March PCE Price Index Preview: Economists Warn of Broadening Inflation Impact from Rising Oil Prices to More Sectors

Economists expect the Federal Reserve's preferred measure of inflation will follow its counterpart inflation measures and remain stubborn in March.

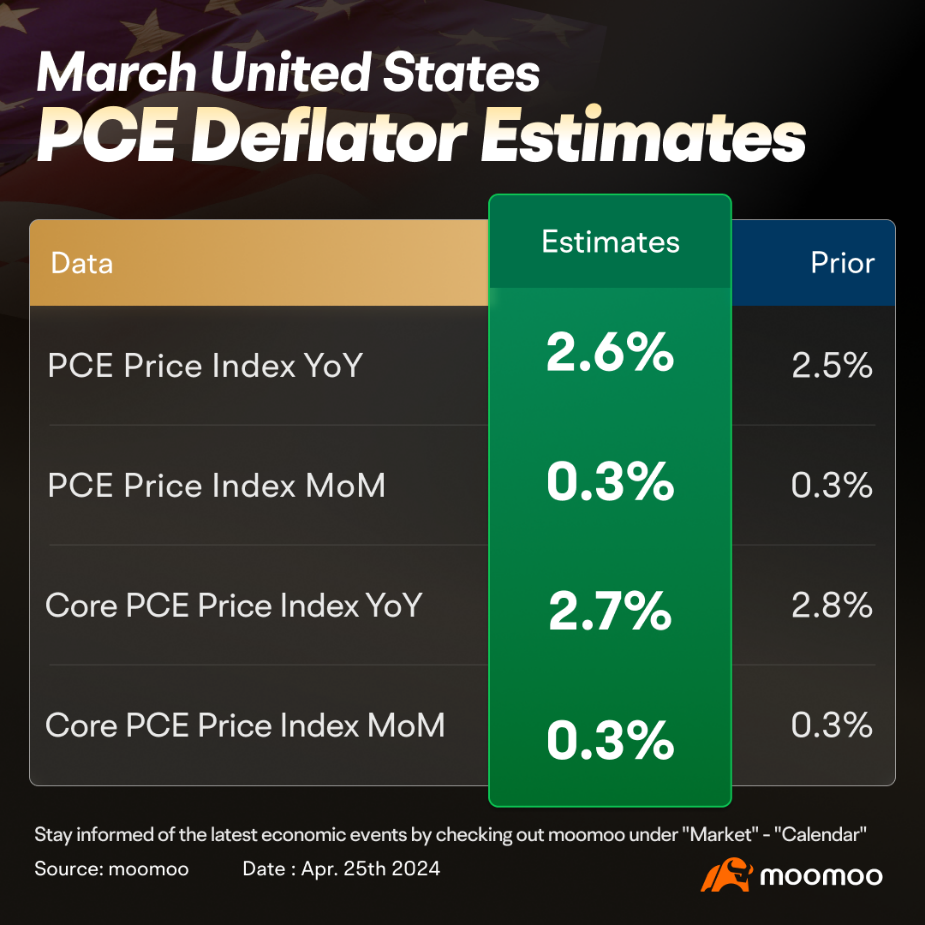

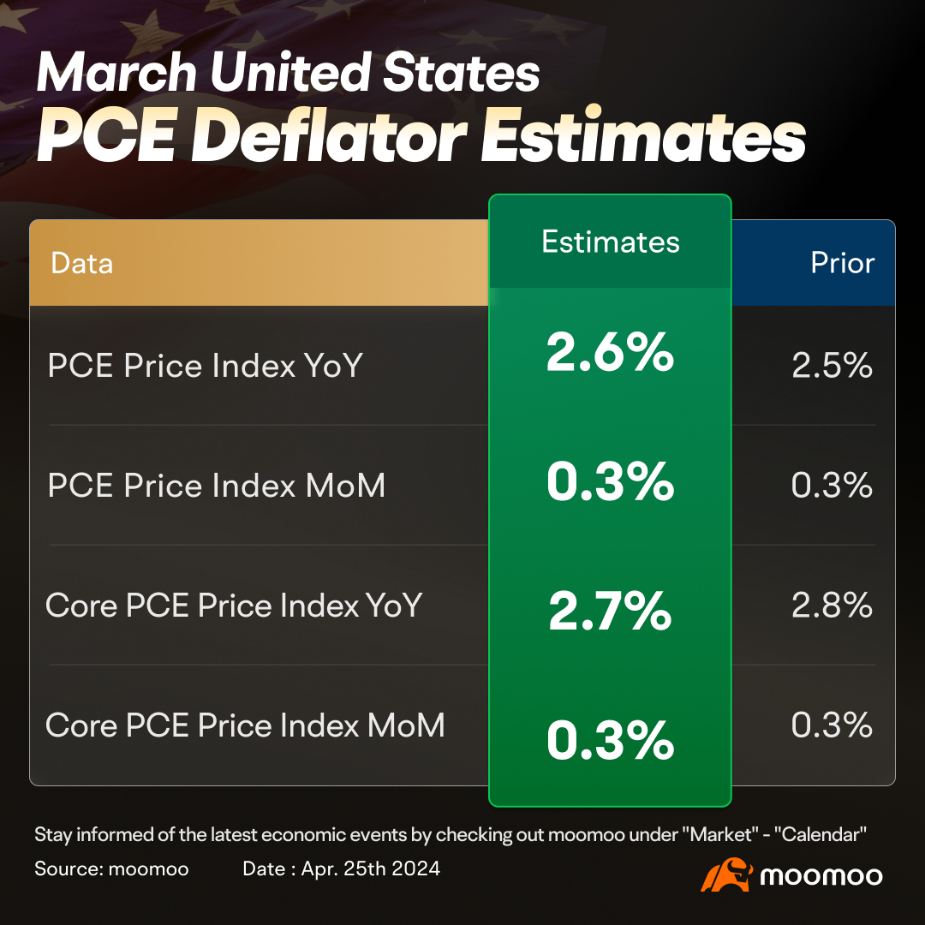

The cost of living measured by the Bureau of Economic Analysis's Personal Consumption Expenditures (PCE) index is expected to increase by 2.6% over the 12 months ending in March, according to a survey of Bloomberg. That would be an acceleration from the 2.5% annual rate reported in February. Economists also expect core inflation, which excludes volatile prices for food and energy, to have declined to 2.7% from 2.8% in February. Meanwhile, the details could make the Federal Reserve's job of parsing the data more difficult.

■ Import prices have turned from a deflationary factor to an inflationary driver

Prices for U.S. imports, all commodities, increased 0.4 percent over the year ended March 2024, the first 12-month increase since January 2023. Data from the Bureau of Labor Statistics shows that food import prices rose 1.6% MoM, while metal prices rose 1.2% MoM, which may increase manufacturing costs in the future.

■ A rebound in house prices could trigger another pick-up in residential inflation

On April 23rd, the U.S. Census Bureau reported a spike in new home sales numbers and prices. The median price of new houses sold in March surged from $406,500 to $430,700, while the average sales price was $524,800.

Gregg Logan, a housing analyst and managing director at RCLCO Real Estate Consulting, anticipates lower mortgage rates in the second half of this year, which he believes will lead to stronger new-home sales in the third and fourth quarters.

Prospective home buyers are encountering a scarcity of choices in the resale market, despite a slight improvement in available inventory this spring. The situation could become even more challenging as the market for new homes is also expected to tighten. The construction of new single-family homes experienced a significant decline of 12.4% in March, and the number of permits, which indicate future building activity, dropped to the lowest level seen in five months.

"The battle against inflation is posing multiple challenges," notes Carl Harris, chairman of the National Association of Home Builders. "Rising interest rates not only elevate the cost of housing for potential buyers but also increase the expenses related to the development and construction of both single-family homes and apartment buildings."

Goldman Sachs's analyst Jan Hatzius recently raised his forecast for residential inflation. He expected official shelter inflation—which places greater weight on OER than on rent—to slow from a monthly pace of +0.43% in March to +0.34% by December 2024 (implying a year-over-year rate of +4.9%, up from our previous forecast of +4.3%) and +0.28% by December 2025 (+3.7% year-over-year, up from our previous forecast of +3.1%).

■ A wage-inflation spiral could lead to a core inflation rise in the second half year

Elevated hiring and higher average weekly earnings likely drove up incomes and supported March personal spending. Bloomberg's analyst Anna Wong estimates personal income rose 0.6% amid nearly 0.8% growth in employee compensation. Elevated retail sales foreshadow hot personal spending, which is likely to rise 0.7%, keeping personal saving rates below 4.0%.

Income and spending growth could contribute to an inflation impulse, especially in the service sector. Economists are concerned that inflation could pick up again in the second half of this year. Anna Wong predicts that the core PCE Price Index could float back above 3.0% in H2.

■ What's the implication for the Fed?

After the Fed adopted an excessively dovish position in December, the market's enthusiastic anticipation of rate reductions gained momentum. This overstimulation of the economy compelled the central bank to reverse its course.

If this week's PCE data exceeds expectations, the Fed is bound to maintain its hawkish stance.

Last Tuesday, Fed Chair Jerome Powell confirmed Wall Street’s fears by saying that because of the robust labor market and remaining progress required on inflation, rates would stay where they are “for as long as needed.”

Investors had begun 2024 pricing in more than 1.5 percentage points of interest-rate cuts over the course of the year. Today, they expect rates to fall by only 0.5 points. CME FedWatch shows that the likelihood of the Fed keeping the current rates at the June FOMC meeting is 84.8%, and there is a probability of 58.5% of keeping the rates at the July Fed meeting.

Options markets even suggest a roughly 20% chance of a US rate increase within the next 12 months, a sharp increase from earlier in the year. The potential for the Federal Reserve's next move to be an uptick in rates, an idea previously mentioned by ex-US Treasury Secretary Lawrence Summers, is now being more seriously considered by analysts and investors.

Benson Durham from Piper Sandler has assessed there's nearly a 25% chance of rate increases over the coming year, while PGIM's examination of Barclays options data suggests a 29% probability of such a hike within the same period.

Last week John Williams, president of the New York Fed, said that “If the data are telling us that we would need higher interest rates to achieve our goals, then we would obviously want to do that”.

Richard Clarida, a Pimco economic adviser and former vice-chair of the US central bank, noted that while a rate rise isn't his primary expectation, it could occur if core inflation exceeds 3%. He mentioned that the Fed would need to consider rate hikes again if the data continues to fall short of expectations.

Source: CME, Bureau of Labor Statistics, Bloomberg

By Moomoo US North America Team Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment