $Abercrombie & Fitch(ANF.US$, which reported results prior to the market open, fell 13% Tuesday. $Urban Outfitters(URBN.US$ slipped 9% after its earnings report.

Meme stocks suffer worst day since June as risk-off rages

Meme stocks including $GameStop(GME.US$ and $Bed Bath & Beyond Inc(BBBY.US$ are tumbling Tuesday as investors bail out of riskier assets in favor of value-oriented companies.

A group of 37 retail-trader favorites tracked by Bloomberg fell 5.5% Tuesday, the worst drop for the group since mid-June.

Profitable companies are leaving money-losing stocks in the dust

Making a profit is really paying off again. Investors are rewarding companies that make money at the highest rate in almost two decades when compared to their money-losing peers.

The average return for profitable members of the $Russell 3000 Index Ishares(IWV.US$ is 36% this year, about triple the gains for unprofitable companies, data compiled by Bloomberg show.

Retail traders jump back into tiny biotechs ahead of holiday

Two tiny biotechs, $iSpecimen(ISPC.US$ and $Longeveron(LGVN.US$, are the latest to see their stocks caught up in a social media-fueled frenzy ahead of a U.S. trading holiday.

ISpecimen closed 49% higher Tuesday after more than doubling at the open and triggering a volatility halt. The stock is majority held by individuals and about 44% is held by insiders.

Rocket Lab CEO says companies not reusing rockets are making 'a dead-end product'

$Rocket Lab(RKLB.US$ CEO Peter Beck has dramatically changed his tune on reusing rockets, a practice made increasingly popular by Elon Musk's SpaceX.

"I think anybody who's not developing a reusable launch vehicle at this point in time is developing a dead-end product because it's just so obvious that this is a fundamental approach that has to be baked in from day one," Beck said on Tuesday.

SpaceX is launching a NASA spacecraft that will crash into an asteroid

Elon Musk's SpaceX is set to launch a first-of-its-kind planetary defense mission for NASA in the early hours of Wednesday morning. "We're smashing into an asteroid," NASA's Launch Services Program senior launch director Omar Baez said.

The mission is known as the Double Asteroid Redirection Test (or DART). NASA is trying to learn how to deflect a threat if it were headed toward Earth.

Apple sues company known for hacking iPhones on behalf of governments

$Apple(AAPL.US$ is suing NSO Group, an Israeli firm that sells software to government agencies and law enforcement that enables them to hack iPhones. Amnesty International said earlier this year it discovered recent-model iPhones belonging to journalists and human rights lawyers that had been infected with NSO Group malware.

Apple said on Tuesday it patched the flaws that enabled the NSO Group malware and would warn iPhone owners who may have been targeted.

Source: Bloomberg, CNBC

103

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)