Kathy needs to take her own advice and apply it to the rose colored glasses she has about Tesla.

Cathie Wood Sounds Warning About Nvidia, Whose Rally She Missed

Cathie Wood Sounds Warning About Nvidia, Whose Rally She MissedKathy needs to take her own advice about Tesla.

Flaxfield

reacted to

$Super Micro Computer (SMCI.US)$ This is overbought, and has risen from $300 to $800 in a month. Anyone caught holding this over the weekend will lose 40% more when we open Tuesday at $500

5

5

Flaxfield

commented on

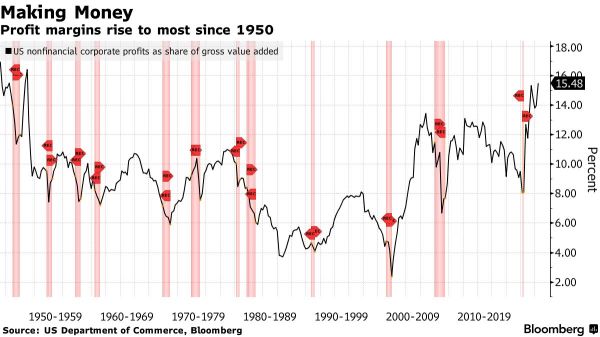

US corporate profit margins has reached its highest since 1950, suggesting companies have been able to keep profit margins high by cutting cost and passing higher costs along to consumers.

After-tax profits as a share of gross value added for non-financial corporations, improved in the second quarter to 15.5% -- the most since 1950, according to Commerce Department figures published Thursday.

With household budgets squeezed by the rising...

After-tax profits as a share of gross value added for non-financial corporations, improved in the second quarter to 15.5% -- the most since 1950, according to Commerce Department figures published Thursday.

With household budgets squeezed by the rising...

8

9

Flaxfield

commented on

$Hycroft Mining(HYMC.US$ some body help me I am so new to stock trading how does this work all I know is buy when its low and sell when its high so how do you make profit off your shares? and do you cash out the profit only when it closes? how do you make money 💰💲💰sorry if I sound like I been living under a rock![]()

![]() but I really want to learn so if any one can help that would be much appreciated thankyou so much

but I really want to learn so if any one can help that would be much appreciated thankyou so much

1

15

Flaxfield

liked

A good company can continuously use incremental capital to obtain a high rate of return in an extended period. On the contrary, a bad company will require a continuous large amount of capital investment but has a low rate of return. How to judge the subsequent rate of return of the purchasing company?![]()

![]()

![]()

Buffett said that 2 points are essential:

1. Buy the company that you know

It can predict future cash flow, do the right thing in the ability circle, and avoid major mistakes.

2. Ensure sufficient margin of safety

Good companies that meet the conditions must be bought in heavy positions because few good companies exist. $Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$

The industries and companies that Buffett likes almost certainly still have a competitive advantage in the next 10 or 20 years, and the environment is unlikely to undergo significant changes. $AMC Entertainment(AMC.US$

For example, for a blue-chip such as $Apple(AAPL.US$ , if you take a stop loss and do a long-term trend in a large cycle, it will not be stopped until now. From the end of 2008 to now, it has been a trend of rising lows. Even the market with four circuit breakers at the beginning of 2020 not stop. This is the so-called large-period broad stop loss and does not hinder long-term investment.

There is also a survivor's in addition to non-stop loss and payback. Sometimes you see a trader using a specific high-risk method and earning wealthy profits in a year, and the profit margin far exceeds Buffett.

![]() Is it possible?

Is it possible?

Of course possible;

![]() Can it be replicated?

Can it be replicated?

It may not be possible;

![]() Can it last?

Can it last?

Of course not;

Otherwise, the top master in the market would not be Buffett.![]()

![]()

![]()

Don't be messed up by all sorts of large profit orders and information pushes of various stocks. Under the iceberg, more large loss orders unreleased. If you always maintain fully leveraged transactions and do not protect the profits you have already made, you will soon return to the market in most cases. $NVIDIA(NVDA.US$ $Lucid Group(LCID.US$ $NIO Inc(NIO.US$

Trading requires a high degree of self-discipline, persistence, and hard work. It's not that you make money in trading; it's that you have to do these to make money.

Buffett said that 2 points are essential:

1. Buy the company that you know

It can predict future cash flow, do the right thing in the ability circle, and avoid major mistakes.

2. Ensure sufficient margin of safety

Good companies that meet the conditions must be bought in heavy positions because few good companies exist. $Berkshire Hathaway-A(BRK.A.US$ $Berkshire Hathaway-B(BRK.B.US$

The industries and companies that Buffett likes almost certainly still have a competitive advantage in the next 10 or 20 years, and the environment is unlikely to undergo significant changes. $AMC Entertainment(AMC.US$

For example, for a blue-chip such as $Apple(AAPL.US$ , if you take a stop loss and do a long-term trend in a large cycle, it will not be stopped until now. From the end of 2008 to now, it has been a trend of rising lows. Even the market with four circuit breakers at the beginning of 2020 not stop. This is the so-called large-period broad stop loss and does not hinder long-term investment.

There is also a survivor's in addition to non-stop loss and payback. Sometimes you see a trader using a specific high-risk method and earning wealthy profits in a year, and the profit margin far exceeds Buffett.

Of course possible;

It may not be possible;

Of course not;

Otherwise, the top master in the market would not be Buffett.

Don't be messed up by all sorts of large profit orders and information pushes of various stocks. Under the iceberg, more large loss orders unreleased. If you always maintain fully leveraged transactions and do not protect the profits you have already made, you will soon return to the market in most cases. $NVIDIA(NVDA.US$ $Lucid Group(LCID.US$ $NIO Inc(NIO.US$

Trading requires a high degree of self-discipline, persistence, and hard work. It's not that you make money in trading; it's that you have to do these to make money.

37

28

Flaxfield

voted

moomoo annual ceremony is happening right now!

Check it out here:

2021 in Review: Grow Together to the Moon!

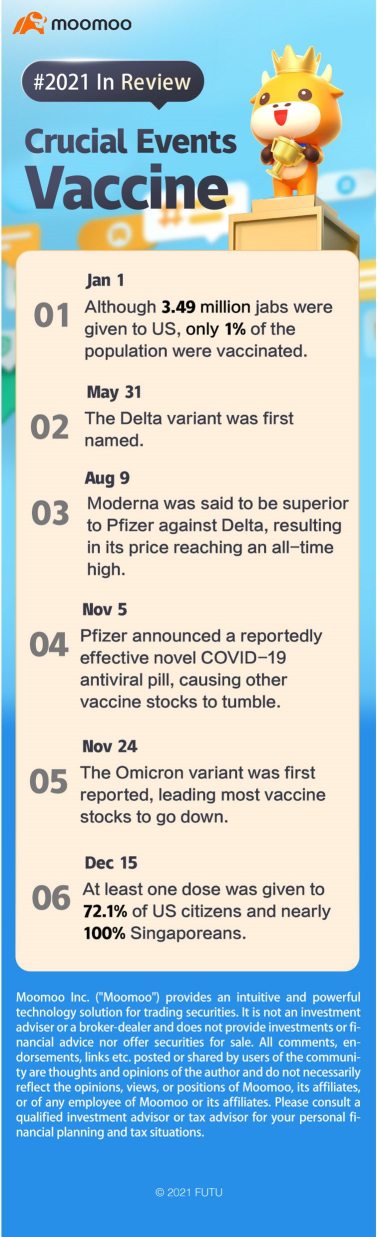

When can I get the vaccine? One of the most-searched questions on Google indicates people's biggest worry in 2021. However, it's an entirely different story for vaccine stocks holders. Sometimes they want the market sentiments to be different because they found that the line in the cases-versus-price graph increases exponentially.

Instead of getting vaccinated, investors stared at news channels. They tried to find the next catalyst for a strong momentum of growth. Are they speculating? Yes, they are. Maybe you'd like to join them if you look at the cost-benefit ratio or the daily performance of the trending vaccine stocks.

Anyway, I sincerely hope that the vaccines will be enough for every mooer![]() . Sufficient supply also indicates healthy cash flows... Oh, I mean, the virus might stop spreading if most of us are vaccinated.

. Sufficient supply also indicates healthy cash flows... Oh, I mean, the virus might stop spreading if most of us are vaccinated.

We also hope that the vaccine stocks could become value stocks with solid business models and stable cash flows one day. In that case, there will be no need for us to be on tenterhooks all day, waiting for monthly job reports or the infection numbers anymore.

Well, unless you enjoy the extreme volatility of the sudden outbreaks and are confident that you can profit from the biotech stocks shortly.

Did you get the vaccine?

Do you think the word "Vaccine" here qualifies to be the word of the year?

If you've got better ideas, please comment below to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Musk

Check it out here:

2021 in Review: Grow Together to the Moon!

When can I get the vaccine? One of the most-searched questions on Google indicates people's biggest worry in 2021. However, it's an entirely different story for vaccine stocks holders. Sometimes they want the market sentiments to be different because they found that the line in the cases-versus-price graph increases exponentially.

Instead of getting vaccinated, investors stared at news channels. They tried to find the next catalyst for a strong momentum of growth. Are they speculating? Yes, they are. Maybe you'd like to join them if you look at the cost-benefit ratio or the daily performance of the trending vaccine stocks.

Anyway, I sincerely hope that the vaccines will be enough for every mooer

We also hope that the vaccine stocks could become value stocks with solid business models and stable cash flows one day. In that case, there will be no need for us to be on tenterhooks all day, waiting for monthly job reports or the infection numbers anymore.

Well, unless you enjoy the extreme volatility of the sudden outbreaks and are confident that you can profit from the biotech stocks shortly.

Did you get the vaccine?

Do you think the word "Vaccine" here qualifies to be the word of the year?

If you've got better ideas, please comment below to let us know.

You May Also Like:

Word of the Year: Apes

Word of the Year: Musk

118

15

Flaxfield

liked

$Ford Motor(F.US$ The current level around $13. 40 is potentially important. It was a high in January 2018 and last March. It also provided support for prices between mid-July and mid-August. Breaking through it could draw traders from the sidelines.

1

1

Flaxfield

reacted to

$Vertex Energy(VTNR.US$ vertex itself needs some energy now 😂😂😂

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)