一起來发

Set a live reminder

$Grab Holdings(GRAB.US$

Grab Q1 2024 earnings conference call is scheduled for May 15 at 8:00 PM ET/ May 16 at 8:00 AM SGT/May 16 at 10:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Grab's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information and educational use only and is not a recommendation or en...

Grab Q1 2024 earnings conference call is scheduled for May 15 at 8:00 PM ET/ May 16 at 8:00 AM SGT/May 16 at 10:00 AM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from Grab's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation is for information and educational use only and is not a recommendation or en...

14

2

一起來发

liked

$Hang Seng Index(800000.HK$ tmr dunno will down how much, 700? usually double

1

2

一起來发

voted

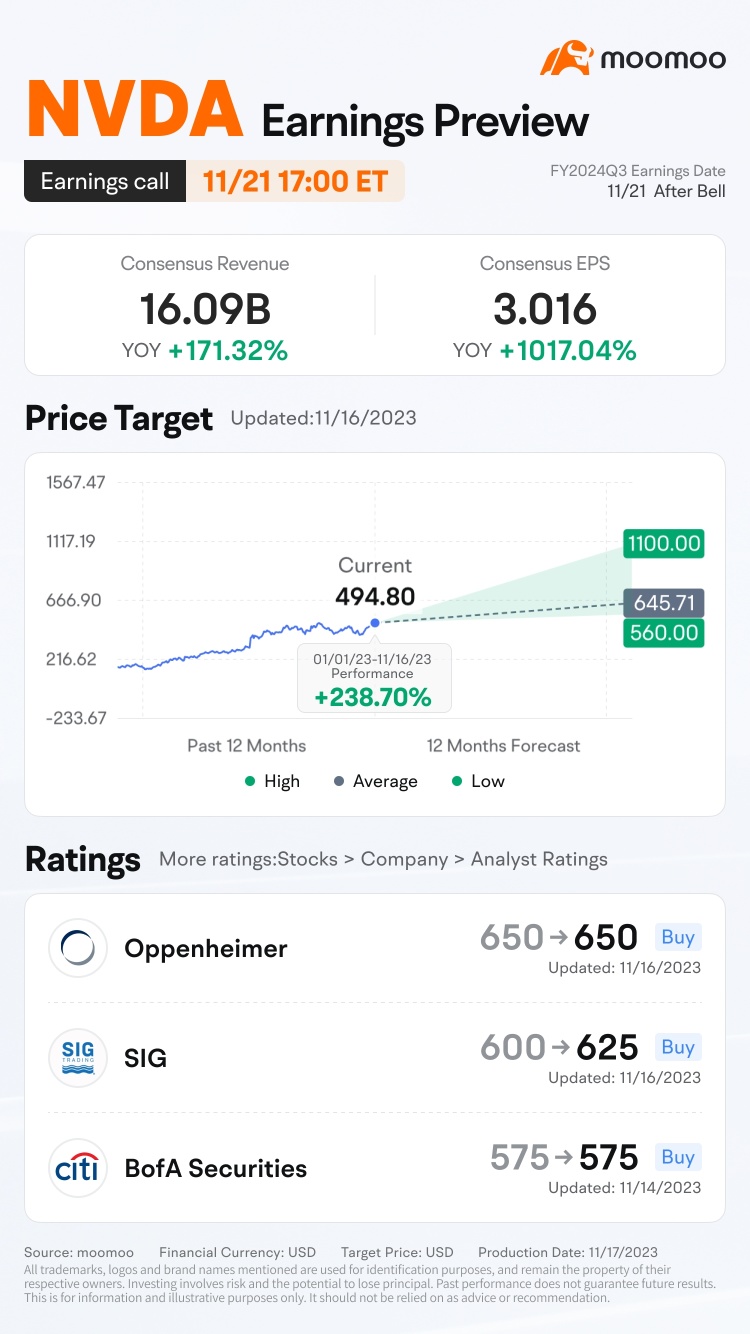

$NVIDIA(NVDA.US$ is releasing its Q3 FY24 earnings on November 21 after the bell. ![]()

How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET on November 22 (e.g., If 50 mooers make a correct guess, they will get 200 points each!)

(Vote wil...

How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA(NVDA.US$'s opening price at 9:30 AM ET on November 22 (e.g., If 50 mooers make a correct guess, they will get 200 points each!)

(Vote wil...

94

78

一起來发

voted

Spoiler:

![]() At the end of this post, there is a chance for you to win points!

At the end of this post, there is a chance for you to win points!

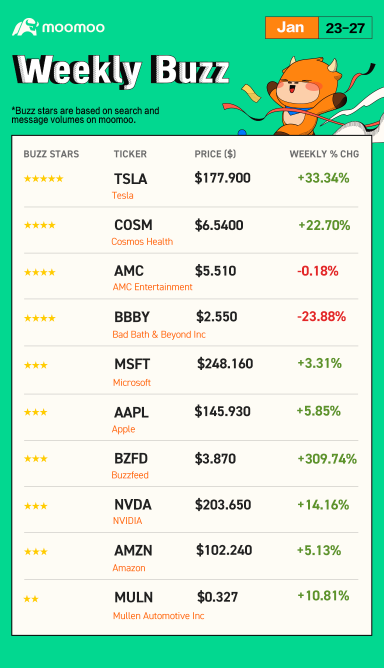

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on the moomoo platform based on search and message volumes of last week (Nano caps are excluded).

Make Your Choices

Buzzing Stocks List & Mooers Comments

It was one of the best weeks for US equity investors as all the major indices ended ...

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on the moomoo platform based on search and message volumes of last week (Nano caps are excluded).

Make Your Choices

Buzzing Stocks List & Mooers Comments

It was one of the best weeks for US equity investors as all the major indices ended ...

+3

58

52

一起來发

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

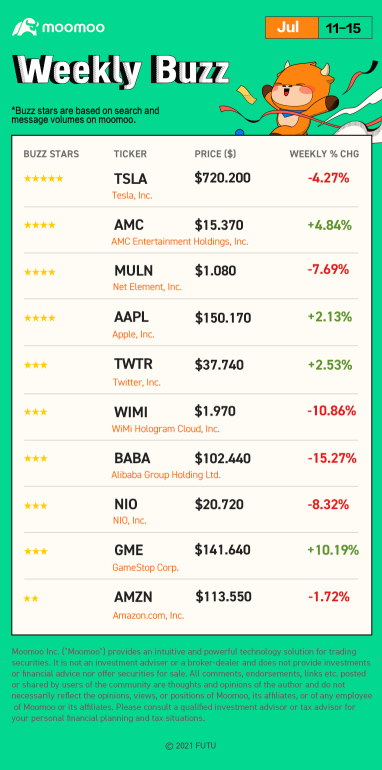

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Three major indices moved downward, ...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Three major indices moved downward, ...

+4

64

68

一起來发

voted

Recently, metaverse has become the hottest topic to which mooers are paying close attention.![]() Standing on the cusp of virtual social networking, social media giant Facebook has changed its name to lead the latest trend. $Meta Platforms(FB.US$ Events are happening every day in moomoo. Which trends are mooers riding?

Standing on the cusp of virtual social networking, social media giant Facebook has changed its name to lead the latest trend. $Meta Platforms(FB.US$ Events are happening every day in moomoo. Which trends are mooers riding?![]()

To embrace the new trend, @moomoo Academy is changing its name. We are still committed to sharing the most advanced investment ideas and knowledge, launching activities to gather your views, and posting the outstanding ones in the account for all of you. Here is where mooers' wisdom is accumulated, and gamification strategies are adopted to make teaching more engaging!

Let's get together to brainstorm and choose a new trending name for @moomoo Academy. Here, we have three proposals:

1. Meta Moo

Learning is like playing a game where you work hard to defeat the monsters to get to the higher levels. Intuition developed from the past investing experience becomes a vital part of an investor's toolkit. Immerse yourself in moomoo and explore the virtual gamification elements of social interaction.

2. moomoo Idea

Collect every idea you have when you are investing, and finally, construct your unique investment logic. Here, we are presenting the investment insights shared by you, our dear friends.

3. mooers Strategy

Share your investment strategies and experiences with all mooers so that beginners can learn from the experienced and mooers can interact with their counterparts. You are improving as you are communicating.

Hunting moment! Cast your precious vote in the name-changing survey of @moomoo Academy.

We are calling on mooers to be part of the name changing event and become the content producers of the new account. Name changing is so cool, and we want you to be part of it. Please remember that all suggestions are welcome and appreciated.![]()

If you have a better name, please leave it in the comment below!![]()

To embrace the new trend, @moomoo Academy is changing its name. We are still committed to sharing the most advanced investment ideas and knowledge, launching activities to gather your views, and posting the outstanding ones in the account for all of you. Here is where mooers' wisdom is accumulated, and gamification strategies are adopted to make teaching more engaging!

Let's get together to brainstorm and choose a new trending name for @moomoo Academy. Here, we have three proposals:

1. Meta Moo

Learning is like playing a game where you work hard to defeat the monsters to get to the higher levels. Intuition developed from the past investing experience becomes a vital part of an investor's toolkit. Immerse yourself in moomoo and explore the virtual gamification elements of social interaction.

2. moomoo Idea

Collect every idea you have when you are investing, and finally, construct your unique investment logic. Here, we are presenting the investment insights shared by you, our dear friends.

3. mooers Strategy

Share your investment strategies and experiences with all mooers so that beginners can learn from the experienced and mooers can interact with their counterparts. You are improving as you are communicating.

Hunting moment! Cast your precious vote in the name-changing survey of @moomoo Academy.

We are calling on mooers to be part of the name changing event and become the content producers of the new account. Name changing is so cool, and we want you to be part of it. Please remember that all suggestions are welcome and appreciated.

If you have a better name, please leave it in the comment below!

141

32

一起來发

commented on

Tell us your favorite stock using only emojis!

OK, start with me.

🍎

Rewards calling! Comment to win rewards!

Moomoo news team and I hold the event together for a month! I will post discussions every day and Moomoo news team will support the event with reward points! We will pick the top 2 'liked' and top 3 'insightful' comments every weekday& top 10 'liked' and top 10 'insightful' comments every weekend to be the winners.![]()

![]()

![]() For more details, click here.

For more details, click here.

Follow me to join the latest discussion!

OK, start with me.

🍎

Rewards calling! Comment to win rewards!

Moomoo news team and I hold the event together for a month! I will post discussions every day and Moomoo news team will support the event with reward points! We will pick the top 2 'liked' and top 3 'insightful' comments every weekday& top 10 'liked' and top 10 'insightful' comments every weekend to be the winners.

Follow me to join the latest discussion!

![[Rewards Calling] Tell us your favorite stock using only emojis!](https://ussnsimg.moomoo.com/5136216541564457464.png/thumb)

84

372

一起來发

liked and commented on

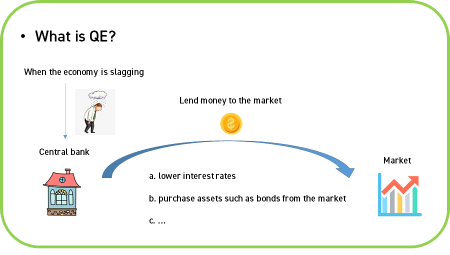

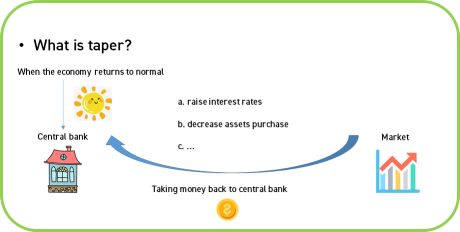

On Wednesday, the Fed said taper may come soon if the economy continues to progress, but didn't announce the specific dates.

This should be the biggest news for the financial market. But wait... what is taper and why is it so important?

What is taper?

Before talking about taper, we should know what QE is —— the opposite of taper.

When the economy is slagging, the central bank tends to lend more money to the market. This aims to increase consumption and investment, which is a good way to take the sluggish market back to normal.

To lend money out, the central bank can lower interest rates or purchase assets such as bonds from the market. These measures are summarized as QE (Quantitative Easing).

Therefore, the opposite of QE —— taper, is taking money back to the central bank, by raising interest rates or decreasing assets purchases.

With rising interest rates, people who are using leverage may choose to sell their stocks because they can't afford the high cost of borrowing. As more people sell, the stock price will fall. As a result, the stock market may react negatively to taper.

How about this time?

On Wednesday, the Fed said the U.S. central bank could begin scaling back asset purchases in November and complete the process by mid-2022. However, after the Fed's announcement, US stocks staged a comeback from their September rout, which is a proof of strong market confidence.

If there is anything else you would like to know, ask me in the comment section below!![]()

This should be the biggest news for the financial market. But wait... what is taper and why is it so important?

What is taper?

Before talking about taper, we should know what QE is —— the opposite of taper.

When the economy is slagging, the central bank tends to lend more money to the market. This aims to increase consumption and investment, which is a good way to take the sluggish market back to normal.

To lend money out, the central bank can lower interest rates or purchase assets such as bonds from the market. These measures are summarized as QE (Quantitative Easing).

Therefore, the opposite of QE —— taper, is taking money back to the central bank, by raising interest rates or decreasing assets purchases.

With rising interest rates, people who are using leverage may choose to sell their stocks because they can't afford the high cost of borrowing. As more people sell, the stock price will fall. As a result, the stock market may react negatively to taper.

How about this time?

On Wednesday, the Fed said the U.S. central bank could begin scaling back asset purchases in November and complete the process by mid-2022. However, after the Fed's announcement, US stocks staged a comeback from their September rout, which is a proof of strong market confidence.

If there is anything else you would like to know, ask me in the comment section below!

184

52

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)