BCE Earnings Preview: Challenging Operating Environment and High Dividend Yield in the Spotlight

BCE Inc. is set to report earnings on May 2rd before market open. The intense competition phase in Canadian telecom could be painful for operators, and the worst may not be over.

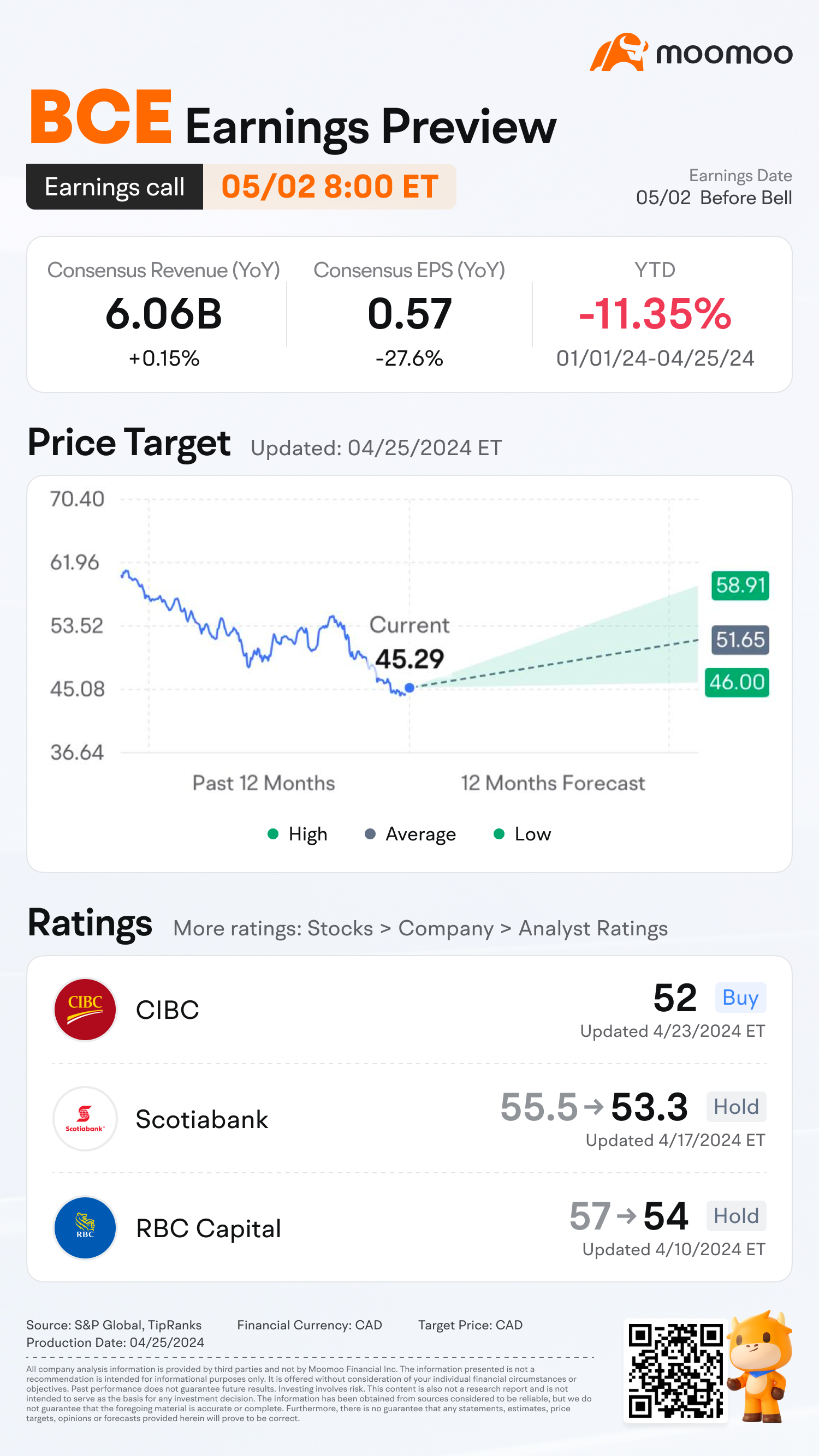

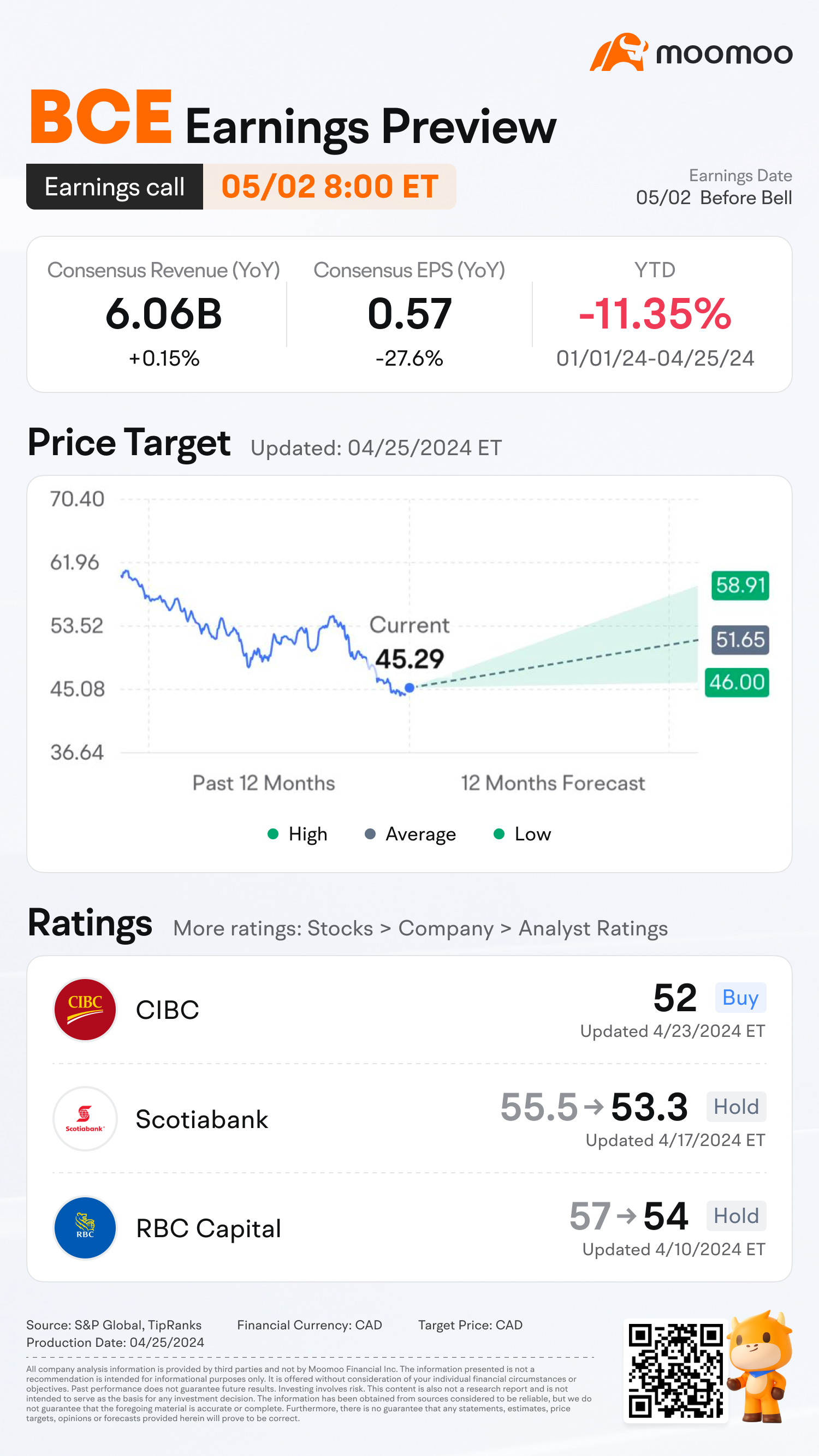

Consensus Estimates

● Analysts project Bell Canada’s consolidated revenue for the first quarter at C$6.06 billion, up slightly (0.15%) from the year-ago period.

● Earnings per share (EPS) are expected to be C$0.57, down 27.6% from the year-ago quarter.

● Competitive dynamics continue to weigh on BCE and the broader Canadian Communications ecosystem due to elevated promotional in Q124.

● One of BCE's most attractive features is its high dividend yield, close to 9%, and the state of its free cash flow in Q1 is a critical factor for the sustainability of its high dividend.

The tough competitive environment in Canadian telecom continues to weight on BCE

JP Morgan lowers its consolidated revenue forecast by 1% to $6.05 billion and EBITDA by 3% to $2.549 billion ahead of Q1 earnings release, mainly due to higher CTS costs and challenging media competition.

JP Morgan said that the competitive dynamics continue to weigh on BCE and the broader Canadian telecom due to elevated promotional activity in Q124. It is unclear when this pressure will ameliorate.

Looking at it by segment:

● Bell Communication and Technology Services (Bell CTS): JP Morgan maintains postpaid phone adds of 40k and Internet net adds of 25k in Q1 despite increase in competitive intensity. While wireless/mobile ecosystem subscriber tailwinds persist (population, penetration, bundled sell-in), JP Morgan expects aggressive pricing action to pressure 1Q (and 2024) ARPU trends.

● Bell Media: Due to intense competition and weak advertising trends, JP Morgan has lowered its EBITDA forecast for Bell Media for the first quarter of 2024. Additionally, it has revised down the revenue forecast for the first quarter to $733 million.

Barclays also lower its estimates to reflect higher-than-typical promotional aggressiveness that has carried over from Q423, resulting in a continued challenging operating environment. Q423 saw a nearly unprecedented uptick in churn across the industry, and while churn will likely come down in Q1 due to typical seasonality, it remains elevated relative to historical trends due to aggressive promotional pricing and heavy switcher activity in the quarter.

Keep an eye on BCE's investments in fiber, 5G, and cloud/security

According to JP Morgan, BCE's investments in fiber, 5G, and cloud/security will lay the foundation for the company's future growth. With leading share in enterprise, BCE is also well positioned to benefit as opportunities in IoT and MEC emerge. However, JP Morgan maintains its Neutral rating on BCE shares given its slower growth profile relative to peers.

Jerome Dubreuil, an analyst at Desjardins, also said in a note,“slow revenue growth and high expenses related to restructuring activities and fiber network buildouts keep investors cautious about the telecom sector.”

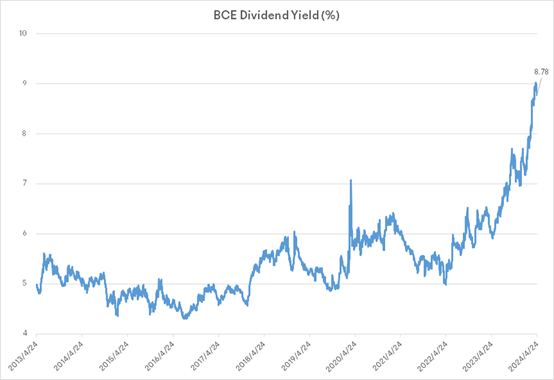

Betting on BCE stock depends on the dividend

The most attractive feature of Canadian telecom stocks is their high dividend yield, and betting on BCE is essentially a bet on the dividend. In recent weeks, BCE's dividend yield has been approaching an unprecedented 9%.

Source: Bloomberg

However, whether the high dividend yield can be sustained in the future is the primary concern for investors.

Now, BCE’s dividend growth is looking fragile, with a 3.1% increase -12 cents per share on an annualized basis – which is a step down from the usual annual increase of more than 5%. Part of the problem here is that the telecom has been distributing more money to shareholders than it has been generating in terms of free cash flow or earnings, driving a payout ratio that is now well above 100 per cent. In the long run, this is unsustainable.

According to Bloomberg, analysts expect free cash flow to reach C$396.6 million in the first quarter of 2024, an increase from the year-ago period, but there is a significant decline from the previous quarter due to typical seasonality.

In addition, BCE's stance on dividend growth is also worth noting during their Q1 earnings call. Previously, in the Q4 2023 earnings call, BCE’s President and CEO Mirko Bibic said, " We're increasing the BCE common share dividend by 3.1% for 2024. It's our 16th year of uninterrupted growth, demonstrating our unwavering commitment to dividend growth. Dividend growth remains central to our value proposition and we'll continue to prioritize it in our capital allocation."

Although BCE’s dividend prospects aren’t what they used to be, do you think it's worth the risk when the dividend yield is close to 9%?

Source: JP Morgan, Barclays, The Globe and Mail

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102547705 : My personal account

74619152 : In France please I don't understand anything

74619152 : I would like to have everything in FRENCH