The Week Ahead (AMZN, AMD, AAPL, BCE Earnings; Fed Interest Rate Announcement, Canada GDP Data)

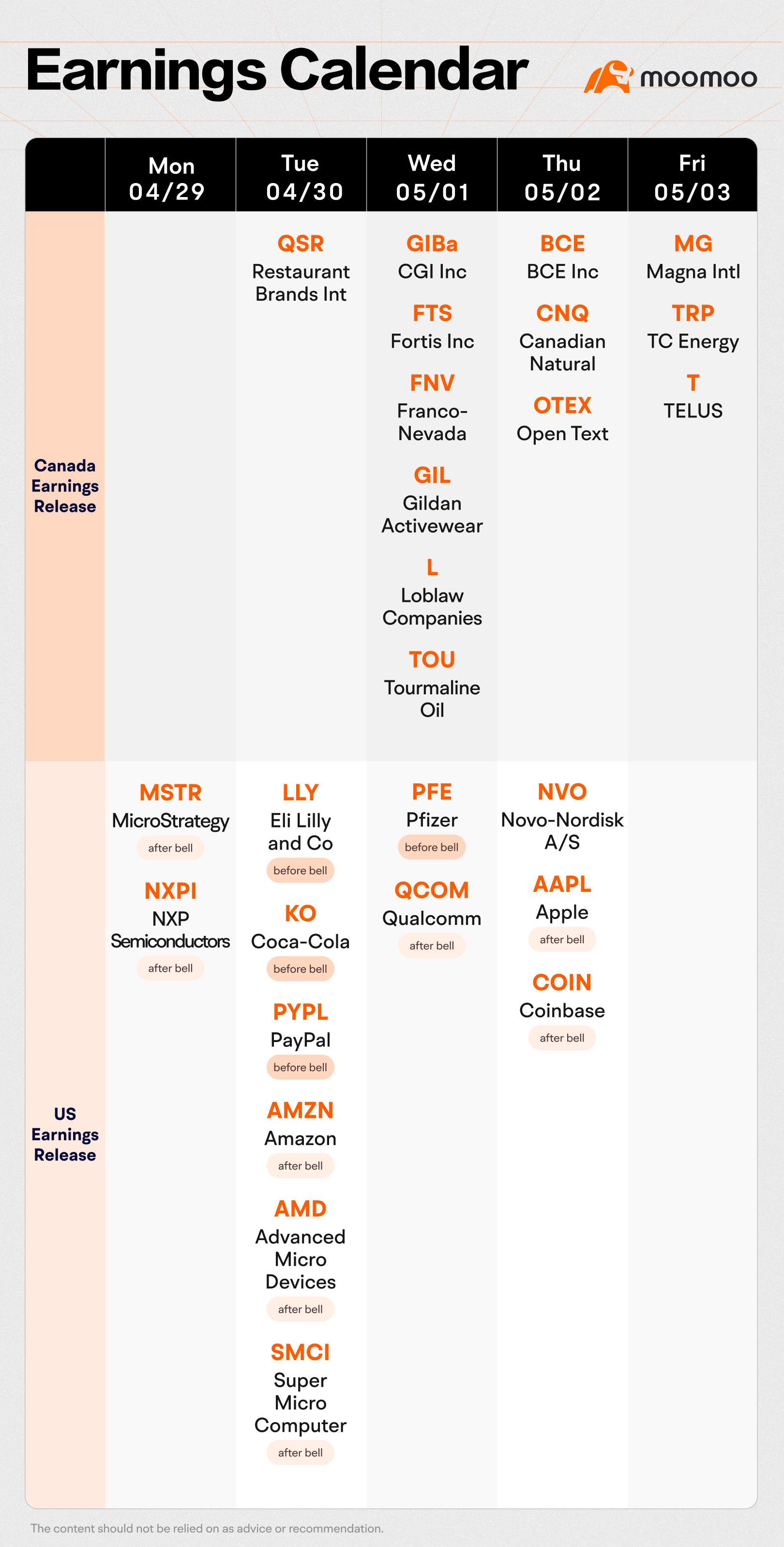

Earnings Calendar

The forthcoming week in US is set to witness an upsurge in the corporate earnings season, with mega-caps $Amazon(AMZN.US$ and $Apple(AAPL.US$ slated to release their earnings on Tuesday and Thursday, respectively. Additionally, a plethora of consumer-facing companies such as $Coca-Cola(KO.US$ are also expected to report their earnings.

Moreover, investors are also keeping a close eye on AI darling $Advanced Micro Devices(AMD.US$ and $Super Micro Computer(SMCI.US$ , as well as the cryptocurrency exchange $Coinbase(COIN.US$, whose financial reports are also slated for release week ahead.

In Canada, the largest telecom company $BCE Inc(BCE.CA$ is set to report earnings on May 2rd before market open. Besides, $Canadian Natural Resources Ltd(CNQ.CA$ is set to release its earnings result on Thursday while $TC Energy Corp(TRP.CA$ and $TELUS Corp(T.CA$ will announce on Friday.

Amazon Earnings Preview

$Amazon(AMZN.US$ is expected to deliver a positive first quarter update on Tuesday April 30, as it showcases the strengths of its web and ad services, analysts believe.

Bank of America predicts revenue will reach US$143 billion for the quarter while underlying earnings come in at US$11.5 billion.

Sales guidance keeps in line with Wall Street estimates but earnings forecasts are slightly higher than the market’s prediction of US$11.3 billion.

Both Amazon Web Services and its advertising segment are expected to come in on the upside of Wall Street guidance, BoA says, while the bank also sees potential for a retail earnings beat.

“We expect a 1Q beat, and while 2Q set up has some unusual q/q hurdles, we expect positive 1Q metrics and call commentary to be constructive,” Bank of America said.

“Given expanding retail margins, (robust ad growth with a likely 1Q boost), and expected AWS acceleration, we think the stock is still set up for multiple expansion in 2024.”

Apple Earnings Preview

$Apple(AAPL.US$ will report fiscal Q2 earnings as the share price trades down nearly 12% YTD, underperforming the broader market. This selloff is due to concerns over iPhone sales in China, a weaker consumer environment, and investors punishing Apple for its slow start to the AI race.

Wall Street analysts are anticipating Q2 EPS of $1.50 on revenue of $89.8 million, which is a decrease compared to Q2 2023's $1.88 on $117.51 billion. Apple is preparing for a lackluster quarter concerning iPhone sales. The firm's flagship product is encountering major obstacles in the pivotal Chinese market, where increased competition from domestic smartphone manufacturers is proving to be a significant challenge. Moreover, worldwide consumers are retaining their iPhone devices for longer periods before upgrading, which is further hindering demand and sales growth. Given that the iPhone is the primary generator of Apple's revenue, this projected decline in iPhone sales is likely to have an adverse effect on the firm's overall performance for the quarter.

BCE Earnings Preview

$BCE Inc(BCE.CA$ is set to report earnings on Thursday before market open. The intense competition phase in Canadian telecom could be painful for operators, and the worst may not be over.

Analysts project Bell Canada’s consolidated revenue for the first quarter at C$6.06 billion, up slightly (0.15%) from the year-ago period. Earnings per share (EPS) are expected to be C$0.57, down 27.6% from the year-ago quarter.

According to JP Morgan, competitive dynamics continue to weigh on BCE and the broader Canadian Communications ecosystem due to elevated promotional activity in 1Q24. It is unclear when this pressure will ameliorate. JP Morgan maintain its Neutral rating on BCE, but lower price target to C$47 (from C$54), which implies 7.3x 2025E EV/EBITDA vs. 7.2x 2024E today.

Economic Calendar

Job Figures and Fed's Interest Rate Meeting

The latest U.S. jobs report and the Federal Reserve's interest rate decision will be released along with more mega-cap earnings, which will be the main events for investors in the week ahead.

The Fed is scheduled to convene on Wednesday, and it is widely expected that interest rates will remain unchanged next week. According to the CME FedWatch tool, the market is currently pricing in only a modest 25 bp rate cut in 2024, a significant decrease from the six or seven cuts that investors had previously predicted for this year. Wall Street is eagerly awaiting insights into the state of the economy and the possibility of future rate cuts. Investors will also closely scrutinize Fed Chair Jerome Powell's remarks after the meeting, seeing if he has turned more hawkish after the recent data.

According to David Alcaly, the lead macroeconomic strategist at Lazard Asset Management:

" Three straight months of higher-than-hoped inflation challenges the idea that this is seasonal volatility, as Powell has acknowledged; At best, it delays rate cuts. At worst, it implies the Fed needs to slow the economy."

A labor market update is also set to take center stage, with the highly anticipated April nonfarm payrolls report scheduled for release on Friday. Economists are predicting 243,000 added for the month, which would represent a slight decline from March's impressive figure of 303,000 jobs added. The labor market has proven to be surprisingly robust thus far, showing that the economy can withstand the effects of rising interest rates and skyrocketing prices of consumer goods.

Canada Gross Domestic Product (GDP) in February

In Canada, the latest GDP data is likely to show momentum in the economy fading quickly following the surprisingly strong start to the year, suggesting much of that earlier strength was driven by an easing of previous supply constraints and better than normal winter weather. Analysts expect February GDP to post a 0.3% increase, which may come in a tick below its advance estimate, while early data for March have shown declines in manufacturing and wholesaling, raising the possibility of a modest decline in economic activity for that month.

Source: CIBC, Trading Economics, RBC, CanadianInsider, CNBC

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73684506 : very informative