Apple Launches Vision Pro Amid iPhone Sales Pressure and Market Valuation Scrutiny

$Apple(AAPL.US$ is poised to release its Vision Pro headsets in the US next month, facing the challenge of declining iPhone sales, notably in China.

The sales of the new mixed reality headsets will commence on February 2, with pre-orders opening on January 19, priced from $3,499. This news comes as Apple's shares have decreased by almost 6% following downgrades from two banks, sparking debate about whether the company's nearly $2.9 trillion market cap can be justified given current earnings and profit trends.

Analysts cautious on Vision Pro sales

Apple touts the Vision Pro as a transformative device for mobile computing and a new chapter in "spatial computing," with CEO Tim Cook declaring it the most advanced consumer electronics device ever made.

However, analysts are tempering their expectations for the Vision Pro's financial impact, as noted by UBS in December, suggesting the device would initially have a "limited financial impact."

Challenges ahead for Apple

This cautious stance reflects the disparity between Apple's soaring market valuation and its lukewarm growth prospects. Despite a 48% rise in share price during 2023, Apple's quarterly revenue has seen declines ranging from 0.7% to 5.5% over the last four reported quarters. Additionally, the latest iPhone releases have not driven momentum as seen in previous years.

The iPhone's latest iteration lacked significant new features, and Apple now contends with increased competition from Chinese tech giant Huawei, which has rebounded from U.S. sanctions.

On top of this, Apple is navigating a legal dispute over its newest Apple Watch and potentially faces a major antitrust case from the U.S. Department of Justice, as reported by the New York Times.

These factors lead to questions about whether Apple's stock warrants a valuation on par or greater than other Big Tech companies that exhibit stronger growth potential.

Apple stock looks expensive

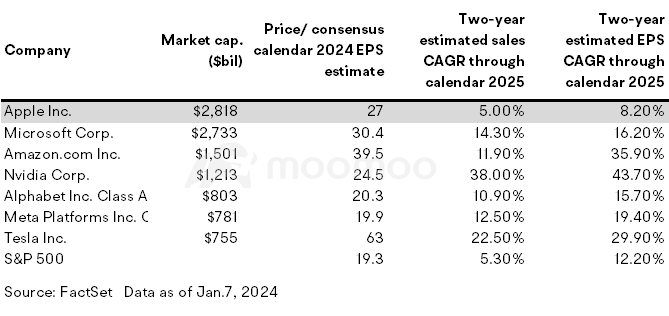

Currently, Apple's stock trades at 27 times the projected earnings for 2024, compared to lower P/E ratios for $Alphabet-A(GOOGL.US$ and $Meta Platforms(META.US$, despite Apple's slower anticipated earnings growth of 8.2% and sales increase at a 5% compound annual growth rate over the next two years.

Barclays analyst Tim Long, in a recent downgrade note, pointed out that Apple's P/E multiple has significantly risen over the past five years and suggests that the current valuation peak may not hold amidst a period of underwhelming results and elevated multiples.

Long predicts that 2024 may reveal further risks within Apple's services, indicating that Apple requires a fresh growth catalyst, either through new products or significant services. Yet, with Apple's traditional secrecy around upcoming projects, investors may remain in suspense regarding future product announcements.

Source: Market Watch, Financial Times, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

151345481 : A product to test the waters

Jamesjinlin : It's time to cheat on chips again.