'Terrific News' on Canada Inflation: Chief Economist Raises Bets on First Rate Cut in June

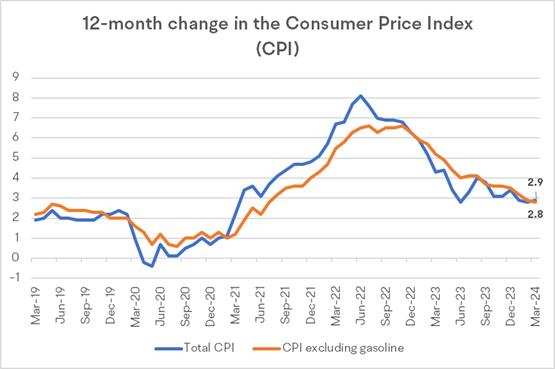

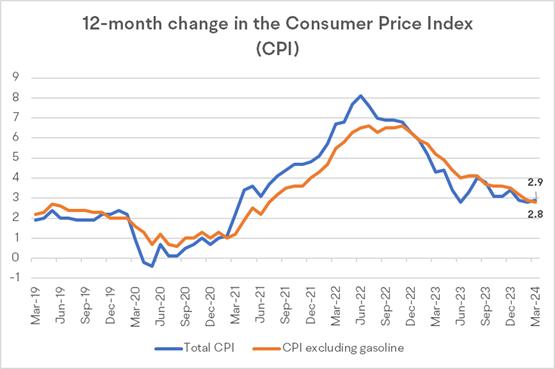

Canada's annual inflation rate ticked up as expected to 2.9% in March, but the central bank's closely watched measures of core inflation eased for a third straight month, data showed on Tuesday, reviving bets for a June interest rate cut.

After the data release, money market saw a roughly 55% chance of a June rate cut from a 44% chance earlier. Here’s what economists are saying about the latest numbers:

CIBC Capital Markets continues to expect a first cut in June

The latest consumer price index data meet the Bank of Canada’s requirement for core inflation, Andrew Grantham, an economist with CIBC Capital Markets, said in a note.

CPI core trim and median — the central bank’s two preferred measures of inflation — slowed to 3.1 per cent and 2.8 per cent, respectively, cooler than analysts surveyed by Bloomberg expected.

Central Bank officials said in their April 10 interest rate decision that they would need to see continued evidence that core inflation was sustainably slowing before they would consider a first rate cut.

“Today’s data meets that requirement, although there is one more CPI print to come before the bank’s next policy decision,” Grantham said. “We continue to expect a first cut at that June meeting.”

Desjardins Group retaining a call for a June rate cut

"The inflation data for March should give monetary policymakers confidence that the progress made in taming consumer price pressures is sustainable," Desjardins managing director and head of macro strategy Royce Mendes wrote in a research note on Tuesday, retaining a call for a June rate cut.

"When Macklem said he wanted to see more of what he had seen in January and February, this type of release was exactly what he was looking for. That said, cooperation from the federal government (in the budget) and the next CPI release will both be key in seeing that forecast materialize," he said.

Some economists are worried that increased spending by Ottawa could feed inflation.

Capital Economics also sees a 'growing chance' of a rate cut in June

“There is a growing chance of the bank cutting interest rates at its next meeting in early June,” Olivia Cross, North America economist at Capital Economics Ltd, said in a note, citing the continued slowdown in the Bank of Canada’s most-watched core measures of inflation.

The central bank won’t be “too concerned” by the slight uptick in headline inflation that was partly the result of higher gasoline prices, Cross said.

However, inflation risks still persist as gas prices have climbed in April amid rising tensions in the Middle East.

“The good news for the bank is that, thanks to more favourable base effects from here, there is scope for headline inflation to fall in the coming months despite the rise in gasoline prices,” Cross said.

Cooling in core inflation is welcome news, says BMO Economics

“The steady cooling in core inflation is welcome news,” Douglas Porter, chief economist at Bank of Montreal, said in a note, highlighting that three of four measures of core inflation have come in below three per cent “for the first time since the summer of 2021.”

“For the Bank of Canada, this result is likely just good enough to keep them on track for a potential trim in June.” Porter said.

Source: Financial Post, Yahoo Finance

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment