how does this all work is it worth time to do this I'm confused

1

$Bitcoin(BTC.CC$ the king of coi s

4

Donald Gray

reacted to and commented on

Candlestick patterns, which are formed by either a single candlestick or by a succession of two or three candlesticks, are some of the most widely used technical indicators for identifying potential market reversals or trend change. ![]()

![]()

![]()

Doji candlesticks, for example, indicate indecision in a market that may be a signal for an impending trend change or market reversal. The singular characteristic of a doji candlestick is that the opening and closing prices are the same, so that the candlestick body is a flat line. The longer the upper and/or lower "shadows", or "tails", on a doji candlestick – the part of the candlestick that indicates the low-to-high range for the time period – the stronger the indication of market indecision and potential reversal.

There are several variations of doji candlesticks, each with its own distinctive name, as shown in the illustration below:![]()

![]()

![]()

The typical doji is the long-legged doji, where price extends about equally in each direction, opening and closing in the middle of the price range for the time period. The appearance of the candlestick gives a clear visual indication of indecision in the market. When a doji like this appears after an extended uptrend or downtrend in a market, it is commonly interpreted as signaling a possible market reversal, a trend change to the opposite direction.![]()

![]()

![]()

The dragonfly doji, when appearing after a prolonged downtrend, signals a possible upcoming reversal to the upside. Examination of the price action indicated by the dragonfly doji explains its logical interpretation. The dragonfly shows sellers pushing price substantially lower (the long lower tail), but at the end of the period, price recovers to close at its highest point. The candlestick essentially indicates a rejection of the extended push to the downside.![]()

![]()

![]()

The gravestone doji's name clearly hints that it represents bad news for buyers. The opposite of the dragonfly formation, the gravestone doji indicates a strong rejection of an attempt to push market prices higher, and thereby suggests a potential downside reversal may follow.![]()

![]()

![]()

The rare, four price doji, where the market opens, closes, and in-between conducts all buying and selling at the exact same price throughout the time period, is the epitome of indecision, a market that shows no inclination to go anywhere in particular.![]()

![]()

![]()

There are dozens of different candlestick formations, along with several pattern variations. It's certainly helpful to know what a candlestick pattern indicates – but it's even more helpful to know if that indication has proven to be accurate 80% of the time.![]()

![]()

![]()

Doji candlesticks, for example, indicate indecision in a market that may be a signal for an impending trend change or market reversal. The singular characteristic of a doji candlestick is that the opening and closing prices are the same, so that the candlestick body is a flat line. The longer the upper and/or lower "shadows", or "tails", on a doji candlestick – the part of the candlestick that indicates the low-to-high range for the time period – the stronger the indication of market indecision and potential reversal.

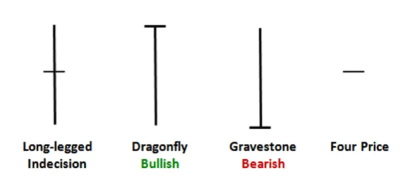

There are several variations of doji candlesticks, each with its own distinctive name, as shown in the illustration below:

The typical doji is the long-legged doji, where price extends about equally in each direction, opening and closing in the middle of the price range for the time period. The appearance of the candlestick gives a clear visual indication of indecision in the market. When a doji like this appears after an extended uptrend or downtrend in a market, it is commonly interpreted as signaling a possible market reversal, a trend change to the opposite direction.

The dragonfly doji, when appearing after a prolonged downtrend, signals a possible upcoming reversal to the upside. Examination of the price action indicated by the dragonfly doji explains its logical interpretation. The dragonfly shows sellers pushing price substantially lower (the long lower tail), but at the end of the period, price recovers to close at its highest point. The candlestick essentially indicates a rejection of the extended push to the downside.

The gravestone doji's name clearly hints that it represents bad news for buyers. The opposite of the dragonfly formation, the gravestone doji indicates a strong rejection of an attempt to push market prices higher, and thereby suggests a potential downside reversal may follow.

