Jan. PCE Price Index Preview: Inflation in the Election Year is a Test for Bidenomics

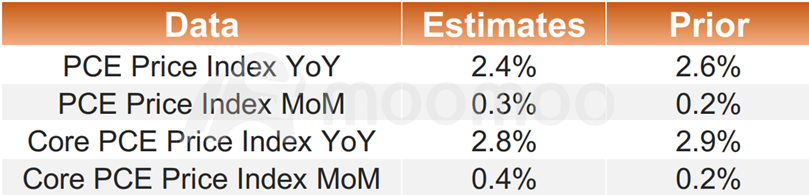

The Bureau of Economic Analysis will release the Personal Consumption Expenditure stats and the price index at 8:30 ET on Thursday.The PCE deflator is expected to fall from 2.6% to 2.4%, and the core PCE price index is expected to fall from 2.9% to 2.8%.

■ The deflation benefiting from the fall of import prices is about to end

Import Prices in the United States increased by 0.80% to 139.50 points in January from 138.40 points in December of 2023, according to the U.S. Bureau of Labor Statistics. Higher prices for both nonfuel and fuel imports contributed to the overall increase.

Prices for each of the major finished goods import categories advanced as well. Consumer goods prices rose 1.1% in January, the largest monthly increase since the 1-month percent change series was first published in January 1989. It was driven by a 4.1% advance in medicinal, dental, and pharmaceutical materials. Automotive vehicle prices advanced 0.8 percent in January, the largest monthly increase since May 2011. Higher prices for parts, engines, bodies, chassis, and passenger cars led the January advance. It shows that the impact of the Red Sea crisis on car imports is beginning to appear.

Import foods, feeds, and beverages prices rose 1.5% in January. The price index for capital goods also rose in January, increasing 0.4 percent.

■ The pressure on inflation from an overheated economy in 2024 could still potentially persist

The US economy may once again exceed expectations in 2024. The NABE (National Association for Business Economics) Outlook Survey panelists sharply revised upwards their projections for U.S. economic growth in 2024.

NABE President Ellen Zentner said, “The forecast now calls for inflation-adjusted gross domestic product to increase by 2.2%, up from 1.3% forecasted in the December Outlook Survey. The stronger February growth forecasts for 2024 result from upward revisions to key sectors of the economy, including personal consumption expenditures, nonresidential fixed investment, residential investment, and government consumption expenditures and gross investment.”

The latest quarter's GDP shows that government spending is an important driving force that continues to prevent the U.S. economy from falling into recession. The level of government spending is much higher than before the epidemic era, but this also increases the risk of inflation. The “artificially created prosperity” has led to a wage-inflation spiral that has kept service sector inflation high.

■ Real purchasing power is another hidden indicator that needs attention

Personal income data will also be released on Thursday. Historical stats indicate that the growth of wages and salaries has maintained good momentum, and there has been an accelerated increase in personal interest income. However, there has been a continuous negative growth in current transfer receipts, and the growth of proprietors' income has also stalled.

Consensus estimates show that personal income for January is expected to increase by 0.4%. If the growth rate of personal income exceeds the rate of inflation, it implies an increase in real purchasing power; otherwise, it suggests that the efforts to combat inflation are not sufficiently effective.

■ A test of Biden's economic policy:

Different from the Reagan era, which leaned towards "supply-side" economics, emphasizing supply over demand with policies that called for spending cuts and tax reductions, Bidenomics focuses on national industrial policy and a higher level of government intervention. Trump has recently attributed the persistence of inflation to Biden's economic policies during election campaigns. An NBC poll indicates Biden is trailing behind the former president in terms of dealing with the economy.

A higher-than-expected inflation figure could lead to volatility in the financial markets and raise expectations for more hawkish Fed action. Despite the CME FedWatch indicating that the first rate cut this year has been postponed to at least May, there is still doubt whether merely maintaining interest rates will be sufficient to control inflation. As we previously mentioned, former Treasury Secretary Larry Summers even stated outright in an interview that the Federal Reserve's next move should be to raise interest rates rather than cut them.

Fighting inflation requires the sustained effort of a series of policies. The White House might need to trim its budget for the new year further in order to reverse the Democrats' polling weaknesses in the economic domain. Taking measures to stabilize the situation in the Middle East is also of urgent necessity, as the inflation momentum and upcoming release could potentially shape the political landscape and influence the policy direction of the United States.

By Moomoo US Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Mrrichierich : Bidenomics huh?!

EVERYTHING THAT PEDO touches turns to shit!! Stark difference between Trumps kids & potato Joe kids but Trumps the bad guy huh lmao!! If your stupid enough to believe that then your just part of the herd!!

EVERYTHING THAT PEDO touches turns to shit!! Stark difference between Trumps kids & potato Joe kids but Trumps the bad guy huh lmao!! If your stupid enough to believe that then your just part of the herd!!

103239140 : Assalamualaikum wbt sorry friend2 all

Nederhoed : The MoM is actually targeted near .36%, not .3%. They want to sugarcoat it by not even rounding to the nearest number. The tick downs will have a reverse effect in months to come from the MoM being higher than a .2% This will inturn delay cuts. Also, Bidenomics, there is a reason why we have 3 branches of government. Trump had the Covid19 pandemic. Obama had the housing, banking, and motor vehicle crisis. W. Bush had 9/11 attacks. All had a very negative impact on our economy. We have been out of balance since Clinton was in office. Keep raising the debt ceiling, spending our taxpayer money in places most will never go. The inflation really has been on the rise for a long time. So when we raise the debt ceiling, we need a higher GDP. How do we do that, we print more money and raise "The Cost of Living." Salaries are higher, goods cost more to produce, and tax revenue is greater = higher GDP.

Robbing Peter to pay Paul is all we have been doing. If you don't think something is going to give in the future, then you are blind because history does repeat itself.

1000proof Mrrichierich: Going into business is risky. Staying in business is hard. Being successful in business takes more than just luck.

One of the most important factors required to move a business from startup to ongoing success is adequate capital. That means a business person must have plenty of money to sustain operations while the business builds sales and revenues. If it runs out of money, it runs out of time, and the business fails. This first rule of business is called DROOM — Don’t Run Out Of Money.

You’d think that someone who has entered into business as often as Donald Trump would know this rule. Or maybe he does and just doesn’t care, since he lives off a three-legged stool — his inheritance, his stiffing vendors, and the money he raises camouflaged as political support.

Trump’s most recent business venture — like his other business ventures — is tanking. Truth Social was puffed as a competitor for other successful and established social media platforms. Now Truth Social faces an uncertain future due to DROOM, concerns over Trump's dwindling popularity, continued controversies, denial of its trademark application, huge financial losses, and a litany of stiffed vendors.

But, before you feel sorry for the vendors, you have to remember that this is not Trump’s first dance. He has been stiffing vendors for years and years, and those doing business with him should certainly know that they could well be next.

And now the future of Trump's less than a year-old Truth Social is questionable. It is facing huge financial losses and shorting its vendors as Trump faces continued legal controversies and runs this business into the ground, as he has done with other ventures throughout his career.

You keep thinking this man is going to help America it’s you who needs to pull your head out of the sand and stop hiding from the truth.

1000proof 1000proof: Trump's companies have filed for bankruptcy at least six times. This is no exaggeration. Digital World noted this in its SEC filings. This excludes additional business failures that might not have declared bankruptcy, but closed owing vendors, employees and others.

For the record, here are some of Trump's noteworthy business failures.

Trump Airlines — Trump borrowed $245 million to purchase Eastern Air Shuttle. He branded it Trump Airlines. He added gold bathroom fixtures. Two years later Trump could not cover the interest payment on his loan and defaulted.

Trump Beverages — Although Trump touted his water as "one of the purest natural spring waters bottled in the world," it was simply bottled by a third party. Other beverages, including Trump Fire and Trump Power, seem not to have made it to market. And Trump's American Pale Ale died with a trademark withdrawal.

Trump Game — Milton Bradley tried to sell it. As did Hasbro. After investment, the game died and went out of circulation.

Trump Casinos — Trump filed for bankruptcy three times on his casinos, namely the Trump Taj Mahal, the Trump Marina and the Trump Plaza in New Jersey and the Trump Casino in Indiana. Trump avoided debt obligations of $3 billion the first time. Then $1.8 billion the second time. And then after reorganizing, shuffling money and assets, and waiting four years, Trump again declared bankruptcy after missing ongoing interest payments on multi-million dollar bonds. He was finally forced to step down as chairman.

Trump Magazine — Trump Style and Trump World were renamed Trump Magazine to reap advertising dollars from his name recognition. However, Trump Magazine also went out of business.

1000proof 1000proof: Trump Mortgage — Trump told CNBC in 2006 that "I think it's a great time to start a mortgage company. … The real-estate market is going to be very strong for a long time to come." Then the real estate market collapsed. Trump had hired E.J. Ridings as CEO of Trump Mortgage and boasted that Ridings had been a "top executive of one of Wall Street's most prestigious investment banks." Turned out Ridings had only six months of experience as a stockbroker. Trump Mortgage closed and never paid a $298,274 judgment it owed a former employee, nor the $3,555 it owed in unpaid taxes.

Trump Steaks — Trump closed Trump Steaks due to a lack of sales while owing Buckhead Beef $715,000.

Trump's Travel Site — GoTrump.com was in business for one year. Failed.

Trumpnet — A telephone communication company that abandoned its trademark.

Trump Tower Tampa — Trump sold his name to the developers and received $2 million. Then the project went belly-up with only $3,500 left in the company. Condo buyers sued Trump for allegedly misleading them. Trump settled and paid as little as $11,115 to buyers who had lost hundreds of thousands of dollars.

Trump University or the Trump Entrepreneur Initiative — Trump staged wealth-building seminars costing up to $34,995 for mentorships that would offer students access to Trump's secrets of success. Instructors turned out to be motivational speakers sometimes with criminal records. Lawsuits and criminal investigations abound.

Trump Vodka — Business failed due to a lack of sales.

Trump Fragrances — Success by Trump, Empire by Trump, and Donald Trump: The Fragrances all failed due to being discontinued, perhaps as a result of few sales.

Trump Mattress — Serta stopped offering a Trump-branded mattress, again likely due to slacking sales.

Truth Social — This existing Trump business owes big money, and may well be breathing its last.

1000proof Mrrichierich: Stop acting like a child and name calling and bring facts. Make America great again is another scam being pushed by people who are nothing more than a bunch of bigots.

We need to call it like it is.

How can anyone look to Trump for leadership, honesty or integrity when the trail he leaves behind him is littered with slime, broken promises, poor decisions, stiffed vendors, devastating reputation and history of repeated failure?

Simon 5183 Nederhoed: Each American is a complete beggar with hundreds of thousands of dollars in debt, but this beggar has to pay for the military expenses of the Russia-Ukraine war. The Europeans, led by Germany, applauded and called Americans "idiots" behind their backs.