Coinbase Earnings Preview: Spotlight on the Impact of Spot Bitcoin ETFs and the Bitcoin Halving Event

Coinbase is expected to report earnings on May 2, 2024 after the market closes. It's been a historic year for bitcoin, and Coinbase has been a key player in it. As a result, Coinbase’s stock has soared on renewed crypto interest.

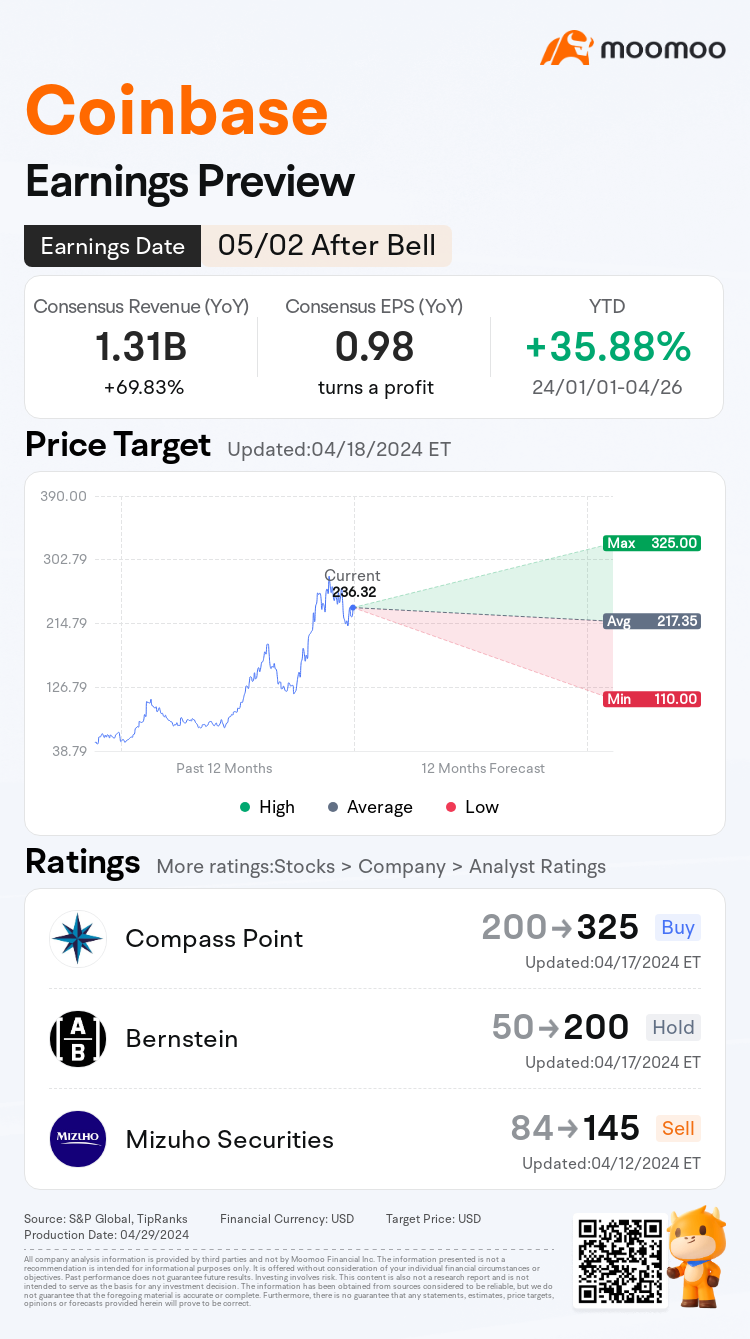

Consensus Estimate

• This company is expected to post quarterly earnings of $0.98 per share in its upcoming report, which represents a year-over-year change of +388.3%.

• Revenues are expected to be $1.31 billion, up 69.83% from the year-ago quarter.

• Over the last four quarters, the company has beaten consensus EPS estimates four times.

The launch of spot bitcoin ETF has both pros and cons for Coinbase

“The advent of bitcoin ETFs and their attraction for professional investors endangers some of the sources of Coinbase's revenue,” Sandeep Rao, analysts at exchange-traded product provider Leverage Shares said in a note. Previously the investors could gain exposure to bitcoin only through regulated exchanges; now they can do so through the ETFs at lower cost.

“Most of the spot bitcoin ETFs offer fees lower than 0.4%, while Coinbase charges between 1.5% to 4%,” Rao said in an interview. “Therefore, investors may prefer to gain exposure to bitcoin via an ETF, which could cause Coinbase’s revenue from bitcoin transactions to decline. Bitcoin transaction fees are around 17% of Coinbase’s total revenue.”

But a long-term driver for Coinbase revenues could be the fees it generates by custody of bitcoin for ETF providers. The company is a custodian for eight of the 11 funds and will receive a 0.2% fee and charge additional fees for storing the bitcoin, Rao said.

"We've always said that ETFs would be a win-win for Coinbase, and we're starting to see that play out on our platform," Coinbase Chief Executive Brian Armstrong said on the company's fourth-quarter earnings call in February. He noted that Coinbase custody accounted for 90% of the $36 billion in bitcoin ETF assets at the time.

"We're earning revenue, not just on custody but also on trading and financing. We've already seen great demand as bitcoin is now the second-largest ETF commodity in the U.S., surpassing silver," Armstrong went on to say.

Bitcoin halving event affects Bitcoin and subsequently impacts Coinbase

Bitcoin’s latest “halving” - the fourth in the cryptocurrency’s history - is now complete. During the last three halvings, bitcoin averaged a 3,108% price increase in the 12 months following the event, Cathie Wood's ARK Invest noted in a recent email to investors.

Where bitcoin goes, other cryptos tend to follow. Bitcoin's market cap of $1.26 trillion represents half of the total global cryptocurrency market cap. Its performance can heavily influence other cryptocurrencies and related stocks.

So, Bitcoin is vital to exchanges like Coinbase as it represented 34% of its total trading volume in fiscal 2023 and 35% of transaction revenue.

Goldman Sachs upgraded its rating on Coinbase to neutral after bitcoin hit a record high and daily trading volumes hit levels not seen since 2021. In addition, the bank lifted its price target to $282 from $170.

Oppenheimer also hoisted its price target on Coinbase stock to $276 from $200 and maintained an outperform rating on shares. Oppenheimer predicts Coinbase's first-quarter trading volume could increase as much as 107% year over year to $300 billion.

Source: CoinDesk, Yahoo Finance, Investor's Business Daily

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

EZ_money : bogus fees for investment