高贵的阿德莱德

commented on

3

6

高贵的阿德莱德

commented on

$Starbucks(SBUX.US$

$CVS Health(CVS.US$

$Estee Lauder(EL.US$

Previously, after standing on the 200-day average, my butt wasn't hot, and I started jumping from the building again.

Starbucks and EL can also be blamed for the slump in business in China. What the hell is CVS doing? I haven't read financial reports, but judging from this stock price trend, I don't need to read earnings reports anymore; just stay away.

Although the stock market's rebound was blocked and may continue to decline or move sideways, it is currently still in a bull market. In a bull market, instead of bottoming out those weak stocks that are still in the middle of a bear market (stock prices don't stand at the 200-day average), it is better to buy bullish stocks that have risen too much and are currently falling due to the return of the mean.

For example $Super Micro Computer(SMCI.US$ Even though it has dropped quite a bit, I have friends $NVIDIA(NVDA.US$ There was no problem with the performance, but the only problem was that it had increased too much before. Now, as long as the stock price falls back to a reasonable valuation, there will be a chance to take off again in the future.

I've said it before, actually $Amazon(AMZN.US$ Financial reports are the most important. There is no dispute that this round of bull market is driven by AI, so the profitability of these big technologies and their investment in AI are the most important factors that determine the height of this bull market.

Therefore, given that Big Tech is very strong (Meta is a weak stock; everything else is strong), I think NVD...

$CVS Health(CVS.US$

$Estee Lauder(EL.US$

Previously, after standing on the 200-day average, my butt wasn't hot, and I started jumping from the building again.

Starbucks and EL can also be blamed for the slump in business in China. What the hell is CVS doing? I haven't read financial reports, but judging from this stock price trend, I don't need to read earnings reports anymore; just stay away.

Although the stock market's rebound was blocked and may continue to decline or move sideways, it is currently still in a bull market. In a bull market, instead of bottoming out those weak stocks that are still in the middle of a bear market (stock prices don't stand at the 200-day average), it is better to buy bullish stocks that have risen too much and are currently falling due to the return of the mean.

For example $Super Micro Computer(SMCI.US$ Even though it has dropped quite a bit, I have friends $NVIDIA(NVDA.US$ There was no problem with the performance, but the only problem was that it had increased too much before. Now, as long as the stock price falls back to a reasonable valuation, there will be a chance to take off again in the future.

I've said it before, actually $Amazon(AMZN.US$ Financial reports are the most important. There is no dispute that this round of bull market is driven by AI, so the profitability of these big technologies and their investment in AI are the most important factors that determine the height of this bull market.

Therefore, given that Big Tech is very strong (Meta is a weak stock; everything else is strong), I think NVD...

Translated

9

3

$Tesla(TSLA.US$

Some say China has saved Tesla once again. I agree with the first half of this statement; I disagree with the latter half. I think: China saved Musk, not Tesla.

Behind the sharp rise in TSLA's stock price is the sharp rise in Lao Ma's own worth. As for Tesla, there is a problem that we all understand; it's impossible that Lao Ma doesn't understand it:

Why did China's electric vehicle industry explode like a blowout after 2019? What major events happened in the electric vehicle industry in 2019?

Moreover, it is impossible for Lao Ma to be unclear about the general context of Sino-US relations. As an American company, doubling down on China can only be described as a risky move. In my opinion, the safer approach would be to set up a production plant in Mexico as soon as possible. Also, if Mexico were as rich as Canada, the problem of illegal immigration would automatically disappear.

When investors begin to calm down from their fervor, they will begin to think about the deep-seated problems caused by Lao Ma's bets on China. Tesla's stock price will also return to reasonable after a few days of overheating.

I might consider the high throw and low absorption band in the 160-200 range. But currently I don't plan to hold Tesla for a long time, and I don't have any faith. All I know is that Cyber Truck has been having problems recently. Whether the car I ordered two years ago can be delivered within the next three years is a question.

Also, at this price, it's not very appealing to me. If there is a shortage of electricity in the future due to AI computing and Bitcoin mining, and as a result, electricity is more expensive than gasoline, what is the plan for me to drive an electric car? At that time, if tax c...

Some say China has saved Tesla once again. I agree with the first half of this statement; I disagree with the latter half. I think: China saved Musk, not Tesla.

Behind the sharp rise in TSLA's stock price is the sharp rise in Lao Ma's own worth. As for Tesla, there is a problem that we all understand; it's impossible that Lao Ma doesn't understand it:

Why did China's electric vehicle industry explode like a blowout after 2019? What major events happened in the electric vehicle industry in 2019?

Moreover, it is impossible for Lao Ma to be unclear about the general context of Sino-US relations. As an American company, doubling down on China can only be described as a risky move. In my opinion, the safer approach would be to set up a production plant in Mexico as soon as possible. Also, if Mexico were as rich as Canada, the problem of illegal immigration would automatically disappear.

When investors begin to calm down from their fervor, they will begin to think about the deep-seated problems caused by Lao Ma's bets on China. Tesla's stock price will also return to reasonable after a few days of overheating.

I might consider the high throw and low absorption band in the 160-200 range. But currently I don't plan to hold Tesla for a long time, and I don't have any faith. All I know is that Cyber Truck has been having problems recently. Whether the car I ordered two years ago can be delivered within the next three years is a question.

Also, at this price, it's not very appealing to me. If there is a shortage of electricity in the future due to AI computing and Bitcoin mining, and as a result, electricity is more expensive than gasoline, what is the plan for me to drive an electric car? At that time, if tax c...

Translated

4

1

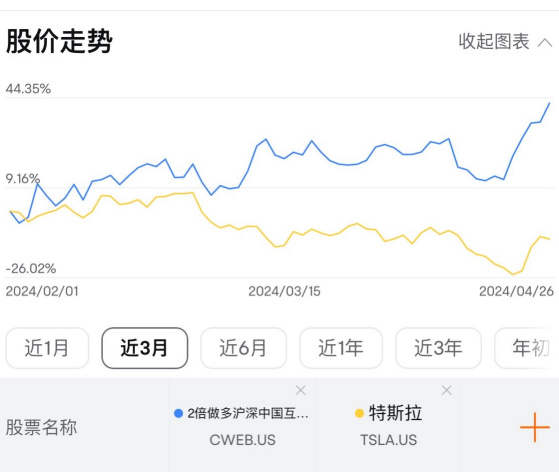

Moreover, it also significantly outperformed the China Securities Index this year![]()

$Tesla(TSLA.US$

$Direxion Daily CSI China Internet Index Bull 2x Shares ETF(CWEB.US$

$Tesla(TSLA.US$

$Direxion Daily CSI China Internet Index Bull 2x Shares ETF(CWEB.US$

Translated

2

$NVIDIA(NVDA.US$

$Amazon(AMZN.US$

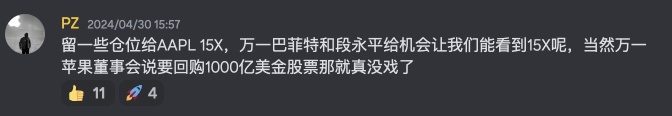

Currently, Big Tech's earnings report is almost the same; it's just AMZN and AAPL. AAPL is not on the AI track. Even if the financial report explodes, it won't have much impact on NVDA. The main thing is AMZN.

Other big AI technologies are currently quite strong. Among them, Meta is strong; even if the stock price is broken, they still have to buy chips. Goog and MSFT are pretty good; if you have money, you can keep buying chips. So it's just AMZN.

However $Super Micro Computer(SMCI.US$ They are also worthy of attention; after all, they are good friends. Other financial reports, including amd, should have little impact. As for NVDA's own financial report, it's still early, so don't worry about it for now.

I hope AMZN and SMCI's financial reports will satisfy Wall Street and get the stock market out of this period of decline.

$Amazon(AMZN.US$

Currently, Big Tech's earnings report is almost the same; it's just AMZN and AAPL. AAPL is not on the AI track. Even if the financial report explodes, it won't have much impact on NVDA. The main thing is AMZN.

Other big AI technologies are currently quite strong. Among them, Meta is strong; even if the stock price is broken, they still have to buy chips. Goog and MSFT are pretty good; if you have money, you can keep buying chips. So it's just AMZN.

However $Super Micro Computer(SMCI.US$ They are also worthy of attention; after all, they are good friends. Other financial reports, including amd, should have little impact. As for NVDA's own financial report, it's still early, so don't worry about it for now.

I hope AMZN and SMCI's financial reports will satisfy Wall Street and get the stock market out of this period of decline.

Translated

3

2

高贵的阿德莱德

commented on

$Tesla(TSLA.US$

Less than a week later, Tesla is stealing headlines again.

If my 160 call didn't sell, now it's not hot pot money![]()

![]()

![]()

But it doesn't matter. Ordinary people can't make this kind of money; even if they do, it's because of luck.

If FSD can be successfully approved in China, it would definitely be a good thing, but I'm curious exactly how many paying users it will have. Road conditions in China are much more complicated than in the US. The congested roads, aggressive driving style, serious lack of courtesy, and a large number of illegal non-motor vehicles are also quite a challenge to the FSD. But then again, even though I'm an old driver, I really don't dare to drive in China. If I need to drive home, I probably really need to rent a Tesla with an FSD![]()

Get back to business. My current opinion on Tesla: At around 180, probably between 160 and 200, it fluctuates widely and continuously digests the trap above. Concentrate your chips around 180, then choose a direction to break through. This direction depends not only on Tesla itself, but also on the macro environment and Sino-US relations. It is currently impossible to predict. But if you choose to go up at that time, the increase will not be less than 50%.

If you like the band, you can play by throwing small positions high and low at this stage. If you don't like it, just wait for a breakthrough later, and it will take a huge amount of money.

Less than a week later, Tesla is stealing headlines again.

If my 160 call didn't sell, now it's not hot pot money

But it doesn't matter. Ordinary people can't make this kind of money; even if they do, it's because of luck.

If FSD can be successfully approved in China, it would definitely be a good thing, but I'm curious exactly how many paying users it will have. Road conditions in China are much more complicated than in the US. The congested roads, aggressive driving style, serious lack of courtesy, and a large number of illegal non-motor vehicles are also quite a challenge to the FSD. But then again, even though I'm an old driver, I really don't dare to drive in China. If I need to drive home, I probably really need to rent a Tesla with an FSD

Get back to business. My current opinion on Tesla: At around 180, probably between 160 and 200, it fluctuates widely and continuously digests the trap above. Concentrate your chips around 180, then choose a direction to break through. This direction depends not only on Tesla itself, but also on the macro environment and Sino-US relations. It is currently impossible to predict. But if you choose to go up at that time, the increase will not be less than 50%.

If you like the band, you can play by throwing small positions high and low at this stage. If you don't like it, just wait for a breakthrough later, and it will take a huge amount of money.

Translated

3

6

高贵的阿德莱德

commented on

$Alphabet-C(GOOG.US$

I was really shocked by this wave of earnings. Google tells everyone that I'm still an older brother, and I haven't become a younger brother! (Idiom: AI is being surpassed by Microsoft)

I used to be bullish on Goog from 136-140, bought it, held it, and sold it when it was around 156. Unfortunately, I went short. But it doesn't matter; I believe this wave of gains is only the beginning, not the end. After all, the reason why my brother's stock has always been tepid is to question: has the search business been taken away by AI? Can the cloud business have a bigger share of the competition with AWS and Azure? Most importantly, has AI already been greatly surpassed by Microsoft?

An earnings report used facts to respond to investors' questions. Google has also gone back from being underrated to being reasonable.

My biggest feeling about this financial report: the overvalued ones fell, the underestimated jumped up, and the oversold ones skyrocketed. It is a reasonable trend of the bull market to adjust and accumulate energy. Everything has returned to a reasonable price, which is conducive to continued growth in the future. I predict, $Amazon(AMZN.US$ with $Apple(AAPL.US$ The same will be true of financial reports. As for Brother Hao $NVIDIA(NVDA.US$ It will still be the most heavyweight financial report on the market. It will determine the subsequent trend of AI and all technology stocks. Currently in turmoil, I chose to wait for an opportunity.

Today's operations: $Microsoft(MSFT.US$ I sold it, earned a few points, and replaced all positions $Alphabet-C(GOOG.US$ ! Microsoft fell back after being blocked, at...

I was really shocked by this wave of earnings. Google tells everyone that I'm still an older brother, and I haven't become a younger brother! (Idiom: AI is being surpassed by Microsoft)

I used to be bullish on Goog from 136-140, bought it, held it, and sold it when it was around 156. Unfortunately, I went short. But it doesn't matter; I believe this wave of gains is only the beginning, not the end. After all, the reason why my brother's stock has always been tepid is to question: has the search business been taken away by AI? Can the cloud business have a bigger share of the competition with AWS and Azure? Most importantly, has AI already been greatly surpassed by Microsoft?

An earnings report used facts to respond to investors' questions. Google has also gone back from being underrated to being reasonable.

My biggest feeling about this financial report: the overvalued ones fell, the underestimated jumped up, and the oversold ones skyrocketed. It is a reasonable trend of the bull market to adjust and accumulate energy. Everything has returned to a reasonable price, which is conducive to continued growth in the future. I predict, $Amazon(AMZN.US$ with $Apple(AAPL.US$ The same will be true of financial reports. As for Brother Hao $NVIDIA(NVDA.US$ It will still be the most heavyweight financial report on the market. It will determine the subsequent trend of AI and all technology stocks. Currently in turmoil, I chose to wait for an opportunity.

Today's operations: $Microsoft(MSFT.US$ I sold it, earned a few points, and replaced all positions $Alphabet-C(GOOG.US$ ! Microsoft fell back after being blocked, at...

Translated

10

13

高贵的阿德莱德

commented on

$Microsoft(MSFT.US$

After today's preventative decline, the trend after the earnings report became confusing.

It fell 6% to the 370 support level. In the future, you can seek to stop the decline and rebound, or you can break the position and continue to fall

It rose 6% to 415, which happened to be at MA20. In the future, you can try to break through the rise or fall back if blocked

It seems that the power of space has reached a balance here, which is really interesting![]()

![]()

![]()

With this trend, I don't need to gamble with options. However, I drastically reduced my positions around 415 a few days ago because Microsoft broke down. According to the left-right fight theory, I can now buy back some positions in small quantities. It's equivalent to reducing the cost of doing it. So I should be buying some today.

After today's preventative decline, the trend after the earnings report became confusing.

It fell 6% to the 370 support level. In the future, you can seek to stop the decline and rebound, or you can break the position and continue to fall

It rose 6% to 415, which happened to be at MA20. In the future, you can try to break through the rise or fall back if blocked

It seems that the power of space has reached a balance here, which is really interesting

With this trend, I don't need to gamble with options. However, I drastically reduced my positions around 415 a few days ago because Microsoft broke down. According to the left-right fight theory, I can now buy back some positions in small quantities. It's equivalent to reducing the cost of doing it. So I should be buying some today.

Translated

4

3

高贵的阿德莱德

commented on

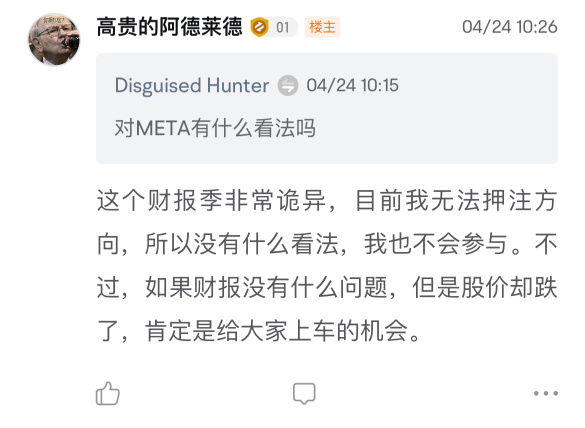

$Meta Platforms(META.US$

This wave of decline in Meta has reversed an island pattern. I call this pattern Wang Ba Gaizi 🐢, which is a very strong bearish pattern. If you want to destroy it, you usually need to do another island-shaped reversal (jump back to the top); otherwise, it can be said that Wang Ba Lai is actually hammered.

With such a huge lid, today's decline is only the beginning, not the end. So I'm not saying I'm going to check it out today, ha. The reason I'm so excited is that I saw an opportunity for a drastic retracement, giving this person who didn't get on the bus a chance to get back on the bus.

First, there were no chips in the previous jump, so how did you go up and how did you get out.

Then, look for strong support below. However, it soared all the way up until now, and there really wasn't any strong support![]() The probability of getting to the beginning of 3 is very high.

The probability of getting to the beginning of 3 is very high.

The most optimistic one is to hold the 400 integer mark. It shows that the overall mood is optimistic and full of enthusiasm. Based on current market sentiment, this probability is unlikely.

More optimistic. The 200-day average is around 370-380. Mean regression.

If not so optimistic, the sideways fluctuation range is at the top of the range, around 330-340. That's an underestimate.

In the most pessimistic terms, the sideways market fluctuated at the lower end, around 300-310, which is seriously underestimated. This can't get any lower unless the general market returns to a bear market.

Also, I chose to enter on the right.

However, if I were to pick a stock to bottom recently, I would still prefer Brother Gu $NVIDIA(NVDA.US$

This wave of decline in Meta has reversed an island pattern. I call this pattern Wang Ba Gaizi 🐢, which is a very strong bearish pattern. If you want to destroy it, you usually need to do another island-shaped reversal (jump back to the top); otherwise, it can be said that Wang Ba Lai is actually hammered.

With such a huge lid, today's decline is only the beginning, not the end. So I'm not saying I'm going to check it out today, ha. The reason I'm so excited is that I saw an opportunity for a drastic retracement, giving this person who didn't get on the bus a chance to get back on the bus.

First, there were no chips in the previous jump, so how did you go up and how did you get out.

Then, look for strong support below. However, it soared all the way up until now, and there really wasn't any strong support

The most optimistic one is to hold the 400 integer mark. It shows that the overall mood is optimistic and full of enthusiasm. Based on current market sentiment, this probability is unlikely.

More optimistic. The 200-day average is around 370-380. Mean regression.

If not so optimistic, the sideways fluctuation range is at the top of the range, around 330-340. That's an underestimate.

In the most pessimistic terms, the sideways market fluctuated at the lower end, around 300-310, which is seriously underestimated. This can't get any lower unless the general market returns to a bear market.

Also, I chose to enter on the right.

However, if I were to pick a stock to bottom recently, I would still prefer Brother Gu $NVIDIA(NVDA.US$

Translated

7

4

高贵的阿德莱德

commented on

The picture is from yesterday's post. Keep the view unchanged today.

What is wrong with the financial report? The slowdown in growth is reasonable. With such a large base, how can it grow so easily. Capital expenditure, is the low cost of efficiency going back to burning money again? It shouldn't be enough, but layout AI will definitely continue to burn money.

So I plan to wait until the stock price falls into place, at least after exploiting leveraged speculation, and when the 10-year interest rate stops rising, and wait for an opportunity to get on the bus.

$Meta Platforms(META.US$

What is wrong with the financial report? The slowdown in growth is reasonable. With such a large base, how can it grow so easily. Capital expenditure, is the low cost of efficiency going back to burning money again? It shouldn't be enough, but layout AI will definitely continue to burn money.

So I plan to wait until the stock price falls into place, at least after exploiting leveraged speculation, and when the 10-year interest rate stops rising, and wait for an opportunity to get on the bus.

$Meta Platforms(META.US$

Translated

5

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

高贵的阿德莱德 : Yes brother, it's hit again, congratulations I'm not good at blocking financial reports, but I also have some AAPL in my hands, so it would be nice if it went up

I'm not good at blocking financial reports, but I also have some AAPL in my hands, so it would be nice if it went up

高贵的阿德莱德 PZ实盘OP: Next time you buy @我, I'll be delighted too

高贵的阿德莱德 PZ实盘OP: Next time you buy @我, I'll be delighted too

高贵的阿德莱德 PZ实盘OP: Next time you buy it for me, I'll be delighted

高贵的阿德莱德 PZ实盘OP: Next time you buy it, at me, ha, I'll be delighted