Why It's Time to Favor Canadian Stocks Over U.S. Equities in Your Portfolio

As the world economy navigates through geopolitical tensions and macroeconomic shifts, the Canadian stock market is emerging as a beacon of potential outperformance, according to Brian Belski, Chief Investment Strategist at BMO. His analysis suggests that while the US stock market's current upward trajectory may be reaching its apex while Canadian equities are on the cusp of a bullish phase.

"There is an increasing risk of more stagnant US equity market returns over the near term. ... When we examine a potential deceleration of upward momentum in the U.S. stock market, our work shows Canada can still post solid returns and outperform the U.S. during more rangebound U.S. markets. In fact, our work shows there are many areas within the Canadian equity market that are poised for a strong catch-up trade. This is particularly relevant given that Canada remains well-positioned from a valuation and fundamental standpoint. As such, we believe the TSX is likely to outperform near term even if US equity markets exhibit more tempered returns over the next few months," Brian wrote in a note.

A Tale of Two Economies

Persistently strong economic data out of the U.S. underpinned by a solid consumer demand backdrop continues to complicate the Fed's decision-making process. Buoyant equity markets, large fiscal tailwinds, and higher-than-expected population growth likely all played a role in propping up economic growth than otherwise expected. In Canada, however, inflation readings have surprised somewhat on the downside over early 2024 relative to the BoC's prior expectations. The BoC's preferred 'core' CPI measures are running above the top end of the BoC's 1% to 3% target on a year-over-year basis but the policy statement pointed to the more recent 3-month annualized growth rate as further evidence that price growth momentum is slower. Moving forward, a negative output gap and higher unemployment rate are all implying that inflation pressures are more likely to slow rather than rise.

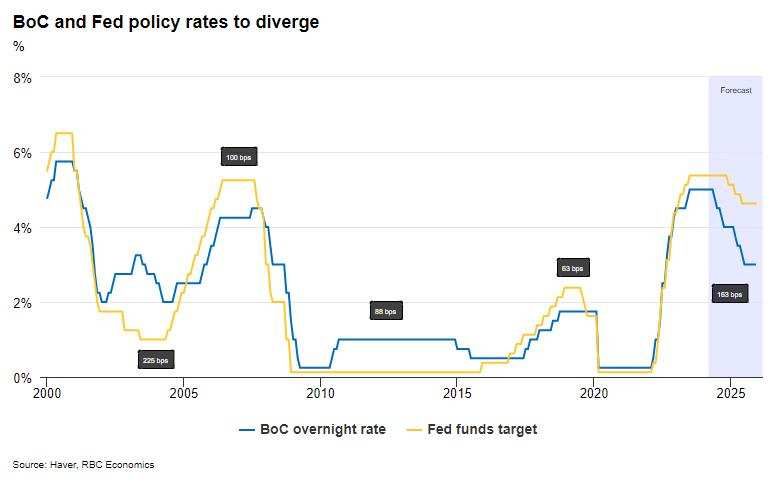

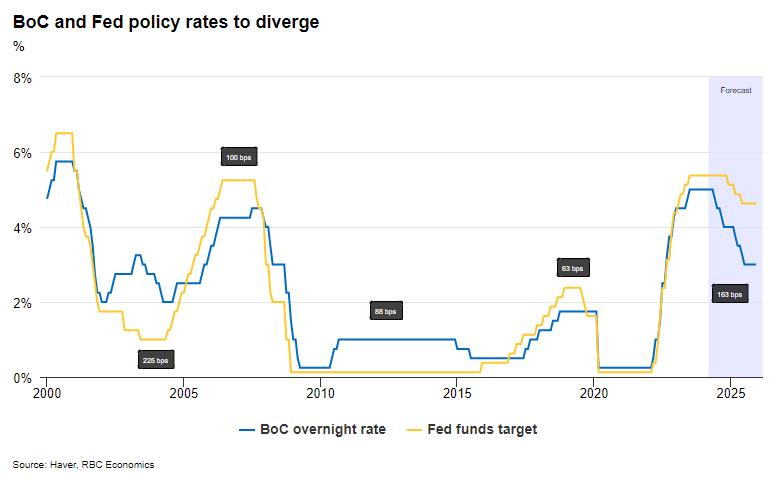

Swap markets are signaling a belief in Canada's imminent monetary easing, with a striking 78% chance priced in for a June rate cut. This is a stark difference from the 20% probability assigned to the U.S. starting the first rate cut in June. RBC projects a decisive action plan from the BoC, with four rate cuts expected throughout the year, starting as early as June. This contrasts with a more conservative approach from the Fed, where a rate cut isn't expected until December 2024.

Belski anticipates a moderation period for the U.S. stock market as the initial optimism for 2024 rate cuts wane. On the other hand, Canada's anticipated interest rate cuts could energize interest-sensitive sectors like banking and utilities, thus propelling the overall market index.

Canada's advantage amid geopolitical risk

The geopolitical landscape, with tensions in the Middle East and Ukraine, underscores Canada's role as a stable trading partner, rich in natural resources, poised to support business activity in the coming years.

In response to geopolitical risk, gold prices broke through $2,400 an ounce on Friday, but closed the session lower as technical indicators indicated its rally had run too hot and investors liquidated positions. The latest developments in the Middle East rekindled the flight to safety, with a number of Wall Street banks lifting their price forecasts for gold. $Goldman Sachs(GS.US)$ has stated that risk-averse sentiment will drive gold prices to soar, with the institution raising its year-end gold price forecast from $2,300 to $2,700 per ounce.

Oil futures were barely moved by Iran's unprecedented attack on Israel, with traders attributing the lackluster price action to the notion that the strike was well-flagged beforehand. Citigroup's base case is for tensions to remain "extremely high" in the Middle East, underpinning prices. "What is not priced into the current market, in our view, is a potential continuation of a direct conflict between Iran and Israel, which we estimate could see oil prices trade up to +$100/bbl, depending on the nature of the events," analysts including Max Layton wrote in a note.

"We estimate that oil prices already reflect a $5-to-$10-a-barrel risk premium from downside risks to supply," before the weekend attacks by Iran, Goldman Group Sachs analysts, including Daan Struyven, said in a note. "If the market were to price a higher probability of reduced Iran supply, then this could contribute to a higher geopolitical risk premium," they said.

As resource prices are expected to rise, Canadian energy and gold mining shares are likely to benefit, subsequently lifting the commodity-heavy Canadian stock market. Bank of America analysts have pointed out that the 2020s may see a shift in focus towards energy and food security. Canada's unique positioning in these areas—coupled with political stability—positions it well to navigate the uncertainties and conflicts that may define the decade.

Source: BMO, RBC Economics, Globe and Mail

Dear mooers, how have you recently allocated your portfolio between Canadian and U.S. stocks? Please leave a comment below![]()

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment