Market Moovers | Tesla Deliveries Fall, Semi's Pull Back, the Rain Brought Pain

Morning Mooers! April rain better mean the market pain stops by May! The market is dropping Tuesday, punctuated by Tesla. The fan favorite EV maker made less EV's than last year and dropped 5%.

It is April 2nd, and the market must have been playing April fools with a calm Monday, here are you morning moovers:

MOOVERS

$Tesla fell after the firm said it produced 433,371 vehicles in the first quarter, down from 440,808 in the same period a year ago. Deliveries fell to 386,810, down from 422,875 in the same period last year.

$NVIDIA, speaking of the mag seven, fell 2.3%, a day after a director at the firm sold about 11k shares.

Within the S&P 500, $Humana was the largest decliner, down 13% .$CVS Healthfollowed, down 8.6%. Tesla was the seventh decliner on the index, and number one falling on the Nasdaq 100.

SECTORS

When it comes to sectors tracked by moomoo, Nvidia and Semiconductors were down big, pulling back about 2.2%. Recently listed $GCT Semiconductor Holding dropped 9.9%, leading the fall. Further down in the pack, $ON Semiconductorand $Advanced Micro Devices fell nearly 4%.

RECAP

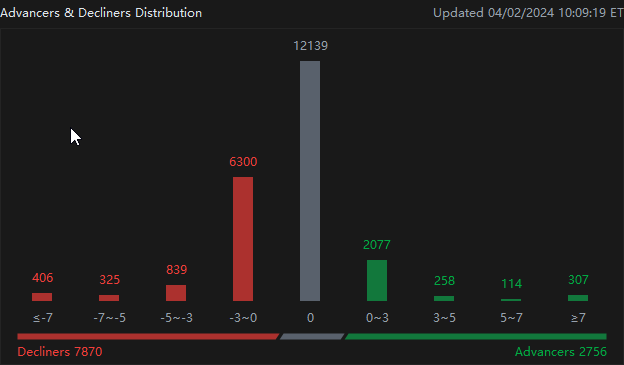

Overall, 7,870 equities in the U.S. market were in the red, compared to just 2,756.

Shortly after 10:30 A.M. EST, the $S&P 500 Index fell 1%, the $NASDAQ 100 Index(.NDX.US$ fell 1.39%, and the $Dow Jones Industrial Average fell 1.05%.

MACRO

Job openings recorded by JOLTS were just shy of expectations at 8.75M, but above last weeks 8.74M.

Yields on U.S. government debt jumped Tuesday after last Friday's PCE report.

The yield on the 10-year Treasury note jumped almost 12 basis points to 4.389%, from 4.311% on Thursday. Yields hit a four month high, as investors price in the reality that fewer Federal Funds rate cuts may be likely in 2024. The probability of a June rate cut dropped below 50% according to CME Fed Watch tool on Monday, and now sits at about 60%.

Throughout the day, we should hear speeches from multiple FOMC members, that will hopefully bring more light to the rate cut situation. Look out for moomoo updates on Daly, Mester, Williams, and Bowman.

And Mooers thats whats mooving today, let me know in the comments below why you think the market is finally pulling back this April second.

Source: Bloomberg, Dow Jones, CNBC, Reuters

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

74277136 : Im nnewt.phos trading thing so I'm doing all my reding and rrsearch