The Market (Important)

Deep Dive Counter: 10

Date: 04/19/2023

Introduction

Good morning everyone! I hope everyone is doing well and enjoying their day in the market with cash ready to deposit into the bank account. Today is an incredibly important day and therefore this post will be extensive and packed with information. I don't want to waste any time, so onto the article.

Today's Topics

- ![]() Key Headlines

Key Headlines ![]()

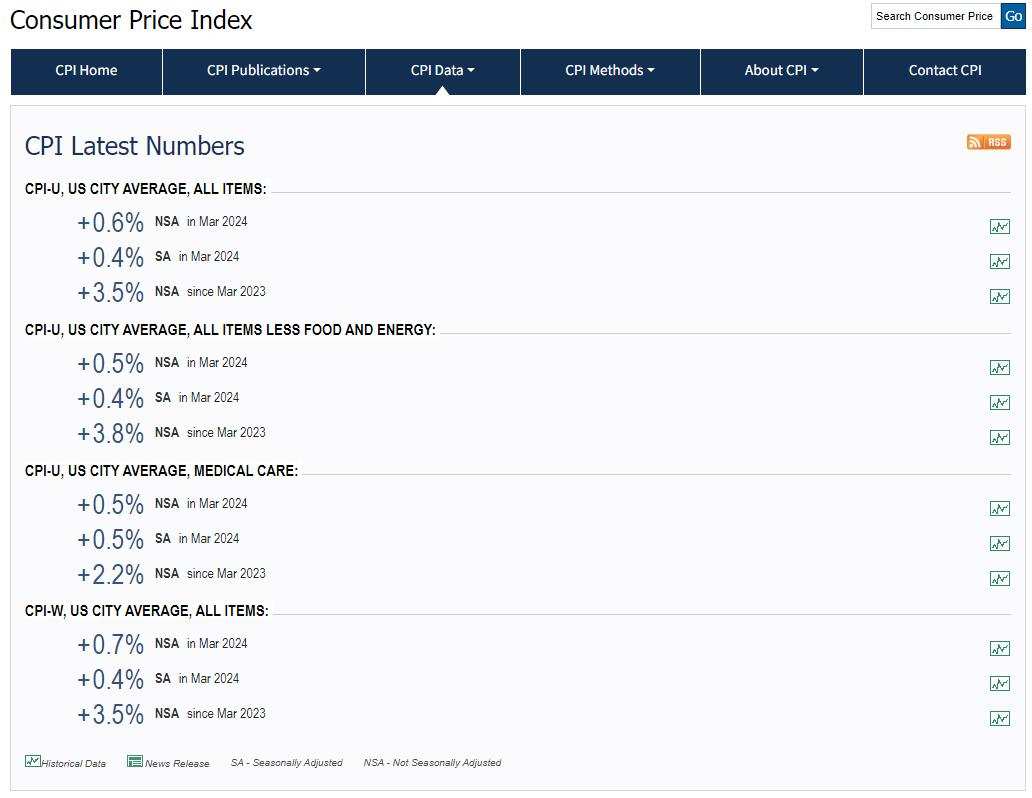

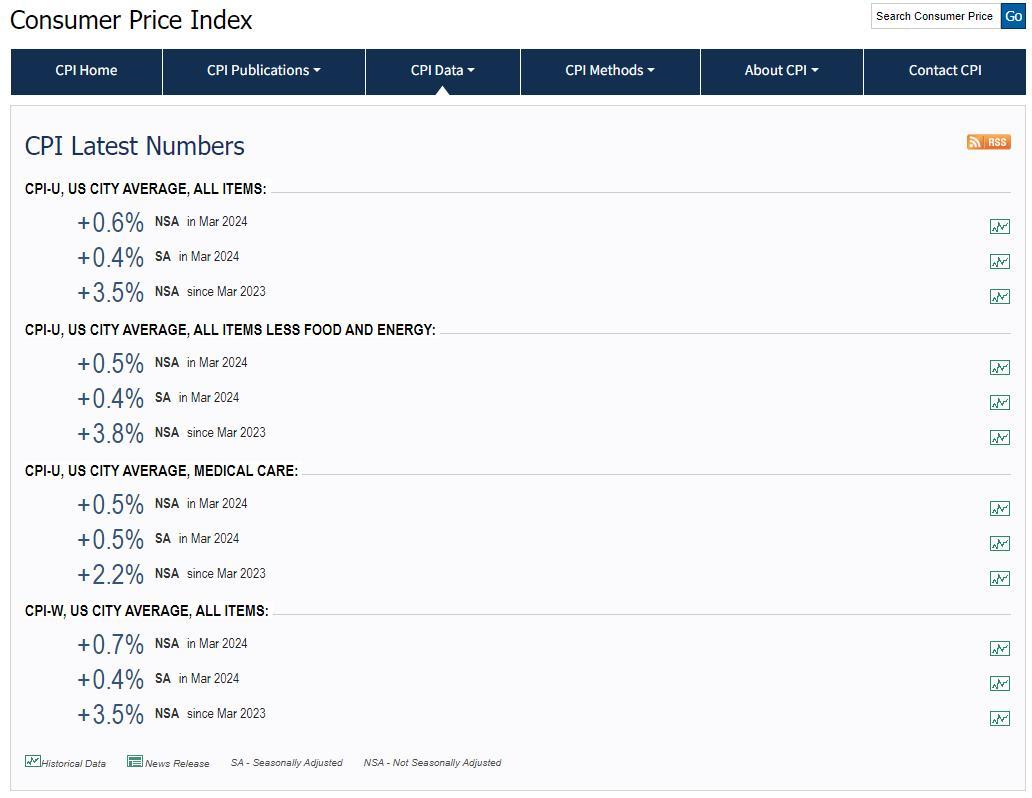

- ![]() Economic Data

Economic Data ![]()

- ![]() Economic Graphs

Economic Graphs ![]()

- ![]()

![]()

![]()

![]()

![]() FEAR AND GREED

FEAR AND GREED ![]()

![]()

![]()

![]()

![]()

- ![]()

![]()

![]() BUBBLE?

BUBBLE? ![]()

![]()

![]()

- ![]()

![]() Put and Call Ratio

Put and Call Ratio ![]()

![]()

News

There has been a ton of news recently, from Fed Speakers, to global tensions rising, all the way to the Bitcoin Halving.

- Increase In Card Member Spending Boosts Amex Q1 Revenue, Company Eyes Steady Annual Growth

- Attacks on Iran and Isreal sparking war fears

- Jobless Claims

April 13

212,000

215,000

212,000

- Powell says conditions needed to cut rates likely to take longer to appear

- Fed's Williams says he doesn't feel 'urgency' to cut rates

- Home sales are getting hammered by high mortgage rates, but one region is holding up

- Leading index for U.S. economy retreats again after first increase in two years

- Fed's Beige Book finds steady economic growth but little progress in reducing inflation

- Builder-confidence index stalls in April as mortgage rates hit 7%. Buyers are 'back on the fence waiting for interest rates to fall,' one builder says

- Default, Transition, and Recovery: U.S. Speculative-Grade Corporate Default Rate To Hit 4.75% By December 2024 After Third-Quarter Peak

WIth US citizens using their credit cards more, companies such as AMEX beat earnings strong to the bull side. This is good for the company, but may be inversly correlated to the improvement of inflation.

More spending = More Inflation

Less spending = Moderation of Inflation

No spending = No Economy

Keep an eye on Credit Card company earnings. I expect more credit lenders to have bullish earnings with directly correlates with the fact that inflation is not going down. Remember, we cannot directly get spending data from invidividuals themselves, but there are other metrics to look at.

Recap

In an article I wrote in January, we talked about:

The chart on January 24th

Current Fear and Greed Index

Looks bearish, doesn't it?

Bubble?

Still researching the Bubble, but I don't think it has popped yet. I might keep this research to myself as I don't want hedge funds knowing what I know hahaha. I am joking, once I find the bubble I will post it FOR MEDIUM FOLLOWERS ONLY.

Put Call Ratio (02/14/2024)

Put Call Ratio Today

From today's Put Call Ratio, it looks like there is not a lot of interest with Puts, but there also is a lot of Call selling. So the market is moving more on sentiment than with the options overall.

The intraday Put and Call ratio is an entirley different thing. However, it looks like not a lot of investors are opening put positions. the skew in the ratio is as a result of call holders selling. Might be a profit taking move based on technicals.

TLDR:

- Looks like not a lot of put buying, but a lot of call selling

This means that a move down has not been entirley priced in, put buyers must be cashing. First time I have seen this sort of ineffeciency in markets. Might also mean that no one is exiting their positions in stocks.

Eventhough the Fear ticker is kicking up, no one is "sold" yet.

Could mean a reversal, or even a BUBBLE

-If there were more interest in put buying, the open interest line would be above the candles. Instead, the open interest hardly got to the candles at all. This might mean that there is fear in not taking profit. AKA, take profit sell off.

Where call buyers aren't re-entering for a swing trade. I have never seen this sort of movements in markets.

My thesis is further supported by the fact that these candles are ALL TIME HIGHS. Look where the interest is at?

-Calls still loading / holding

-Puts exiting

- Callers just selling their positions

- Put open "interest" is not heavy at all

No one is interested in puts. The move somehow caught market makers and investors off guard? How could they not see the possible top reveral? We have been talking about it for weeks!

Options Summary

This is a very basic options fundamental lesson:

-If everyone thinks a stock is going up, IV is increased and the less money you make as its priced in on the call side.

