$SPDR S&P 500 ETF(SPY.US$ $SPDR S&P 500 ETF(SPY.US$

Transaction Record

Trading plan:

High Polishing Low Absorption

Now that you buy at a slightly higher price, you just have to wait for the higher ones to appear before dumping 18 stocks

Reserve 447-449 share price reminder, wait patiently for selling points

Transaction Record

Trading plan:

High Polishing Low Absorption

Now that you buy at a slightly higher price, you just have to wait for the higher ones to appear before dumping 18 stocks

Reserve 447-449 share price reminder, wait patiently for selling points

Translated

loading...

1

Transaction Record

$SunPower(SPWR.US$

As stated above, all I need to do is:

1) Observe more, move less

2) Do not trade in stocks, but analyze the fundamentals, technical and news aspects, and wait patiently for the time machine

3) USE SPOLANDI SECRETARIES AND BRANCH TRENDS TO DECIDE TO BUY AND SELL STOP LOSS AND STOP PROFIT POINTS MUST BE SET AFTER BUYING OR SELLING

4) Buy and sell before the end of the trade in the tail or after the end of the trade, thus avoiding overpricing and heavy encumbrances

5) When buying and selling in the disc, it must be done. If you sell, you must buy, you must sell, in case it changes the next day

6) In addition to setting stop loss and stop profit points, you should not set automatic limit prices.

7) You can't buy or sell multiple times in a day except T

8) Duplicate every day and make a trading plan for the second trading day

$SunPower(SPWR.US$

As stated above, all I need to do is:

1) Observe more, move less

2) Do not trade in stocks, but analyze the fundamentals, technical and news aspects, and wait patiently for the time machine

3) USE SPOLANDI SECRETARIES AND BRANCH TRENDS TO DECIDE TO BUY AND SELL STOP LOSS AND STOP PROFIT POINTS MUST BE SET AFTER BUYING OR SELLING

4) Buy and sell before the end of the trade in the tail or after the end of the trade, thus avoiding overpricing and heavy encumbrances

5) When buying and selling in the disc, it must be done. If you sell, you must buy, you must sell, in case it changes the next day

6) In addition to setting stop loss and stop profit points, you should not set automatic limit prices.

7) You can't buy or sell multiple times in a day except T

8) Duplicate every day and make a trading plan for the second trading day

Translated

loading...

1

4

I wish all motorcycle riders good health, prosperity, and lots of financial resources in the new year. True freedom is a combination of a healthy body and freedom of wealth.

May the world be peaceful, and the epidemic will eventually be repelled by many parties, just like nothing. May humanity live in peace, help and love each other, rather than disagree, causing workers and people to lose their wealth.

May everyone enjoy the sea of shares unhindered, let reason overcome emotions, let failure become the mother of success, and live forever in the past. May Courage ➕ think rationally and successfully to help everyone fulfill their New Year's wishes. Hope on earth, let's work together!![]()

![]()

![]()

May the world be peaceful, and the epidemic will eventually be repelled by many parties, just like nothing. May humanity live in peace, help and love each other, rather than disagree, causing workers and people to lose their wealth.

May everyone enjoy the sea of shares unhindered, let reason overcome emotions, let failure become the mother of success, and live forever in the past. May Courage ➕ think rationally and successfully to help everyone fulfill their New Year's wishes. Hope on earth, let's work together!

Translated

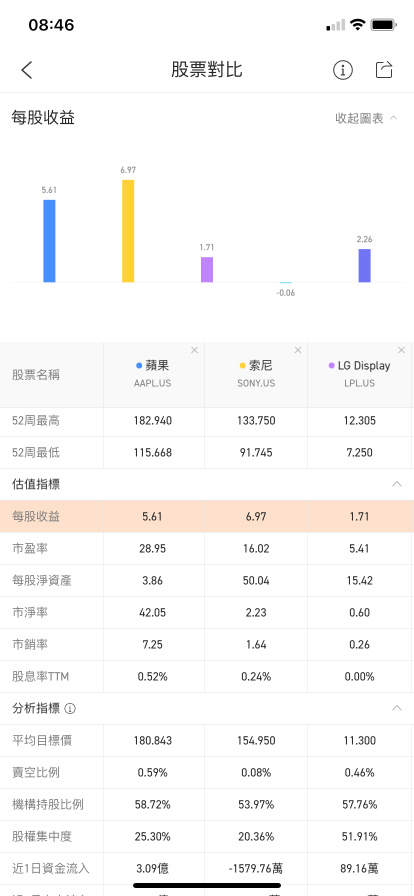

Thanks to Futubull for providing a powerful stock comparison function. I will continue to take time to study and try to keep up with everyone![]()

1) Quotation-Exploration-Investment Tools-Stock Comparison

I'll use this feature to select stocks in the same market and industry:

2) Specific stocks - detailed quotes - VS

I used this feature to compare individual holdings, because Apple is an S&P 500 weighted stock, and the trend is very similar; Alibaba is a bit different, but the basic trend is also downward:

3) Quotations - Finances - Metrics - Key Metrics

I will use this function to compare the company's performance and capital inflows, etc., to determine which stock has a higher investment value:

Although the week has been falling and falling, the pace of investment has not changed. I hope to achieve my 2022 goals through continuous learning and analysis, learning lessons from failure, and gaining experience from victory.

1) Quotation-Exploration-Investment Tools-Stock Comparison

I'll use this feature to select stocks in the same market and industry:

2) Specific stocks - detailed quotes - VS

I used this feature to compare individual holdings, because Apple is an S&P 500 weighted stock, and the trend is very similar; Alibaba is a bit different, but the basic trend is also downward:

3) Quotations - Finances - Metrics - Key Metrics

I will use this function to compare the company's performance and capital inflows, etc., to determine which stock has a higher investment value:

Although the week has been falling and falling, the pace of investment has not changed. I hope to achieve my 2022 goals through continuous learning and analysis, learning lessons from failure, and gaining experience from victory.

Translated

46

9

1) Calm down and re-analyze. If the logic does not change, and only short-term quantitative capital is withdrawn, then stick to ownership; if the performance falls short of expectations, then reduce or close positions and invest the capital in other strong stocks with an upward trend to reduce losses and increase the profit and loss ratio.

2) For individual stocks with constant logic, pay close attention to changes in stock prices and trading volume. Never increase positions during a downward trend, but choose to buy when the decline stops and stabilizes, so you can gradually reduce costs and turn losses into profits.

3) Make a trading plan after the market. Don't keep an eye on the market too often unless you do T. You can set price alerts and related actions. You can even set stop-loss points and take-profit lines when you don't have time, so you don't miss out on trading points.

2) For individual stocks with constant logic, pay close attention to changes in stock prices and trading volume. Never increase positions during a downward trend, but choose to buy when the decline stops and stabilizes, so you can gradually reduce costs and turn losses into profits.

3) Make a trading plan after the market. Don't keep an eye on the market too often unless you do T. You can set price alerts and related actions. You can even set stop-loss points and take-profit lines when you don't have time, so you don't miss out on trading points.

Translated

My first investment in the new year was to store 10 shares of apples $Apple(AAPL.US$ and 10 shares $SPDR S&P 500 ETF(SPY.US$ Impairment 10 shares $Alibaba(BABA.US$

Transaction Record

Transaction Record

Translated

loading...

1

5

After being involved in trading for half a year, from initially watching the market nervously and frequently losing money to my current peaceful mentality, I have realized that it is important to have the right mindset and keep learning to improve my mental quality.

1) In the past, accounts were not allowed to have half a bit of capital; they were always full. Gradually, they realized that when their positions were full, individual stocks or funds were withdrawn, or that their favorite stocks were finally waited until they had a point to buy, but there was no capital allocation, and a great opportunity was lost. Controlling my positions and paying attention to trading points and news has made me gradually get rid of this nervous mentality of being nervous and trembling, like walking on thin ice every day;

2) Overcoming emotional trading - making a trading plan before opening the market, setting stop-loss points, take-profit levels, controlling bottom positions, changing positions, and trading high and low, largely helped me avoid emotional trading that chased gains and losses;

3) How to train my mind to become stronger - market analysis and continuous learning have kept me away from emotional restlessness and invest steadfastly. Setting price reminders and notes analysis points, and timely reminders when I'm not clear after waking up or before going to bed has reduced a lot of mindless work.

4) Change your mindset and embrace change. Over a period of time, a certain sector or individual stock is not necessarily profitable, yet when looking at an extended cycle, the yield gradually moves upward. However, there are many bubbles where individual stocks are rising. There is no support for performance, but only a rise in mood. They will soon rise and fall. No matter what, we must face reality and analyze objectively. Even if the stock price falls and the logic is still there, then stick to owning it and wait for the opportunity to come; the opposite is to stop losing and exit. Do...

1) In the past, accounts were not allowed to have half a bit of capital; they were always full. Gradually, they realized that when their positions were full, individual stocks or funds were withdrawn, or that their favorite stocks were finally waited until they had a point to buy, but there was no capital allocation, and a great opportunity was lost. Controlling my positions and paying attention to trading points and news has made me gradually get rid of this nervous mentality of being nervous and trembling, like walking on thin ice every day;

2) Overcoming emotional trading - making a trading plan before opening the market, setting stop-loss points, take-profit levels, controlling bottom positions, changing positions, and trading high and low, largely helped me avoid emotional trading that chased gains and losses;

3) How to train my mind to become stronger - market analysis and continuous learning have kept me away from emotional restlessness and invest steadfastly. Setting price reminders and notes analysis points, and timely reminders when I'm not clear after waking up or before going to bed has reduced a lot of mindless work.

4) Change your mindset and embrace change. Over a period of time, a certain sector or individual stock is not necessarily profitable, yet when looking at an extended cycle, the yield gradually moves upward. However, there are many bubbles where individual stocks are rising. There is no support for performance, but only a rise in mood. They will soon rise and fall. No matter what, we must face reality and analyze objectively. Even if the stock price falls and the logic is still there, then stick to owning it and wait for the opportunity to come; the opposite is to stop losing and exit. Do...

Translated

2

2021 has passed, and I started studying investing in July. What I have earned is not profit, but experience and lessons. Well, in the new year, I hope to achieve my small goals and earn 25%. The plan for the year is spring. Write down a plan today so that you can fully invest and execute it. After a year, take stock to see if you have made any progress.

1. Investment target: Continued long-term investment $SPDR S&P 500 ETF(SPY.US$ , $Apple(AAPL.US$ , $Alibaba(BABA.US$ . though $Alibaba(BABA.US$ We are still losing money now, but by throwing high and absorbing low, I believe we will achieve floating profits in the near future. Plan to invest $Tesla(TSLA.US$ . Keep an eye on it $Tesla(TSLA.US$ , intervene when a point of purchase appears, and hold it for a long time. $Celestica(CLS.US$ This is a stock given to me by Futubull. I didn't understand the analysis before, and I still hold one share. I plan to increase my investment amount at the right time to bring more profit.

2. Capital preparation: Plan a monthly fee. After deducting the necessary fees, no less than $2,500 will be used for investment, distributed evenly to each target and maintain 50% of the positions, and 50% of the capital will be used as high...

1. Investment target: Continued long-term investment $SPDR S&P 500 ETF(SPY.US$ , $Apple(AAPL.US$ , $Alibaba(BABA.US$ . though $Alibaba(BABA.US$ We are still losing money now, but by throwing high and absorbing low, I believe we will achieve floating profits in the near future. Plan to invest $Tesla(TSLA.US$ . Keep an eye on it $Tesla(TSLA.US$ , intervene when a point of purchase appears, and hold it for a long time. $Celestica(CLS.US$ This is a stock given to me by Futubull. I didn't understand the analysis before, and I still hold one share. I plan to increase my investment amount at the right time to bring more profit.

2. Capital preparation: Plan a monthly fee. After deducting the necessary fees, no less than $2,500 will be used for investment, distributed evenly to each target and maintain 50% of the positions, and 50% of the capital will be used as high...

Translated

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

寧静以待OP 浮影: Sold early ha