ahyao

commented on

ahyao

liked

[Brief description] Malaysia's semiconductor stocks will decouple from the US technology sector in 2023. The main reason is that demand has not recovered, and they have not directly benefited from Nvidia and the AI chip industry chain.

After entering 2024, many semiconductor companies said that the inventory removal cycle has come to an end. With the exception of automotive semiconductors, all other semiconductor types have seen a recovery trend.

In February 2024, as MPI handed over better-than-expected financial reports and a positive outlook, another giant, INARI, was also highly anticipated by the market, and the results will be released on February 26.

Judging from the current market capital flow, it seems that the revolving theme of baseball has spread to the foot of the technology sector.

On the auspicious day of 28/2/2024, let's listen to Zeff's in-depth sharing of INARI's performance report and more industry updates! Promise you!

[Mentor] Zeff Tan, Chief Mentor at SHARIX Malaysia, Stock Market Researcher [Join us] Tailored for moomoo users! See you on February 28th at 8:00pm! Want to know the latest developments in the semiconductor industry? Hurry up and invite the shareholders around you to learn together!

[Disclaimer] All opinions expressed in the live stream and video are the independent opinions of SHARIX. moomoo and its affiliates are not responsible for their content and opinions

After entering 2024, many semiconductor companies said that the inventory removal cycle has come to an end. With the exception of automotive semiconductors, all other semiconductor types have seen a recovery trend.

In February 2024, as MPI handed over better-than-expected financial reports and a positive outlook, another giant, INARI, was also highly anticipated by the market, and the results will be released on February 26.

Judging from the current market capital flow, it seems that the revolving theme of baseball has spread to the foot of the technology sector.

On the auspicious day of 28/2/2024, let's listen to Zeff's in-depth sharing of INARI's performance report and more industry updates! Promise you!

[Mentor] Zeff Tan, Chief Mentor at SHARIX Malaysia, Stock Market Researcher [Join us] Tailored for moomoo users! See you on February 28th at 8:00pm! Want to know the latest developments in the semiconductor industry? Hurry up and invite the shareholders around you to learn together!

[Disclaimer] All opinions expressed in the live stream and video are the independent opinions of SHARIX. moomoo and its affiliates are not responsible for their content and opinions

Translated

427

75

ahyao

commented on

ahyao

commented on

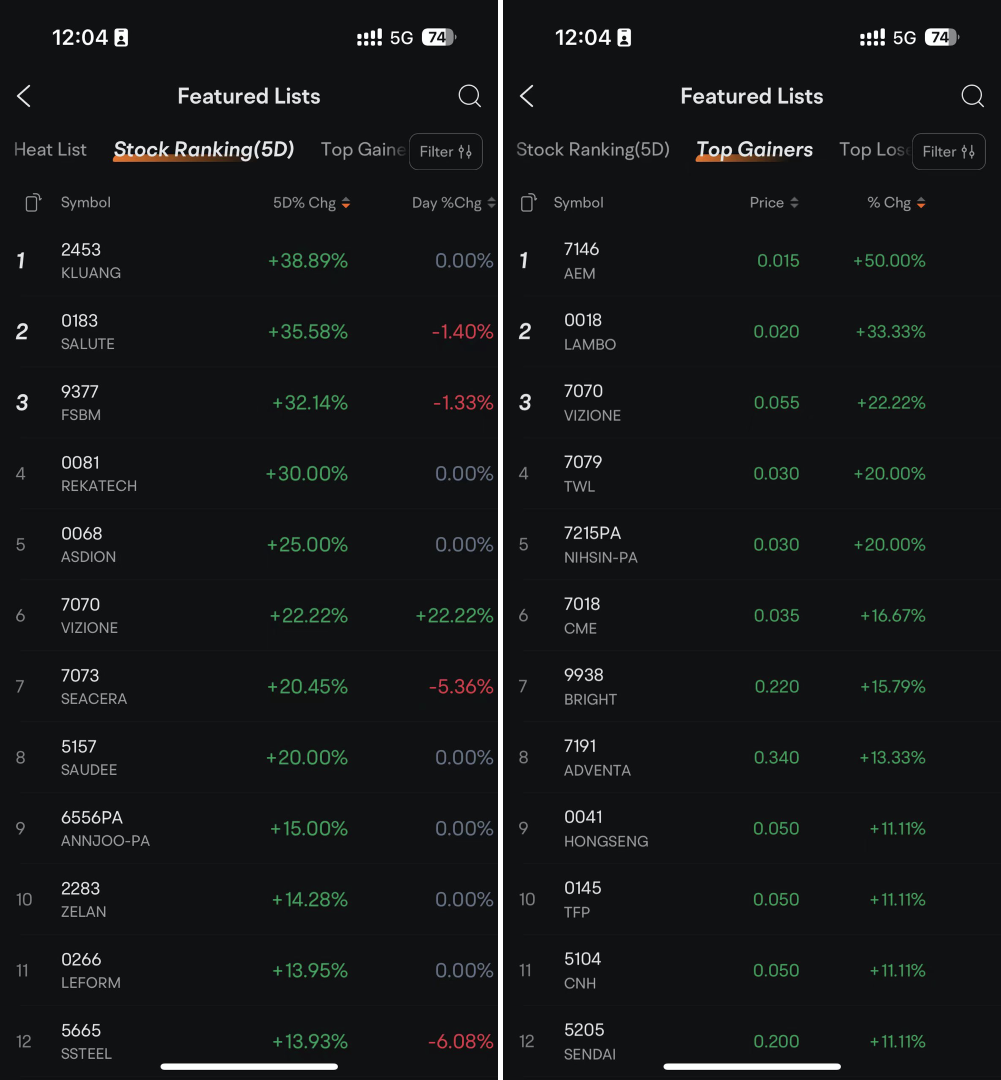

Moomoo is currently hosting a stock paper trading activity in Malaysia that targets local users🔥🔥. Participants can gain a better understanding of the overall market, including stock prices, trading volumes, and other indicators by engaging in paper trades. This method effectively improves trading skills and knowledge, as it allows investors to validate their trading strategies and test their reliability.

In addition to enhancing trading abilitie...

In addition to enhancing trading abilitie...

+5

33

17

ahyao

liked

As we all know, the US and China are the world's two major powers, so they rank in the top 2 in export data. And where are we in Malaysia?? We appear on the left. What I admire about Singapore is that with such a small territory and population, it has more export data than Malaysia.

Find your weaknesses and move on. It is hoped that under the new government, Malaysia can continue to expand and strengthen its exports. Go for it.

Find your weaknesses and move on. It is hoped that under the new government, Malaysia can continue to expand and strengthen its exports. Go for it.

Translated

59

1

ahyao

liked

$Nike(NKE.US$ When we talk about MAGNI, we think of it relying too much on NIKE. FY's single major customer, NIKE, contributed 88% of revenue in 2023, a remarkable proportion. However, in the past two years, the trend between MAGNI and NIKE began to decouple. After the pandemic, NIKE's turnover broke through record highs for 3 consecutive years, growing 37% from the bottom of FY2020.

On the other hand, MAGNI's turnover has been bottlenecked for the past 3 years and has not been able to break through the RM1.23 Bil mark. Over the past 10 years, MAGNI's turnover has continued to grow along with NIKE. The recent stagnation, we presume, is due to the fact that orders given by NIKE to MAGNI in recent years have remained unchanged, and additional orders have been transferred to peers in other countries to diversify the potential risks in the supply chain.

The figure above is an excerpt from MAGNI's annual report. At its peak, net profit reached RM127.186 mil (owning a large sum of money is like selling land), but it fell to RM95.371 mil in the latest fiscal year.

With sales falling 4.8% in the latest quarter, MAGNI handed over a new high of RM32.726 mil net profit for the 10th quarter. Profit Margin, which grew by 36.2% year over year, increased quite a bit.

The increase in margin was mainly due to the company's operating costs falling 6 per year...

On the other hand, MAGNI's turnover has been bottlenecked for the past 3 years and has not been able to break through the RM1.23 Bil mark. Over the past 10 years, MAGNI's turnover has continued to grow along with NIKE. The recent stagnation, we presume, is due to the fact that orders given by NIKE to MAGNI in recent years have remained unchanged, and additional orders have been transferred to peers in other countries to diversify the potential risks in the supply chain.

The figure above is an excerpt from MAGNI's annual report. At its peak, net profit reached RM127.186 mil (owning a large sum of money is like selling land), but it fell to RM95.371 mil in the latest fiscal year.

With sales falling 4.8% in the latest quarter, MAGNI handed over a new high of RM32.726 mil net profit for the 10th quarter. Profit Margin, which grew by 36.2% year over year, increased quite a bit.

The increase in margin was mainly due to the company's operating costs falling 6 per year...

Translated

+1

71

ahyao

voted

China’s economic performance has been gloomy and generally below the market’s consensus. The National Bureau of Statistics of China had released July’s CPI , YoY -0.3% , a slightly bit better than market’s expectation of -0.4% . This is the first time China fell into deflation since early 2021.

Most of the news circulating out there were portraying this set of data badly , but the MoM increment in CPI was neglected by the market.

From the chart abov...

Most of the news circulating out there were portraying this set of data badly , but the MoM increment in CPI was neglected by the market.

From the chart abov...

34

ahyao

liked

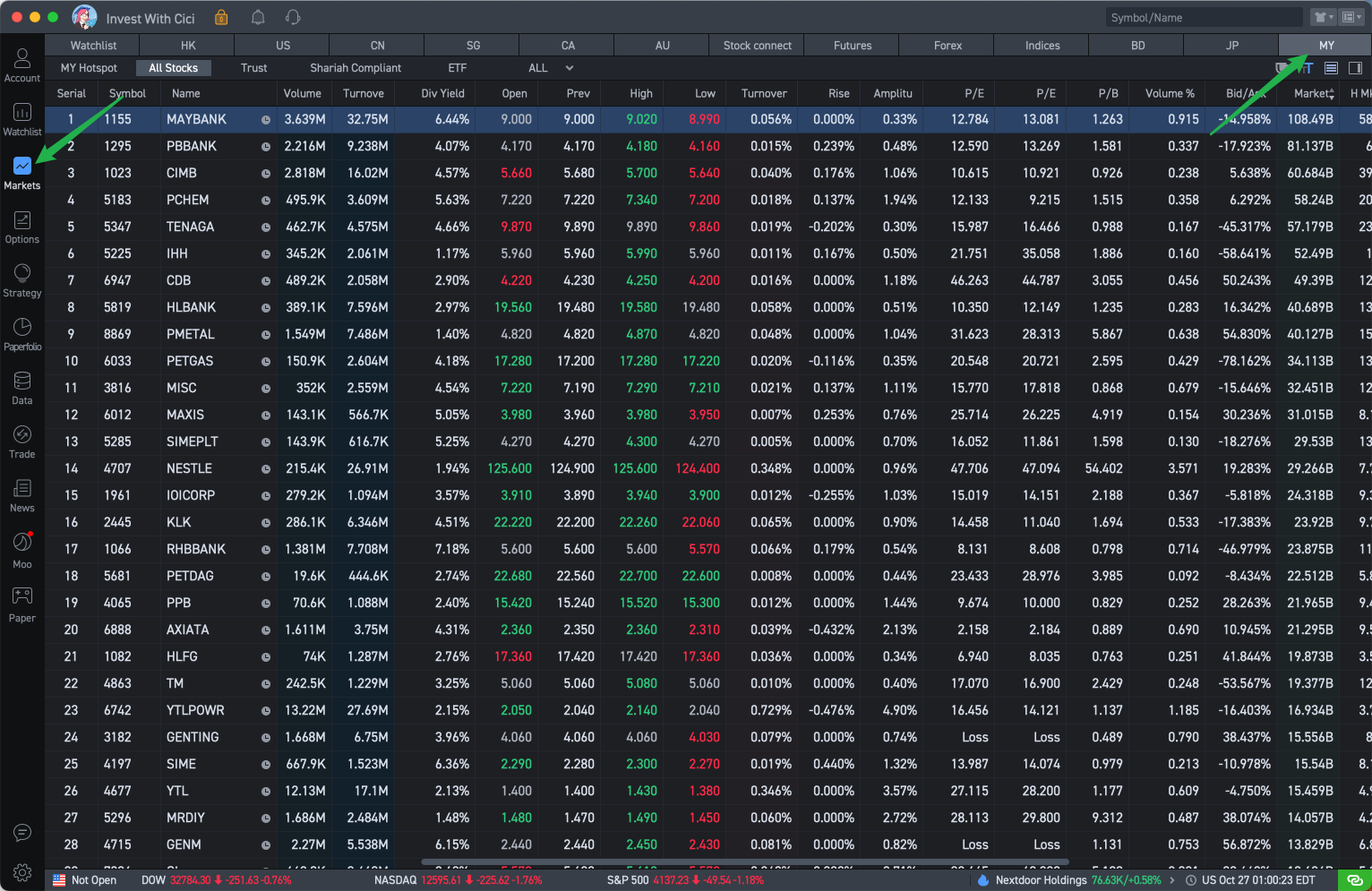

In June, Malaysia's listed companies finally broke the 1,000 mark. Mainly because many companies have taken turns going public recently, and the second half of the year will come one after another.

As of August, the total number of listed companies in Malaysia Stock Exchange was 1,007, and it is expected that 15 or more companies will line up for listing in the next 5 months. In fact, now, after many technology or EMS sectors have surged more than 100% after listing, there will be a correction in the next few months, so there is no need to be too anxious if you can't get an IPO.

I sincerely hope that all newly listed companies will do their best to grow their company, not just to make money by going public. Also, the Moo Moo horse stock market is already online, so everyone can start exploring hard. We will also share more useful features with you in the future.

As of August, the total number of listed companies in Malaysia Stock Exchange was 1,007, and it is expected that 15 or more companies will line up for listing in the next 5 months. In fact, now, after many technology or EMS sectors have surged more than 100% after listing, there will be a correction in the next few months, so there is no need to be too anxious if you can't get an IPO.

I sincerely hope that all newly listed companies will do their best to grow their company, not just to make money by going public. Also, the Moo Moo horse stock market is already online, so everyone can start exploring hard. We will also share more useful features with you in the future.

Translated

37

Hi everyone, newbie Xiaobai started studying online

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

ahyao : let's go

ahyao : GTP

ahyao : What brand of hairspray do you use

ahyao : Is the father of that memory stick back home still there?

ahyao :

View more comments...