CMebaby

liked

Introduction

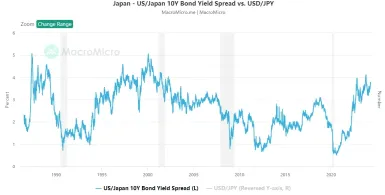

According to a Bloomberg report on April 10, Berkshire Hathaway, led by Warren Buffett, intends to issue yen-denominated bonds globally once again. A week later, on the 18th, Berkshire announced that the scale of this bond issuance amounted to 263.3 billion yen, marking the largest issuance of its yen bonds since their debut in 2019.

Of particular note, Berkshire's decision to borrow yen comes at a time when the currency is plung...

According to a Bloomberg report on April 10, Berkshire Hathaway, led by Warren Buffett, intends to issue yen-denominated bonds globally once again. A week later, on the 18th, Berkshire announced that the scale of this bond issuance amounted to 263.3 billion yen, marking the largest issuance of its yen bonds since their debut in 2019.

Of particular note, Berkshire's decision to borrow yen comes at a time when the currency is plung...

+2

30

1

CMebaby

liked

$NVIDIA(NVDA.US$ Tatsuko really left me dazed all weekend last Friday. Fortunately, it took me a week to recover

Translated

9

1

CMebaby

liked

$YTL(4677.MY$

Yang Zhongli's institutional volume and price have risen sharply, and the sharp rise in stock prices has reached its highest level in two months.

The main reason for this is that major investment banks say that the company's stock price still has a lot of room to rise, thus boosting buying. Some have even given a target price of RM3.33.

So do you think the company's stock price can go higher? Will Malaysia's FTSE Composite Index benefit from this? We welcome your comments.

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

Source: Nanyang Commercial Daily, Bursa Malaysia

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

Yang Zhongli's institutional volume and price have risen sharply, and the sharp rise in stock prices has reached its highest level in two months.

The main reason for this is that major investment banks say that the company's stock price still has a lot of room to rise, thus boosting buying. Some have even given a target price of RM3.33.

So do you think the company's stock price can go higher? Will Malaysia's FTSE Composite Index benefit from this? We welcome your comments.

$FTSE Bursa Malaysia KLCI Index(.KLSE.MY$

Source: Nanyang Commercial Daily, Bursa Malaysia

Disclaimer: This content is for informational and educational purposes only, and does not constitute any specific investment, investment strategy, or recommendation endorsement. The reader shall bear any risk and responsibility arising from reliance on this content. Always conduct your own independent research and evaluation and consult professional advice if necessary before making any investment decisions. The author and related participants are not responsible for any loss or damage resulting from the use or reliance on the information contained in this article.

Translated

30

CMebaby

liked

I originally viewed TDM as a plantation Group with a healthcare arm. About 17 years ago, the healthcare segment only accounted for about 16% of the Group revenue. The Group plantation operations then was mainly in Malaysia and this accounted for a large part of the Group’s revenue.

The Group decided to expand it plantations segment by venturing to Indonesia. It took several years to get this going such that the maiden revenue from the Indonesian plantation was only i...

The Group decided to expand it plantations segment by venturing to Indonesia. It took several years to get this going such that the maiden revenue from the Indonesian plantation was only i...

20

1

CMebaby

liked

In the video, I explained why $TENCENT(00700.HK$ is heading up.

It can be seen clearly from charts.

If you haven’t watch the video, watch it now.

Now, the price is at a resistance of 332.

If you had bought in around 305, that would be a nice 13% profit in a short period.

If the price breaks above 332, I will update it in another post.

Follow me for fresh updates!![]()

It can be seen clearly from charts.

If you haven’t watch the video, watch it now.

Now, the price is at a resistance of 332.

If you had bought in around 305, that would be a nice 13% profit in a short period.

If the price breaks above 332, I will update it in another post.

Follow me for fresh updates!

From YouTube

23

CMebaby

liked

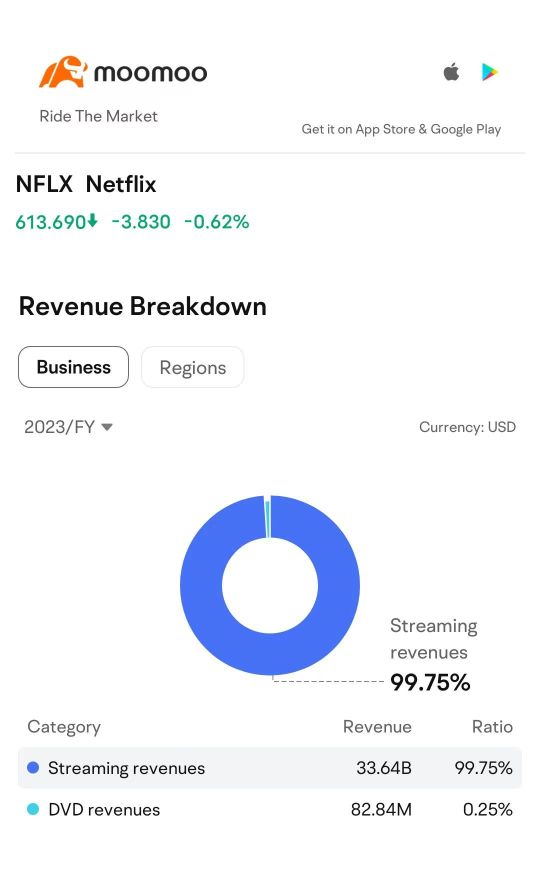

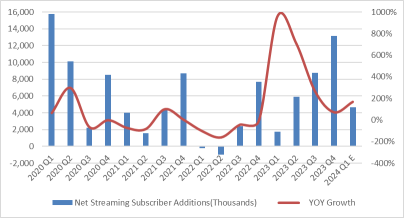

$Netflix(NFLX.US$ is set to release its earnings report after the market closes on April 18, Eastern Time. In the previous two quarters, Netflix's stock price surged impressively by 16.1% and 10.7%, respectively, following their earnings announcements. Since the beginning of the year, Netflix's share price has risen by 26.83%, outperforming the S&P 500 index and reaching a new high for the first time in nearly two...

+1

38

3

CMebaby

liked

ironore running hard $BHP Group Ltd(BHP.AU$ $Fortescue Ltd(FMG.AU$ $Rio Tinto Ltd(RIO.AU$ $Rio Tinto Ltd(RIO.AU$

11

CMebaby

liked

I know…it sucks to even see this headline, I feel your pain.

US Federal Reserve Chair Jerome Powell and other top U.S. central bank officials have recently made it clear that interest rate cuts are not imminent. Powell emphasized that the current tight monetary policy needs to continue for a longer period to ensure inflation approaches the Fed’s target of 2%. Despite previous expectations of rate reductions this year, recent economic data showing persistent inflation has led t...

US Federal Reserve Chair Jerome Powell and other top U.S. central bank officials have recently made it clear that interest rate cuts are not imminent. Powell emphasized that the current tight monetary policy needs to continue for a longer period to ensure inflation approaches the Fed’s target of 2%. Despite previous expectations of rate reductions this year, recent economic data showing persistent inflation has led t...

60

5

CMebaby

liked

In Friday's trading, the three major US stock indexes all closed down more than 1%. Among them, the Dow recorded its biggest weekly decline since the Bank of Silicon Valley went out of business, while the S&P 500 experienced its worst week in nearly five months. Among technology stocks, Apple rose against the market, with weekly gains of more than 4%, while the chip stock index plummeted by more than 3%, and Intel and AMD declined by more than 5% and 4%, respectively. Furthermore, J.P. Morgan Chase plummeted 6.5% after the earnings report was released, the biggest one-day decline in nearly four years.

Although the Pan-European stock index rebounded on Friday, it still closed down for two consecutive weeks, while the oil and gas sector bucked the trend and rose 2.5% to a new high since 2008. In the bond market, due to the escalation of geopolitical risks in the Middle East, the yield on US 10-year Treasury bonds fell 10 basis points from a nearly five-month high. Meanwhile, the dollar index hit a new five-month high, while the yen hit a new low since 1990 for three consecutive days.

The crude oil market rebounded against the backdrop of a tense situation in the Middle East, although it continued to decline throughout the week. U.S. crude oil prices once surged more than 3% in the intraday period, hitting a new high in nearly half a year, but then fell back. Gold fell sharply after successive intraday record highs. At one point, it fell 4% from its high level. In the cryptocurrency market, Bitcoin also experienced a wave of sharp fluctuations. At one point, it plummeted by more than $6,000 and fell below the $66,000 mark.

The Chinese market was also under pressure during the US stock period. The China Securities Index plummeted 4.6%. Among them, Xiaopeng Motor and NIO Auto plummeted by nearly 10% and 8%, respectively. The offshore renminbi also fell sharply in the intraday period, approaching 7...

Although the Pan-European stock index rebounded on Friday, it still closed down for two consecutive weeks, while the oil and gas sector bucked the trend and rose 2.5% to a new high since 2008. In the bond market, due to the escalation of geopolitical risks in the Middle East, the yield on US 10-year Treasury bonds fell 10 basis points from a nearly five-month high. Meanwhile, the dollar index hit a new five-month high, while the yen hit a new low since 1990 for three consecutive days.

The crude oil market rebounded against the backdrop of a tense situation in the Middle East, although it continued to decline throughout the week. U.S. crude oil prices once surged more than 3% in the intraday period, hitting a new high in nearly half a year, but then fell back. Gold fell sharply after successive intraday record highs. At one point, it fell 4% from its high level. In the cryptocurrency market, Bitcoin also experienced a wave of sharp fluctuations. At one point, it plummeted by more than $6,000 and fell below the $66,000 mark.

The Chinese market was also under pressure during the US stock period. The China Securities Index plummeted 4.6%. Among them, Xiaopeng Motor and NIO Auto plummeted by nearly 10% and 8%, respectively. The offshore renminbi also fell sharply in the intraday period, approaching 7...

Translated

15

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)