-If everyone thinks a stock is going up, but goes down, then IV is in your favor as it is not what market makers expected therefore you make more money on the put side.

-If everyone thinks that a stock is going down, say $Tesla(TSLA.US$, but Elon comes out and suprises the market with bullish news, those who placed calls will make more money since the volatility is priced in to the sell side.

If everyone thinks a stock is going up, say $Apple(AAPL.US$, but Tim Apple comes out and suprises the market with bearish news, those who placed puts will make more money since the volatility is priced in to the buy side.

This is how people make a lot of money, by doing the research and placing trades that no one expects or is against everyone else. The more implied the move to the upside or downside, the more money is made if the stock moves in a way that is not implied or expected.

So these charts tell me that no one thought the top was in yet.

Probably because of Jerome's bullish news of rate cuts this year, which he later retracted.

Therefore, everyone thought the market would continue to go up with a dip here and there.

(hence the no larger open put interest)

Instead, Jerome and the Fed reversed their inflation outlook catching everyone off guard and those who bought puts made more money since IV was not in their favor.

(hence the callers taking profit and not a lot of put buyers)

I hope this makes sense haha.

SPY Charts

Daily

Fibonacci Extention Tool indicator of possible support at the $497.05 level, above the Daily 100EMA. Not much else to nice here other than the fast breakdown.

Keep in mind the upside gaps as we move to the downside.

We have already filled one gap.

The lowticker is picking up speed, but we will have to see if the buyers can find support. This downside move is too strong on the daily chart. I want to see a reversal of some sort, but we will need bullish news for the next upside move.

Spy 4 Hour

There are a lot of buyers down here at the $490 to $497 range. I think this may be an area of rejection to the upside, but I would not be suprised if we started moving sideways. The most bearish, and unlikely outcome, is the market will continue to sell down with volume.

There is still an imbalance at the $512 level.

SPY 1 Hour

The possible inverse head and shoulders is still not confirmed yet. However, the price has rejected exactly off of the $495 level for now. There are no other obvious pattern except the downwards channel.

However, the move down feels too sharp. I could be wrong, but usually sharp moved to the downside or upside are met with some sort of correction. This could mean that the price might retest the upperchannel. Convenietly at the $500 level and an area of selling liquidity.

If the price continues to reject off the Fibonacci levels, this seems almost too obvious. I might take a trade back to retest the $500 level. If it rejects off $500 with volume, then my confidence for more downside is increased.

Almost textbook reversal to liquidty, then rejection off of the significant level.

SPY 15 Minute

No obvious pattern here. Rejection off of the $495 Fibonacci level, and selling liquidity back at the $499 range.

SPY 5 Minute

Almost nothing here as well to mention. Same with the other time frames. Rejection off the $495 Fibonacci level, but there is liquidity up there at the $498 level.

SPY 1 Minute

There does look like to be a possible breakout structure forming to the upside. If buyers can close above the breakout structure, Retest and Reject it to the downside, then we might see a reversal upside on the day.

There are three areas of sellers.

The $497 level

The $498 level

The $499 level

We know that the heaviest sellers ate at the $499 level with moderate selling liquidity at the $498 level. If buyers can step up, we might break those levels to retest $499 around power hour.

Trends

SPY Weekly

Eventhough there is a sell off in markets, the overall sentiment is Bullish. There is no reason to get overally bearish until we reach the previous year's All Time High to the downside. That would render the cup and handle on the longer time frames as complete with a possible change of character. If the CHoCH prints on the weekly, it may get bearish fast. If a bullish break of structure prints, then the move may be just a rebalance in markets after the strong move upside. A bullish BoS will give me more confidence of upside. A bearish BoS will not print unless we reject to the upside, and move further than the area of rejection.

I will make a Deep Indicator article about CHoCH and BoS itself as they, similar to Volumetric Trading, Smart Money Concepts, and VWAP are one of the most powerful trading indicators you can use. It will be an advanced lesson, but I will do my best to try to explain what they are and how to trade them.

Tin Foil

I have some suprise Tin Foil for everyone! However, I have to mention that Tin Foil is sort of like a theory without any facts to support it. Sort of like a hunch, or conspiracy theory. So take what I say with a grain of salt and in no way is this me saying it will happen or wont happen. You may certainly lose money listening to my Tin Foil, so please do not take a trade based off my ideas. Consult your financial advisor and do your own research before thinking about taking a position.

I will be posting the Tin Foil as a For Followers post after this article.

Conclusion

Phew! If you made it this far, thank you for reading. I know this post was not structured as well as the other ones, but it has a lot of information that is absolutely important to pay attention to as the markets move lower. I hope I was able to explain some of my research and analysis in a way that is easy to understand.

Look forward to the Tin Foil post!

Thank you for all the support and have a great weekend. I hope you all have made some money this week and I am grateful for all.

At the time of writing, Bitcoin is at $64,005.61 and SPY is at $496.900

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment