71235697Kev

liked

After Omicron hit the world, global stocks and oil prices plunged last Friday. The S&P 500 was last down 2%, while oil futures dropped more than 10%.![]()

![]()

When the stock market is plummeting, some people believe it's "the time to be afraid is when others are greedy."![]()

![]()

Friday's brutal market sell-off is a buying opportunity for both stocks and crypto assets, Anthony Scaramucci of investment firm SkyBridge Capital said.

Scaramucci believes the Federal Reserve is now less likely to tighten monetary policy as aggressively as it had planned because of the pandemic coming again.

The Skybridge Capital boss added that he sees the situation as a"mini March of 2020." Markets saw a steep sell-off as coronavirus first hit the world economy in the spring of last year, after which stocks rose again.

Stocks suffered their biggest falls since 1987 in March 2020, but huge stimulus packages from governments and central banks have since helped set them soaring. The S&P 500 has roughly doubled from its March 2020 low.

"If you believe in the long-term fundamentals as we do, this is the time to be buying," he said.

Do you agree with him? Do you think it's the right time to buy the dip?![]()

![]()

Source: businessinsider

When the stock market is plummeting, some people believe it's "the time to be afraid is when others are greedy."

Friday's brutal market sell-off is a buying opportunity for both stocks and crypto assets, Anthony Scaramucci of investment firm SkyBridge Capital said.

Scaramucci believes the Federal Reserve is now less likely to tighten monetary policy as aggressively as it had planned because of the pandemic coming again.

The Skybridge Capital boss added that he sees the situation as a"mini March of 2020." Markets saw a steep sell-off as coronavirus first hit the world economy in the spring of last year, after which stocks rose again.

Stocks suffered their biggest falls since 1987 in March 2020, but huge stimulus packages from governments and central banks have since helped set them soaring. The S&P 500 has roughly doubled from its March 2020 low.

"If you believe in the long-term fundamentals as we do, this is the time to be buying," he said.

Do you agree with him? Do you think it's the right time to buy the dip?

Source: businessinsider

26

3

71235697Kev

liked

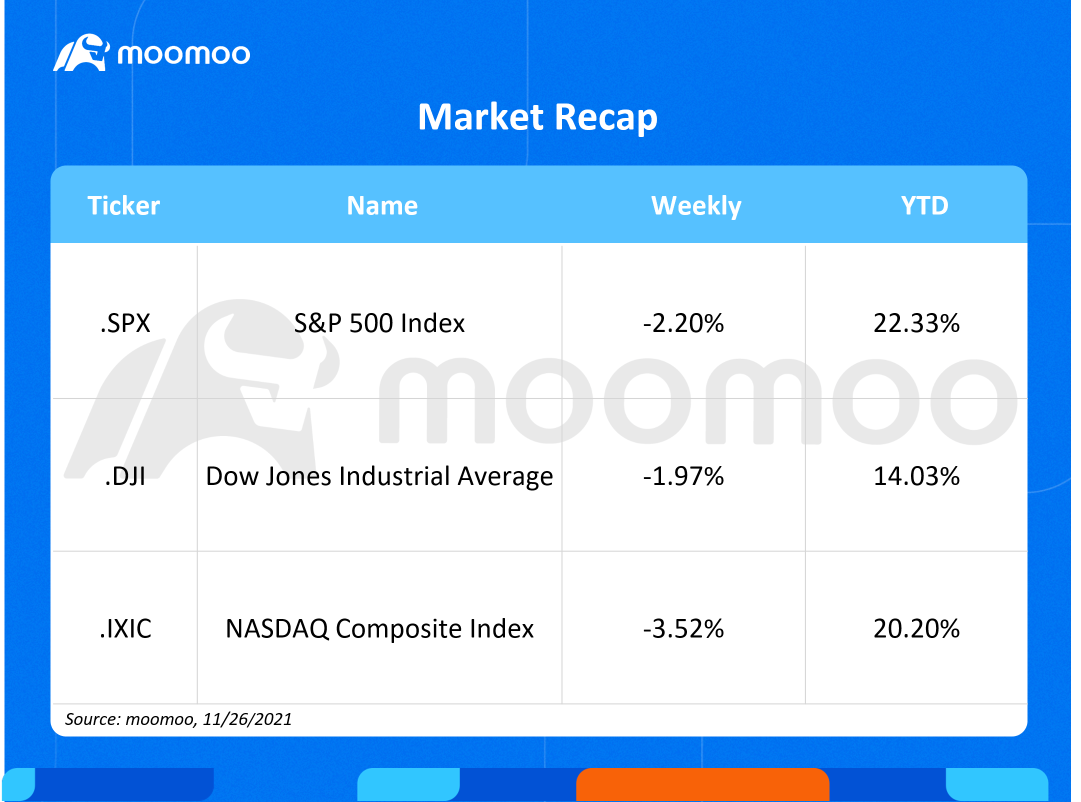

Weekly market recap

Stock futures moved higher in overnight trading Sunday following Friday's big sell-off as investors monitor the latest developments related to the Covid omicron variant.

Futures on the $Dow Jones Industrial Average(.DJI.US$ Industrial Average gained about 160 points, or 0.5%. $S&P 500 Index(.SPX.US$ futures added 0.6% and $Nasdaq Composite Index(.IXIC.US$ 100 futures rose 0.7%.

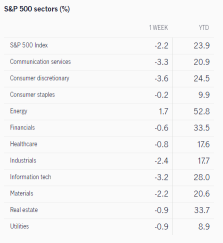

The Dow was down 1.97%. The S&P 500 tumbled 2.20% and the Nasdaq Composite slipped 3.52% last week. The three major indexes were negative last week.

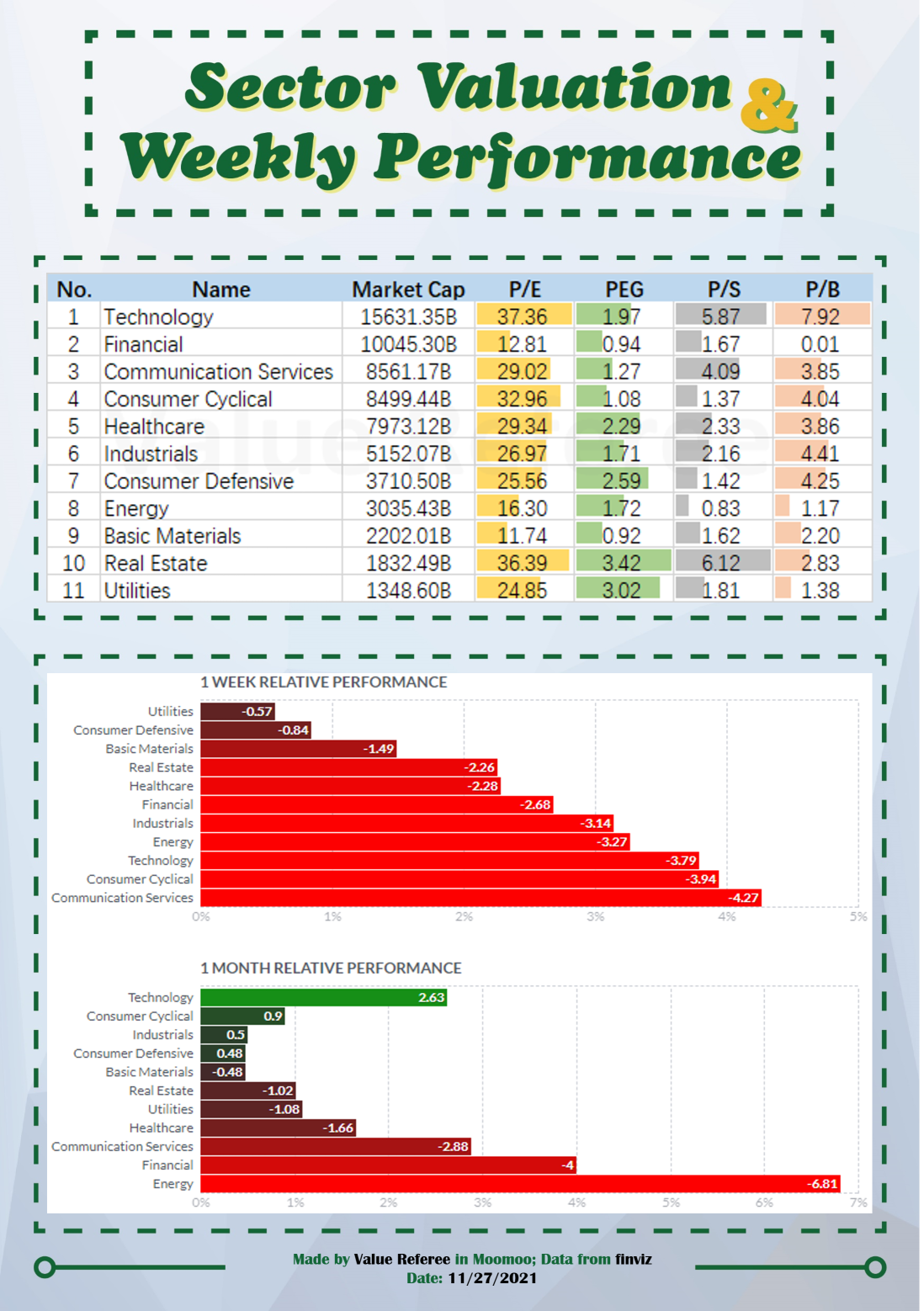

Here's a look at the return of S&P 500 sectors

This week ahead in focus

After a holiday-shortened week, investors will be back in the swing of things amid the Cyber Monday online shopping event. Earnings will be light next week, but there are still some high-profile reports to be seen. On Tuesday, GlobalFoundries, Hewlett Packard Enterprise, NetApp,and Salesforce.com report results. CrowdStrike Holdings, Okta, Snowflake and Splunk report on Wednesday. DocuSign, Dollar General, Kroger, Marvel Technology, Ulta Beauty headline Thursday's Earnings Report.

As for housing market indicators, the National Association of Realtors on Monday released its pending home sales index for October. The consensus estimate is for 117 readings, roughly even with the September figure. On Tuesday, S&P CoreLogic releases the Case-Shiller National Home Price Index for September. Economists have forecast a 19.5% year-over-year gain, down slightly from August's jump of 19.8%.

Economic data releases include the Institute for Supply Management's Chicago Purchasing Managers Index and the Conference Board's Consumer Confidence Index. Both November reports are due on Tuesday. Expectations for the former are for a reading of 68.9, roughly even with October's figures, while the expectation for the latter is to read 110.4, nearly three points lower than October.

Monday 11/29

National Association Realtors releases its Pending Home Sales Index for October. The consensus estimate is for 117 readings, roughly even with the September figure. The index, a forward-looking indicator of home sales based on contract signing, fell 8% year-on-year in September and has declined for four consecutive months from last year's levels.

Tuesday 11/30

$Bank of Nova Scotia(BNS.CA$, $GlobalFoundries(GFS.US$, $Hewlett Packard Enterprise(HPE.US$, $NetApp(NTAP.US$, $Salesforce(CRM.US$, and $Zscaler(ZS.US$ report earnings.

S&P Corelogic For September, Case-Shiller releases the National Home Price Index. Economists forecast a 19.5% year-over-year gain, slightly lower than August's 19.8% jump, the fifth consecutive record increase for the index.

Institute for Supply Management releases its Chicago Purchasing Managers Index for November. The reading is expected to be 68.9, roughly even with the October figures. The index is slightly below its record peak, which was hit in May.

Conference board releases its Consumer Confidence Index for November. The consensus call is for a 110.4 reading, down about three points from October. The index is sharply down from its highs since reaching this summer, due to inflation concerns.

Wednesday 12/1

$CrowdStrike(CRWD.US$, $Okta(OKTA.US$, $PVH Corp(PVH.US$, $Royal Bank of Canada(RY.CA$, $Snowflake(SNOW.US$, $Splunk(SPLK.US$ and $Synopsys(SNPS.US$ report quarterly results.

ADP release Its national employment report for November. Private sector employment is expected to increase to 510,000 jobs after an increase of 571,000 in October.

Census Bureau Reports data on construction expenses. Economists forecast 1% month-over-month growth for the construction outlay, a seasonally adjusted annual rate of $1.59 trillion.

Thursday, 12/2

$Canadian Imperial Bank of Commerce(CM.CA$, $DocuSign(DOCU.US$, $Dollar General(DG.US$, $The Kroger(KR.US$, $Marvell Technology(MRVL.US$, $The Toronto-Dominion Bank(TD.CA$, and $Ulta Beauty(ULTA.US$ holds conference calls to discuss earnings.

Labour Department Preliminary jobless claims report for the week ending November 27. Claims hit a 52-year low in last week's report, and the four-week average is now slightly higher than pre-pandemic levels.

Friday 12/3

Bureau of Labor Statistics Releases jobs report for November. Economists have forecast 525,000 benefits for non-farm payrolls, and for the unemployment rate to tick up a tenth of a percentage point to 4.5%.

$Bank of Montreal(BMO.CA$ reports fiscal fourth quarter 2021 results.

ISM issues Its services PMI for November. The consensus estimate is for 65 readings, versus October's 66.7, which was a record for the index.

Source: CNBC, Dow Jones Newswires, jhinvestments

Stock futures moved higher in overnight trading Sunday following Friday's big sell-off as investors monitor the latest developments related to the Covid omicron variant.

Futures on the $Dow Jones Industrial Average(.DJI.US$ Industrial Average gained about 160 points, or 0.5%. $S&P 500 Index(.SPX.US$ futures added 0.6% and $Nasdaq Composite Index(.IXIC.US$ 100 futures rose 0.7%.

The Dow was down 1.97%. The S&P 500 tumbled 2.20% and the Nasdaq Composite slipped 3.52% last week. The three major indexes were negative last week.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

After a holiday-shortened week, investors will be back in the swing of things amid the Cyber Monday online shopping event. Earnings will be light next week, but there are still some high-profile reports to be seen. On Tuesday, GlobalFoundries, Hewlett Packard Enterprise, NetApp,and Salesforce.com report results. CrowdStrike Holdings, Okta, Snowflake and Splunk report on Wednesday. DocuSign, Dollar General, Kroger, Marvel Technology, Ulta Beauty headline Thursday's Earnings Report.

As for housing market indicators, the National Association of Realtors on Monday released its pending home sales index for October. The consensus estimate is for 117 readings, roughly even with the September figure. On Tuesday, S&P CoreLogic releases the Case-Shiller National Home Price Index for September. Economists have forecast a 19.5% year-over-year gain, down slightly from August's jump of 19.8%.

Economic data releases include the Institute for Supply Management's Chicago Purchasing Managers Index and the Conference Board's Consumer Confidence Index. Both November reports are due on Tuesday. Expectations for the former are for a reading of 68.9, roughly even with October's figures, while the expectation for the latter is to read 110.4, nearly three points lower than October.

Monday 11/29

National Association Realtors releases its Pending Home Sales Index for October. The consensus estimate is for 117 readings, roughly even with the September figure. The index, a forward-looking indicator of home sales based on contract signing, fell 8% year-on-year in September and has declined for four consecutive months from last year's levels.

Tuesday 11/30

$Bank of Nova Scotia(BNS.CA$, $GlobalFoundries(GFS.US$, $Hewlett Packard Enterprise(HPE.US$, $NetApp(NTAP.US$, $Salesforce(CRM.US$, and $Zscaler(ZS.US$ report earnings.

S&P Corelogic For September, Case-Shiller releases the National Home Price Index. Economists forecast a 19.5% year-over-year gain, slightly lower than August's 19.8% jump, the fifth consecutive record increase for the index.

Institute for Supply Management releases its Chicago Purchasing Managers Index for November. The reading is expected to be 68.9, roughly even with the October figures. The index is slightly below its record peak, which was hit in May.

Conference board releases its Consumer Confidence Index for November. The consensus call is for a 110.4 reading, down about three points from October. The index is sharply down from its highs since reaching this summer, due to inflation concerns.

Wednesday 12/1

$CrowdStrike(CRWD.US$, $Okta(OKTA.US$, $PVH Corp(PVH.US$, $Royal Bank of Canada(RY.CA$, $Snowflake(SNOW.US$, $Splunk(SPLK.US$ and $Synopsys(SNPS.US$ report quarterly results.

ADP release Its national employment report for November. Private sector employment is expected to increase to 510,000 jobs after an increase of 571,000 in October.

Census Bureau Reports data on construction expenses. Economists forecast 1% month-over-month growth for the construction outlay, a seasonally adjusted annual rate of $1.59 trillion.

Thursday, 12/2

$Canadian Imperial Bank of Commerce(CM.CA$, $DocuSign(DOCU.US$, $Dollar General(DG.US$, $The Kroger(KR.US$, $Marvell Technology(MRVL.US$, $The Toronto-Dominion Bank(TD.CA$, and $Ulta Beauty(ULTA.US$ holds conference calls to discuss earnings.

Labour Department Preliminary jobless claims report for the week ending November 27. Claims hit a 52-year low in last week's report, and the four-week average is now slightly higher than pre-pandemic levels.

Friday 12/3

Bureau of Labor Statistics Releases jobs report for November. Economists have forecast 525,000 benefits for non-farm payrolls, and for the unemployment rate to tick up a tenth of a percentage point to 4.5%.

$Bank of Montreal(BMO.CA$ reports fiscal fourth quarter 2021 results.

ISM issues Its services PMI for November. The consensus estimate is for 65 readings, versus October's 66.7, which was a record for the index.

Source: CNBC, Dow Jones Newswires, jhinvestments

+2

85

5

71235697Kev

liked and commented on

U.S. futures rise, oil up as traders weigh omicron

U.S. equity futures and crude oil rose Monday as traders weighed the possible impact of the omicron coronavirus strain on global economic reopening. Currency markets stabilized after Friday's volatility.

Equity futures for Japan advanced, while Australian shares slid at the open and oil jumped back above $70 a barrel. The $S&P 500 Index(.SPX.US$ last week had its worst post-Thanksgiving performance since 1941 and the yield on 10-year Treasuries slid the most since March 2020.

El Salvador 'bought the dip,' acquiring 100 more bitcoin

El Salvador President Nayib Bukele said the Central American country had taken advantage the 7.7% decline in Bitcoin on Friday to purchase 100 more of the coins.

Dollar bonds from El Salvador are among the worst-performing in emerging markets so far this month, lagging only defaulted Lebanese debt, according to data compiled from a Bloomberg index.

Online travel stocks fall most since March 2020 on variant fears

Shares of online travel companies, including $Booking Holdings(BKNG.US$ and $Expedia(EXPE.US$, fell the most since the earliest days of the Covid-19 pandemic over worries about a new, heavily-mutated variant of the virus.

Expedia plummeted as much as 11.9%, the most since March 2020, placing it among the 10-worst-performing stocks in the S&P 500 Friday, according to data compiled by Bloomberg. Booking fell as much as 9.6%.

Moderna says an omicron variant vaccine could be ready in early 2022

$Moderna(MRNA.US$'s Chief Medical Officer Paul Burton said Sunday the vaccine maker could roll out a reformulated vaccine against the omicron coronavirus variant early next year. It's not clear whether new formulations will be needed, or if current Covid vaccinations will provide protection against the new variant that has begun to pop up around the globe.

Omicron was classified as a "variant of concern" by the WHO last week.

Black Friday shopping in stores drops 28% from pre-pandemic levels as shoppers spread spending throughout the season

Traffic at retail stores on Black Friday dropped 28.3% compared with 2019 levels, according to preliminary data from Sensormatic Solutions. Traffic was up 47.5% compared with year-ago levels, Sensormatic said.

"It's clear shoppers are shopping earlier this season, just as they did last season," said Brian Field, senior director of global retail consulting at Sensormatic. Online, retailers rang up $8.9 billion in sales on Black Friday, down from the record of about $9 billion spent on the Friday after Thanksgiving a year earlier, according to data from Adobe Analytics.

Shoppers are buying from resale retailers more than ever

The resale market is booming, and by 2023 is expected to reach $51 billion. That has been fueled by shifting consumer demands, from shopping in more sustainable ways as well as trying to secure hard-to-find luxury items.

Resale platforms like The RealReal and $ThredUp(TDUP.US$ have benefited, and other traditional retailers like $Macy's(M.US$ and J.C. Penney are finding their own ways in.

Black Friday rout shows dangers of margin borrowing

Friday's global retreat from riskier assets exposes a vulnerability of the broad market advance of the past year and a half: the rising use of leverage, or borrowed money.

Margin borrowings in October were up 42% from a year earlier to $935.9 billion, according to data from the Financial Industry Regulatory Authority, Wall Street’s self-regulator. Meanwhile a measure of cash holdings among individual investors fell to 46% of margin balances, Mr. Goepfert said, the lowest reading in data going back to 1997.

Hertz-Tesla deal signals broad shift to EVs for rental-car companies

The rental-car industry, long a big bulk-purchaser of new models in the car business, is sharpening efforts to add , the latest in a broader global shift among companies embracing greener technologies to cut their greenhouse-gas emissions.

Two of the biggest car-rental firms— $Hertz Global(HTZ.US$ and $Avis Budget(CAR.US$—recently revealed plans to expand their plug-in offerings as the auto industry rolls out more options for drivers looking to avoid gasoline.

Source: Bloomberg, WSJ, CNBC

U.S. equity futures and crude oil rose Monday as traders weighed the possible impact of the omicron coronavirus strain on global economic reopening. Currency markets stabilized after Friday's volatility.

Equity futures for Japan advanced, while Australian shares slid at the open and oil jumped back above $70 a barrel. The $S&P 500 Index(.SPX.US$ last week had its worst post-Thanksgiving performance since 1941 and the yield on 10-year Treasuries slid the most since March 2020.

El Salvador 'bought the dip,' acquiring 100 more bitcoin

El Salvador President Nayib Bukele said the Central American country had taken advantage the 7.7% decline in Bitcoin on Friday to purchase 100 more of the coins.

Dollar bonds from El Salvador are among the worst-performing in emerging markets so far this month, lagging only defaulted Lebanese debt, according to data compiled from a Bloomberg index.

Online travel stocks fall most since March 2020 on variant fears

Shares of online travel companies, including $Booking Holdings(BKNG.US$ and $Expedia(EXPE.US$, fell the most since the earliest days of the Covid-19 pandemic over worries about a new, heavily-mutated variant of the virus.

Expedia plummeted as much as 11.9%, the most since March 2020, placing it among the 10-worst-performing stocks in the S&P 500 Friday, according to data compiled by Bloomberg. Booking fell as much as 9.6%.

Moderna says an omicron variant vaccine could be ready in early 2022

$Moderna(MRNA.US$'s Chief Medical Officer Paul Burton said Sunday the vaccine maker could roll out a reformulated vaccine against the omicron coronavirus variant early next year. It's not clear whether new formulations will be needed, or if current Covid vaccinations will provide protection against the new variant that has begun to pop up around the globe.

Omicron was classified as a "variant of concern" by the WHO last week.

Black Friday shopping in stores drops 28% from pre-pandemic levels as shoppers spread spending throughout the season

Traffic at retail stores on Black Friday dropped 28.3% compared with 2019 levels, according to preliminary data from Sensormatic Solutions. Traffic was up 47.5% compared with year-ago levels, Sensormatic said.

"It's clear shoppers are shopping earlier this season, just as they did last season," said Brian Field, senior director of global retail consulting at Sensormatic. Online, retailers rang up $8.9 billion in sales on Black Friday, down from the record of about $9 billion spent on the Friday after Thanksgiving a year earlier, according to data from Adobe Analytics.

Shoppers are buying from resale retailers more than ever

The resale market is booming, and by 2023 is expected to reach $51 billion. That has been fueled by shifting consumer demands, from shopping in more sustainable ways as well as trying to secure hard-to-find luxury items.

Resale platforms like The RealReal and $ThredUp(TDUP.US$ have benefited, and other traditional retailers like $Macy's(M.US$ and J.C. Penney are finding their own ways in.

Black Friday rout shows dangers of margin borrowing

Friday's global retreat from riskier assets exposes a vulnerability of the broad market advance of the past year and a half: the rising use of leverage, or borrowed money.

Margin borrowings in October were up 42% from a year earlier to $935.9 billion, according to data from the Financial Industry Regulatory Authority, Wall Street’s self-regulator. Meanwhile a measure of cash holdings among individual investors fell to 46% of margin balances, Mr. Goepfert said, the lowest reading in data going back to 1997.

Hertz-Tesla deal signals broad shift to EVs for rental-car companies

The rental-car industry, long a big bulk-purchaser of new models in the car business, is sharpening efforts to add , the latest in a broader global shift among companies embracing greener technologies to cut their greenhouse-gas emissions.

Two of the biggest car-rental firms— $Hertz Global(HTZ.US$ and $Avis Budget(CAR.US$—recently revealed plans to expand their plug-in offerings as the auto industry rolls out more options for drivers looking to avoid gasoline.

Source: Bloomberg, WSJ, CNBC

102

10

71235697Kev

liked and commented on

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)