The rare, four price doji, where the market opens, closes, and in-between conducts all buying and selling at the exact same price throughout the time period, is the epitome of indecision, a market that shows no inclination to go anywhere in particular.

There are dozens of different candlestick formations, along with several pattern variations. It's certainly helpful to know what a candlestick pattern indicates – but it's even more helpful to know if that indication has proven to be accurate 80% of the time.

106

15

well 1 of 3 things number #1 use the knowledge that moomoo makes available and research even there trusted words when picking what stocks I choose number #2 be patient and hold nu.ber #3 don't follow trends and be very very xarefull to not listen to fud or others posy when deciding my portfolio

Donald Gray

reacted to

thank you moomoo team for being the most involved in user mentoring and intera

1

Donald Gray

voted

There's a saying that goes: "The present you is made up by all the decisions you've made in the past."

In that case, would you like to look back on all mooers' votes before and find out what "made you" or led to your paper gain/loss now?

On Aug. 5, Daily Poll asked about "What's the future of automakers?"

What's the future of automakers? Click to see>>

63% of mooers chose "New brands like Tesla"

Only 15% of mooers chose "Traditional brands like GM"

22% of mooers chose "I'm so broke" (WTF lol )

On Aug. 30, Rivian filed for its upcoming IPO. Daily Poll asked about "How do you feel about the new competitor?"

Rivian, the EV maker backed by Amazon and Ford has filed for its IPO. Click to see>>

11% of mooers chose "a threat to other EV makers."

12% of mooers chose "nah, bye bye soon."

77% of mooers chose "strong background, keep watching."

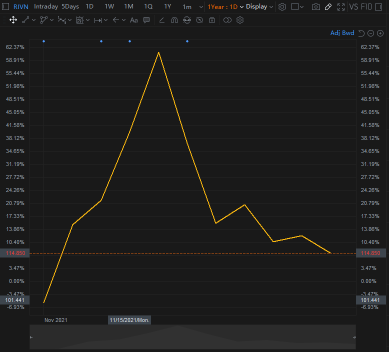

Let's take a look at their one year performance:

$Tesla(TSLA.US$

$Rivian Automotive(RIVN.US$

$Lucid Group(LCID.US$

New EV brands do deliver strong growth on their stock price.

However, traditional brands are doing great as well.

$Ford Motor(F.US$

$General Motors(GM.US$

Even though they were doing well and also showed an upward trend in stock price.

The EV battlefield: Oldest automakers are on fire. Click to see>>

Still, only 13% of mooers think GM and F will win the battle 10 years later.

63% of the mooers were convinced that TSLA is the G.O.A.T.

And here come the questions:

Do you think you were right then?

Or what made you change your mind?

You May Aalso Like:

Daily Poll: Battery issue drains Rivian stock.

Daily Poll: The "EV Big Three."

+3

97

3

Donald Gray

commented on

Hi, mooers, yesterday is Thanksgiving day, how was everyone going?

First of all, we at moomoo Courses are so very grateful to everyone who supports us. It is because of your support that we are more motivated to make better courses. Thanks for having you

At the same time today is also #4 Weekly Wins (Because of the festival, the event was postponed to Friday). To express our gratitude for your support, we decided to give back to you

This is our latest tailred made video on How to pick stocks. Yes, it's totally free for you.

If the skill is useful, forward it to your friends and share it with more people.

Spoiler alert:

In the following weeks, moomoo Courses will unveil a new series of courses on

How to invest in stocks: Quick-Start Guide.

Teach you how to invest wisely and build your wealth gradually.

What you'll learn:

[Weekly Wins]

Learn this course and let us know what other investment skills and knowledge you would like to acquire.

PS: Only followers of Moomoo Courses will become lucky winners.

Now till 10pm on November 28 (GMT-5).

Winners will be announced on November 29 (GMT-5).

Welcome to Courses in Moo Community, we help you trade like a pro.

233

94

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)