What Investment Opportunities Arise From Anticipated Rate Cuts

Investor expectations for Federal Reserve rate cuts have changed quickly in recent months due to concerns about triggering inflation in the robust economy. The Fed has indicated a potential reduction of interest rates by 75 basis points this year. However, rising Treasury yields, with the 10-year yield reaching a peak not seen since November, reflect skepticism about rate cuts. This skepticism is fueled by recent strong labor market data and other indicators of economic growth.

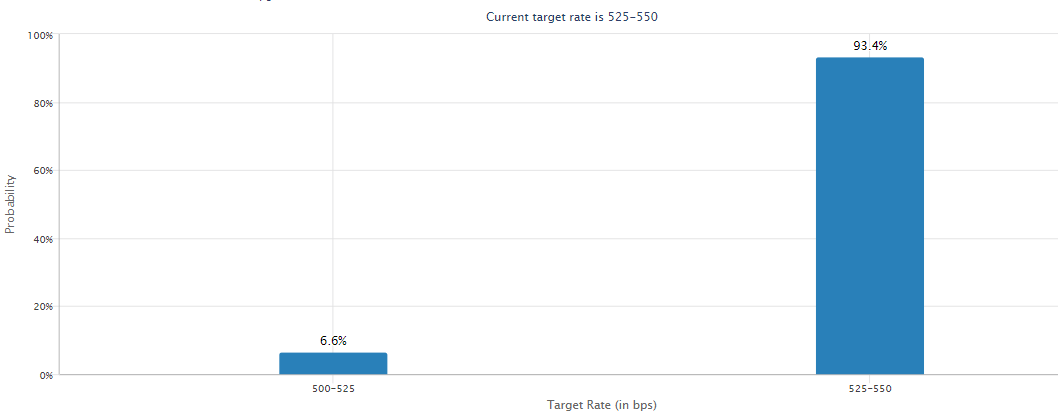

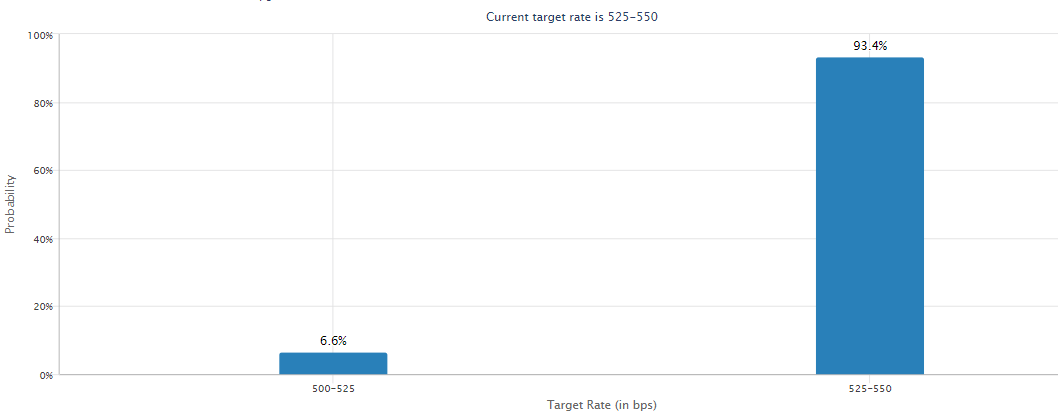

Despite this, the Fed has stated an intention to maintain the current policy rate between 5.25% and 5.5% until there is more confidence that inflation will reach their 2% target. The solid economic data, combined with minimal progress towards controlling inflation, has led Fed officials, including Chair Jerome Powell, to advocate for a cautious approach to any decision on rate reductions.

Fed Rate Hike Possibility Remains

As mentioned before, persistent inflation has led to speculation about a potential rate increase instead. Despite high interest rates maintained by the Fed since July, economic data suggests little improvement in 2023. The March Consumer Price Index revealed a 3.5% rise in prices from the previous year, exceeding February's 3.2% and surpassing economists' forecasts. This was the largest increase in six months, driven by rising gas prices and elevated housing costs, causing concern on Wall Street. The unexpected inflation data resulted in a significant selloff and diminished expectations for a June rate cut, as indicated by futures markets.

The U.S. economy is proving to be incredibly resilient and the market is taking care of the Fed's dual mandate on its own, amid the recent spike in bond yields," said Skyler Weinand, chief investment officer at Regan Capital in Dallas. "With unemployment strong and commodity prices heating up, the Fed's next move could very well be a rate hike to tame prices and keep inflation under control."

Federal Reserve Chairman Jerome Powell has not recently spoken about the possibility of raising interest rates, attributing early-year inflation surges to potential "seasonal factors." However, during the Fed's March meeting, some policymakers disagreed, suggesting that the inflation increases were widespread and not just statistical outliers, as revealed by the minutes released Wednesday. Former Treasury Secretary Larry Summers said Wednesday the March CPI report raises the odds that the Fed will hike rates.

You have to take seriously the possibility that the next rate move will be upwards rather than downwards," Summers said in a Bloomberg TV interview Wednesday.

Which Sectors Could Benefit from Rate Cut Expectations

• Commodity

The rise in the gold price has come at a time of dollar strength, falling inflation expectations, and during which the Fed has moved market expectations toward a 'higher for longer' conviction. All those developments would typically hurt the gold price, but it's forged ahead regardless," said David Rosenberg, the president of Rosenberg Research.

Rosenberg's team points out that the recent surge in gold prices is driven by demand, with central banks buying gold as a hedge against economic risks and a shift away from reliance on the US dollar and Chinese yuan. Central banks, reversing earlier trends, purchased 361 tonnes of gold in Q3 2023, as opposed to selling gold in 2022. The appetite for gold is stronger in emerging markets, while Western interest is dampened due to high interest rates and robust stock markets. Additionally, the gold demand is bolstered by its increased industrial use, particularly in electronics manufacturing for AI technologies, which is expected to sustain.

Rosenberg also links the recent increase in gold prices to rising global geopolitical tensions and an uncertain macroeconomic environment. He suggests that the trend towards increased militarization and confrontation globally has made gold's role as a hedge against risk more important. Additionally, concerns about the high US debt-to-GDP ratio, rising debt service costs, uncertain election results, and the potential for a fiscal crisis are leading investors to increase their gold holdings as a protective measure.

Sugandha Sachdeva, Founder of SS WealthStreet, anticipates an upward trend for gold and silver prices in 2024, despite potential short-term corrections that may attract buyers. While short-term profit-booking could impact gains, the overall forecast for both metals is positive. Geopolitical tensions from high-stakes elections in key economies and the US central bank's planned rate cuts during the year are expected to maintain support for the prices of gold and silver.

• Tech Stocks

Tech giants, known as the "Magnificent 7," propelled a stock market rally, with $Apple(AAPL.US$ and $NVIDIA(NVDA.US$climbing over 4%, and $Amazon(AMZN.US$achieving a record high not seen since 2021 with a gain of over 1.5%. On the inflation front, the Producer Price Index (PPI) for March increased by 0.2%, less than expected, and the annual rise of 2.1% was also below forecasts, yet it marked the largest yearly increase in nearly a year.

Following a March CPI report that exceeded expectations, stocks retreated, and bond yields jumped as investors adjusted their views on the Federal Reserve's policy, now anticipating just two rate cuts in 2024, expected later than initially thought.

Against that backdrop, the expectation that interest rates will decrease in 2024 has provided the latest push for tech stocks, especially since there are limited signs that high borrowing costs are slowing earnings.

Interest rate volatility is expected to continue in the short term, potentially impacting stock prices. However, equity investors should look beyond this single factor. "We're keeping an eye on how falling inflation rates might make stock valuations seem more attractive," comments Haworth. He observes that a reduction in inflation from its present state would likely have a positive effect on the valuation of stocks.

To bid stock prices higher, investors need to believe that earnings will grow faster than is indicated by current expectations and generate more attractive growth potential than the current elevated yields on fixed income instruments," says Haworth.

Source: CNN Business, REUTERS, U.S. Bank, CME Group, mint, Yahoo Finance, Business Insider

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

10baggerbamm : as a general rule profitable companies in the technology sector example Nvidia Apple Microsoft who carry no debt the cost of borrowing is irrelevant the direction of the FED is irrelevant to their business model. a startup company a small cap company that is heavily reliant upon debt for operations whether selling equity as a matter of percent to somebody and they have to use an opportunity cost to determine is this the best investment I need to get more for my investment because I can get from another company with similar risk a greater percentage of equity and or when they have to borrow risk capital from a bank they're going to be 12 13% in today's environment so a smaller cap is very reliant on interest rates and it is extremely sensitive just like a homeowner that wants to refinance when rates fall small companies will do this to preserve cash flow.. so a company that borrows $100 million at 12 and a half percent if rates were to come down 200 basis points they could refinance at 10 and a half percent and that difference is free cash to them so it is quite significant with small caps it is not relevant for highly profitable companies aside from all stocks live in the ocean and the rising tide of declining interest rates lifts all stocks and the perception of rates higher will reduce the buoyancy of all stocks causing them to decline slightly.

104132545 10baggerbamm :

103119097 : Monetary policy is no longer purely meant for managing the economy but being used for financial sovereignty "WAR"…?

razo2 : you guys should just all in oil commodities when they cut rates you see how inflation will come back like a monster.

razo2 10baggerbamm : you seen oil prices bro? they cut rates oil will be back above 120

10baggerbamm razo2 : I'm going to play oil based off of Trump's winning the election and what I will be backing the truck up and buying is DRIP. you're just having on the of the administration that's in office is hell bent on destroying the economy which he's doing every day because they're globalists they want to bring down the United States and let other country succeed the whole socialist idea brought to you by the failure 44. they want a global governments they want a new world order they want crime they want poverty they want larger government they believe in this global warming climate change complete hoax and lie. look for federal and the only salvation for the United States is Donald Trump because he will rip up the agenda from this lying shitbag in office now and oil prices will drop precipitously back down to below 40s and high 30s over several years. drip ETF will go up hundreds of percent in the low twenties to even mid-upper twenties possibly $30. and I will make over a million dollars on that trade.

Slug : If they cut rates early and we fall deeper into inflation . stagflation becomes major. What are you pumping