我们会瘦的

liked and commented on

$iShares China Large-Cap ETF(FXI.US$

$Tesla(TSLA.US$

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

When they see a rise in stock, they want to catch up; when they see a decline, they panic; or they buy it after listening to a recommendation from a friend or Big V, and have made a happy profit, but have lost money because they are frustrated but don't know why. I'm sure many of you have experienced this. Greed and fear are human instincts. It is said that the hardest thing about investing is to overcome human nature. If you want to maintain a good mindset, you can't just rely on strong and excellent psychological qualities to fight against human weaknesses; you also need to have a perfect trading system of your own. So how do you do that?

1. First, you need to understand your investment style

1. Appropriate investment cycle. Are you good at short-term investments or long-term investments?

2. Type of investment. What is the expected return and the maximum acceptable loss, conservative, or aggressive?

3. Investment preferences. Are there any industries or fields you are familiar with; and when selecting specific stocks, do you refer to fundamentals or technical aspects?

Understanding these issues can better help us build a trading system that matches our own style

2. Establishing a trading system means that you should understand these issues before buying stocks, including:

1. Why buy it? What is the basis and criteria for selection? (Select target)...

$Tesla(TSLA.US$

$Apple(AAPL.US$

$Occidental Petroleum(OXY.US$

When they see a rise in stock, they want to catch up; when they see a decline, they panic; or they buy it after listening to a recommendation from a friend or Big V, and have made a happy profit, but have lost money because they are frustrated but don't know why. I'm sure many of you have experienced this. Greed and fear are human instincts. It is said that the hardest thing about investing is to overcome human nature. If you want to maintain a good mindset, you can't just rely on strong and excellent psychological qualities to fight against human weaknesses; you also need to have a perfect trading system of your own. So how do you do that?

1. First, you need to understand your investment style

1. Appropriate investment cycle. Are you good at short-term investments or long-term investments?

2. Type of investment. What is the expected return and the maximum acceptable loss, conservative, or aggressive?

3. Investment preferences. Are there any industries or fields you are familiar with; and when selecting specific stocks, do you refer to fundamentals or technical aspects?

Understanding these issues can better help us build a trading system that matches our own style

2. Establishing a trading system means that you should understand these issues before buying stocks, including:

1. Why buy it? What is the basis and criteria for selection? (Select target)...

Translated

10

6

我们会瘦的

liked and commented on

$Tesla(TSLA.US$

$Occidental Petroleum(OXY.US$

$Lockheed Martin(LMT.US$

$Netflix(NFLX.US$

The major market indices rebounded as scheduled yesterday. Is it time to follow up and go long? The answer is probably not yet. From the perspective of Japanese K-line technical analysis, all major indices are in a downward trend, and the upward pressure to rebound is also strong, so it is not suitable to aggressively go long. The market has been unstable recently, and I haven't taken any action. However, I was able to actually operate blindly, thanks to the experience of following my mentor's reading notes to learn the legendary experience of Wall Street stock master Jesse Livermore. For newcomers to the stock market, instead of randomly buying stocks, it's better to start learning by reading books about stocks. If you are interested in reading books, you can search the internet for Jesse Livermore's financial reading notes, and I believe you will also gain quite a bit.

$Occidental Petroleum(OXY.US$

$Lockheed Martin(LMT.US$

$Netflix(NFLX.US$

The major market indices rebounded as scheduled yesterday. Is it time to follow up and go long? The answer is probably not yet. From the perspective of Japanese K-line technical analysis, all major indices are in a downward trend, and the upward pressure to rebound is also strong, so it is not suitable to aggressively go long. The market has been unstable recently, and I haven't taken any action. However, I was able to actually operate blindly, thanks to the experience of following my mentor's reading notes to learn the legendary experience of Wall Street stock master Jesse Livermore. For newcomers to the stock market, instead of randomly buying stocks, it's better to start learning by reading books about stocks. If you are interested in reading books, you can search the internet for Jesse Livermore's financial reading notes, and I believe you will also gain quite a bit.

Translated

12

9

我们会瘦的

liked

$Tesla(TSLA.US$ $FULU HOLDINGS(02101.HK$ $Microsoft(MSFT.US$ $Apple(AAPL.US$ Peter Lynch, I believe you will be familiar with this name. Here is a deal from his investment career, which I saw in a video from a video blogger:In 1972, there was a sharp correction similar to the current one, and then shares of the restaurant chain Taco Bell fell all the way from $14 to $1. It plummeted 93%, but peter thinks taco bell is a high-quality company because they keep opening new restaurants and don't have any debt. So when the stock halved from 14 yuan to 7 yuan, peter began to bottom out. Obviously, he picked up a flying knife. But after continuing to fall, instead of panicking, he began to increase his position at 7 yuan until it fell to 1 yuan. Then in 1978, exactly six years later, taco bell was already his largest position, but it was in that same year that taco bell was acquired by PepsiCo at 42 yuan a share. In six years, it skyrocketed from $1 to $42.Summary of the blogger:1. No one can accurately copy the bottom, such a powerful boss he.

Translated

4

3

我们会瘦的

liked and commented on

Recently, the price of a social media giant has plummeted. I saw N people hurriedly “scavenging the bottom” on various platforms. I thought I had found a big bargain, and as the stock price continued to fall, I started to panic again. Actually, in my opinion, I need to figure out my role in the stock market first, and then do something loyal to that role. If you think about it, what kind of image would it be to wear a Taoist uniform and read the sutras in a temple every day? If you consider yourself a long-term investor, always optimistic about this company, and encounter a sharp drop, you think this is a rare discount opportunity. Then you can continue to invest in the long term, just hold on to it. Don't worry too much about the time costs

If you're just betting on it, it will bounce back. So you need to have a basis for gambling, right? On what basis? technology? news? Feeling? No matter what you base it on, please continue to rely on it.

I'm currently based on technology, so I haven't joined; I'm still waiting. I've heard the phrase “fall sharply, don't break the bottom” from my teacher a long time ago. The logic behind this sentence is the same as what we often hear, “If you stand on the cusp, even a pig can fly.” The reflection is to follow the trend and do more with less. I will continue to explore technical indicators such as GMMA, parallel channels, and minimum resistance levels. Contrast my conclusions with the views on this subject mentioned in the teacher's daily two-day video, and wait patiently for the opportunity. It's like a hungry wolf waiting for its prey. The social media giant is a real piece of meat. I want to make sure I'm eating meat and not a moustache.

If you're just betting on it, it will bounce back. So you need to have a basis for gambling, right? On what basis? technology? news? Feeling? No matter what you base it on, please continue to rely on it.

I'm currently based on technology, so I haven't joined; I'm still waiting. I've heard the phrase “fall sharply, don't break the bottom” from my teacher a long time ago. The logic behind this sentence is the same as what we often hear, “If you stand on the cusp, even a pig can fly.” The reflection is to follow the trend and do more with less. I will continue to explore technical indicators such as GMMA, parallel channels, and minimum resistance levels. Contrast my conclusions with the views on this subject mentioned in the teacher's daily two-day video, and wait patiently for the opportunity. It's like a hungry wolf waiting for its prey. The social media giant is a real piece of meat. I want to make sure I'm eating meat and not a moustache.

Translated

16

13

我们会瘦的

liked and commented on

lookedThe secret to making a profit in US stocks: stock god Jesse Livermore's trading collectionAfterwards, I had a deep experience.

The critical points and minimum resistance levels complement each other. The key point is that before the stock price forms a clear trend, it will fluctuate on one platform for a while. Once the upper pressure level is broken, there will be an upward trend. The stock price will continue to move in the direction of this minimum resistance level.

Thanks to the teacher for the guidance.

Translated

4

5

我们会瘦的

liked and commented on

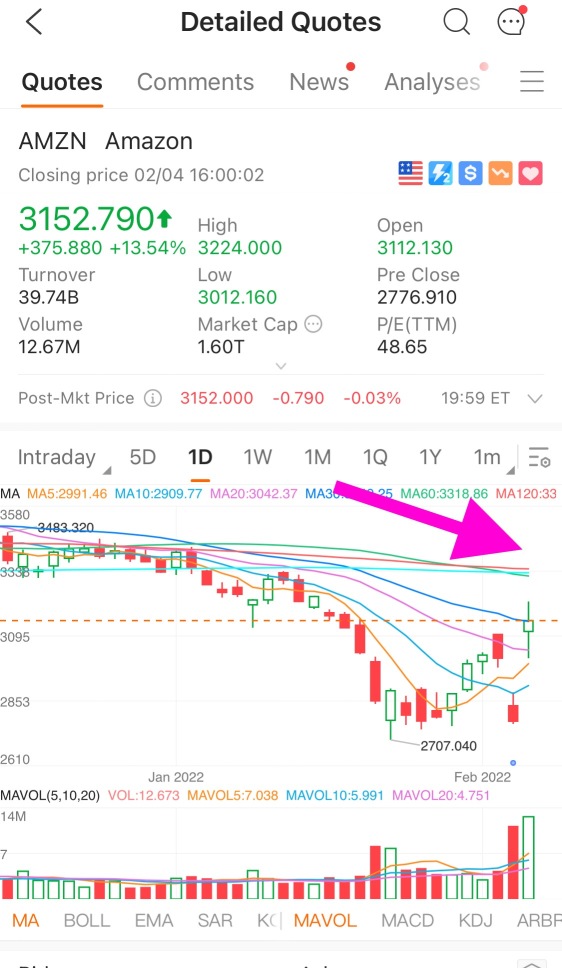

$Amazon(AMZN.US$

Amazon's strong upward attack on Friday brought a glimmer of life to a market that is neither above nor below. Will the bull market return like this? No one knows this. Personally, I think it's better for Amazon to follow the mobile take-profit strategy when the next strong pressure level is 3,300.

In times of market instability, mindful study is also a strategy. Keep studying with my “mentor” as she interprets the Wall Street Master's JESSE LIVERMORE LEGENDARY TRADING BOOK. The reason I put quotes on my mentor is because he doesn't know me at all and doesn't know I have a student like me, but that doesn't affect me in any way by watching his videos to learn from Master JESSE LIVERMORE's experience and improve my knowledge of the market!

Amazon's strong upward attack on Friday brought a glimmer of life to a market that is neither above nor below. Will the bull market return like this? No one knows this. Personally, I think it's better for Amazon to follow the mobile take-profit strategy when the next strong pressure level is 3,300.

In times of market instability, mindful study is also a strategy. Keep studying with my “mentor” as she interprets the Wall Street Master's JESSE LIVERMORE LEGENDARY TRADING BOOK. The reason I put quotes on my mentor is because he doesn't know me at all and doesn't know I have a student like me, but that doesn't affect me in any way by watching his videos to learn from Master JESSE LIVERMORE's experience and improve my knowledge of the market!

Translated

8

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

我们会瘦的 : Thank you for sharing.