One of The Macro Driving Factors for The Rise of Gold and Bitcoin: The Market Is Trading Credit Depreciation

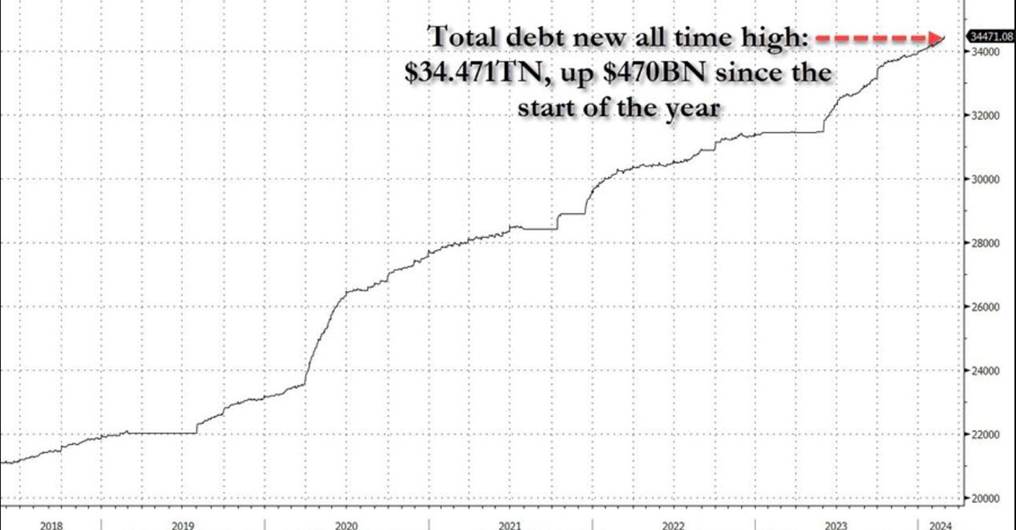

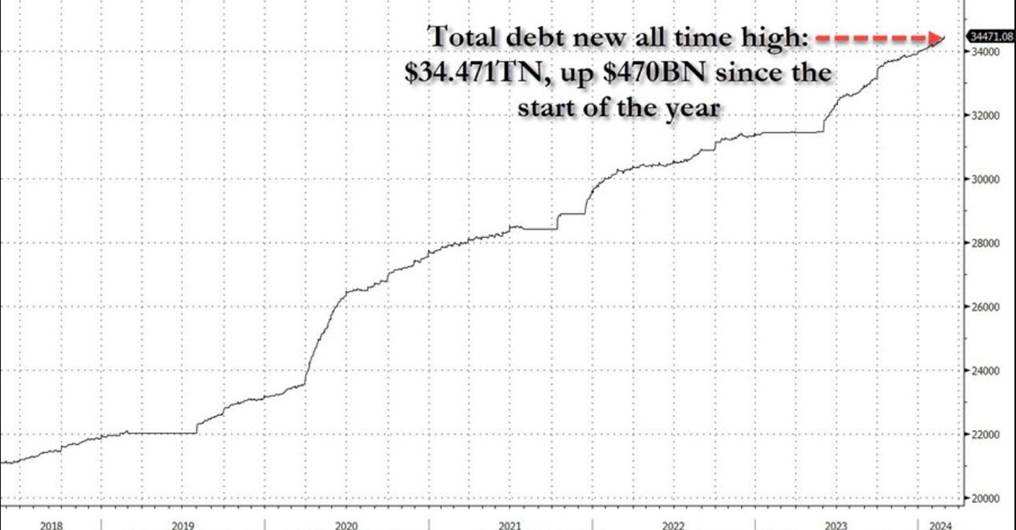

Data from US Treasury Department shows that the US national debt increases by $1 trillion every 100 days. It took 92 days for the national debt to go from $32 trillion to $33 trillion, 106 days from $33 trillion to $34 trillion, and 95 days from $34 trillion to $35 trillion.

Due to the bailout policy after the epidemic, the scale of U.S. debt once soared. In 2022, since the withdrawal of the bailout policy, the increase in U.S. debt slowed down. But starting in the second half of 2023, U.S. debt surged again.

This may be one of the macro drivers of the rise in gold and Bitcoin: the market is trading the depreciation of credit.

■ Where has the growing debt gone?

On Tuesday, the U.S. Treasury Department unveiled fresh measures aimed at increasing the availability of low-cost housing. The plan involves freeing up several billion dollars from unused COVID-19 relief funds allocated to state and local governments, expanding the scope of housing projects that can be financed with this aid.

These efforts are part of the broader strategy by the Biden administration to tackle a significant economic issue that is impacting citizens across the country: the scarcity of affordable housing. The high cost of housing is not only fueling inflation but also affecting public opinion regarding President Joe Biden's economic policies.

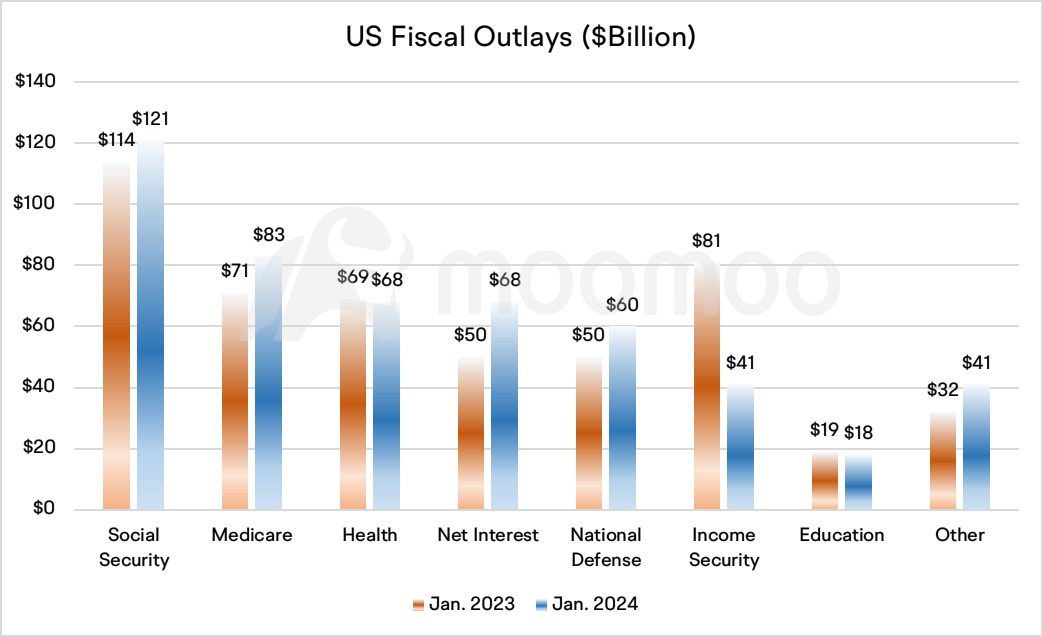

This is just one of the new expenditures of the Biden administration. U.S. Treasury data shows that fiscal outlays' expenditures in debt's net interest, national defense, medicare and many other fields have continued to grow compared to the same period last year. Rising spending increases the need for government debt issuance, raising the risk of credit devaluation.

■ Depleting Overnight RRP may force the Fed to slow down QT

Compared with the growing debt, the liquidity environment is changing in a direction that is unfavorable for absorbing a large amount of U.S. Treasuries.

Overnight RRP is about to be drained. After the ON RRP is drained, asset runoff will reduce commercial banks' reserves 1-for-1, all else equal.

In such an environment, for the Fed, slowing down QT is imminent. Dallas Fed president Lorie Logan suggests that as ON RRPs get drained to very low levels – “when ON RRP balances approach zero,” as she'd said in her January 6 speech – it would be time to slow QT.

Slowing QT doesn't mean the Fed's balance sheet is going to expand again. However, this somehow means that the Fed's independence is threatened in the face of embarrassing fiscal policy.

■ Another key question: Is the growing debt coming from short-term Bills or long-term Notes?

Christopher Waller, member of the Federal Reserve Board of Governors, said he'd like to see a shift in Treasury holdings toward a larger share of short-dated Treasury securities on Friday.

Accordingly, considering that the cost of short-term debt may be reduced, the Treasury Department may increase the proportion of short-term debt issuance and reduce the proportion of long-term debt issuance. The benefit is that long-term debt can be short-termized and avoid leaving a debt snowball in the future.

However, can short-term fiscal revenue absorb these new short-term debts?

An important condition for fiscal sustainability is whether the economy's growth and the growth rate of fiscal revenue could match the rate of debt expansion. It is true that since 2024, U.S. economic growth has continued to exceed expectations. Data shows that personal income tax and corporate income tax have increased compared with the same period last year.

However, since government spending has grown at a higher rate, the deficit level has also risen, challenging the current fiscal sustainability. If a positive cycle of normalizing national debt proves elusive, the rally in gold and Bitcoin may not be over.

Source: US Treasury, BEA, FRED, Bloomberg

By Moomoo US Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101604370 : very informative

phongy45 : I go for a gold collection instead

70510371 : Bitcoin

BelleWeather : I changed my dog’s name to Bitcoin.

David900924 : Bitcoin is the only road to riches in this era, follow me for tips how to benefit and dca smartly even with 80% drop.

not-a-cow David900924: Nonsense.

Eazy73607587 not-a-cow: Edmonton