The Solar Energy Sector Underperformed the Market In 2023, Will It Rebound In 2024?

According to Wood Mackenzie's estimate, the US solar industry grew 55% in 2023 compared to 2022. With nearly 33 GWdc of capacity expected, it will be the nation's largest year of solar installations by far. Solar power will likely remain the energy sector's fastest-growing sub-segment in 2024.

In Bloomberg's latest research report on solar energy sector, the analyst Rob Barnett predicted that $First Solar(FSLR.US$ , $MEYER BURGER TECHNOLOGY AG(MYBUF.US$ , and $Sunnova Energy International(NOVA.US$ , among the fastest-growing companies, could see sales gains exceeding 30% in 2024. Profitability metrics at such companies may improve on easing input costs and strong policy support, including the Inflation Reduction Act.

■ Solar sector underperformed in 2023

Although worldwide demand for solar energy soared in 2023, solar industry stocks experienced a roughly 30% drop in value, underperforming relative to the overall market. Even compared to the wider energy sector, solar stocks also fell short. During this market retreat, valuation measures saw a modest decrease, with the median enterprise value-to-EBITDA ratio settling around 10 times.

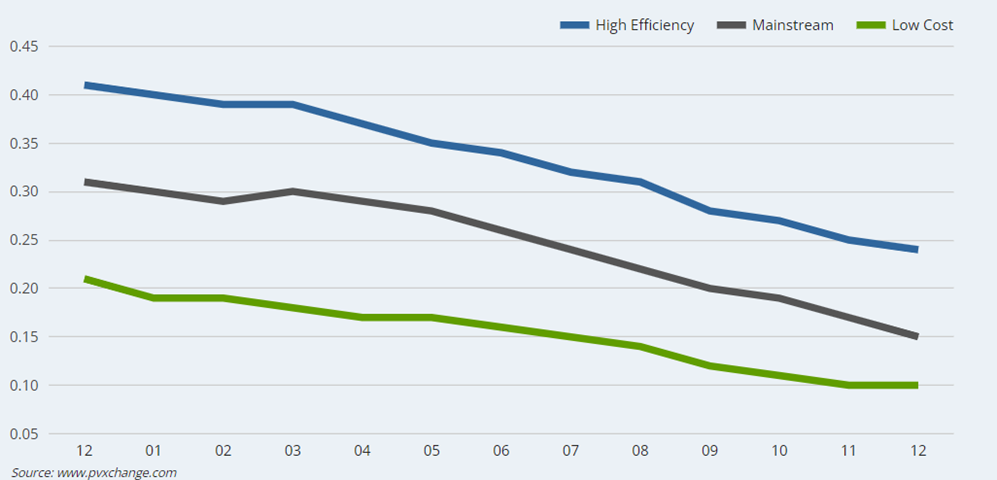

Pvxchange data shows that mainstream solar panel prices decreased by 50% in 2023. This has brought revenue pressure to major solar companies.

Still, First Solar stood out with an impressive performance, as its share prices climbed approximately 15% in 2023. This success is partially attributable to the company's robust position in the US market, coupled with a variety of subsidies that benefit the solar industry.

■ Falling prices for traditional energy sources made new energy sources less attractive in 2023

Natural gas was the largest source—about 40%—of U.S. electricity generation. Natural gas is used in steam turbines and gas turbines to generate electricity. Natural gas prices fell sharply in 2023 as geopolitically generated price surges faded. This has kept U.S. power generation costs down over the last year and reduced the urgency to install solar. However, considering that natural gas prices have fallen back to a reasonable level, there is little room for further decline. Recent unrest in the Middle East may cause a new round of disruptions to the supply chain, so this factor that suppresses solar energy no longer exists in 2024.

■ Cheap solar electrons could fuel demand in 2024

Solar accounted for 48% of all new electricity-generating capacity added to the US grid through the first three quarters of 2023. Cumulative operating solar capacity now stands at 161 GWdc and 4.7 million systems.

According to Wood Mackenzie, the growth outlook for the US solar industry remains strong, averaging 14% annually over the next five years.

The anticipated surge in solar energy demand is chiefly driven by its cost-effectiveness. The levelized cost of electricity for a new solar installation is approximately $60 per megawatt-hour, which is on par with the cost of a new wind facility and about half as expensive as that of a new coal plant. In contrast to nuclear power and other alternative energy sources that lack comparable scalability, the expense of solar installation is expected to decrease as technological advancements boost efficiency and as production capacity grows.

■ Inflation Reduction Act, lowering costs and surging demand may fuel margin for us manufacturers

Rob Barnett expected the Inflation Reduction Act to further propel demand growth and margin expansion. Consensus estimates sales will climb 30% or more in 2024.

In addition to generous new subsidies, declining costs for polysilicon and other raw materials and surging demand growth may also allow companies such as First Solar to improve gross margins.

The cost of polysilicon, an essential ingredient for the solar sector, has plummeted by nearly 80% since August 2022. This sharp decrease may lead to modest upward revisions in the consensus EBITDA forecasts for companies like Canadian Solar, Maxeon, and other solar module producers.

The average firm within the group of U.S.-listed solar peers could witness its EBITDA margin jump to 17% in 2024, up from 9% in 2022,according to Rob Barnett.However, solar project companies such as SunPower and Sunrun are likely to experience the narrowest profit margins, largely due to their business models being more labor-intensive and less influenced by the costs of raw materials compared to solar equipment manufacturers.

Source: Wood Mackenzie, Bloomberg Intelligence, Pvxchange

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73372562 : Thank you so much for this information I will buy the stock too