Market Pulls Back, Reddit Goes Negative | Market Moovers

Good morning mooers! It feels like winter again in Jersey City, and the market is pulling back from back-to-back all-time highs.

RECAP

Shortly after 10:30am est, the $S&P 500 Index pulled back from a 20th straight win by 0.09%. The $Dow Jones Industrial Average fell 0.27%, and the $Nasdaq Composite Index fell 0.10%.

Reddit is feeling the freeze after a dramatic opening session. Here are the rest of the Market Moovers for today.

MACRO

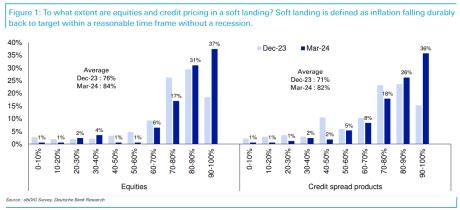

'Soft landing' 84% priced into Stock market: Deutsche Bank survey

Investors and viral personalities use the word "landing" to describe the economy's future after this vicious Fed rate hike cycle: a hard landing in recession or a soft landing with 2% inflation and full employment.

Deutsche Bank asked clients how they believed equities and credit markets were pricing in a soft landing from 0%, or not at all, to 100%. Since they started asking the question in December, the averages have gone up from 76% to 84% for equities and from 71% to 82% for credit, said macro strategist Jim Reid in a Friday note.

Reid said there are two ways to read the results: "Either with the soft landing percentages in the low 80s there is further to go if it actually fully materializes or that on a risk/reward basis, a lot is already positively priced in now, especially given where inflation currently is in the U.S."

SECTORS

Blank Checks Are Still a Thing

The Real Estate sector tracked by moomoo climbed 30% at open and 10% when HCM Acquisition Corp, a blank check SPAC company, merged with Murano Global Investments, a resort and commercial property manager based in Mexico. The news rocketed the stock past $1B in valuation.

"Becoming a publicly listed company represents an important milestone for our organization as it opens up a new source of capital and significantly enhances the international profile of the Company, which will help to advance our growth plans," Elias Sacal, CEO of Murano, said in a press release. "With a portfolio that includes two premium-branded hotels located in the heart of Mexico City, an all-inclusive luxury resort in Cancun, and a pipeline of compelling projects in Cancun and Bajamar with world-class operators, we are primed to expand our portfolio in top tourist destinations across Mexico steadily."

COMPANIES

Market Moovers

$Reddit initially started trading up 30%+, but rapidly pulled back to a 3% decline after an explosive first day trading.

$Digital World Acquisition Corp(DWAC.US$ fell after investors in the blank check company agreed to merge with former President Donald Trumps Truth Social Platform.

$Nike fell 8% after the sportswear company reported Wednesday flat quarterly sales and warned that sales will decline in the first half of the fiscal year.

$Lululemon Athletica, the athletic-apparel company, posted an 2024 outlook that fell short of Wall Street's expectations. Shares slid about 18%.

$Tesla shares were down nearly 2% after Bloomberg reported that it had cut production at its plant in China, amid slowing sales growth.

$FedEx, the delivery giant, reported that recent restructuring efforts helped drive higher quarterly profits, even as demand for parcel deliveries remained soft. Shares were recently up around 7.5%.

$Baidu and $Apple(AAPL.US$ held preliminary talks about using the Chinese companys generative AI technology in its devices in China, the Journal reported. Baidu's American depositary receipts edged higher.

Mooers, what do you think will be the closing price for Reddit this week?

Yesterday, user RDK79 pointed out a headline: “Top U.S. asset manager Vanguard doesn’t believe the Fed will cut interest rates this year’” Do you agree with the divisive idea that we will not see rate cuts?

Source: Bloomberg, Dow Jones, CNBC, Reuters

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

73677513 : Why the heck are you spamming this board ??

Kevin TraversOP 73677513: What board?

SPACELIGHT : I'm bored.

bored.

junclj1223 : Keep posting not relevant posts to Apple(AAPL) comment section.

SpyderCall junclj1223: Apple was included in the article. He mentions Apple and Bidu's potential business partnership.