What to Expect From Alphabet's Upcoming Earnings Report

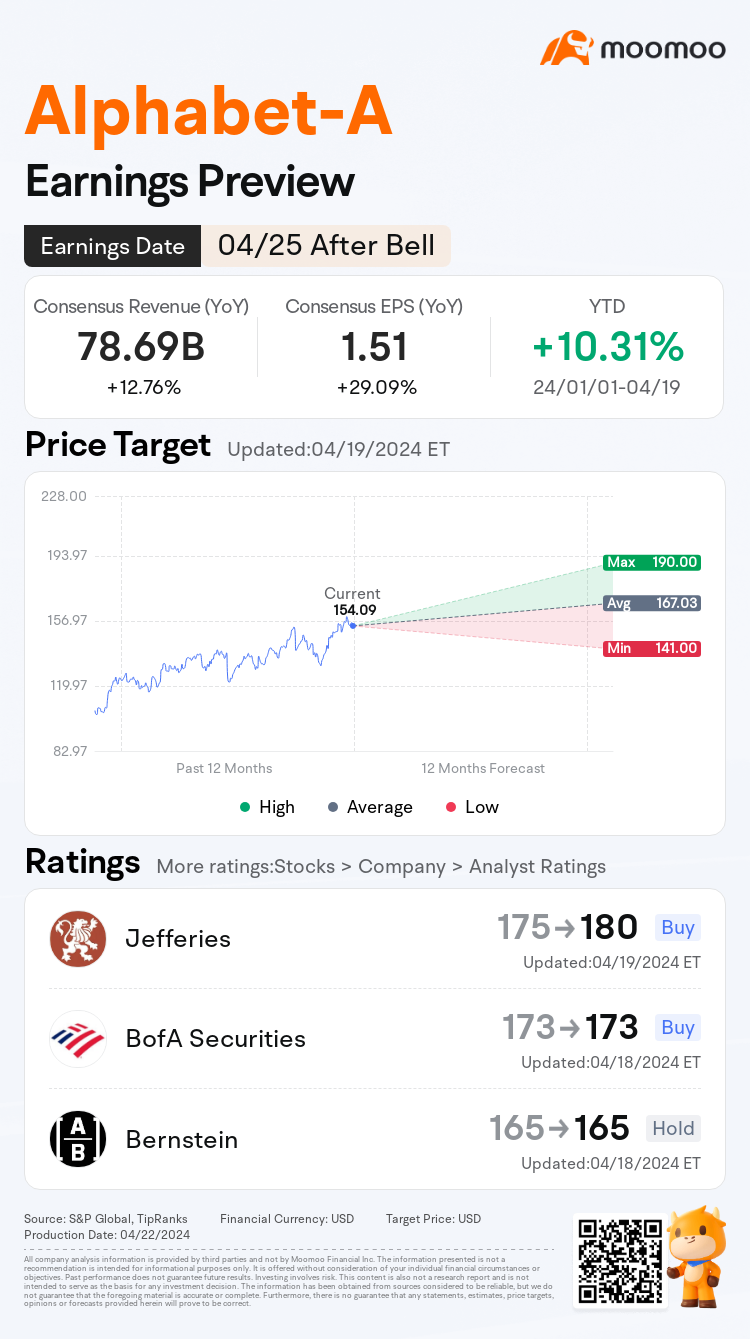

$Alphabet-A(GOOGL.US$, the parent company of Google, is scheduled to release its earnings for the first quarter of 2024 after the market closes on Thursday. As Alphabet's market value approached $2 trillion recently, bolstered by new announcements at its Cloud Next conference, analysts are keenly anticipating continued growth in the cloud segment and looking forward to any new developments regarding the company's artificial intelligence (AI) projects.

Here are key expectations to watch:

Cloud Growth Momentum

Investors are closely monitoring Google Cloud for consistent growth following a notable 25.5% year-over-year increase in its revenue to $9.2 billion in Q4 2023, after a period of modest gains. This growth has alleviated earlier concerns of stagnation.

Analysts from CFRA predict that Google Cloud's revenue will continue to grow at a rate of at least 25% through 2024, emphasizing that profit margins are also crucial, given Google's less aggressive cost-cutting compared to other major tech companies.

Meanwhile, Bank of America analysts expect the cloud segment's revenue to reach $9.34 billion in Q1 and suggest that an improvement in margins could positively affect Alphabet's overall performance.

Advertising

Advertising revenue is projected to stay above 70% of Alphabet's total revenue, with digital ad spending continuing to grow, though at a slower pace than in the past. A 6.5% growth in ad revenue is expected for 2024, attributed to a deceleration in economic expansion compared to 2023. Google's ad revenue is estimated at $253 billion for 2024 and $272 billion for 2025.

YouTube's share of Google's advertising revenue is anticipated to be 13.6% in 2024, a slight increase from 2023, and is expected to exceed 14% in 2025. YouTube's growth is likely to be driven by its extensive reach, high user engagement, and its video-centric platform, which is particularly appealing to brand advertisers.

AI Updates

Google might provide updates on its artificial intelligence (AI) projects as major tech companies vie for a position in the rapidly expanding AI sector. Alphabet has reinforced its dedication to AI by unveiling the Google Axion Processor, an ARM-based custom chip designed for data centers. Leading tech companies, known as hyperscalers, including $Microsoft(MSFT.US$, $Amazon(AMZN.US$, and $Meta Platforms(META.US$, have also developed their own custom AI chips. This move can help these companies control costs and reduce their dependency on $NVIDIA(NVDA.US$. CFRA analysts believe that AI presents additional monetization opportunities for Google across its various business units, including cloud services, search, YouTube, and other areas.

AI is a tailwind for Google as AI use does pose long-term competitive risks for Google, but in 2024 Google (and peers) are likely to see AI monetization improvements," Bank of America analysts said.

Cost Cutting & Layoffs

Alphabet's Google is downsizing its workforce, with the exact number of affected employees not disclosed. The company is focusing on cost reduction and increasing efficiency by streamlining team structures and aligning resources with key product priorities.

Google had previously laid off hundreds of workers from its engineering, hardware, and assistant teams in January as it increases investment in artificial intelligence. CEO Sundar Pichai has warned employees to anticipate further job cuts as the company continues to adjust its operations.

Risk & Uncertainty

• Prolonged decline in online advertising spending could negatively impact revenue and cash flow;

• Prolonged decline in online advertising spending could negatively impact revenue and cash flow;

• Antitrust scrutiny due to search bias and advertising market dominance;

• Possible restrictions by governments on Google's services, affecting user growth and revenue generation;

• Increased merger and acquisition restrictions, similar to $Meta Platforms(META.US$, by the US and other nations aiming to reduce advertising and internet market control

Source: REUTERS, MorningStar, Yahoo Finance, Investopedia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment